The Friday after Thanksgiving is a great day for shopping. It’s also an awful day for fraud. As shoppers flock to retailers to snap up huge discounts on Christmas gifts, they create the perfect cover for fraudsters looking to hide.

Black Fraud Day Not Black Friday

Black Friday is so bad that Fraud Managers across the world refer to it as “Black Fraud Day”.

Authorization volumes can surge 100% or more on Black Friday. As authorization volumes increase, they trigger more unusual spending fraud alerts that need to be cleared by the fraud analyst.

Fraudsters use Black Friday as a cloak of darkness to hide their activities. As more consumers shop out of pattern, fraudsters behaivor appears more commonplace.

Fraudsters figured out a long time ago that this surge in traffic made Black Friday the perfect day to sneak beneath the radar. Since everyone’s spend on their credit card’s is abnormal, the fraudulent activity would not stick out like a sore thumb.

Online Retailers Get it the Worst (Especially This Year)

With online fraud rates increasing 400% this year, retailers are bracing for a very bad Christmas season. Online fraud has increased to 7% of all sales due to BotNet attacks which have automated much of the manual processes for fraudsters.

Online merchants get hit twice with enormous spikes. Once on Black Friday and then again the following Monday which is referred to as Cyber Monday. These two days can rack up enormous losses for retailers particularly for digital goods which can have fraud rates over 10%.

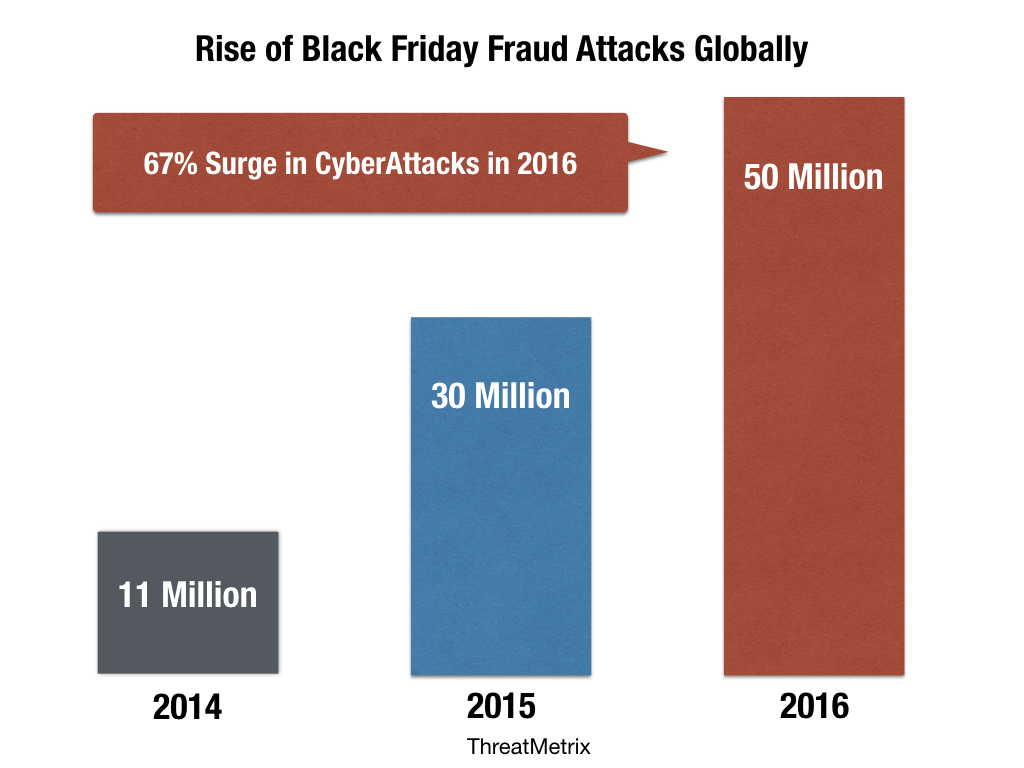

ThreatMetrix, the company that monitors Online Fraud Attacks is predicting millions of cyber attacks on Online Retailers this year. ThreatMetrix has sophisticated technology that can analyze incoming internet traffic to determine if it is a legitimate online shopper or a scammer by looking at such things as the screen resolution, the pattern of login etc.

In the UK for example, they are reporting that online retailers there will experience over 6.5 million attacks for the week. In the US which is a larger market, retailers can expect over 25 million attacks during the week.

If these numbers sound large, it is because they are. ThreatMetrix estimates are predicting a 67% increase in cyber attacks this year.

Coping with Increased Volumes

Predictive Analytics companies like FICO, PointPredictive, SAS, and others have tackled the problem of Black Friday through modeling. By analyzing seasonality in the fraud models against the fraud patterns during Black Friday they can help banks and retailers decipher the fraudulent patterns with more granularity.

By analyzing seasonality in the fraud models against the fraud patterns during Black Friday they can help banks and retailers decipher the fraudulent patterns with more granularity.

The technique which is called “Holiday Calibration” helps to lower spikes in fraud alerts while keeping maintaining the same level of fraud detection. This technique helps banks keep their work effort consistent but also ensures that no fraud is missed while fraudsters try to cloak their behavior.