Australia is positioning itself as a global leader in fighting financial scams. While other countries, like the US, struggle with mounting scam losses, Australias losses have plummeted.

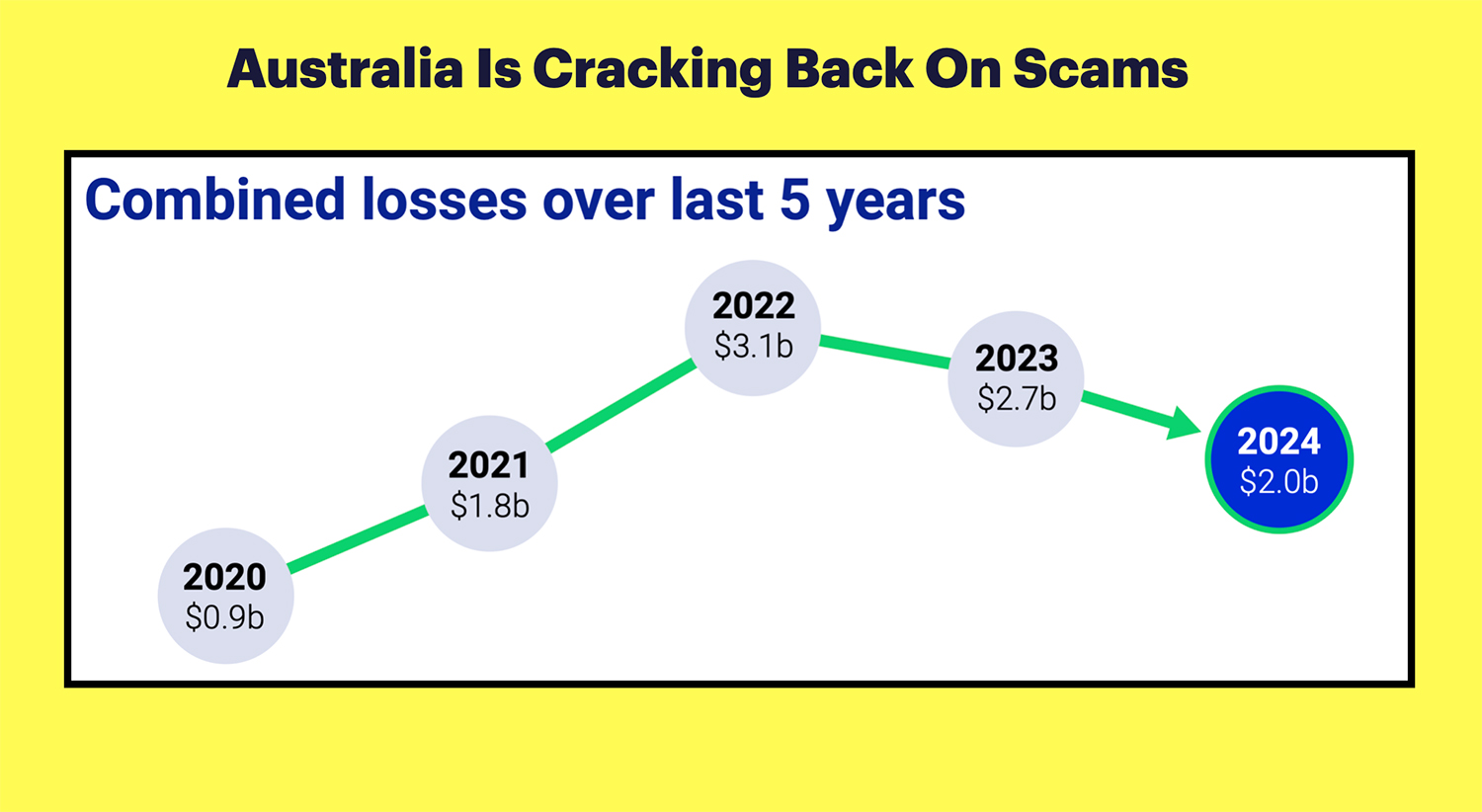

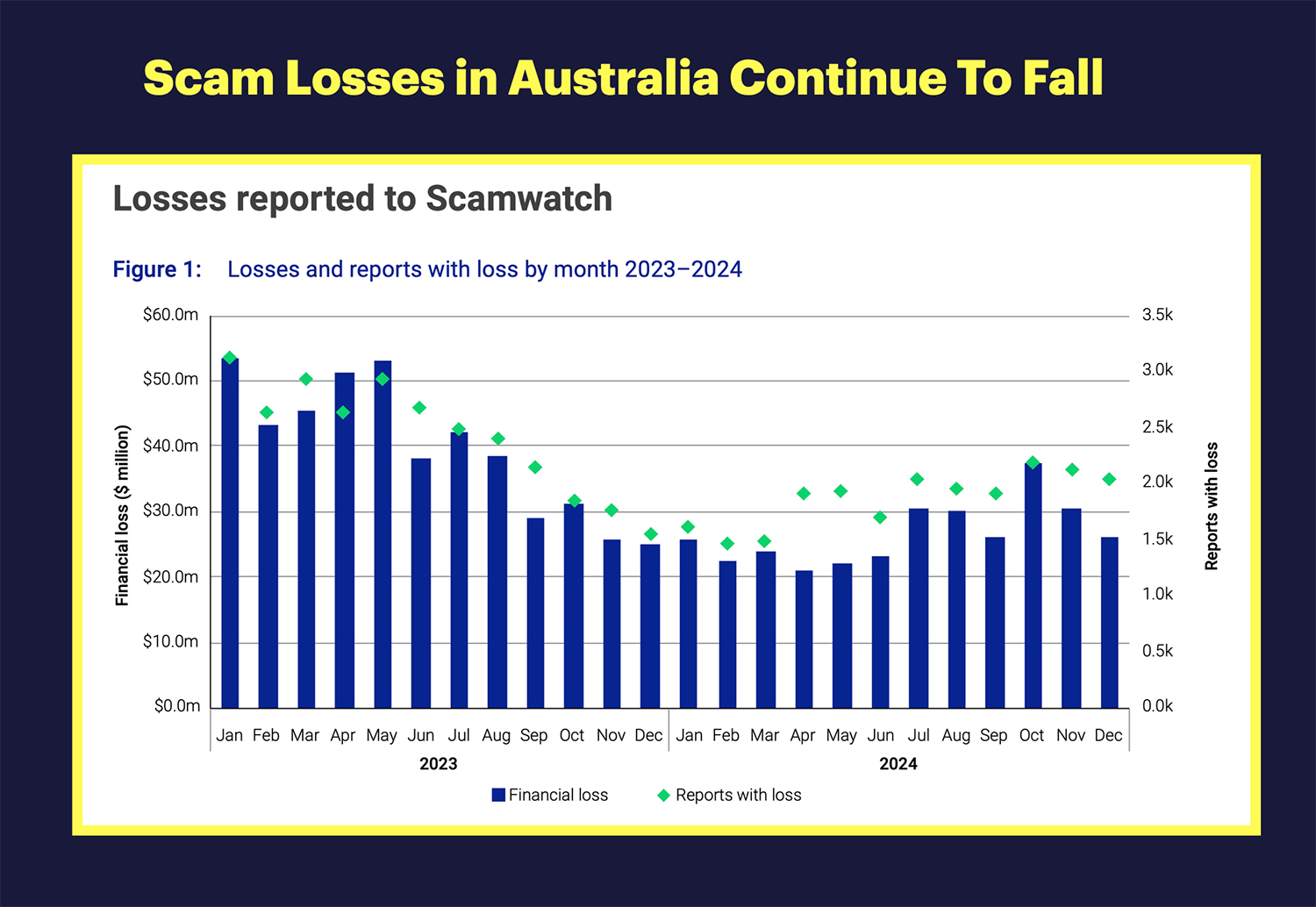

According to the National Anti-Scam Centre’s latest Targeting Scams Report, Australia recorded $2 billion in losses, down from $2.7 billion in 2023.

This marks the second consecutive year of decline in Australia following a peak of $3.1 billion in 2022, demonstrating that Australia is doing something right.

A Sand In The Gears Approach

Australia’s success stems from a fundamental shift in strategy from the UK. They prioritized prevention of scams over victim compensation. It’s called a sand in the gears approach because they slow down payments until it can be verified.

Australian banks were successful in lobbying the government to take a different approach and not focus on having banks pick up the tab because they argued the UK approach was flawed.

The CEO of the Australian Banking Association Anna Bligh described the UK model as a “honeypot” for criminals.

“It sounds very simple doesn’t it. If you fall for a scam, the bank will just pick up the tab, she told Skynews in 2024. “I think there is a very good reason why no country anywhere on earth has followed the United Kingdom in this regard, and that’s because it has made them a honeypot for scammers,”.

The approach mirrors successful fraud prevention methods from the 1990s, when companies in the US introduced real-time transaction monitoring and blocks to stem the rise in credit card fraud. Losses in the US dropped 70% immediately following.

Australian banks now apply similar friction to suspicious payments, sometimes holding them for 24-48 hours.

It wasn’t popular at first, but it is paying dividends now.

Australian Banks Focus Is On Disrupting The Scam

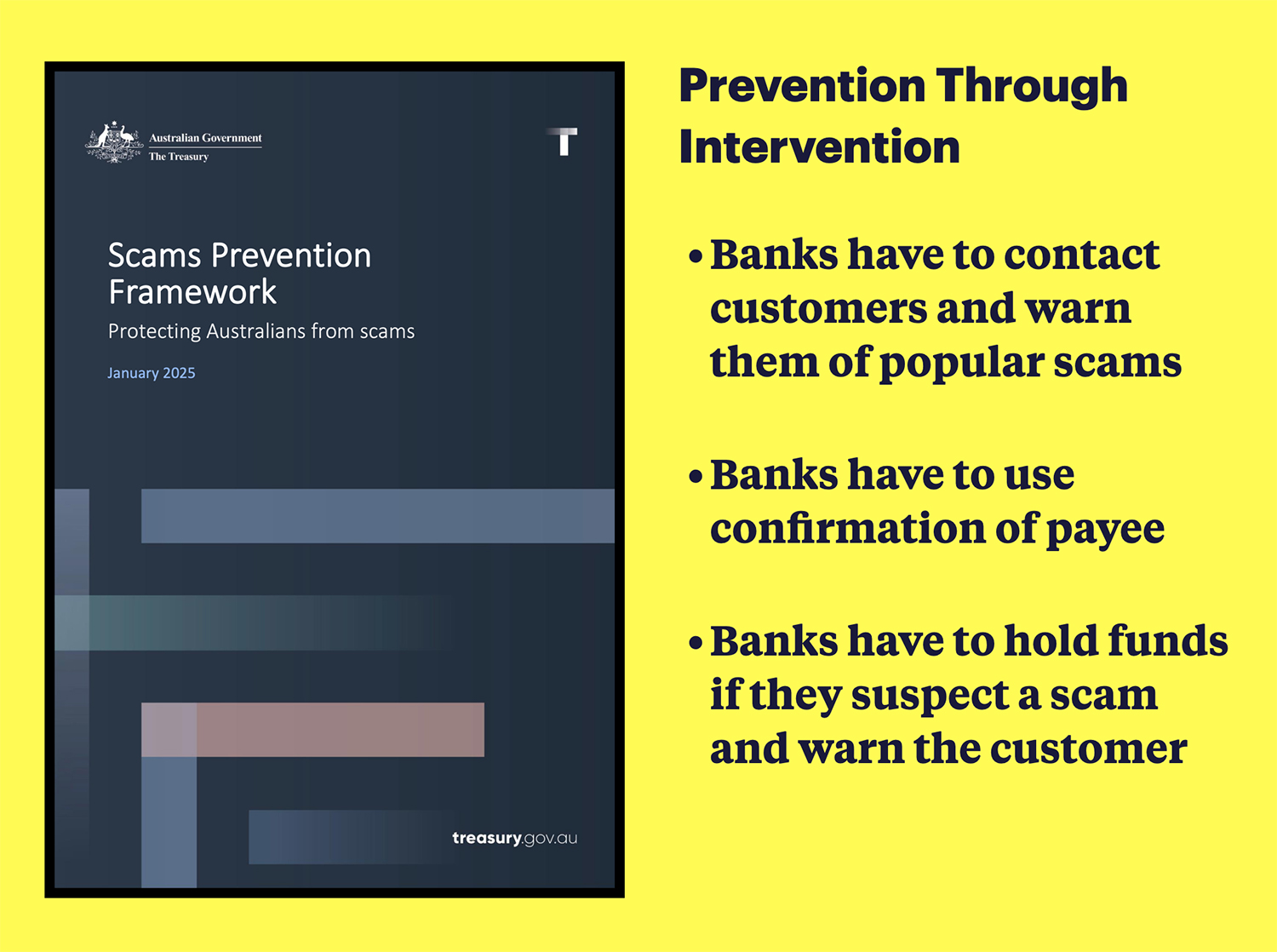

In 2024, Australia introduced the Scam Prevention Framework which introduces another novel approach – disrupting scams.

It requires banks to take reasonable steps to stop a scam proportionate to the level of risk. For exampe, a bank that spots a customer suddenly sending money to a known scam account must intervene much more aggressively than one handling a mildly suspicious transaction.

The framework specifically calls out interdiction steps entities must take:

- They have to alert customers to new scams.

- They have to use confirmation of payee checks.

- They have to place holds on payments if they suspect a scam and warn customer.

It’s the payment holds that were anticipated to be most controversial, however there has not been case, instead customers appear to be understanding of strategy.

Challenges Remain Despite Progress

Despite the significant success, vulnerabilities persist in Australia. Overall scam losses, whole significantly reduced still remain at levels that are much higher than levels experienced before the pandemic.

And there are pockets of society where scams are still increasing. First Nations communities saw losses increase by 73.1% to $6.5 million in 2024, highlighting the need for targeted education programs to at risk populations.

As Australia’s approach continues to yield results, other countries like the US, UK and Canada will be watching. The combination of technological solutions, strong regulatory frameworks, and consumer education may offer the blueprint for success in scams worldwide.