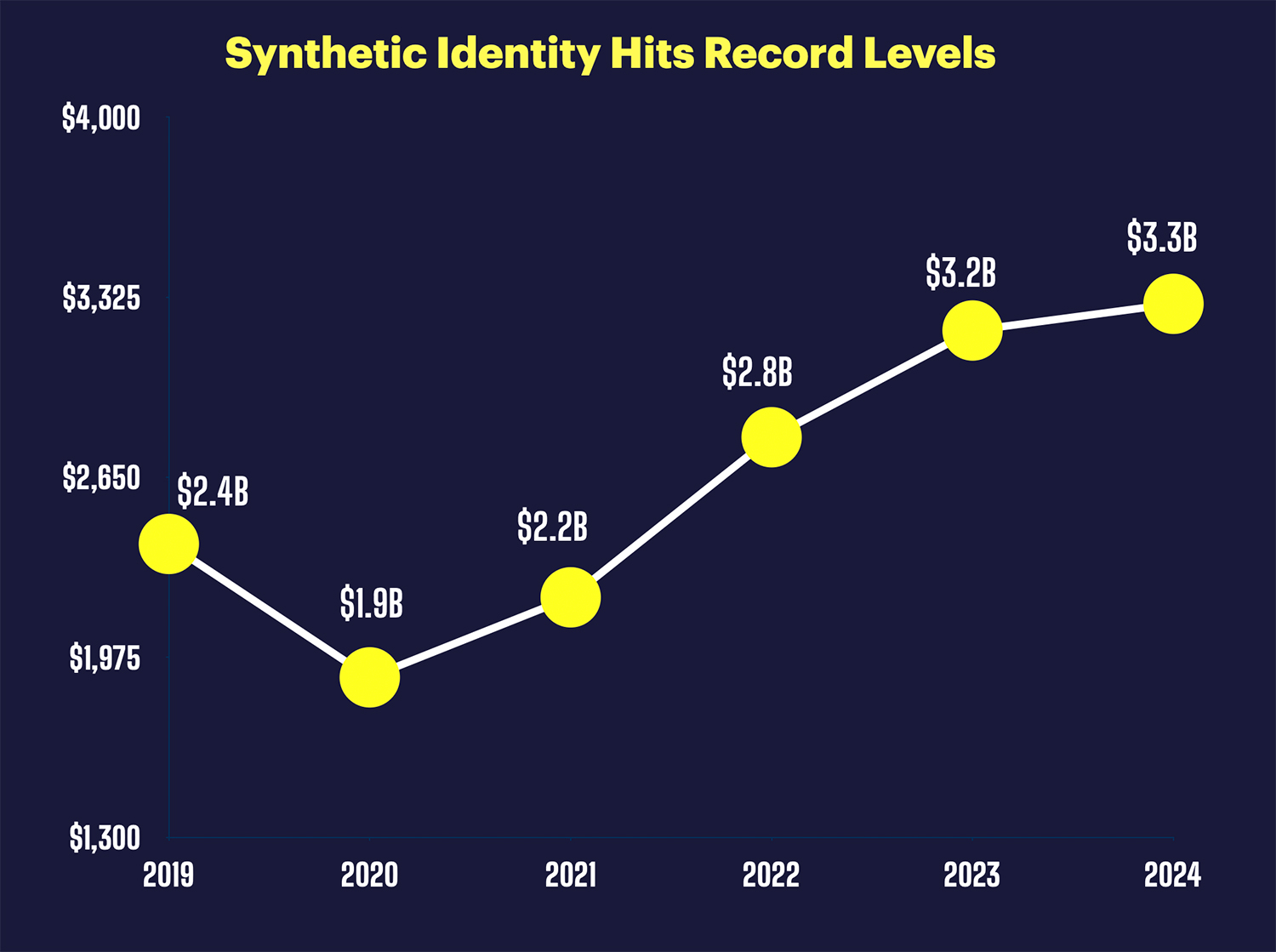

According to TransUnion Synthetic Identity and Credit Washing Fraud have hit another record high and are showing no signs of slowing down anytime soon.

U.S. lenders now face $3.3 billion in potential losses due to Synthetic and a doubling of credit washing since 2021 . This represents an all time high since the firm began tracking the frauds in 2009.

TransUnion says the spike in synthetic fraud is happening because criminals are increasingly using stolen identity credentials obtained through data breaches to create these synthetic identities to make them appear more genuine and real.

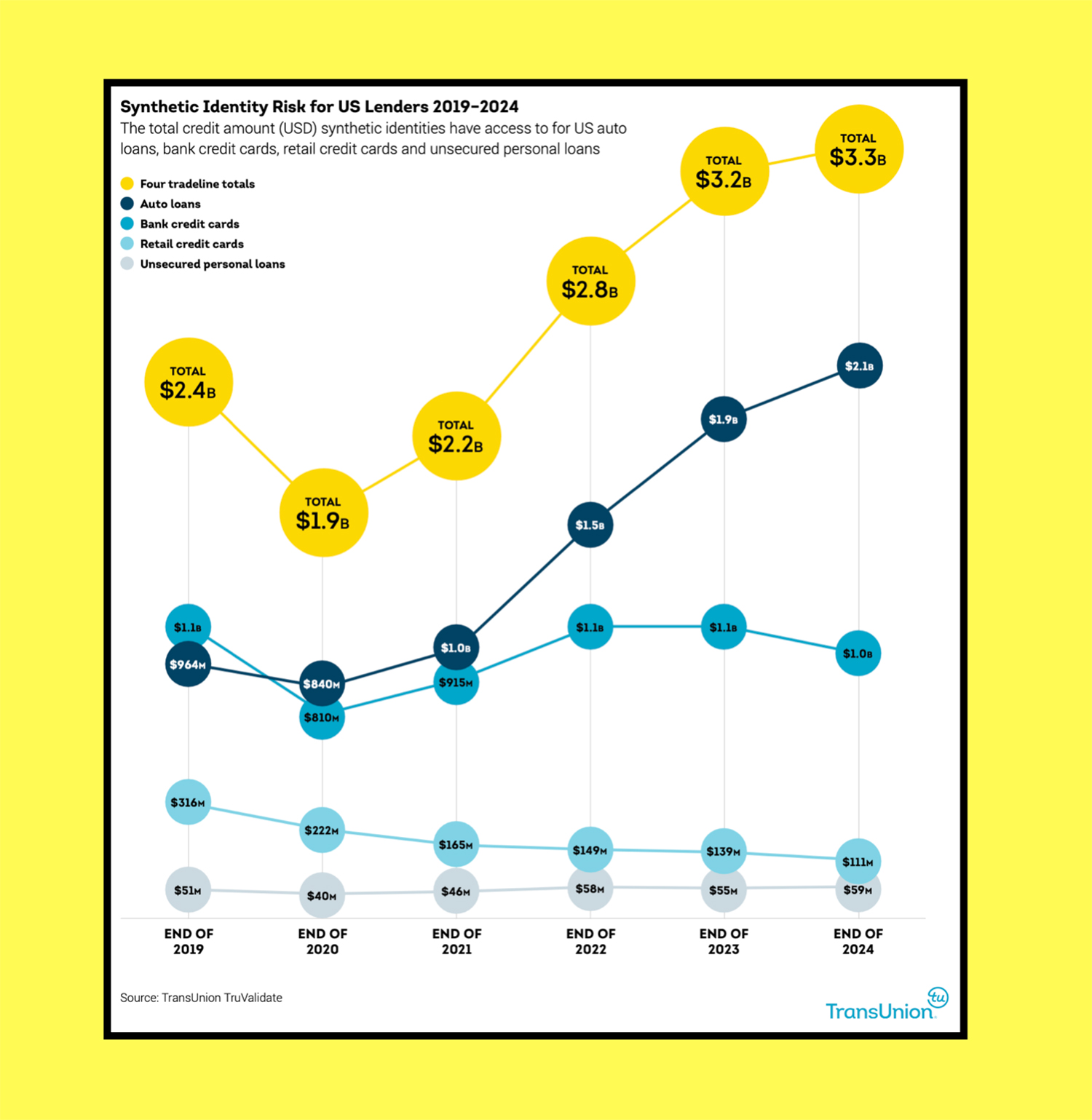

Synthetic Fraudsters Love Auto Loans

Auto Loans continue to get pummeled by synthetic identity fraudsters. For 2024, Auto Lenders lost a whopping $2.1 billion to loans that were established with completely fabricated identities.

Surprisingly, was the only industry that had rising synthetic losses, indicating that the auto industry appears to be the only reason why synthetic keeps increasing each year.

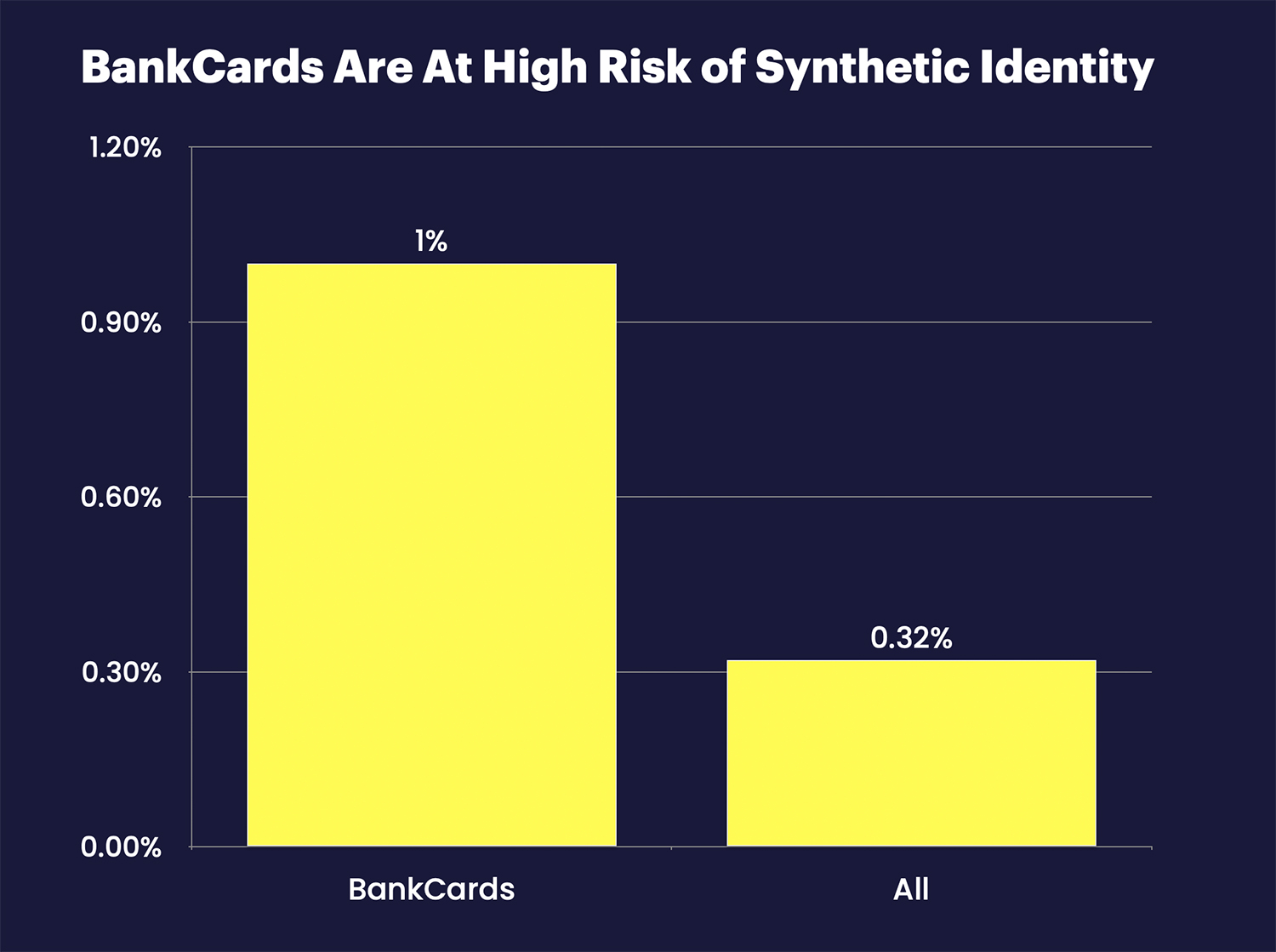

Over 1% Of BankCard Applications Are Synthetic Identities

According to TU, while auto loans represented the largest sector of synthetic identity exposure, bank credit cards experienced an unprecedented surge in fraudulent applications.

For the first time since TransUnion began its reporting, synthetic identity attempts for bank card credit inquiries surpassed 1% at the end of 2024.

This is far higher than the average rate of synthetic identity which TU, indicated was about 32 basis points across all industries.

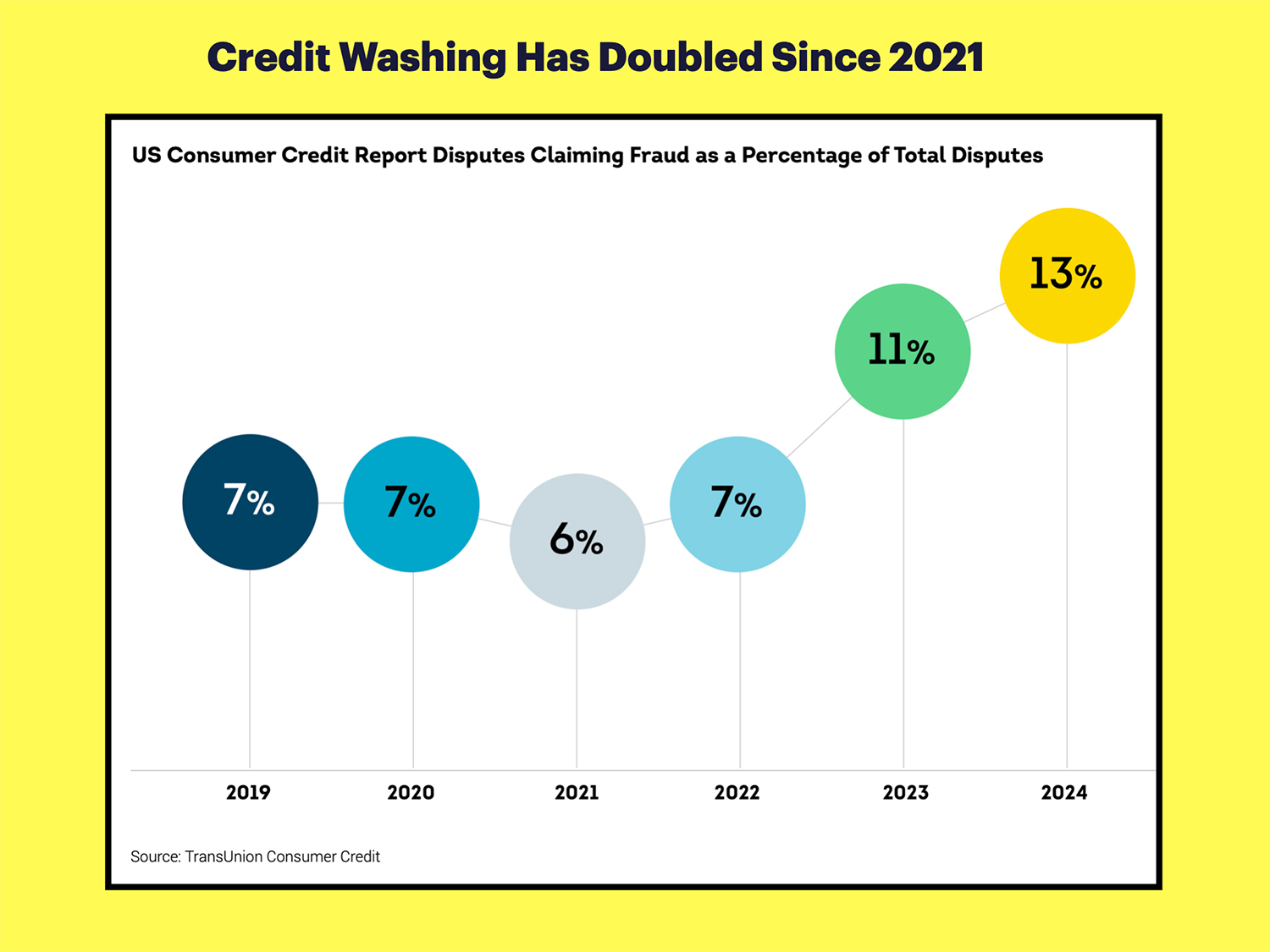

Credit Washing Fraud Has Doubled Since 2021 – Hits All Time High

Alongside synthetic identity fraud, “credit washing” has emerged as a significant and growing fraud according to TransUnion. In fact, it has almost doubled in the last 3 years.

This manipulation tactic involves making false claims of identity theft to completely wipe out bad credit and credit repair companies are minting money, perpetrating the fraud for consumers looking for a quick fix.

TransUnion was hit with a large social media fraud scheme in 2024 which was called the TransUnion 7 Day Credit Sweep. I wrote about the scheme which you can read here.

Credit washing claims hit a five-year high in 2024, with 13% of all U.S. consumer credit report disputes claiming fraud. This represents a substantial increase from 11% in 2023 and nearly double the 7% reported in 2022, creating extended risk for new account openings.

“As identity fraud increases, criminals who commit first-party fraud may seek to recycle an identity using credit washing,” the TransUnion report states. “These false disputes can be made against accounts opened using stolen identities, synthetic identities, or unauthorized transactions on legitimate accounts.”