An article in the Wall Street Journal was published which indicated that 1 in 5 borrower applications have inflated incomes. The article written by Ben Eisen exposes some dealers that lie about the income to get loans approved and put the borrowers in cars that they could not otherwise afford.

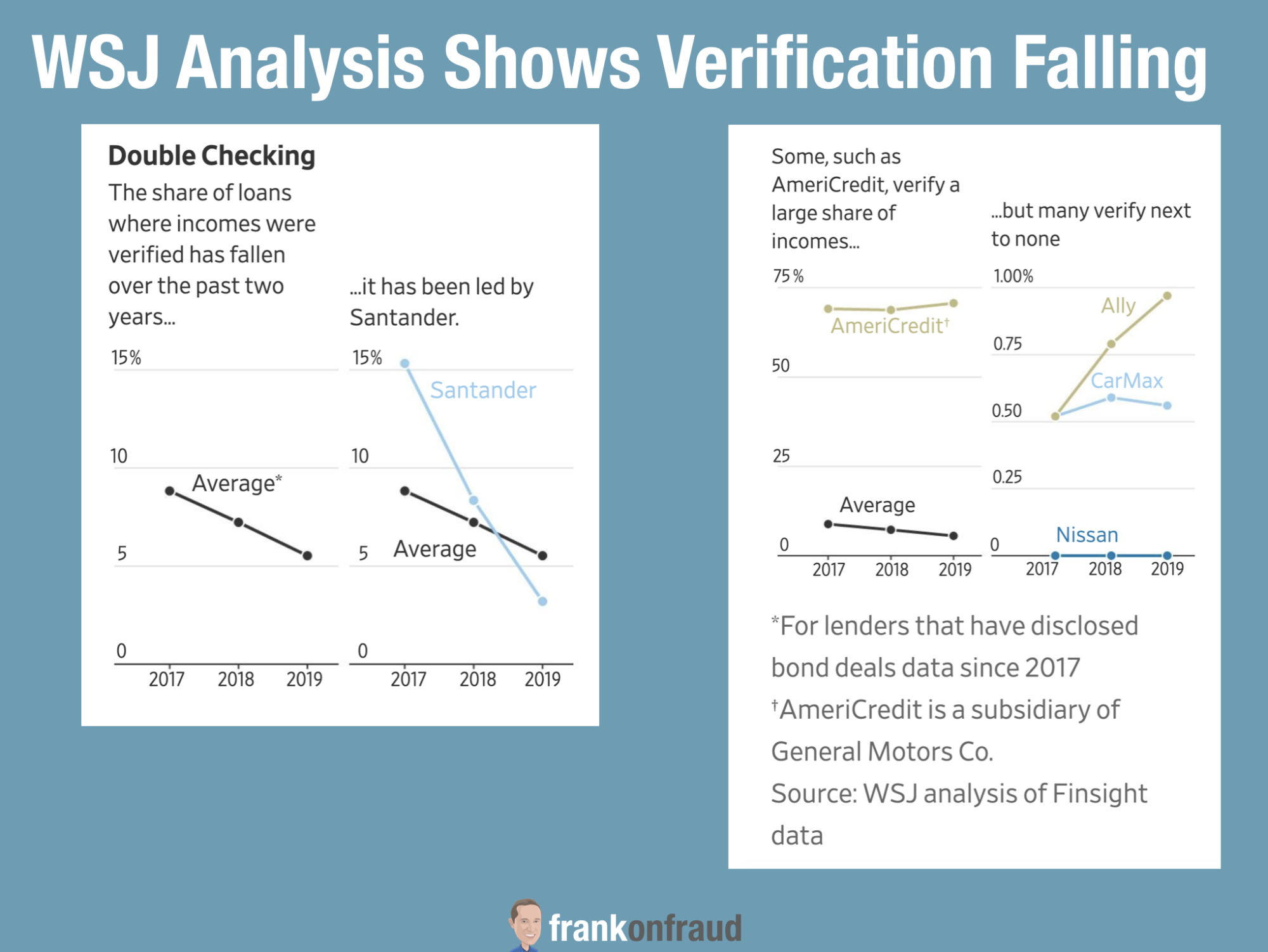

The article also indicated that, even in the face of rising income misrepresentation by car borrowers or dealers, that many lenders are rolling back their income verifications over the last 2 years.

You can read the article – here – An $809 Car Payment, a $660 Income: How Dealers Make the Math Work

The sad impact of all of this is that consumers that otherwise could not afford the car are left holding the bag when the loans default.

The article goes on to point out that a dealer put Mirna López in a car with a $800 a month payment, when her true earnings were only $660 a month. How would a consumer pay a loan of that size when then earnings were less than the payment itself.

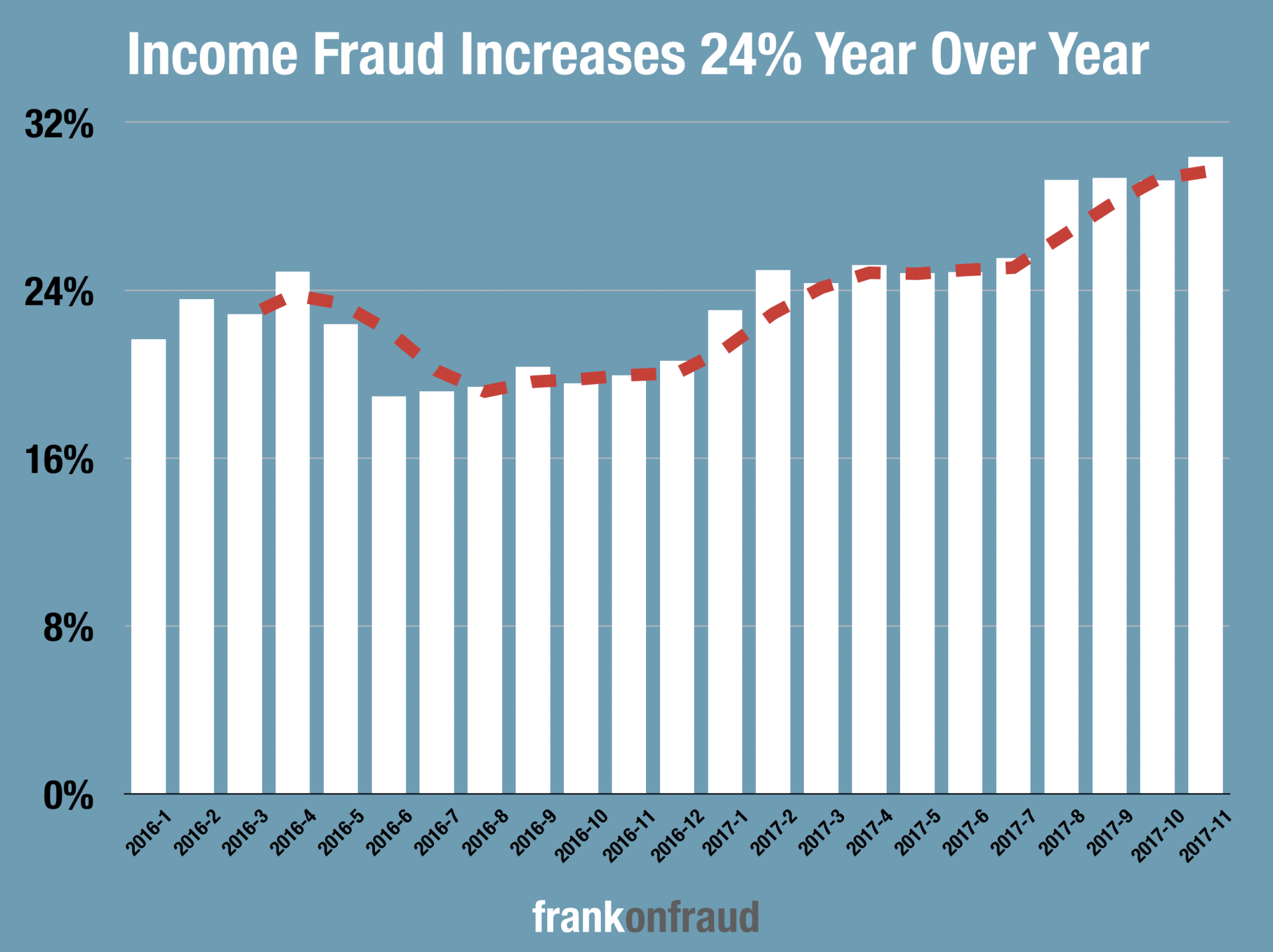

This was the analysis conducted by PointPredictive data scientist which showed that income fraud is on the rise year over year.

Thanks for reading.