The SSA rolled out there new Synthetic Identity Killer – eCBSV – which provides a lender verification if an individual’s SSN, name, and date of birth combination match Social Security records.

Social Security needs the number holder’s written consent with a wet or electronic signature in order to disclose the SSN verification.

The service, which rolled out on a limited basis last month, was limited to a select few companies and is available for pilot testing currently.

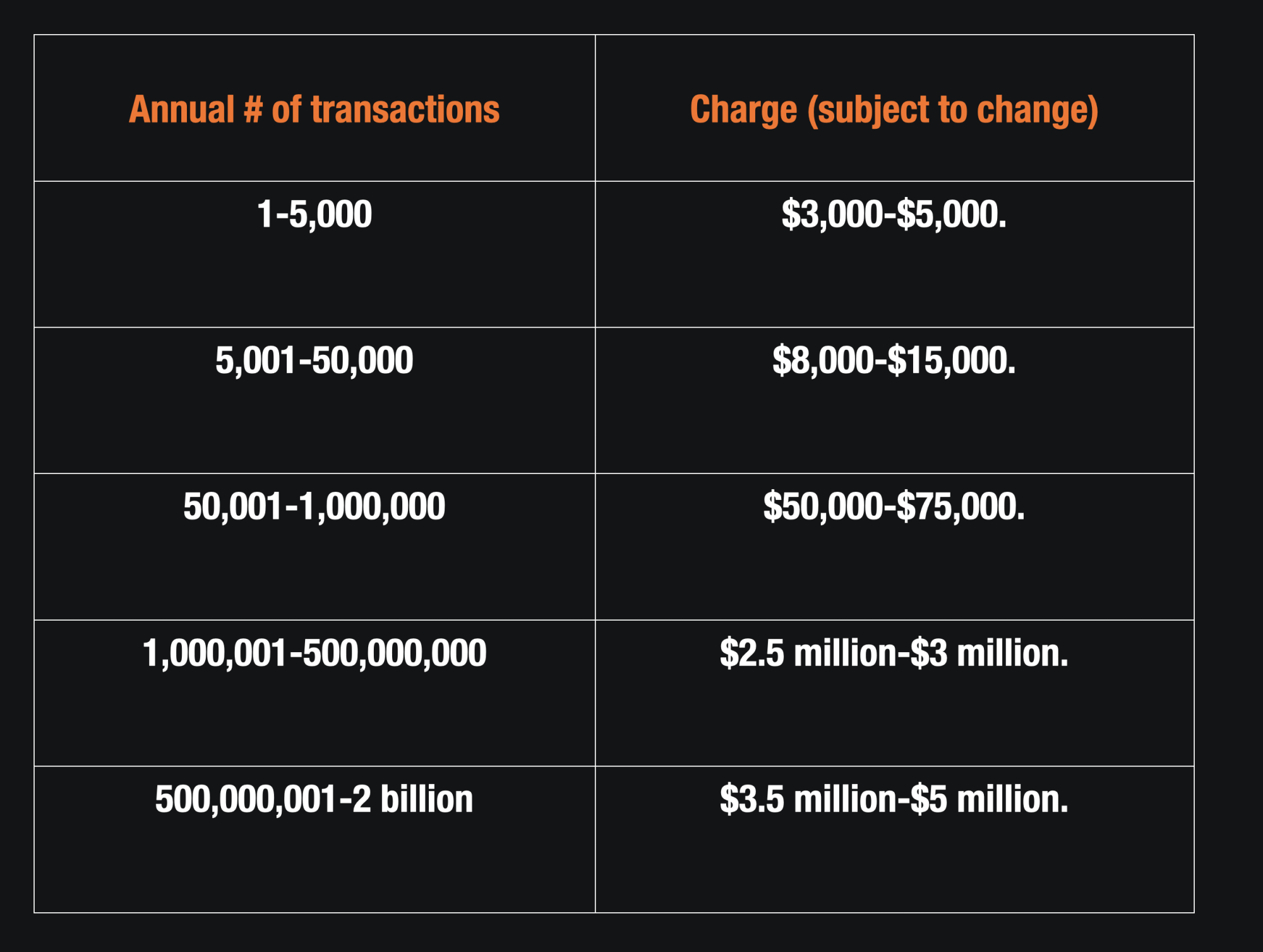

The service will be priced based on volume and lenders will pay based on how many searches they do. The SSA offered some guidance on pricing but it is subject to change. The price could range anywhere from 5 cents to $1 based on the volume.

But how effective will the service be in fighting back against Synthetic Identity?

A validation that the social security number belongs the borrower by matching the name directly with the Social Security Number should be a sure thing right?

Well, SentiLink looked into just that question and the results might surprise you.

Sentilink Publishes a WhitePaper

In September 2019, SentiLink was selected by the SSA to participate in the pilot program. And, just this week, they published a white paper which offers a compelling insight into the strengths and potential weaknesses of the name-checking program.

SentiLink produced the research because as they indicate, “The successful implementation of a verification product depends tactically on understanding its requirements and use cases. But a truly successful implementation means understanding the verification product’s strengths and weaknesses, its mismatch rates and why they occur, how to integrate the product into your existing environment, and what supplementary services may be necessary or rendered redundant as a result.”

The research covers the following:

- The Name, SSN and Date of Birth Match Rate that you can expect to achieve with the eCBSV program

- The mismatch rate by different categories (maiden names, legal name changes, compound names, nicknames, name variations, alternate first names

- Typo rates by Date of Birth and SSN input errors

Surprisingly, the research reveals that up to 18% of checks could result in mismatches for banks and lenders.

This whitepaper is a must read as you prepare for use of the program in your operations. I read the document and it was eye opening and informative. I highly recommend it.

The white paper titled “Optimizing Use of the SSA’s eCBSV for Compliance and Detection of Synthetic Fraud“ can be requested here – Request WhitePaper.