Fraud and scams are reaching epidemic levels. Some say that its higher than any other point in history. And you can count me as one of those people.

But what is behind this stratospheric rise in fraud and scams? What is driving it upward like never before?

I believe it’s social media. Telegram. Facebook. Instagram. Whatsapp. Discord. Reddit. Social Media is ground zero for fraud. It’s where so much fraud starts. It’s where so much of today’s fraud is proliferated.

And all of those companies are providing a platform that is being used in the recruiting, educating and arming would be scammers with new methods and breached data. And in many cases, those same platforms are used to target people to scam them to.

So, if you don’t have a Fraud Analyst on your team that focuses on scanning social media, maybe it’s time you do. Shouldn’t you know what the fraudsters are up to?

Encrypted Chat and Ability To Pay With BitCoin Have Emboldened Fraudsters

10 years ago, committing fraud was a complex and technical crime and so much of the activity occurred in the shadows of the dark web.

But that has changed. Fraud is now on the open internet and fraudsters are not afraid to share that information. Encrypted messaging apps like Telegram have made information sharing anonymous and emboldened fraudsters to share information without fear of getting caught.

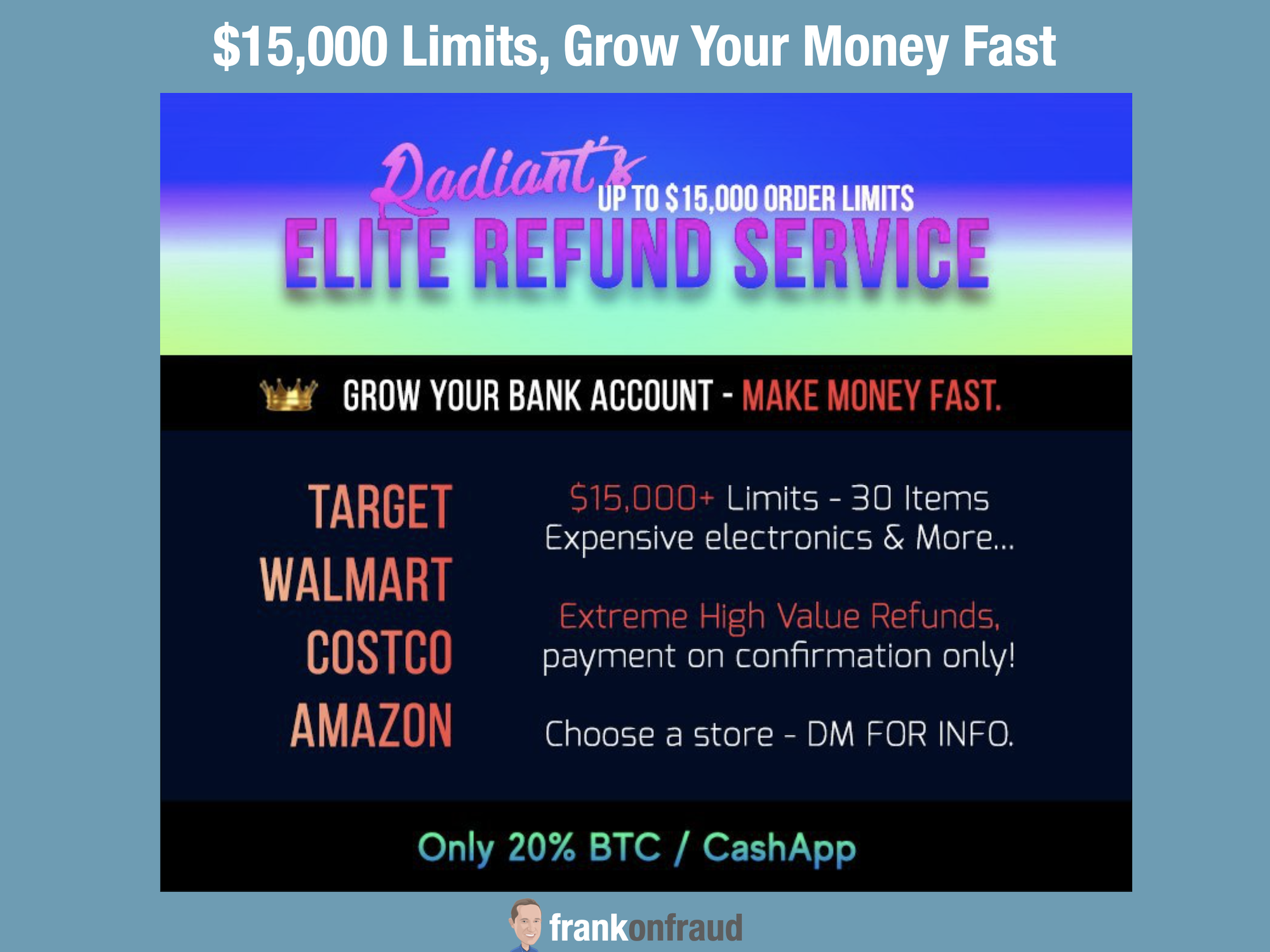

And the ability to pay with Bitcoin means that when fraudsters or scammers want to sell breached data or provide other illegal services, they can get and hide the funds more easily.

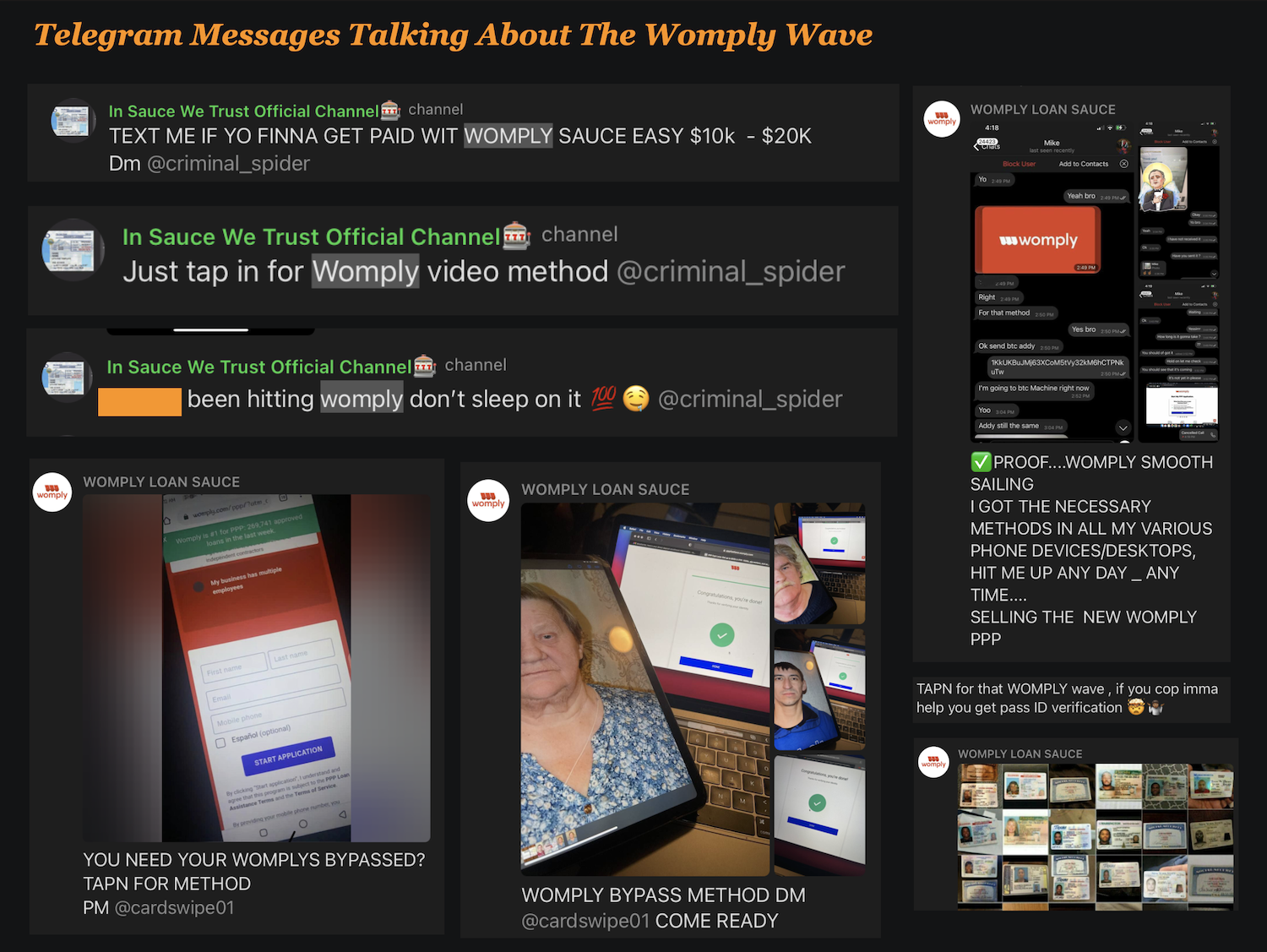

An example of this could be seen just last month on Telegram when fraudsters openly shared how they were targeting Womply – a fintech that provides PPP loans to small banks.

Another example is the open sharing of professional refunding schemes that have resulted in a wave of fraud against online merchants and food delivery services. Here is an advertisement targeting high value brands and their refund policies.

This Open Sharing Creates Opportunity for Fraud Teams to Understand The Latest Tactics

While the shift of fraud to the open internet creates problems, it also creates a new opportunity – fraud teams can now identity fraud patterns much quicker.

Since fraudsters are sharing their fraud tactics openly with each other, it is not difficult to lurk in the popular locations and capture valuable intelligence directly from the fraudsters.

6 Reasons You Should Have A Fraud Analyst Focus on Social Media

If you don’t currently have a fraud analyst designated to scan social media, you should consider it. And here are 5 reasons.

#1 – Fraud Patterns Are Changing Daily

Fraud patterns are changing almost daily now. As one scheme runs the course, it is quickly updated by a brand new method and fraudsters are sharing those methods online. If you are waiting to respond to fraud based on fraud that happened last month, you are far too late in today’s cat and mouse game.

#2 – Your Bank Is Probably Mentioned By Name on Social Media By Scammers and Fraudsters

Your company is probably mentioned on Telegram, Reddit, Instagram and other platforms by name. And they probably are sharing your company’s polices and how to exploit them. If you’re not on social media identifying what they know and what they are doing. You are losing out on valuable intelligence on fraud.

#3 – Your Customers Are Being Targeted By Scammers on Those Social Media Platforms

You may not be on social media. But your customers are. And they are likely being scammed and phished, or they being educated on how to defraud you. To stop the fraud you need to identify where that information is being shared or advertised so that you can get the content taken down by the platforms.

#4 – The Next Fraud Wave May Impact You

Even if you are not finding your own companies name, you need to understand the next fraud wave that might impact your company. Searching for fraud schemes on Telegram is like looking into a crystal ball for future fraud schemes that will target you.

#5 – You Might Find Your Company or Customer Data Being Shared Online

Last week, through a simple Google Search, I identified over 500 customer identities that were being shared on the open internet. A quick search of that data revealed that most of that shared data was being used to create thousands of synthetic identities.

If I didn’t search social media, I would never have been able to identify those social security numbers that are at risk.

#6 – Because Social Media is Ground Zero for Fraud

Social Media is ground zero for fraud. Have you heard the term “keep your enemies close”? Well the same term applies here. If you want to prevent fraud you have to go where your enemies are and find out what they are doing.

Key Task Fraud Analyst Should Focus On

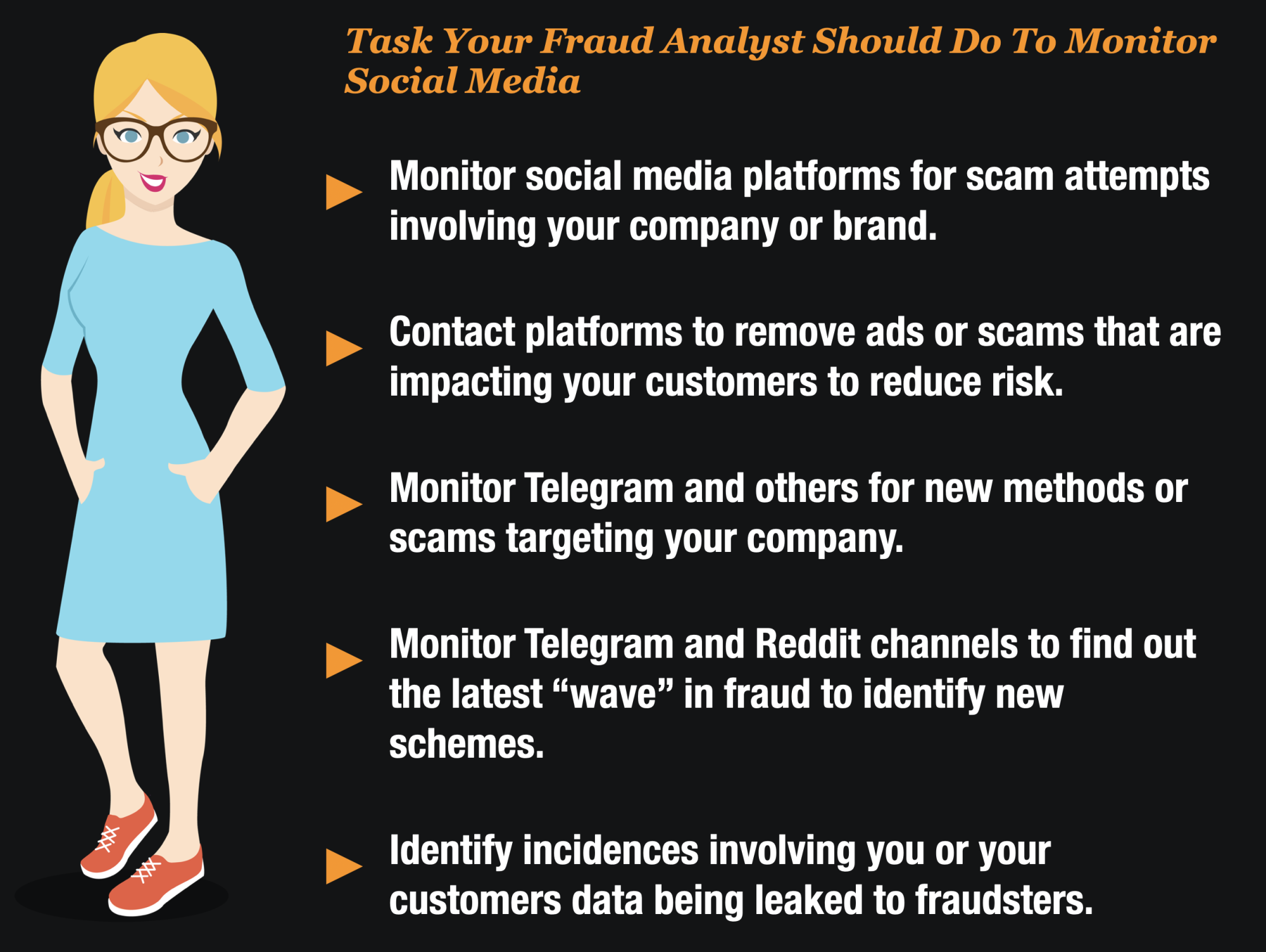

Having a fraud analyst focus on social media, does not have to be their full time role. In as little as a few hours a day, they can probably handle most of the task.

Here are just some of the task they can perform each day:

- Look for your brand – Monitor Instagram, Facebook, Reddit and other platforms with keyword searches involving your brand or company name. Identify if your customers are being targeted.

- Remove Scam Attempts – When you identify harmful content, work with the platforms to remove the scam advertisements or phishing attempts.

- Monitor Message Boards – Monitor message boards on Telegram and others to identify new methods or “fraud waves” that involve your company or products that you provide to consumers.

- Look for Your Data – Look for breached data involving your company that is available on the open internet. You would be surprised how much of your data can be found with simple things like google searches

- Adjust Strategies – The fraud analyst primary goal will be to help you adjust your strategies and policies based on intelligence that they gather during their scanning.

Don’t Know Where to Start?

If you don’t know where to start scanning, contact me. I can give you a list of locations and channels that I search to find fraud patterns and leaked data.

Happy fraud hunting everyone!