Striking a balance between fraud prevention and customer impact is the hardest part of every fraud managers job. The focus shifts so much it’s like riding a see-saw, and so often organizations fail to strike the optimal balance between impact on fraud and impact on the customer.

One day your executives tell you to turn off fraud strategies to decline fewer customers. Customer service is the focus of the business and everyone seems to move in that direction to achieve that goal.

The next month, fraud losses have increased because strategies were turned off, and once again the fraud manager is asked to reduce fraud losses. In those times, the focus on customer impact may be minimal while the business tries to drive down fraud.

This is the see-saw life that a fraud manager will often lead. One day to the next, the priorities change and the business never seems to find that optimal balance where fraud and customer service are at a perfect balance. The equilibrium is never achieved because the success measurements are always changing.

Fraud Metrics Are Often So Often Lopsided

One of the reasons that banks and lenders tend to switch between the focus on fraud and the focus on the customer so rapidly is because their metrics are often lopsided.

Executives tend to see fraud success metrics every day. But they typically only hear about customer complaints. Those complaints are usually so loud, that executives react by screaming, “Turn off the Strategies! We are declining all of our good customers!”

This is never true but it is often accepted as fact because fraud departments rarely have good customer impact measurements.

The metrics are lopsided.

A Simple Monthly ScoreCard Can Tell a Better Story

I discovered a trick several years ago. By creating a new monthly report for a group I was working with, we found that we could educate executives on the balance between fraud and customer impact in such a way that it helped us avoid the big swings.

How did we do it? We created a balanced scorecard that measured the success of the group on how well we managed fraud, but also, on how well we managed to keep customer impact low.

We let the numbers tell the story and do the education for us. And it worked!

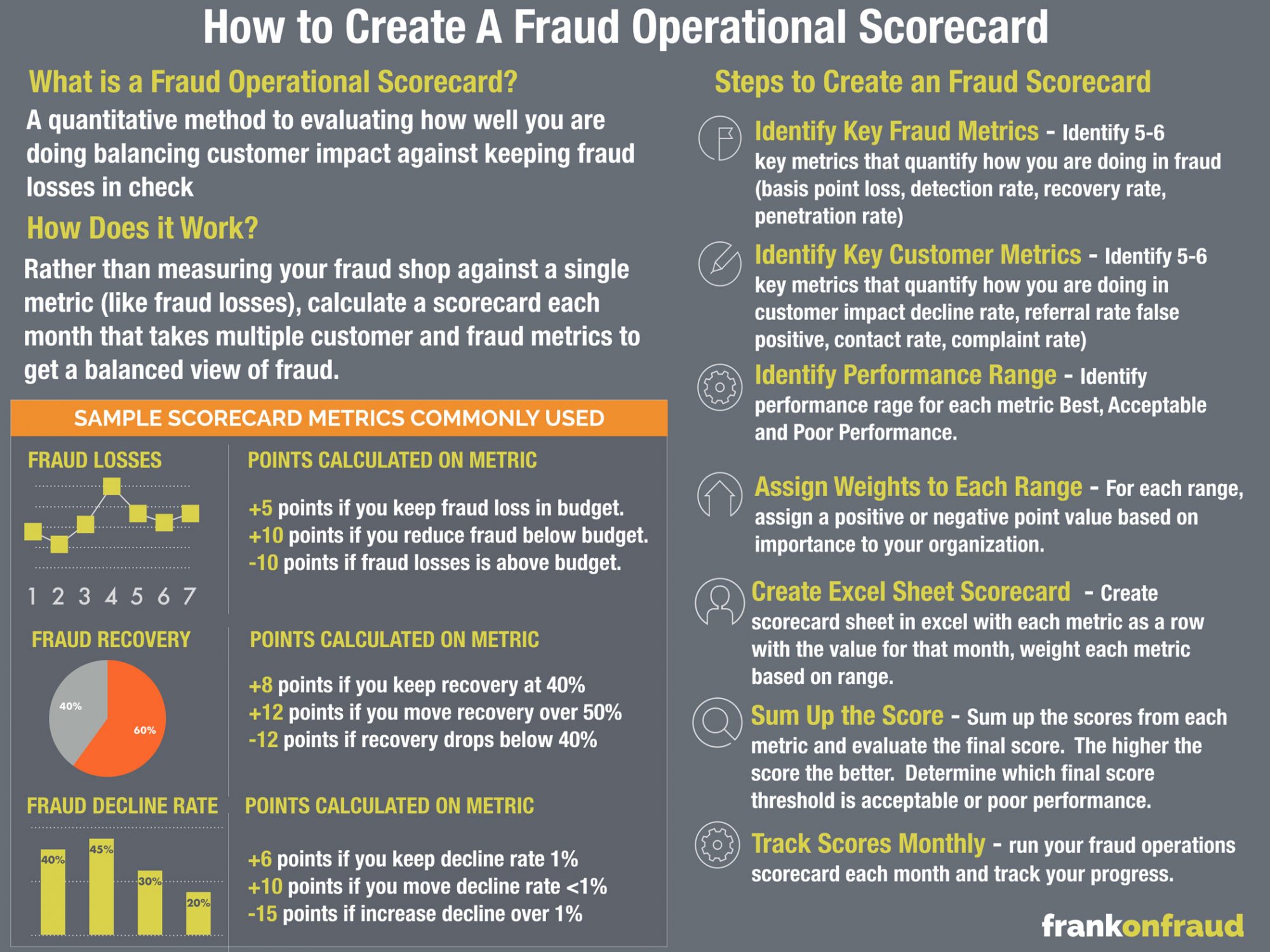

Steps To Create A Fraud Operational Scorecard

There are simple steps you can take to create a fraud operational scorecard. Here they are:

Step 1 – Identify Key Fraud Metrics

Identify 5-6 key metrics that quantify how you are doing in fraud. These can be basis point loss, detection rate, recovery rate, penetration rate and other metrics that quantify the fraud related performance of your group.

Step 2 – Identify Key Customer Metrics

Identify 5-6 key metrics that quantify how you are doing in customer impact decline rate, referral rate false positive, contact rate, complaint rate). Identify metrics that can help you explain how you are managing fraud while keeping customer impact low.

Step 3 – Identify The Failing, Passing and Excellent Ranges for Each Metric

Identify what constitutes great, average and poor performance for each metric that you have chosen. Understand that you will be gauged and scored each month against those ranges.

Step 4 – Assign Weights to Each Range

For each range, assign a positive or negative point value based on importance to your organization.

Step 5 – Create the Scorecard

Create scorecard sheet in excel with each metric as a row with the value for that month, weight each metric based on range.

Step 6 Sum Up the Score

Sum up the scores from each metric and evaluate the final score. The higher the score the better. Determine which final score threshold is acceptable or poor performance.

Step 6 – Track Scores Monthly

Run your fraud operations scorecard each month and track your progress.

And those are the simple steps to achieve a scorecard.

It Can Be Simple, You Can Do it In Excel Each Month

The fraud operations scorecard can be simple. In fact, you probably want it to be for the maximum storytelling power.

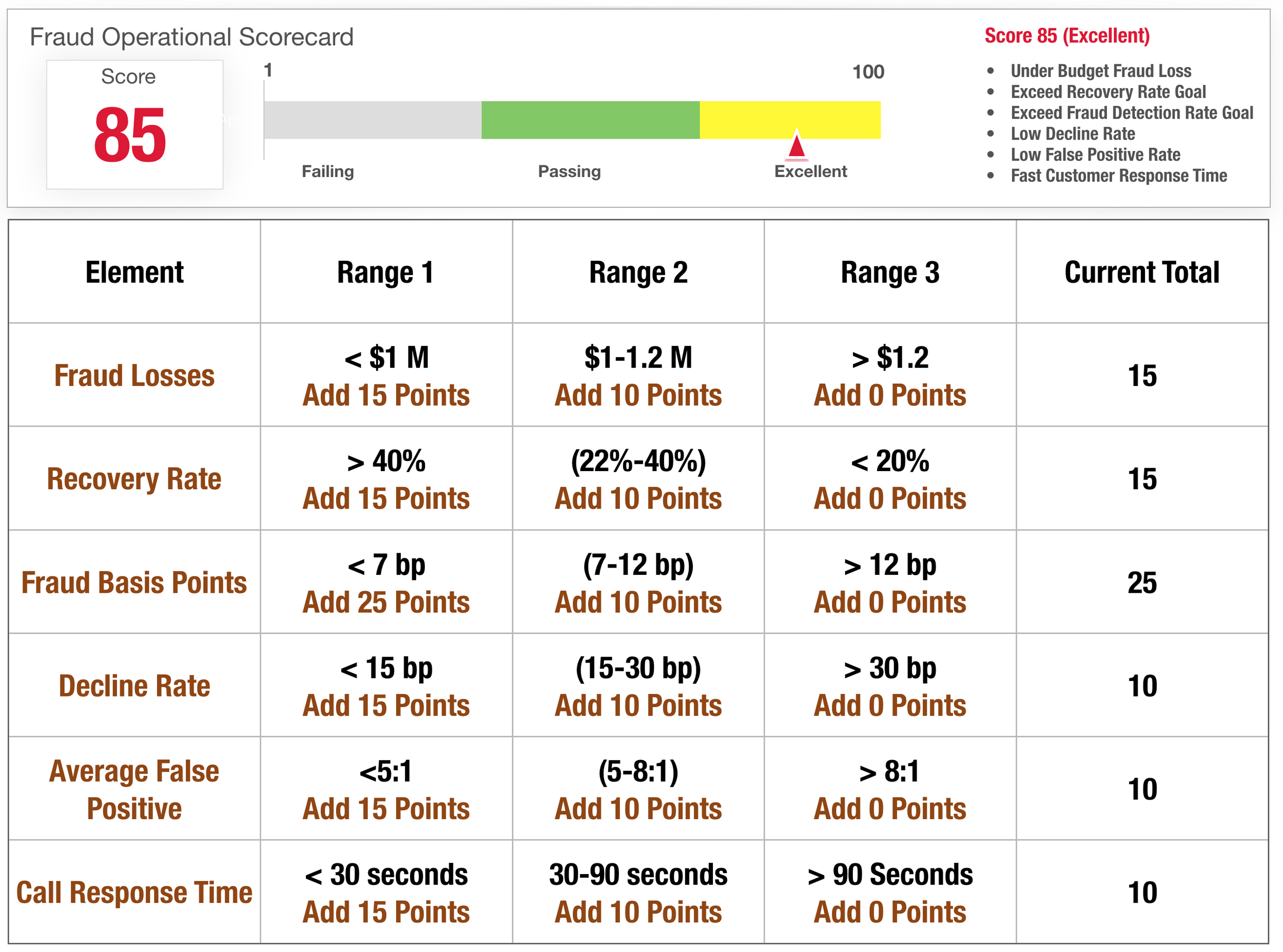

A Sample Fraud Operational Scorecard for You To Use

I created a sample Fraud Operational Scorecard that you could start with to get the idea of how it could work. It is an excel based tool that you can impress your boss with at your next monthly meeting to show him forward you are thinking in terms of creating the perfect fraud balance.

This is obviously pretty simple but it gives you an idea of how you can easily create your own.

Here is A Handy Infographic For You to Print off and Share

Thanks for reading and let me know if you have any questions!