Tradeline selling is gaining popularity as a side hustle. In fact, Side Hustle Nation says it can make you $1,000 a month for doing practically no real work.

But is it worth it? Is this really a dream side hustle where you can make lots of money for nothing?

The answer is no. Selling authorized tradelines has many pitfalls that sellers may not even be aware of. In this article, I will tell you 5 Reasons why you should never consider selling your tradelines to a stranger or authorized tradeline company.

Companies Claim You Can Make $300 to $500 per tradeline

Selling tradelines involves adding strangers as “authorized users” to your credit card accounts so that those strangers can “piggyback” off your good credit score.

The hitch is you have to have good credit. No one wants to piggyback off your bad credit. So you need a credit score of 700 or better to sell tradelines.

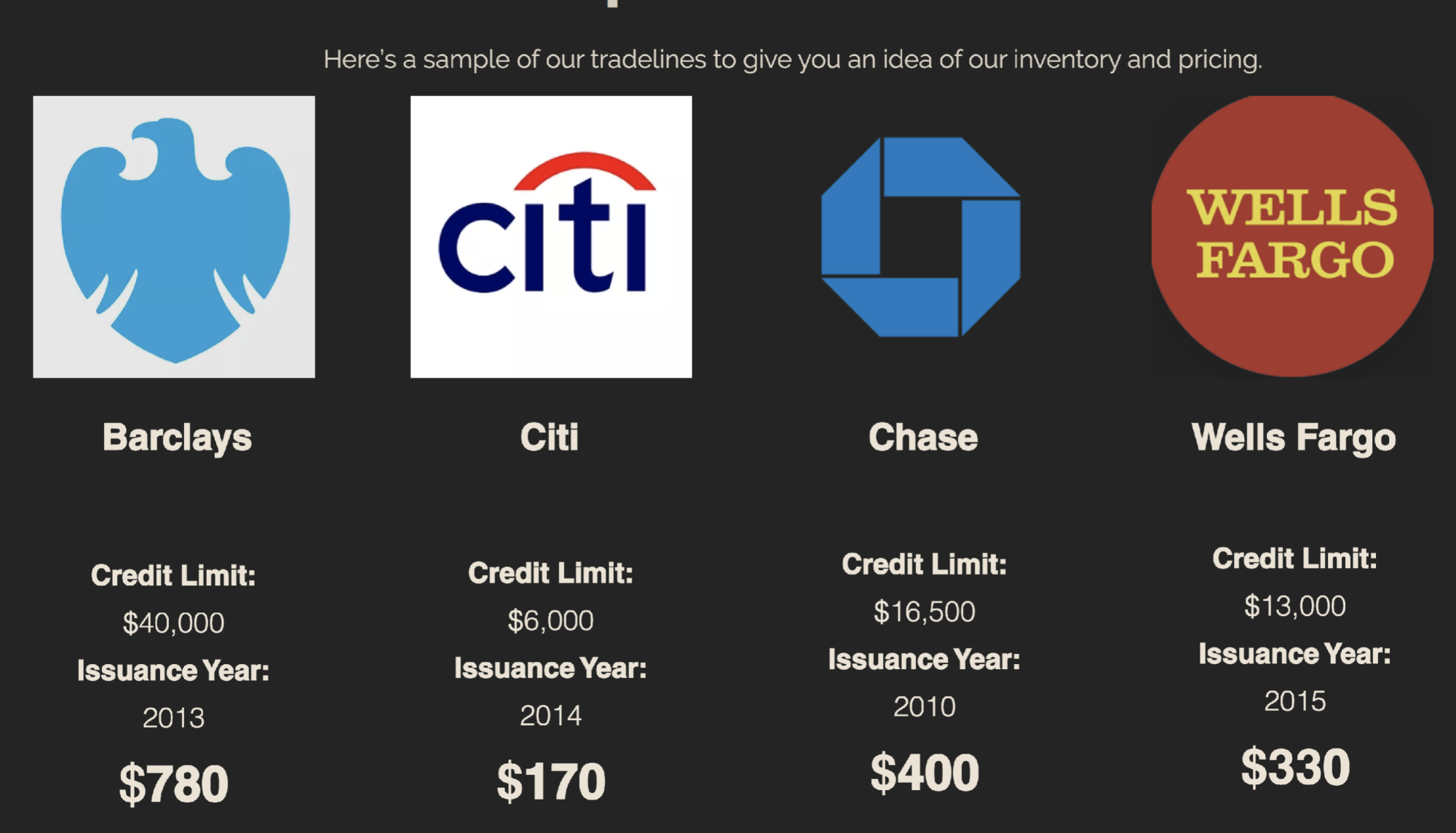

The amount you can earn per tradeline varies. Experts say you can earn between $150 to $300 per tradeline per month. So if you have lots of credit card accounts with high limits your chances of making more money increase.

CoasttoCoastTradelines – one of the larger tradeline brokers out there claim you can make even more and they even show how you how the process works.

You Sign Up With Brokers – Usually Credit Repair Companies

Once someone is interested in selling their tradelines, they need to find a broker that will connect them with people that want to piggyback their credit.

There are thousands of credit repair companies that act as brokers to help them sell their tradelines. Those companies typically have networks of several hundred sellers of tradelines that they will anonymously connect with thousands of people that pay for the service.

Those brokers will typically double the fee that they pay you and charge the seller.

The hitch with these brokers is that often they are CPN Sellers that are helping churn out thousands of fraudulent identities a year and they will use your good credit to legitimize those identities.

How You Make Your Money Selling Tradelines

The process of making money is relatively straightforward.

- You pick a broker – You start by finding one of the thousands of questionable companies that will list your tradelines.

- You submit an application – You send the broker summary information about yourself and the cards you have (the age, the limit, the card name, the date your payment is due, your balance)

- They list you on their service – If chosen they will list you on their sellers list and provide summary details of your cards on their website.

- You add Authorized Users – When they sell your tradeline, they contact you and inform you to add an authorized user. You contact your bank, make up some fake information about why you are adding them – often times you have to lie. When the authorized user cards come in the mail, sometimes you are instructed to use those cards for everyday purchases to legitimize the card request.

- You remove Authorized Users – When the buyer stops paying, you contact the bank and remove them.

Here is one guy that explains the process and he can’t believe why everyone isn’t doing it.

5 Reasons Why Selling Tradelines is A Really Bad Idea

While many tout selling tradelines, fraud experts that understand the downsides warn against falling into the trap.

Here are 5 reasons why you should not sell your tradelines for a quick buck.

#1 – Selling Your Tradelines May Be Violating The Terms of Service of Your Credit Card Account

According to CreditCard.com, selling your tradelines to a stranger is probably against the terms of service that you signed up for with your credit card company.

With the exception of your spouse, domestic partner, or kids, you cannot assign your rights for payment to someone else to use your card. For example, Discover’s cardholder agreement states, “You may not sell, assign or transfer your Account without first obtaining our prior written consent.”

If you are caught violating your card terms, your account could be closed. According to Barry Paperno, a credit score expert and former columnist for CreditCards.com.

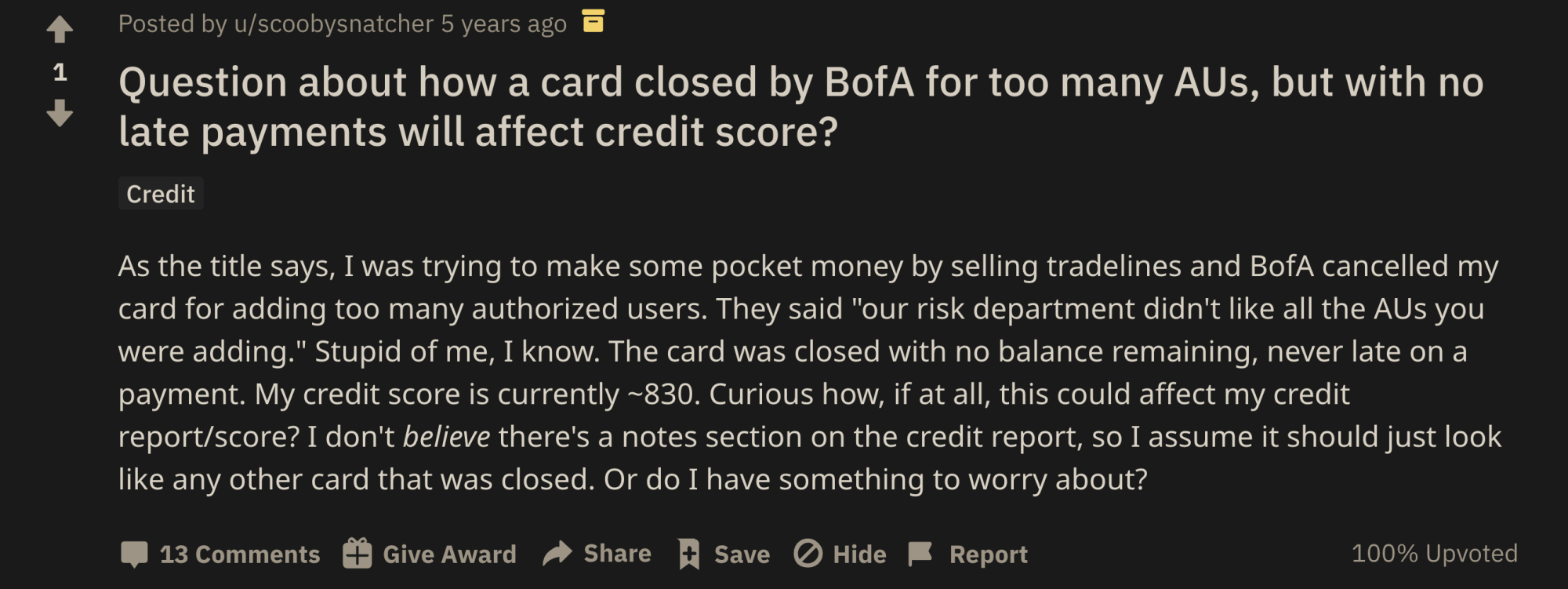

#2 Selling Your Tradelines Can Get Your Card Accounts Closed

Today, most banks monitor for authorized tradeline abuse. Their risk departments will flag any account where more than 4 -6 authorized users have been added.

This unlucky tradeline seller found this out the hard way when Bank of America closed his account after he added too many authorized users.

Once you cross that threshold, and your account is flagged for abuse, it is quite likely that your account could be permanently closed. When a long-standing credit card account is closed by the bank, it has a negative impact on your credit score.

So if you plan on applying for a loan, while you selling your tradelines, you run the risk of hurting your own chances of getting credit.

#3 Selling Your Tradelines Is Possibly Assisting Someone Perpetrate Synthetic Identity Fraud

If you sell authorized tradelines, there is a really high chance that you are adding a person that has created a fake (synthetic) identity, and is using your credit to legitimize that fake identity.

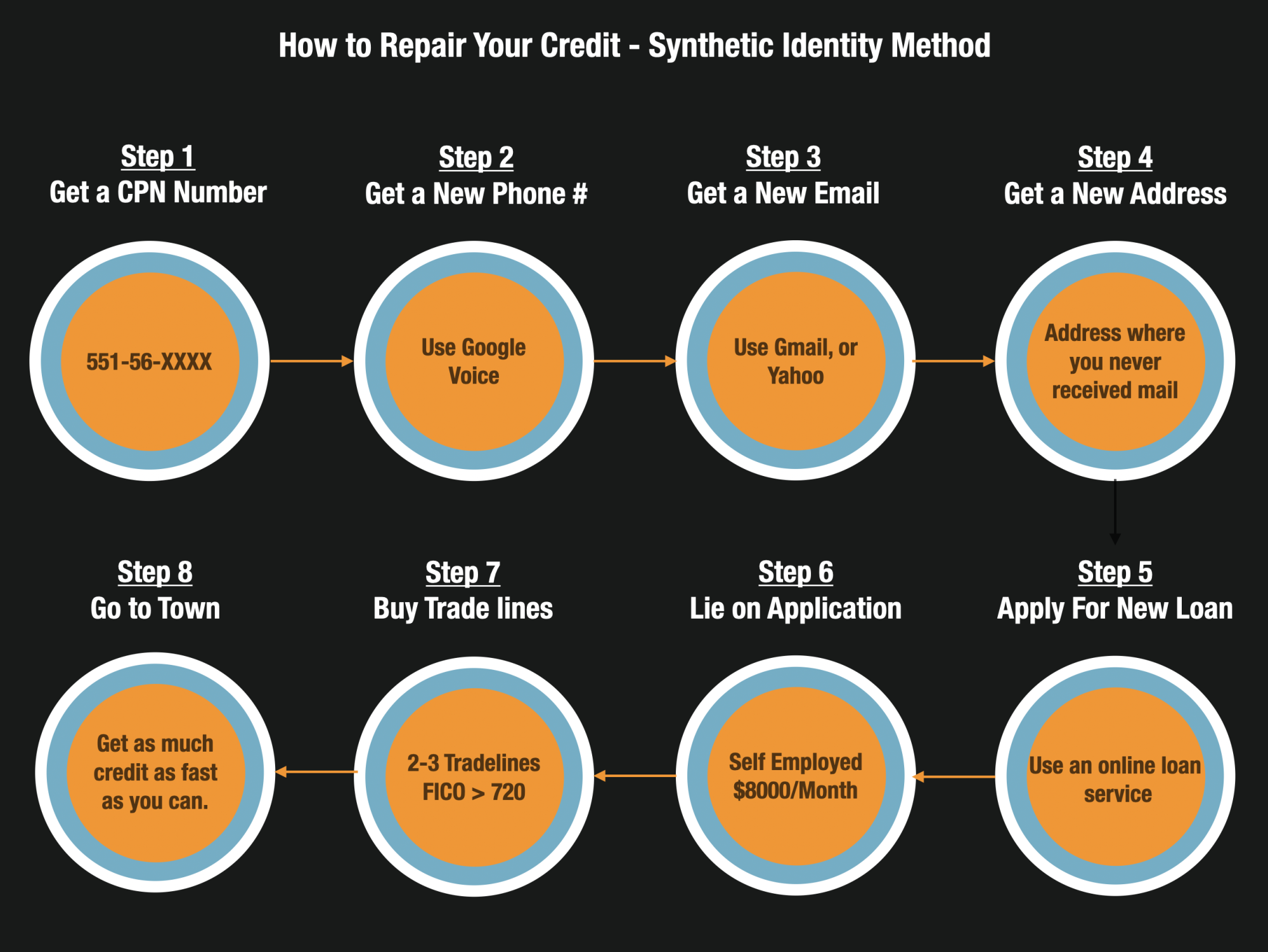

Credit repair companies use a well formulated process of creating a synthetic identity, and the final step in the process is buying tradelines to artificially boost the score of the fake identity.

If you sell your authorized tradeline, you are unknowingly aiding a criminal perpetrate a criminal act.

#4 Selling Tradelines Could Link Your Identity and Address To Fraudsters and Fraud Rings

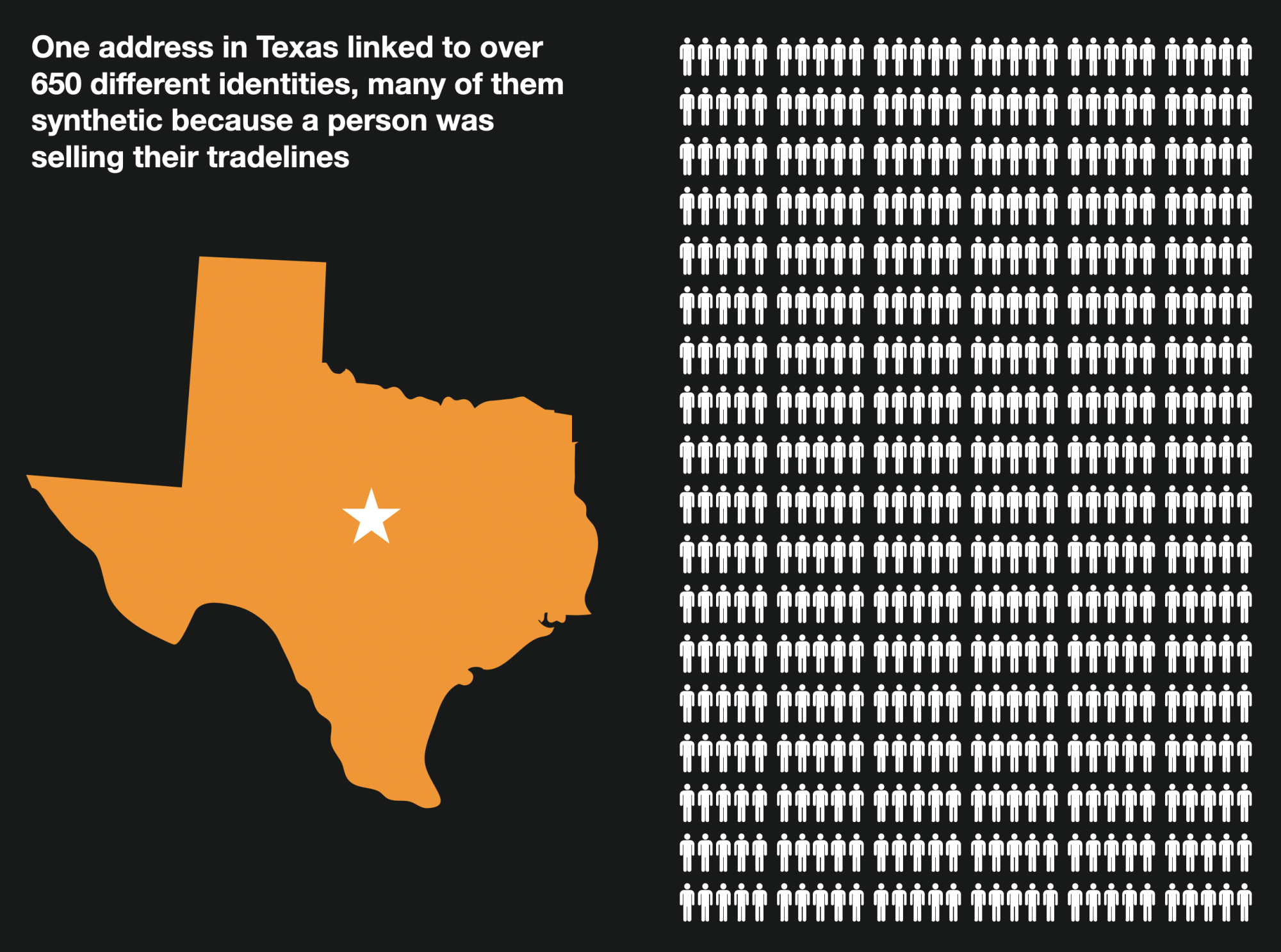

Most people don’t realize, but when you add an authorized user to your account, your address becomes associated with that person.

That’s because the card issuers not only report the authorized tradeline to the credit bureau but they will also report the address. In the case of a synthetic identity, your address now becomes linked in public records.

As an example, investigators recently linked over 650 identities to a single address in Texas. The person that lived at that address appears to have been selling their tradelines for years. Many of those identities were synthetic, and that person’s home has now been linked to the criminal element.

#5 Because You Could Get Scammed Or Become A Victim of Fraud Yourself

When you deal with shady companies, you’re bound to run into problems. And face it, some credit repair companies do shady things.

If a company is actively helping people create synthetic identities which are fraud, why would they not try to scam you too?

Best advice is steer clear of selling your tradelines or engaging in anyway with companies that try to convince you to do it in the first place.

Thanks for reading, good luck and stay away from selling tradelines!