The SBA released a warning citing serious concerns over rampant loan fraud with the agency’s Economic Injury Disaster Loan Program.

The loan program has been the target of fraud since the government expanded to the loan program in March with $10 Billion in additional funding.

Unlike the PPP program, however, the business can have 500 employees or less, the loans are not forgivable, and they require proof that the business suffered a serious economic impact from the pandemic.

To date, the agency has received more than 5,000 complaints from financial institutions receiving loan deposits from suspected fraud. But, this may be just the tip of the iceberg and the agency could receive a wave of fraud reports as more banks look for red flags.

6 Banks Have Reported Nearly 76% of The Fraud

The SBA reports that the fraud reports are highly concentrated to a few banks. In fact nearly 3,800 of the 5,000 fraud complaints come from only 6 banks.

This highly concentrated nature indicates that the vast majority of banks may not be reporting the red flags and that what the SBA is seeing is only the tip of the iceberg.

Credit Union Found a 98% Fraud Rate on EIDL Loans

One Credit Union performed an audit on 60 deposits that they received from EIDL loan recipients, and found that 59 of those loan deposits were suspicious.

The reported their findings to the Criminal Division of the DOJ.

The 10,000 Free Grant Option May Have Been Subject to High Rates of Fraud

The EIDL program allowed applicants to check a box on the application to receive up to $10,000 in free grants that did not need to be paid back.

Applicants that selected that box, would receive 10,000 automatically deposited into their accounts within days of applying for the EIDL program.

Those grants were given whether the loan was approved or not and were intended to be short bridge loans to carry businesses through.

These automatic payments could have made the loan program particularly susceptible to fraud.

Primary Types of Fraud That Are Being Reported

There are a wide variety of frauds being perpetrated. In the 5,000 cases of fraud, the SBA found the following issues.

Serious Concerns of Potential Fraud in Economic Injury Disaster Loan Program Pertaining to the Response to COVID-19

- Accounts established using stolen identities

- Account-holders unable to explain origins of deposits or identify business names on loans

- Account-holders claiming to use the funds to open a business

- Account-holders attempting to transfer funds into investment accounts

- Account-holders attempting to transfer funds to foreign accounts

- Loan deposits being made into accounts with no other account activity that were established remotely just before receiving the loan funds

- Economic injury loan funds made to agricultural businesses being deposited in accounts of unrelated third parties located in different states than the business

- Account-holders attempting to withdraw loan funds in cash or transfer the funds to other newly established accounts

- Economic injury loans or advance grants being deposited into personal accounts–with no evidence of business activity–of customers of the financial institution

Scams on Social Media Are Pervasive

The SBA has found that organized fraud rings are using social media to recruit applicants who will split the money with the ringleaders.

Those applicants are encouraged to provide their PII which is then used to apply for fraudulent EIDL loans under fake business names.

SBA Warns Banks On What Red Flags To Look For

The SBA released guidance on the red flags that banks should look for. When they find these red flags they are advised to file a suspicious activity report for the activity.

- A customer not known to be a small business, sole proprietor, or independent contractor receives a lump sum COVID-19 EIDL ACH deposit from “SBAD TREAS 310” and “Origin No. 10103615” into a personal account.

- A new customer opens an account and shortly thereafter receives a COVID-19 EIDL ACH lump sum deposit from “SBAD TREAS 310” and “Origin No. 10103615”.

- A single account receives multiple EIDL advances or multiple EIDL loan deposits.

Any bank identifying these risk factors is encouraged to file a suspicious activity report or report to the Department of Justice.

Social Media Post Seem to Corroborate The Massive Fraud

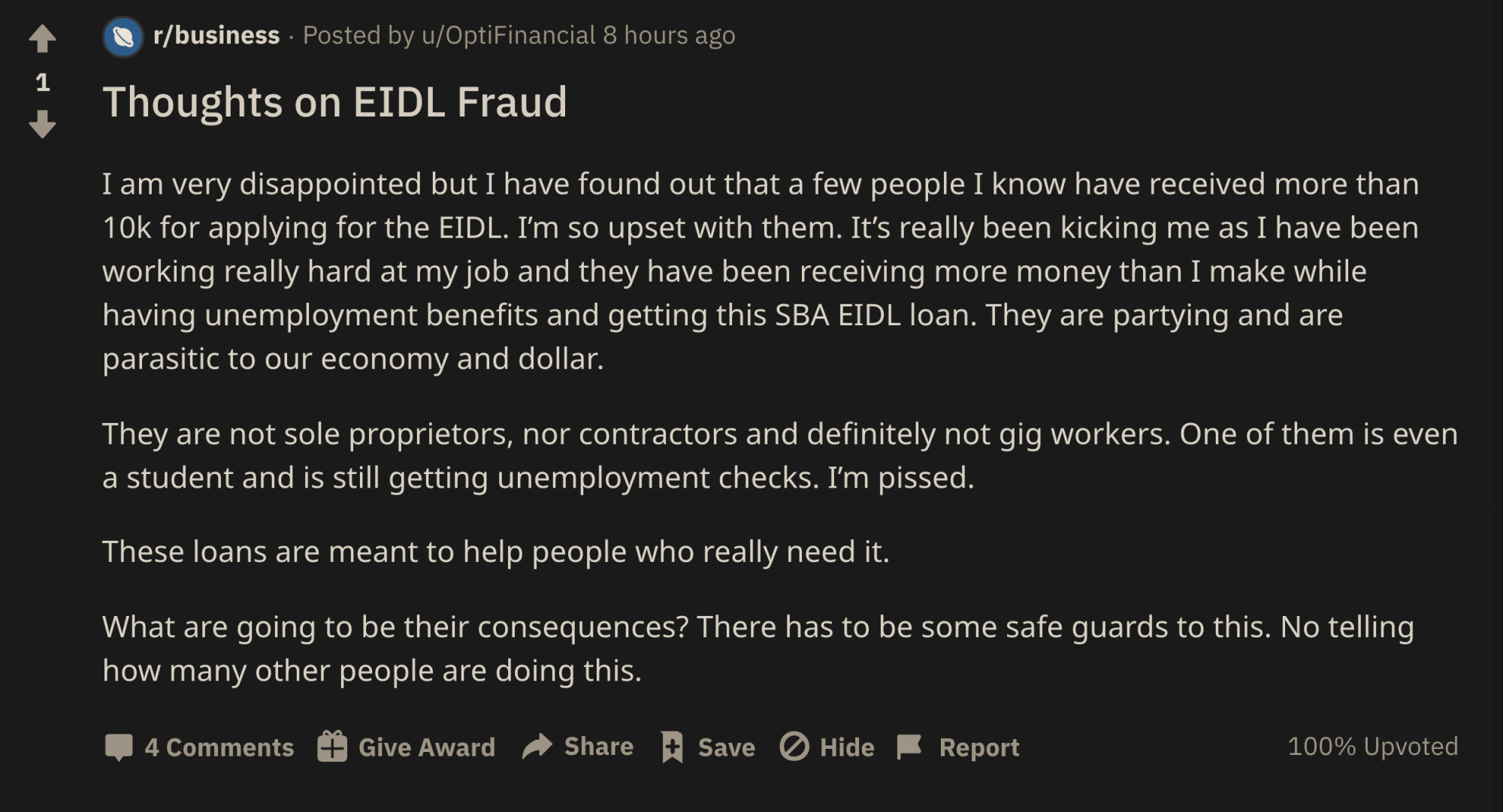

If postings on social media are any indication, there may be tens and thousands of American’s taking advantage of the SBA’s pandemic relief loans.

Here is a recent post that shows just one person’s experience with the program.