The ACFE released its annual report on fraud and they estimate that organizations are losing $4.7 Trillion to occupational fraud each year. That means that companies are losing up to 5% of their revenue to fraud committed by their employees.

The term occupational fraud refers to frauds that are committed by individuals against the organizations that employ them.

A Shocking Level Of Internal Fraud – Bigger Than Any Other Fraud Type.

To conduct the study on internal fraud, the ACFE analyzed 2,110 cases from 133 countries. All told those cases resulted in over $3.6 Billion in losses.

The case data was submitted to the ACFE, which represents more than 90,000 anti-fraud professionals around the world, and covered cases origination from 2012 through 2022.

“This is just a snapshot,” said John Warren, J.D., CFE, Vice President and General Counsel of the ACFE, who co-authored the report with Research Director Andi McNeal, CFE, CPA. “Occupational fraud is likely the costliest and most common form of financial crime in the world. This is bigger than healthcare fraud, tax evasion, money laundering and identity theft.”

As the ACFE pointed out, “The global labor force consists of more than 3.3 billion people, a large majority of whom will never steal or abuse the trust of their employers. But if even a tiny percentage of these individuals cross the line, the result is millions of occupational fraud schemes being committed annually.

The Pandemic and CryptoCurrency Pushed Internal Fraud Risk Up

Two interesting new internal fraud trends were revealed by the ACFE in the report. These new emerging trends resulted in more risk to organizations over the last two years.

#1 Pandemic-related pushed up fraud risk dramatically

It was clear that the pandemic had an impact on occupational fraud cases — both by giving employees new opportunities to commit fraud and by offering organizations new ways to detect it. In fact, half of all fraud cases in the study were affected by the pandemic in some way. With more employees working remotely and organizations implementing major changes in processes, the pandemic created more potential opportunities for fraud in some organizations, as well as bolstering anti-fraud controls in others.

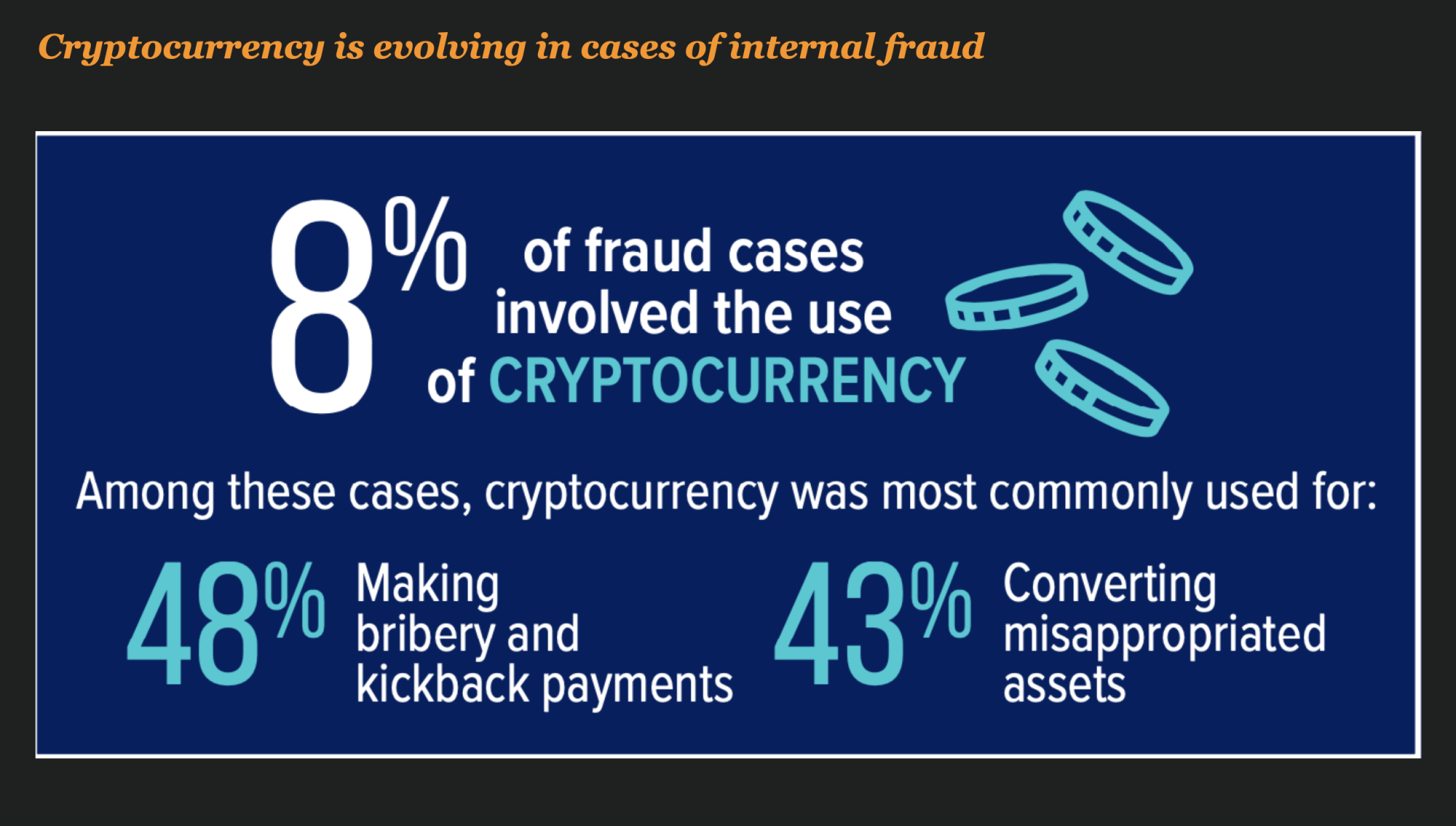

Cryptocurrency-related Internal Fraud Cases Accounted For 8% Of All Cases

The report found that 8% of occupational fraud cases involved cryptocurrency. The most common ways cryptocurrency was used included making cryptocurrency bribery and kickback payments or converting misappropriated assets to cryptocurrency.

“The last two years have resulted in many changes in the business environment—and have evolved the fraud landscape as a result,” said McNeal. Whether it is new payment methods like cryptocurrency or pandemic-related shifts, our latest study shows how both fraud risks and anti-fraud programs are being shaped by these developments.”

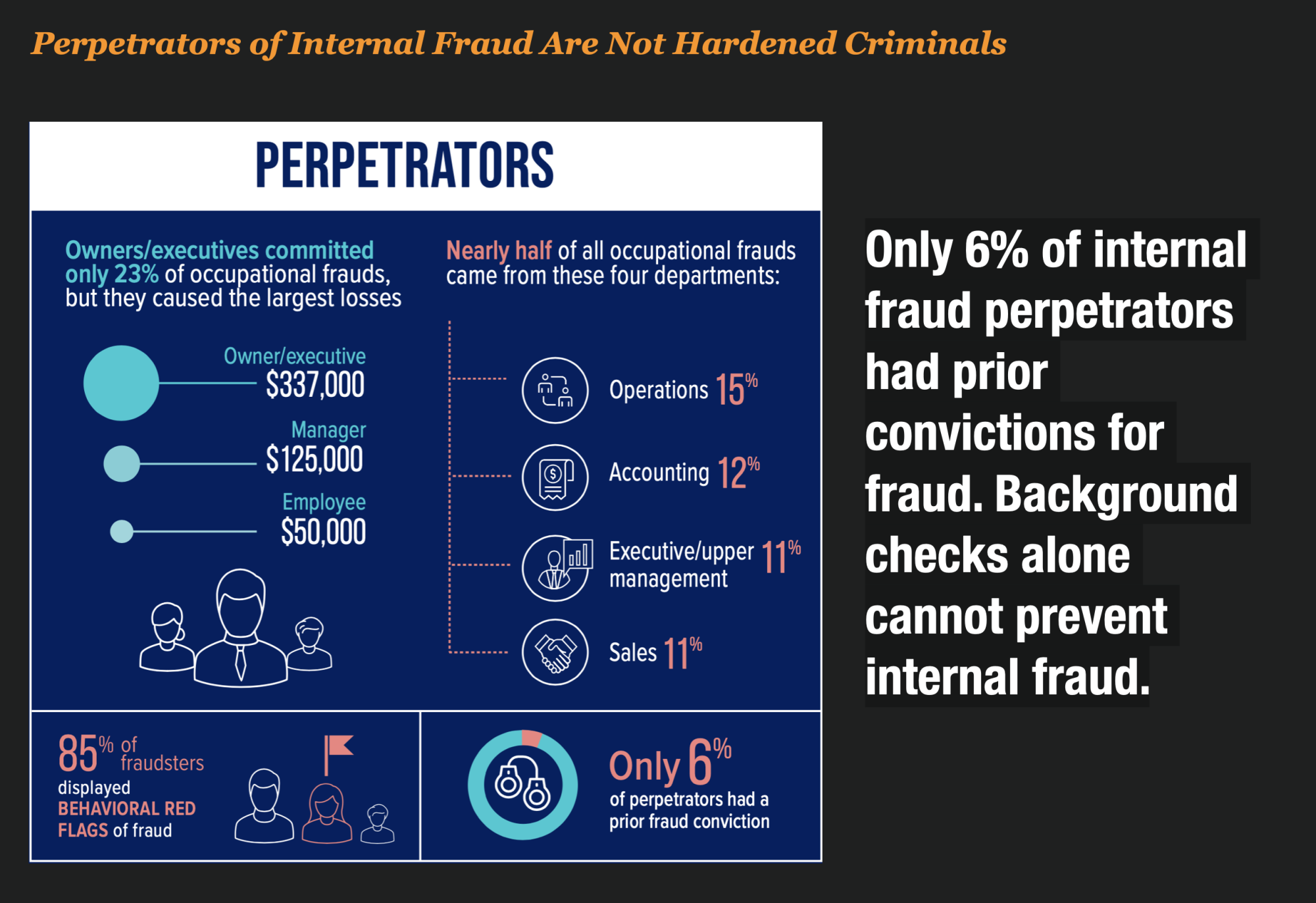

Perpetrators of Internal Fraud Are Not Hardened Criminals

The report highlights some enlightening statistics on internal fraud that shed light on just how misunderstood internal fraud is.

As an example, organizations that feel that they control internal fraud through background checks to weed out bad players will be sad to learn that only 6% of internal fraud perpetrators have prior convictions for fraud. If you think your background checks protect you for internal fraud you are wrong.

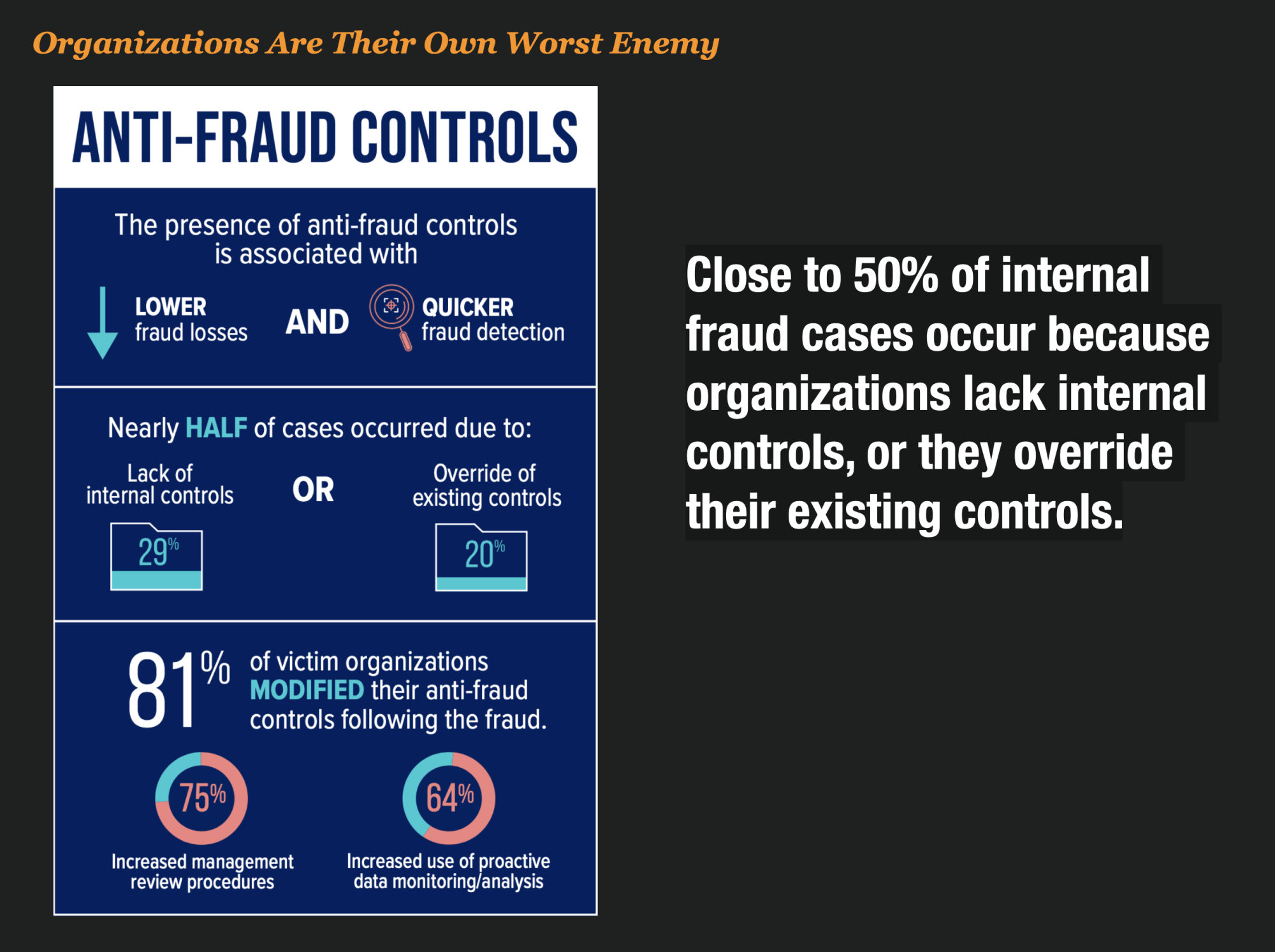

Half of Internal Fraud Results Because Of These Two Things

Over 50% of internal fraud cases occur because organizations let one of these two things happen; 1) They fail to develop internal fraud controls, or 2) they override those controls and let the fraud carry on unabated.

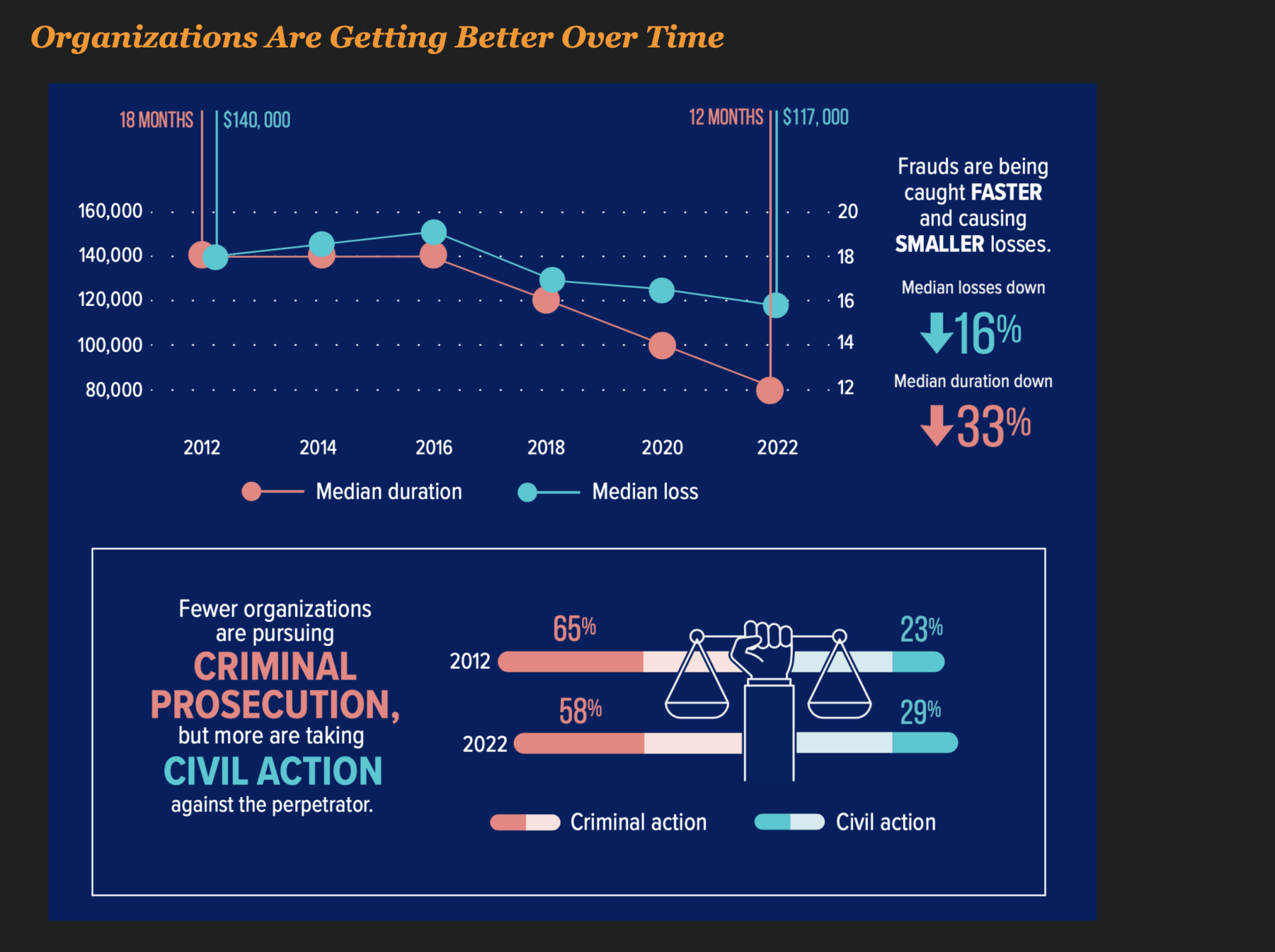

Some Interesting Long Term Trends In Internal Fraud Detection And Resolution

One of the more interesting findings in the report is that organizations are actually getting much better in detecting fraud and stopping it earlier. Since 2012, the median duration of internal fraud has dropped from 18 months to 12 months and the amount they lose has dropped by 16%

Another interesting trend is that organizations are relying less on law enforcement and more on the court system, pursuing more civil action against perpetrators of internal fraud.

The Best Way To Stop Internal Fraud Is To Put In Fraud Controls and Train People on How To Find Red Flags

The best way to stop occupational fraud remains something available to all organizations: Create anti-fraud controls and train employees on how to use them.

In the report, tips were the most common way fraud was detected. With their high success rate and low implementation cost, all organizations should have a tip hotline or mechanism to report fraud. While in the past hotlines were phone lines that employees could call to anonymously report fraud, hotlines today can include forms on a webpage or a special e-mail set up to collect tips.

“No matter how much we try to use advanced tools to detect fraud, the main way it gets detected is by the tip, someone reporting it,” Warren said. “That’s why you need anti-fraud programs. You have to have a hotline; you have to have people know how to tell you.”

It’s also important for employees to know what to look for. If co-workers are living beyond their means — driving a fancy car, going on extravagant vacations or buying items that seem out of place — don’t be afraid to dig deeper.

My Experience With Internal Fraud Is That Most Organizations Bury Their Head In The Sand When It Comes To It

Internal Fraud is something most banks hate to talk about but they all have experienced. Whether they know it or not, they have.

I spent 2 years as an Internal Fraud Investigator with a major bank. My job was to develop policies and procedures for dealing with internal fraud and for monitoring homegrown detection programs to find employees that were stealing data or misusing the host system to commit credit card fraud.

What I learned during those two years was that internal fraud is not well understood or accepted by banks. The bank I worked with quickly disbanded the automated detection program I built because they simply didn’t think it was a high priority. I was surprised to hear that news after I left because I was detecting 5-7 cases of internal fraud each month. How were they continuing to find the fraud?

They weren’t. They just simply let it slip under the radar. I can’t really blame them I guess. That’s what many banks do I have found.

Download the Full ACFE Report Here

The ACFE has made the report available to the public and you can read the full report here.