Many people in the UK may be living next to Frankensteins.

A Lexis Nexis study, on a comprehensive analysis of more than 72 million consumer profiles, has uncovered a disturbing trend that experts have termed “Frankenstein cloning.”

The research revealed that 2.8 million profiles exhibited clear indications of this fraudulent technique, in which criminals meticulously combine authentic personal information with fabricated details to construct novel synthetic identities.

Doing the math means close to 4% of identities in the UK public profiles are synthetic.

It Could Cost The UK Economy Over £4 Billion

According to experts at LexisNexis Risk Solutions, the UK economy could face losses of approximately £4.2 billion by 2027 due to the growing threat of synthetic identity fraud.

They point to US stats, which pin the average loss per synthetic at $15,000. They used a comparatively more conservative average of £1,500 per instance to arrive at their colossal loss estimate.

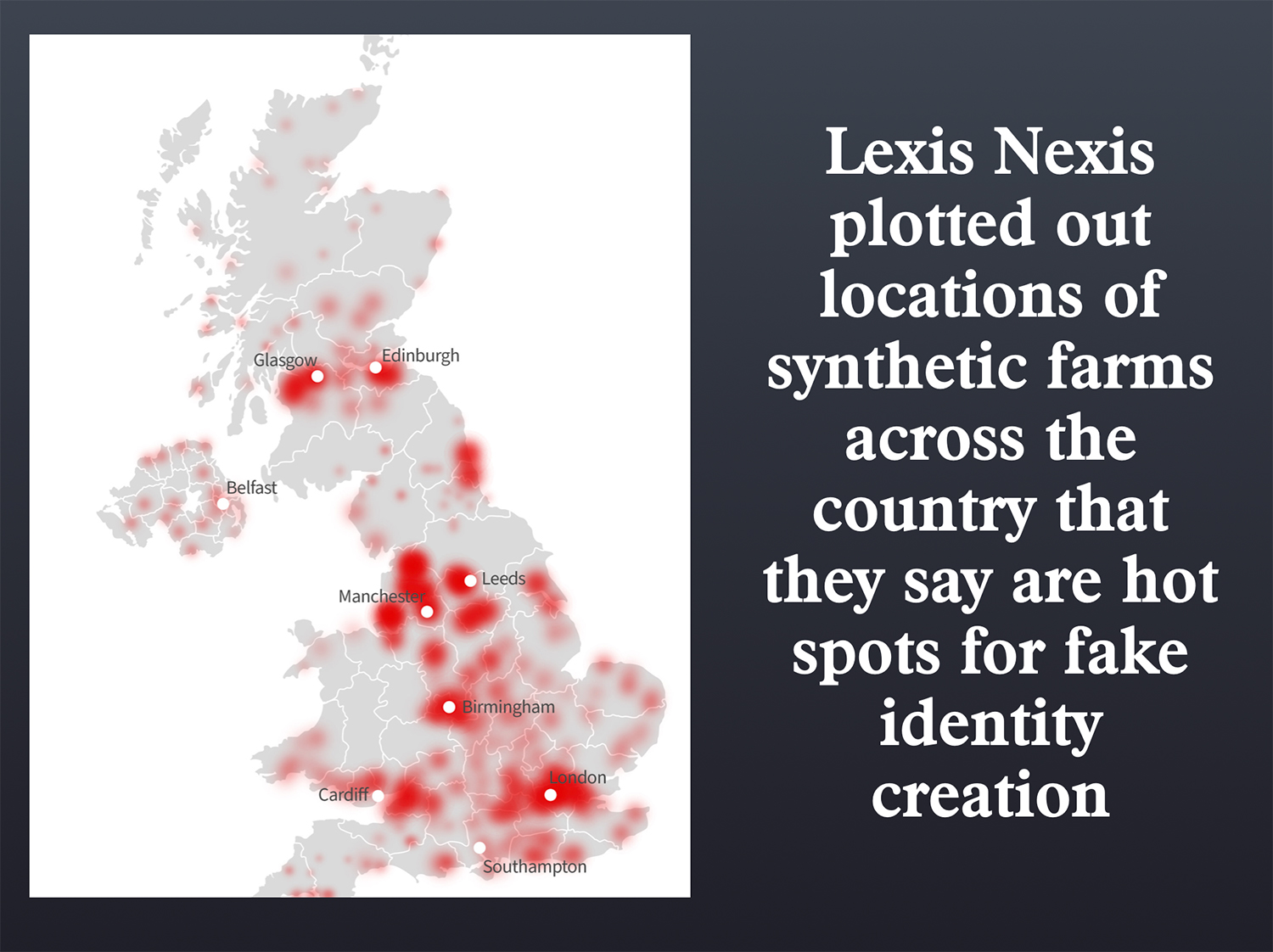

Synthetic Factories and Farms Across The Country

Lexis Nexis researchers believe sophisticated operations are creating these newly discovered synthetic identities. They uncovered compelling evidence that scammers across the United Kingdom are utilizing “synthetic farms” in rural areas and “synthetic factories” in cities to create and cultivate synthetic identities on a large scale.

The study highlighted a specific case in which rental cottages on a farm in Chichester, England, appeared to have been home to 439 suspicious identities over the past seven years. However, only 22 of these identities showed signs of belonging to real individuals.

The fake identities were found to have made hundreds of credit applications, including short-term and payday loans. Investigators also discovered links between some of these identities and a similar farm located hundreds of miles away near Dundee, Scotland, suggesting a potentially widespread network of fraudulent activity.

Noreen Altaf, an Identity Fraud Specialist at Lexis Nexis Solutions, believes part of the problem is that many businesses in the UK are not aware of synthetic identity and how it works.

“At first, a synthetic ID has little value to a fraudster, as it has no credit history, so they need to play the long game. Scammers nurture each false identity by building what appears to be a real credit profile over time, making the synthetic ID seem like a trustworthy customer – because of this, the fraud threat is effectively invisible to firms’ existing fraud defenses until it’s too late.”

According to Noreen, billions are being lost to these synthetic identities. “There is still much businesses don’t know about this fast-emerging threat, so it’s difficult to predict the true potential cost of synthetic fraud to the UK. However, even a very conservative estimate of a £1,500 loss per fraud attack amounts to £4.2 billion in future credit write-offs for companies, with synthetic identities already hiding amongst their customer base – and it could be a lot higher.”

Synthetic Identity Recognition Is Sweeping The Globe

While the US has grappled with the problem of synthetic identity for the last 20 years, other countries have not had nearly the same level of losses.

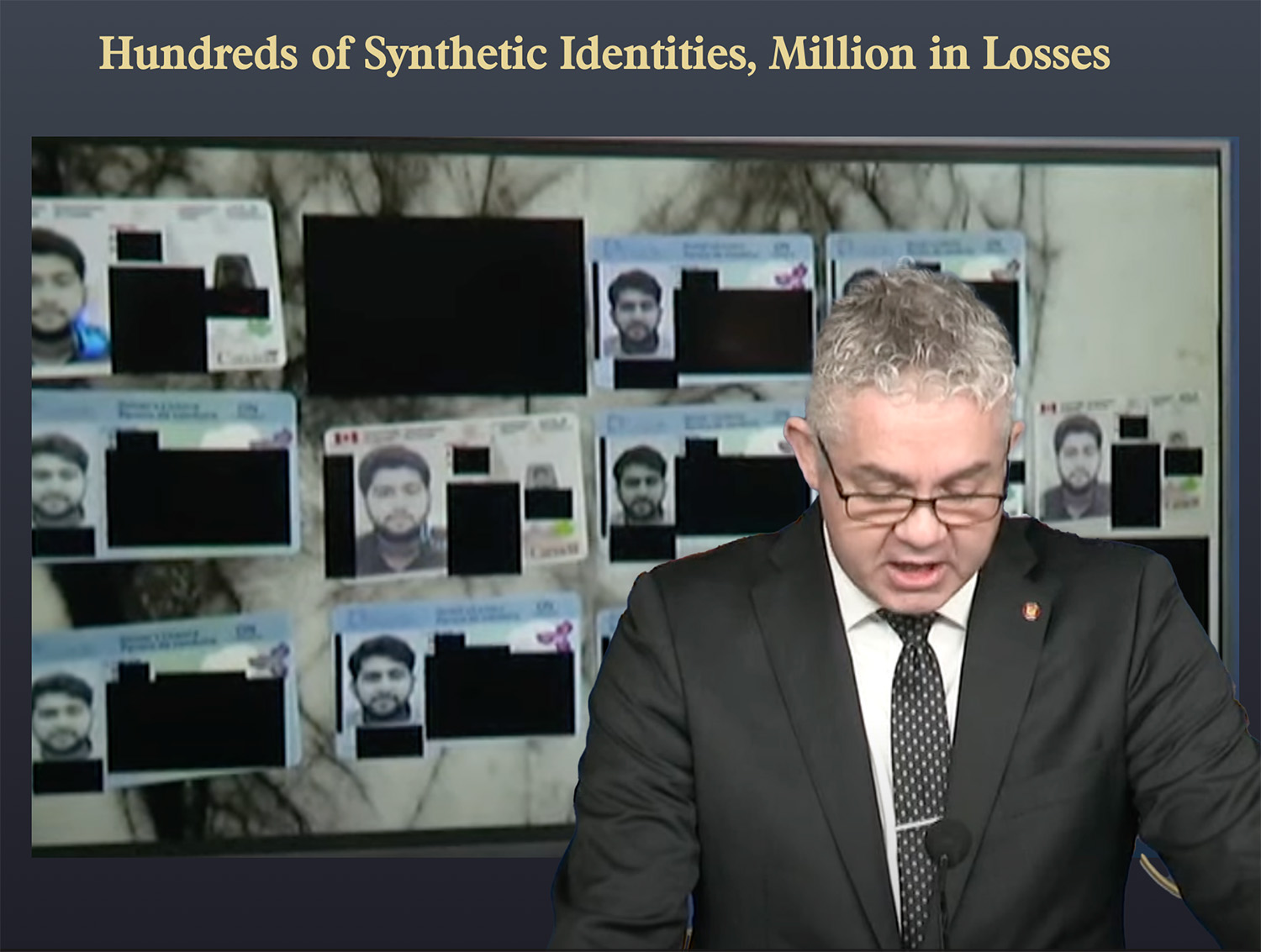

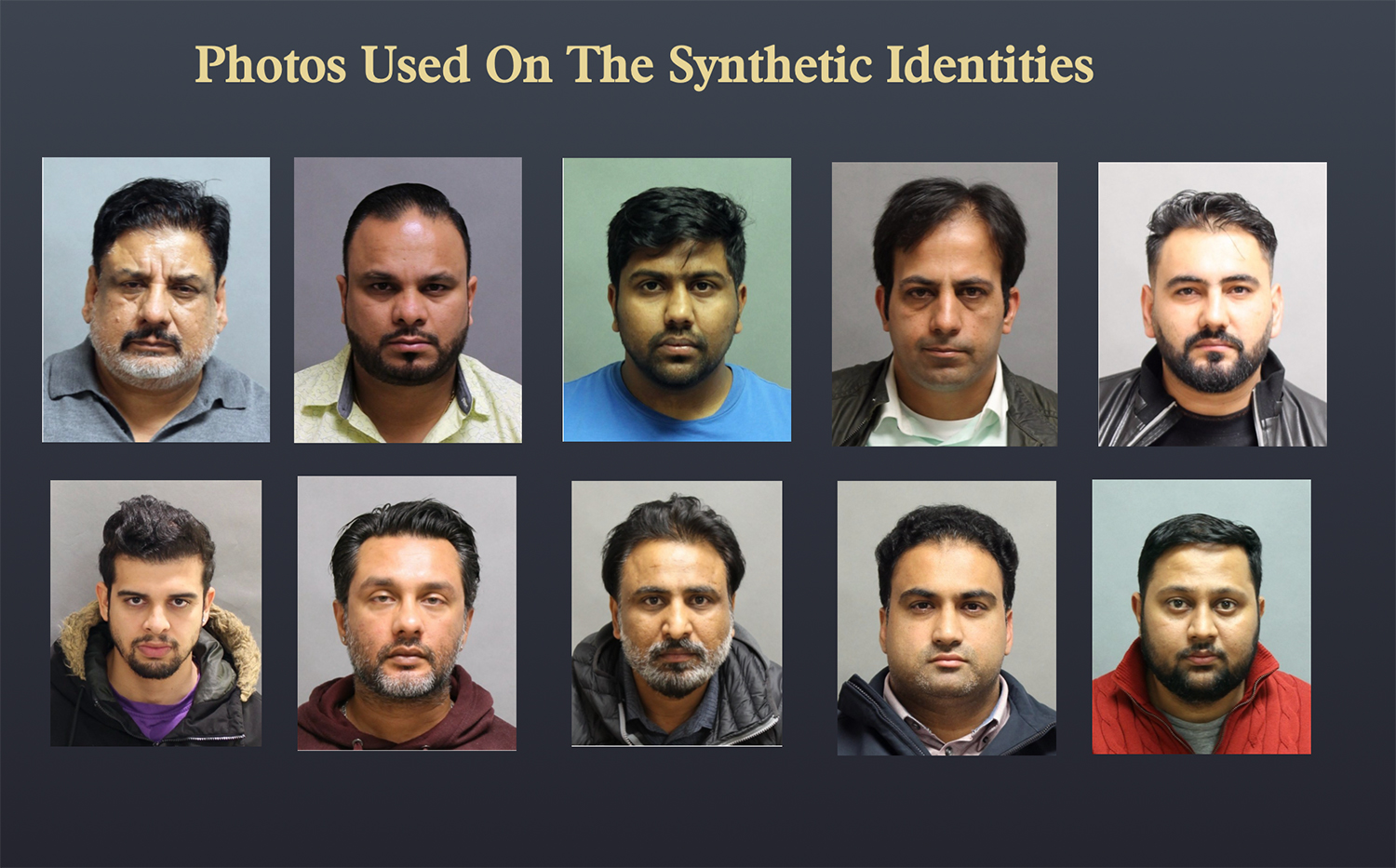

However, last month, Toronto Police announced a sweeping crackdown on Synthetic Identity after a financial institution warned them of the increasing threat in Canada two years ago. The operation called “Deja Vu” is a first of its kind in Canada and it specifically targeted criminals that use fictitious or stolen PII to create new identities.

According to Detective David Coffey of the Financial Crimes Unit, the perpetrators created 680 unique synthetics that were used to open and create hundreds of bank accounts and credit cards in Ontario.

In some cases, the fraudulent accounts were then exploited with bust-out activity to allow them to exceed the set credit and account limits.

The banks incurred $4 million in losses, but they believe there are more. The Toronto Police are asking businesses and banks to look for suspects using these synthetic identities.

At 4% rate of synthetic identity in the UK, that would exceed the synthetic identity problem even here in the US. Socure estimated last year that between 1% and 3% of bank accounts are associated with synthetic identities.