In simpler days, payment fraud used to be pretty straightforward. You had stolen or counterfeit checks and maybe the occasional wired fraud and that was the end of the story.

But over time, that changed. More types of payment options became available – ACH, Zelle, Paypal, Venmo, Cash App, and more of those options became available through different channels – like on your desktop computer, or even on your mobile phone.

The different types of fraud increased dramatically, and banks reporting got more convoluted than ever.

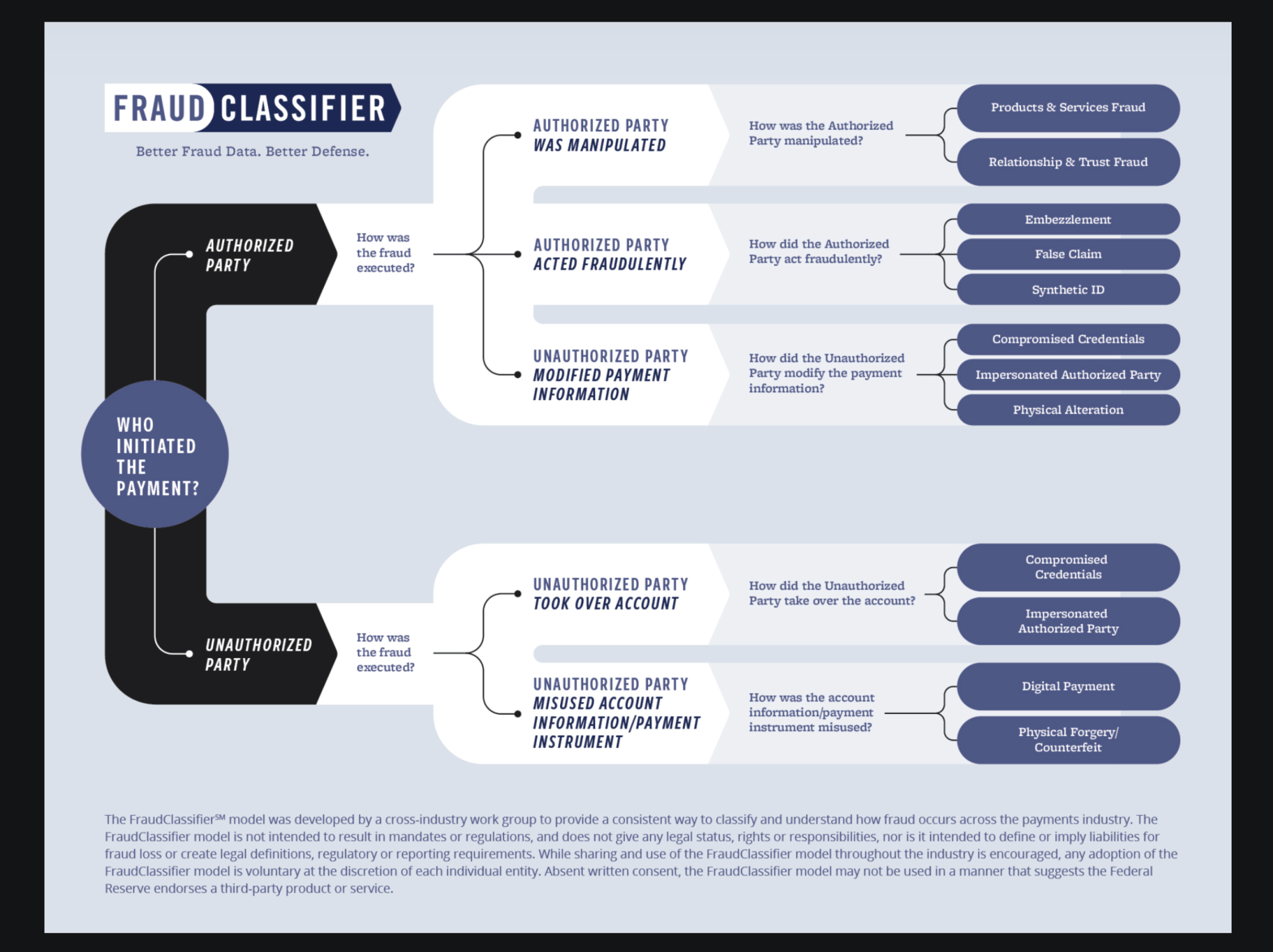

Well, the Federal Reserve recently aimed to fix that. They released a Fraud Classifier Model to help companies consistently report different types of payment fraud.

The Federal Reserve reckons that better data and reporting up front, means better defenses and fraud controls to prevent it in the future. I could not agree more.

According to the release, the key advantage of the FraudClassifier model is the ability to classify fraud independently of payment type, payment channel, or other payment characteristics. The model focuses on a series of questions, beginning with who initiated the payment to differentiate payments initiated by authorized or unauthorized parties. The result is a holistic view of fraudulent events, which can help with more strategic fraud management. Each of the classifications is supported by definitions to facilitate consistent application of the model across the industry.

The model’s classifications provide information on what fraud occurred and how it was perpetrated. Adding payment attributes (such as payment amount, date, type and channel) to these classifications can provide additional insight to help aid the organization in identifying fraud trends.

The brainchild of the Federal Reserve Working Group

The excellent classifier model was created by a group of Senior Executives from the largest and most well respected organizations here in the US. An impressive list for sure.

- Gasan Awad, Fiserv

- Dondi Black, FIS

- Jamey Boone, Early Warning (Zelle)

- Nell Campbell-Drake, Retail Payments Office, Federal Reserve Bank of Atlanta

- Natalie Diana, Bureau of the Fiscal Service, Department of the Treasury

- Carlos Fuentes, Wholesale Product Office, Federal Reserve Bank of New York (March-June 2019)

- Adriana Guaderrama, First Century Bank

- Chris Guard, State Employees’ Credit Union of North Carolina

- Cheryl Gurz, Citizens Bank (March-October 2019)

- Mike Herd, Nacha – The Electronic Payments Association

- Kin Wah Koo, Wholesale Product Office, Federal Reserve Bank of New York

- Rakesh Korpal, JPMorgan Chase

- Lee Kyriacou, The Clearing House

- Danny Luong, PricewaterhouseCoopers

- Kyle Marchini, Javelin Strategy & Research (July 2019-January 2020)

- Roy Olsen, American National Bank & Trust

- Carla Palma, PepsiCo (March-July 2019); XPOLogistics (July 2019-current)

- Al Pascual, Javelin Strategy & Research, (March-July 2019)

- Rene Perez, Jack Henry & Associates

- Kim Plaugher, Navy Federal Credit Union

- Sergio Rodriguera, Jr., SAS (March 2019-January 2020); Federal Reserve Bank of Boston (January 2020-present)

- Kathy Stokes, AARP

- Krista Tedder, Javelin Strategy & Research (January 2020-present)

- Eric Tran-Le, Guardian Analytics