CoreLogic released their latest mortgage application fraud index and they report that the mortgage index increased to 122 for the fourth quarter of 2016.

The trend shows increasing risk for the year overall; up from a National Index value of 115 for Q4 2015, and 108 for Q3 2016.

That’s a pretty significant increase. Experts are projecting that the fraud index will continue to increase due to increased purchase vs refinance volumes that are expected this year.

Purchase transactions have inherently more risk since the borrowers often times have no history of payments or occupancy in a particular property that lender can rely on.

This is the second time in less than a week that mortgage fraud is raising alarm bells. Earlier this week, Equifax reported that Canadian Mortgage Fraud was up nearly 52% as home values there increase to historically high levels.

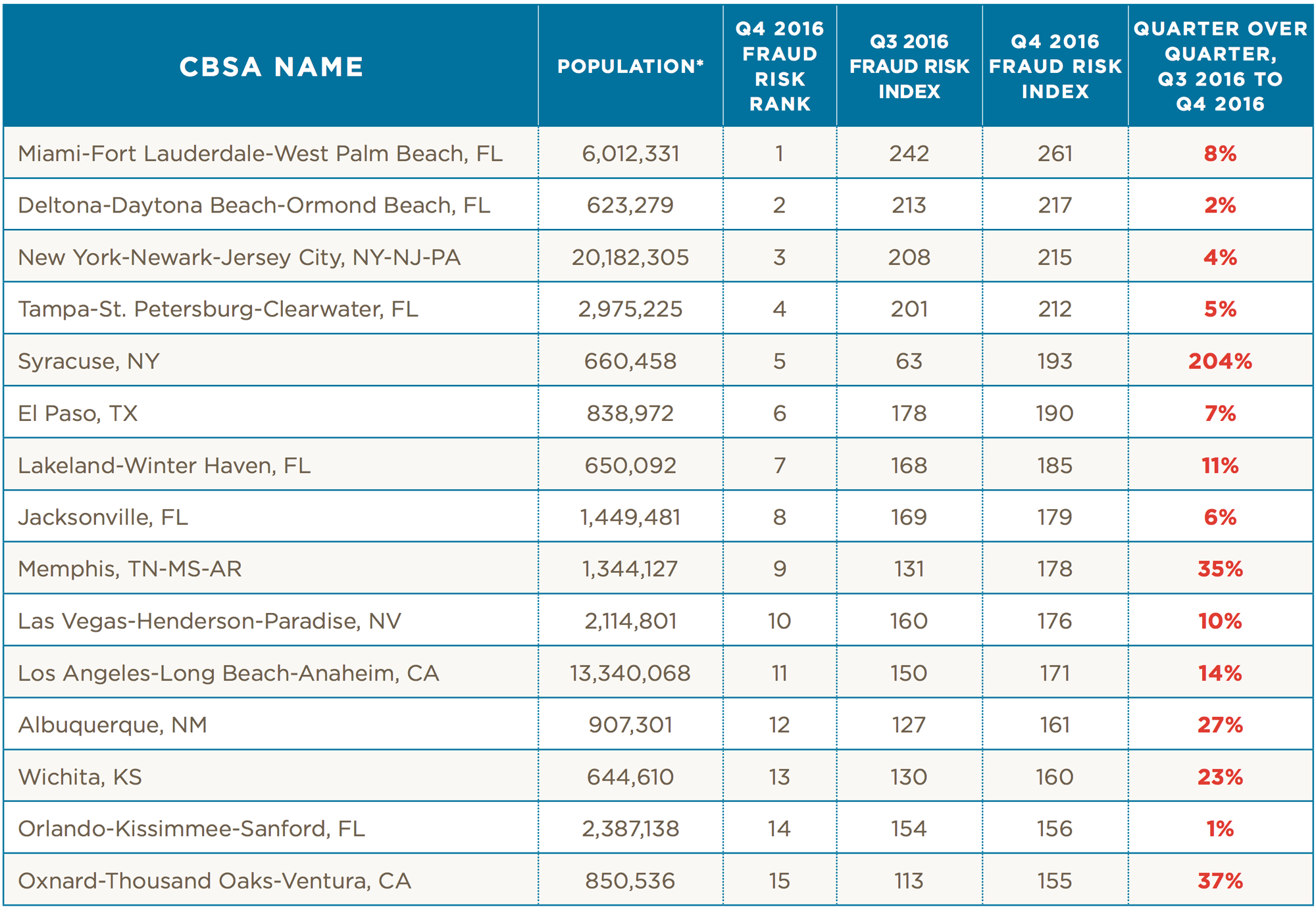

Top Risk Areas of The Country For Mortgage Fraud

CoreLogic detected higher risk activity from the following locations here in the US. You will note Syracuse had a huge spike in application fraud risks which occurred based on a large reverse occupancy fraud scheme in the area.