Check fraud. It seems like it will never go away. And every year another bank seems to get hit with an outbreak that they are forced to publicly disclose.

It’s rare that fraud ever makes its way into banks annual and quarterly filings, but when it does it’s always check fraud.

Checks are seriously more trouble then they are worth for banks, so I decided to research the problem and get to the bottom of it.

My objective? Find cases when check fraud was so egregious that it materially impacted a banks annual earnings reports.

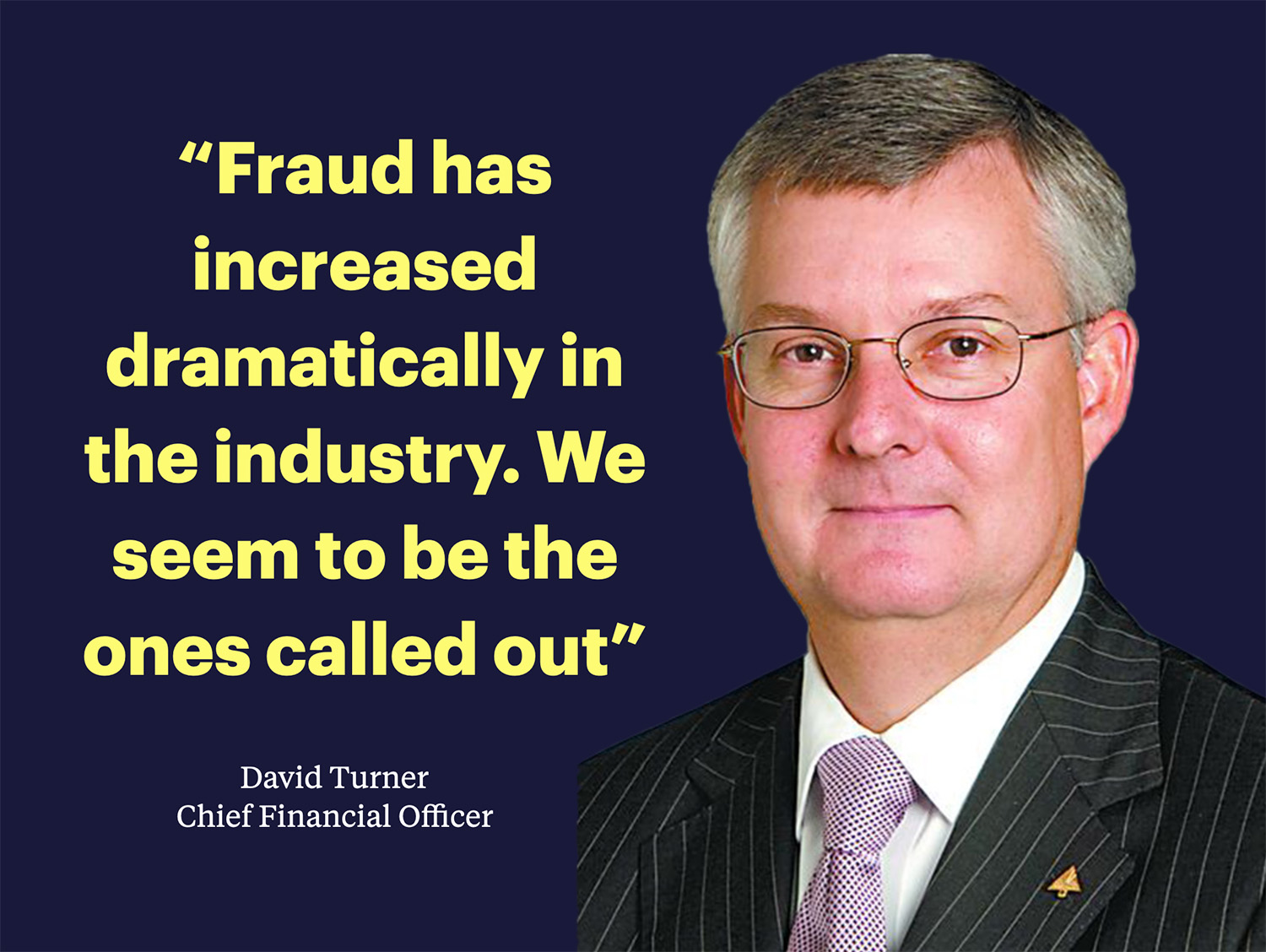

#1 – Regions Bank 2023 – $155 Million

Regions Bank reported the largest publicly disclosed check fraud loss, totaling $155 million across 2023, with an additional $22 million hit in Q1 2024.

The losses were clearly detailed in their earnings calls and financial disclosures.

The problem with check fraud at Regions Bank was related to Check Deposit Fraud. When altered checks were deposited it can take weeks or months for those fraudulent items to be returned. The bank discovered that criminals were depositing altered checks and withdrawing the funds immediately.

CFO David Turner revealed the vulnerability during the Q3 2023 earnings call: “We opened the door too wide, bad people came rushing in, and we didn’t close the door timely enough.”

The fraud led to substantial operational changes at Regions, including modified deposit hold policies to give them more time to verify checks. In June 2023, Regions amended its customer deposit agreement to hold all but $225 of funds deposited by certain check types until the second business day after deposit, replacing their previous next-business-day availability policy

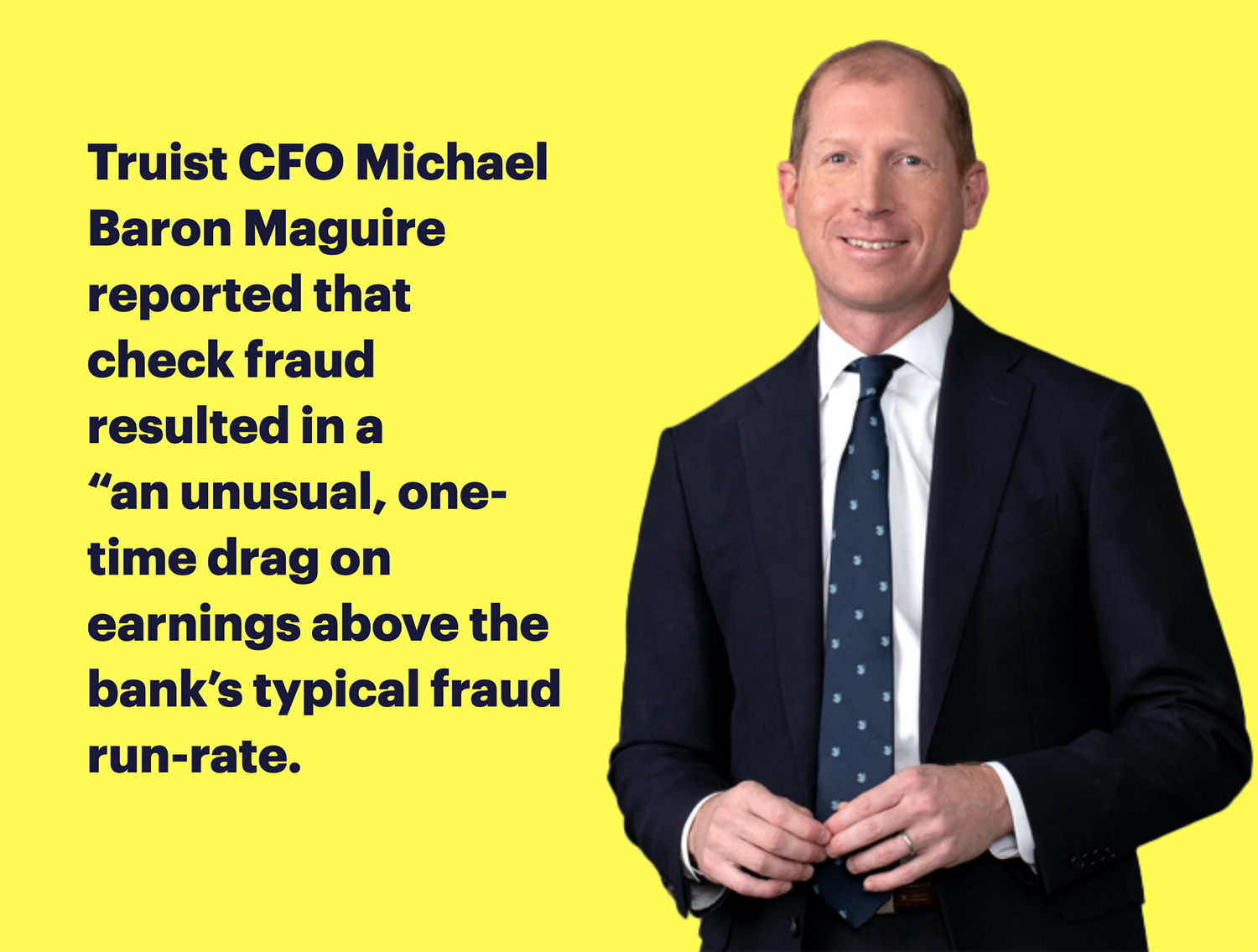

#2 – Truist Financial 2023 – $33 Million

At Truist, check fraud contributed to a $33 million increase in operating losses during the third quarter of 2023.

CFO Michael Baron Maguire reported the losses at the same time that Regions Bank was targeted. Management described this as an unusual, one-time drag on earnings above the bank’s typical fraud run-rate.

The fraud appears to be related to the same type of scheme where criminals took advantage of the hold policies to extract funds before the checks could be verified.

#3 – Key Corp 2020 – $90 Million

In 2020, KeyCorp disclosed a $90 million potential fraud loss. The fraud involved Interlogic Outsourcing, a payroll processing company and customer of theirs that “fraudulently initiated wire transfers” totaling $122 million when insufficient funds existed to cover them.

Unlike typical check fraud cases targeting consumers, this was a case of business fraud combined check kiting and wire transfer manipulation.

The CEO of Interlogic issued fraudulent checks from companies they controlled and then kited the money before the checks cleared.

#4 – S&T Bancorp 2020 – $59 Million

This was one of the largest single customer perpetrated frauds against a bank in history.

In the second quarter of 2020, S&T Bancorp discovered that a business customer of theirs had perpetrated a old school check-kiting scheme—leveraging the float time between accounts to create artificial balances.

Over a period of weeks, the customer deposited millions in checks between multiple S&T accounts, withdrawing funds before the checks fully cleared.

Once uncovered, the bank reversed the fraudulent deposits and recorded a substantial charge-off of over $59 million on their earnings. It reduced their earnings per share by close to $1.20!

#5 – ServisFirst Bancshares 2022 – $1.3 Million

In 2022, ServisFirst Bancshares uncovered a rash of uninsured check fraud that forced a $250,000 quarterly accrual and piled on roughly $1.3 million in legal and investigation fees.

The bank’s fraud team spotted odd deposit patterns, reversed the bad checks and then revamped their fraud controls to focus more on positive pay to curb the losses.

The loss might seem small for a big bank, but it was material enough for ServisFirst to call it out in their quarterly reports.

#6 – JP Morgan Infinite Money Glitch 2024 – $661,000

And last but certainly not least, how can we leave off the famous JP Morgan Infinite Money Glitch of 2024.

While Chase did not disclose losses in their annual reports, it has certainly been very well documented in court filings and criminal proceedings.

This fraud scheme went viral on social media in August 2024 and exploited a temporary technical vulnerability where customers deposited fraudulent checks at ATMs, withdrew funds before the checks could be verified, and disappeared with the cash when the checks bounced.

What Did I Learn? What Can We All Learn?

I learned something during my research and that was this.

Every single instance of large-scale check fraud that hit a banks earnings has been directly tied to criminals and customers exploiting their check hold policies. In 2023, there seemed to be a surge of banks that either changed or updated their hold policies and got absolutely slapped for it.

If you’re not closely looking at how your hold policies can be improved, I highly recommend it!