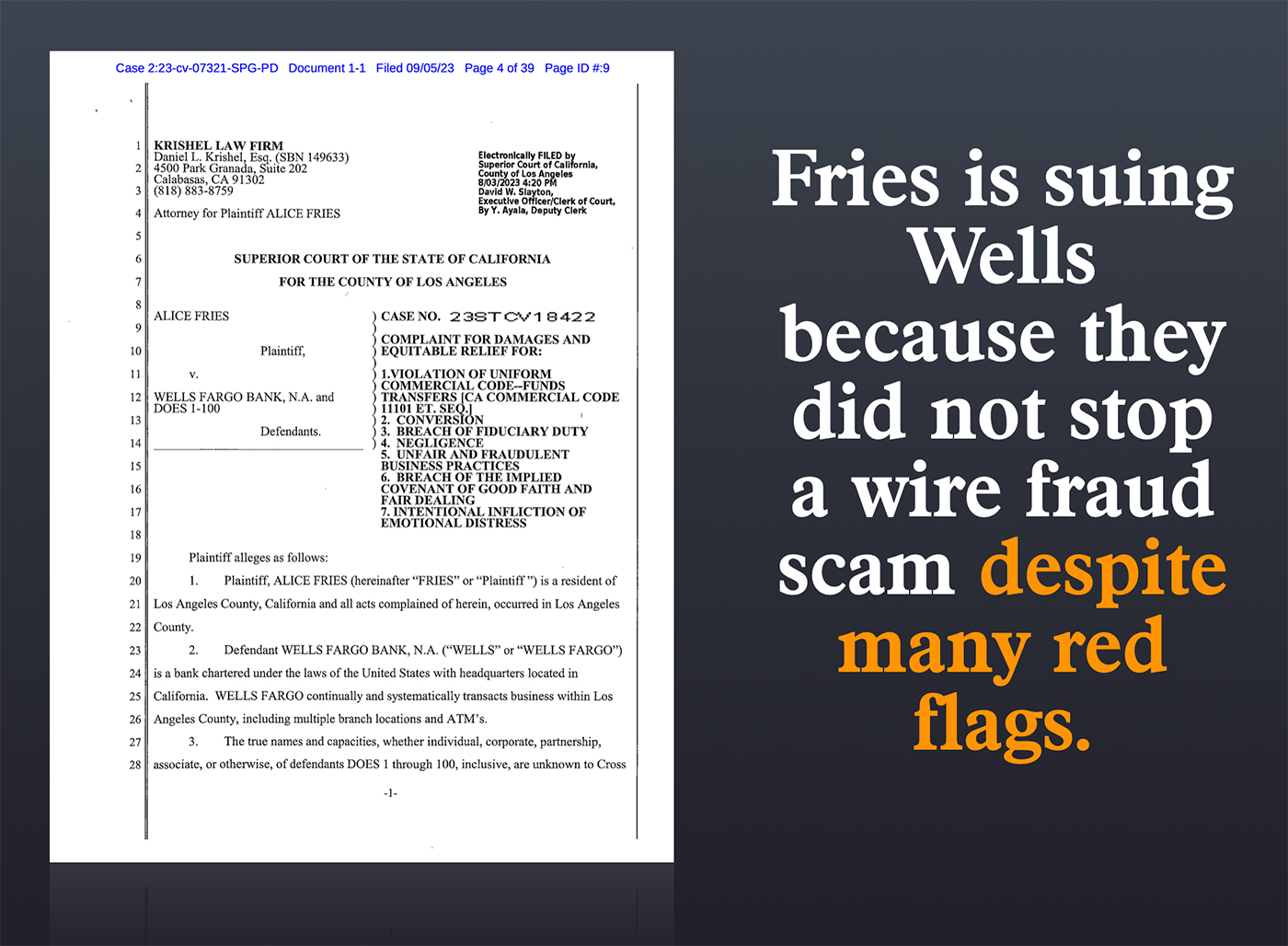

Alice Fries, a long-time Wells Fargo customer, had $100,000 stolen from her account in October through an increasingly common imposter scam that exploits the bank’s “flawed two-factor authentication system.” That is according to a lawsuit filed in Los Angeles.

Alice Fries is now suing Wells Fargo for the stolen money and damages caused by the bank. And based on their arguments in the lawsuit, she just might have a good case against the bank.

How The Scam Went Down – An Impersonation Call

On October 24, 2022, at 1:10 p.m., Fries called a Wells Fargo premier banker and said she would not proceed with certain investments the banker had proposed.

At 1:23 p.m., just nine minutes after the call with Advisor ended, Fries received a call appearing to be from Wells Fargo. The caller ID showed the same 800 number she always got calls from Wells Fargo. Unbeknownst to her, however, the call was a spoof call from a fraudster.

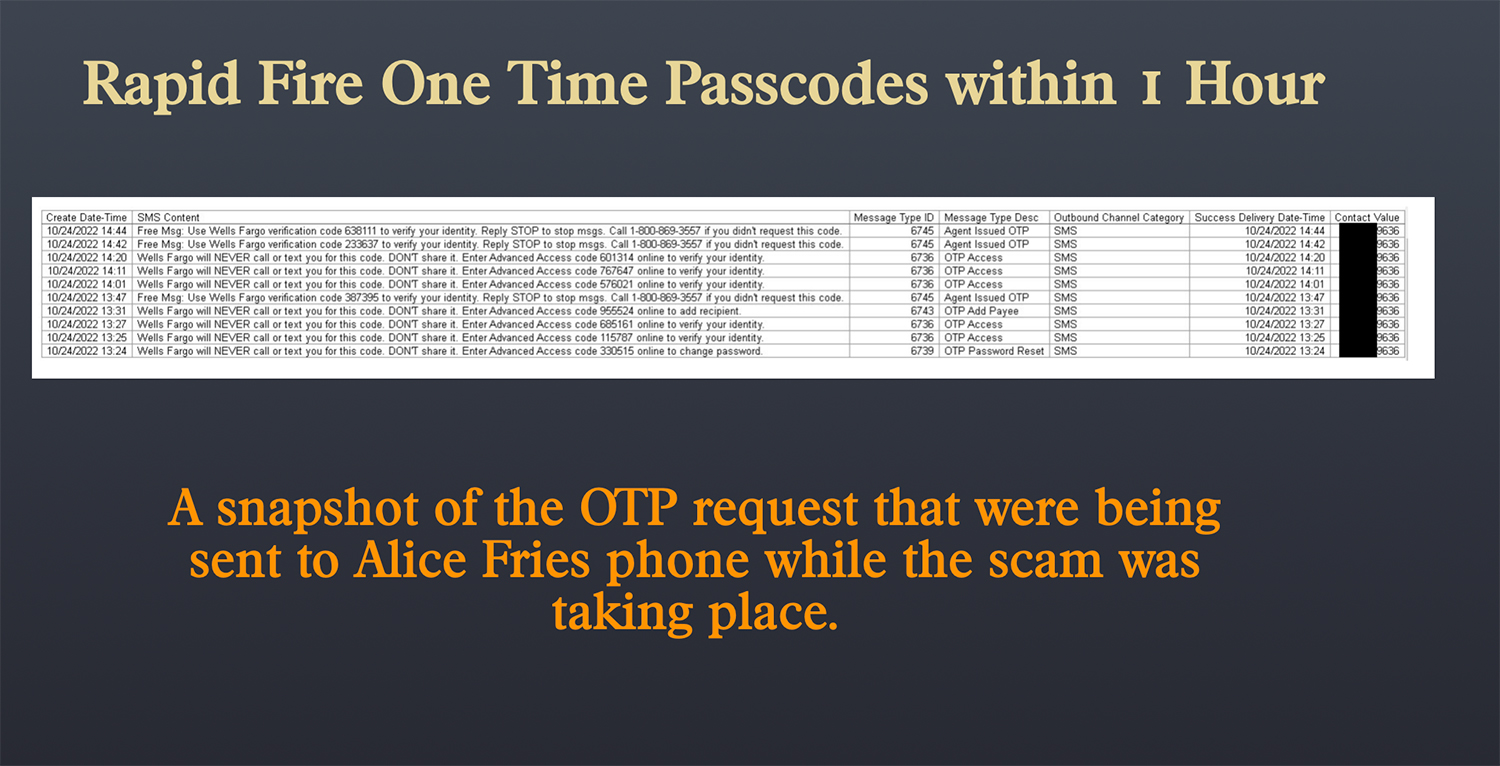

The fraudster claimed Fries’ account was compromised and sent a two-factor authentication (2FA) code for Fries to read back to “verify her identity.” Fries provided the code, not realizing it was a scam. After all she had just been in the phone Wells Fargo minutes before.

While on the call, Fries got suspicious and went to a Wells Fargo branch, where an employee named Walter said it sounded like a scam and told her that a fraudulent $100,000 wire transfer from her account was in process. Fries had been on the call with the fraudster for over an hour by the time she reached the bank.

After speaking to Walter, Fries immediately called the Wells Fargo call center and confirmed she did not authorize the wire transfer. A rep (“Chavi”) said the wire was recalled, and the $100,000 would be returned in 1-2 business days. Chavi gave Fries a confirmation number.

She thought everything was taken care of, and she was relieved to know that the scam had been stopped in its tracks.

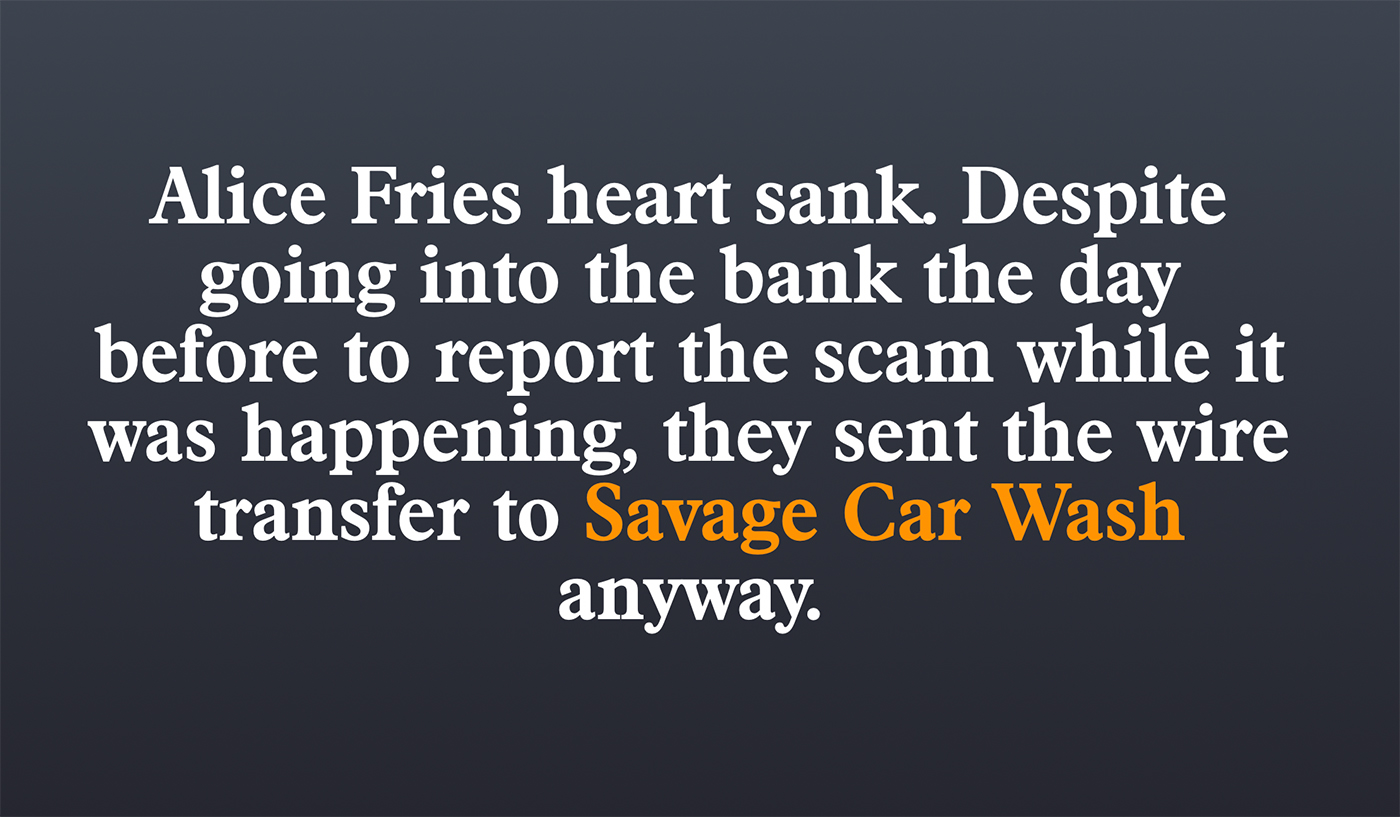

The Wire Transfer Was Never Recalled, And Her Money Was Gone

Alice Fries called Wells Fargo the next day, and her heart sank. Fries was told the wire was not recalled, and her money went to “Savage Car Wash” in Florida, which she has no connection to.

The investigator she spoke to told her they “were well aware of the scam,” which gave her pause because she wondered why Wells Fargo would send the money to a well-known scam.

Fries claims that she immediately filed a dispute to get her money back, but she says that Wells Fargo told her they would not assist her unless she admitted in writing that she “authorized” the $100,000 fraudulent wire transfer.

They eventually refunded Fries $50 as a courtesy, leaving her out $99,950 in losses.

The Plot Thickens – Alice Fries Gets A Copy Of A Conversation Between The Scammer And Wells Fargo

After filing the lawsuit against Wells Fargo, Alice Fries attorneys started to investigate Wells Fargo’s process.

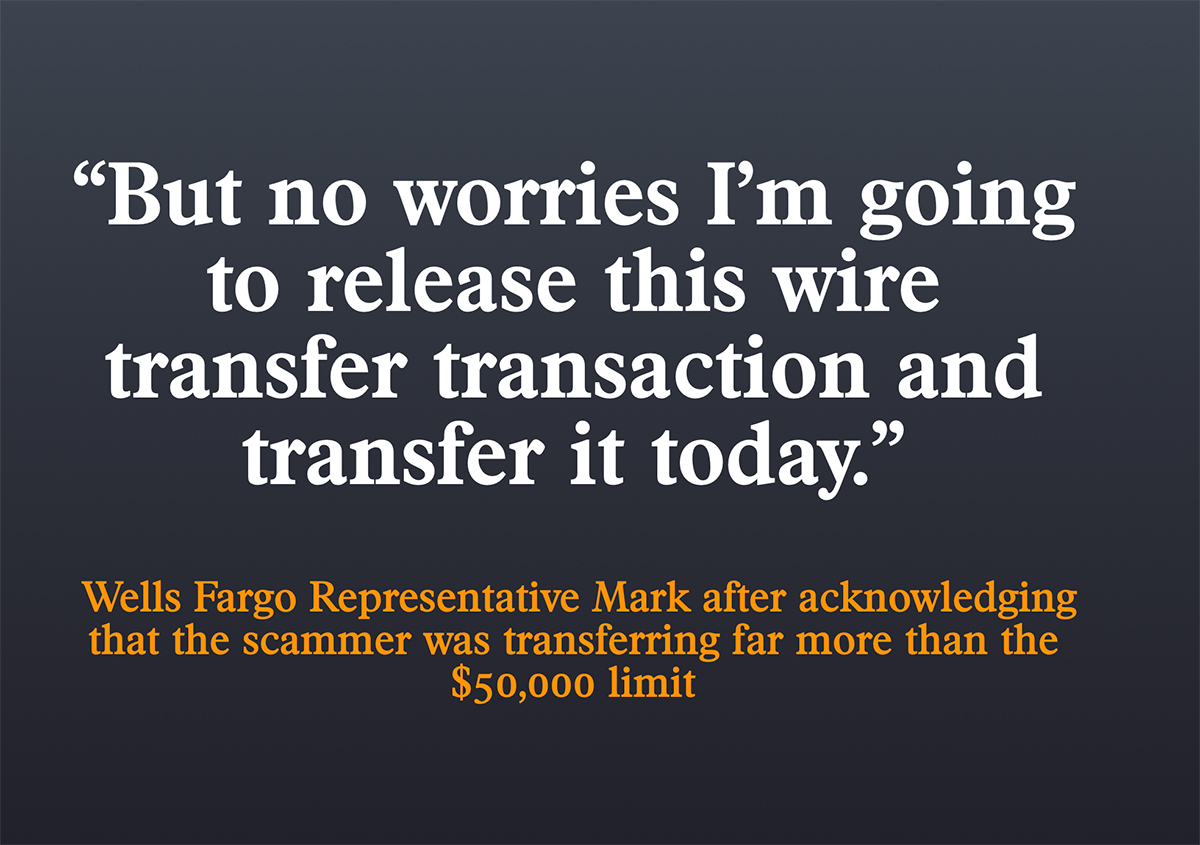

They obtained a copy of the recorded call between a Wells Fargo representative named “Mark” and the fraudster. The recording of a call is a standard procedure for the bank when verifying the legitimacy of large wire transfers. The transcript revealed how “Mark” violated the bank’s security procedures and approved the fraudulent $100,000 wire transfer despite it being in excess of the bank’s policies.

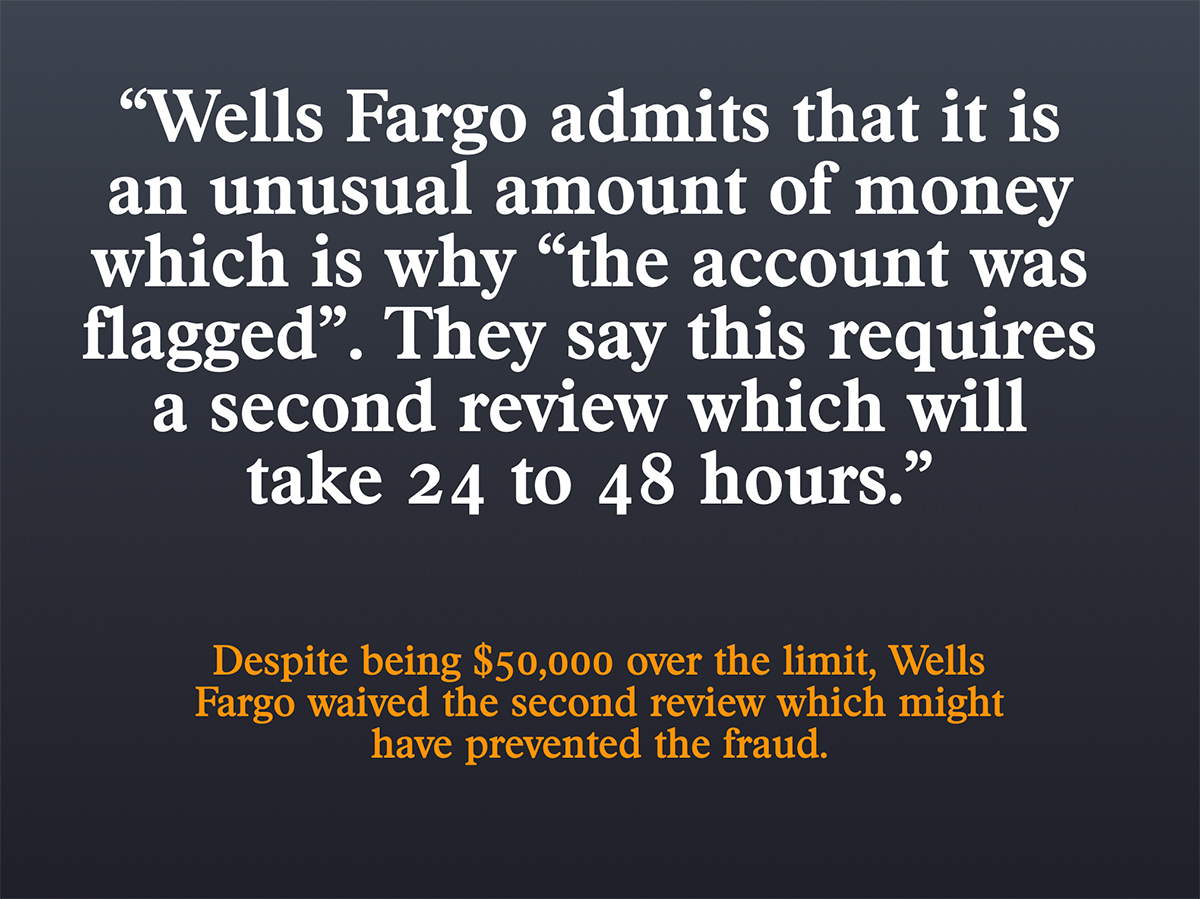

Mark confirmed that Wells Fargo would typically accept a maximum online wire transfer request of $50,000. He told the fraudster that the $100,000 request was “an unusual amount of money” and that is why the account “had been flagged.” Mark also noted that any attempted transfer above $50,000 required a “second review” and that a 24-48 hours delay could occur before the wire was sent.

But Mark later decided to send the wire anyway, saying, “But no worries, I’m going to release this wire transfer transaction and transfer it today.”

Why Alice Fries Might Have A Good Case Against Wells

In my opinion, the Alice Fries imposter scam wire transfer incident could go against Wells Fargo in this case and expose the bank to some losses.

Her attorneys make some good arguments.

Let me break them down here.

#1 Good Point – Impossible To Tell The Fraud Department From The Scammers

Alice Fries argues that Wells Fargo’s two-factor authentication (2FA) system is flawed and easily exploited by scammers impersonating bank employees. The scam that stole $100,000 from her account involved a fraudster asking her to read back a 2FA code to “verify her identity.”

She claimed that Wells Fargo fraud analysts and representatives used the same process to verify her identity in the past. Given that, she claims that Wells Fargo is using a verification process that is highly prone to putting their customers in a vulnerable position.

Alice makes a good point. Banks’ processes of giving customers one-time passcodes to verify their identities while receiving calls create an extremely confusing situation. Why would Wells Fargo use the same process as the scammers?

#2 – Good Point- The Imposter Call Came Minutes After A Real Call With Wells Fargo

Alice Fries became suspicious that the fraudulent call from the Wells Fargo impersonator could be related to an insider at the bank due to the timing of the events. Just nine minutes after Fries ended a call with a Wells Fargo premier banker she received the fraudulent call from someone claiming to be a Wells Fargo representative.

The fact that Fries received a call from the WF fraudster just minutes after concluding her call with the advisor proves that either 1) the fraudster is affiliated with or somehow connected to Wells Fargo or 2) it’s one of the biggest coincidences in bank/wire fraud history.” according to the lawsuit.

Alice makes another good point here, it is highly suspicious.

#3 Good Point – The Representative That Processed The Wire Failed To Spot Many Red Flags

According to the lawsuit, there were several red flags that the Wells Fargo representative (“Mark”) should have noticed during the call with the fraudster but failed to act upon:

- Mark was aware that the online password for Alice Fries’ account had been changed just minutes before the fraudulent wire transfer request.

- The ability to send wire transfers had just been added to Fries’ account, and a new wire transfer payee had been added shortly before the fraudulent request.

- The requested wire transfer amount of $100,000 exceeded Wells Fargo’s standard online limit of $50,000, which should have triggered additional security measures, such as a “second review” and a 24-48 hour delay.

- During the call, Mark failed to ask personal security questions that only the real Alice Fries would know the answers to, instead asking superficial questions like “Is your name Alice M Fries?” and “Can you tell me to whom are you sending the funds to?”

- When the fraudster provided the two-factor authentication (2FA) code, an unknown voice could be heard in the background reading the code to the fraudster, who then relayed it to Mark. This should have been a clear indication that the caller was not the actual account holder.

Despite these numerous red flags, the WF Mark disregarded Wells Fargo’s security procedures and approved the fraudulent $100,000 wire transfer after a brief, superficial conversation with the scammer.

Alice Fries Is Asking For $100,000 And Damages

The lawsuit accuses Wells Fargo of conversion, negligence, breach of contract, and intentionally inflicting emotional distress on Ms. Fries. It seeks compensation for her $100,000 loss plus damages. The bank has a history of misconduct, having paid $3.7 billion in 2020 to settle claims it pressured employees to open fake customer accounts to meet sales goals.

“I put my trust in Wells Fargo to keep my money safe,” said Ms. Fries. “Instead they abandoned me when criminals exploited the bank’s own security flaws. I don’t want others to go through this nightmare.”

Read The Lawsuit Here

Thanks to Mary Ann Miller for the tip on this case.