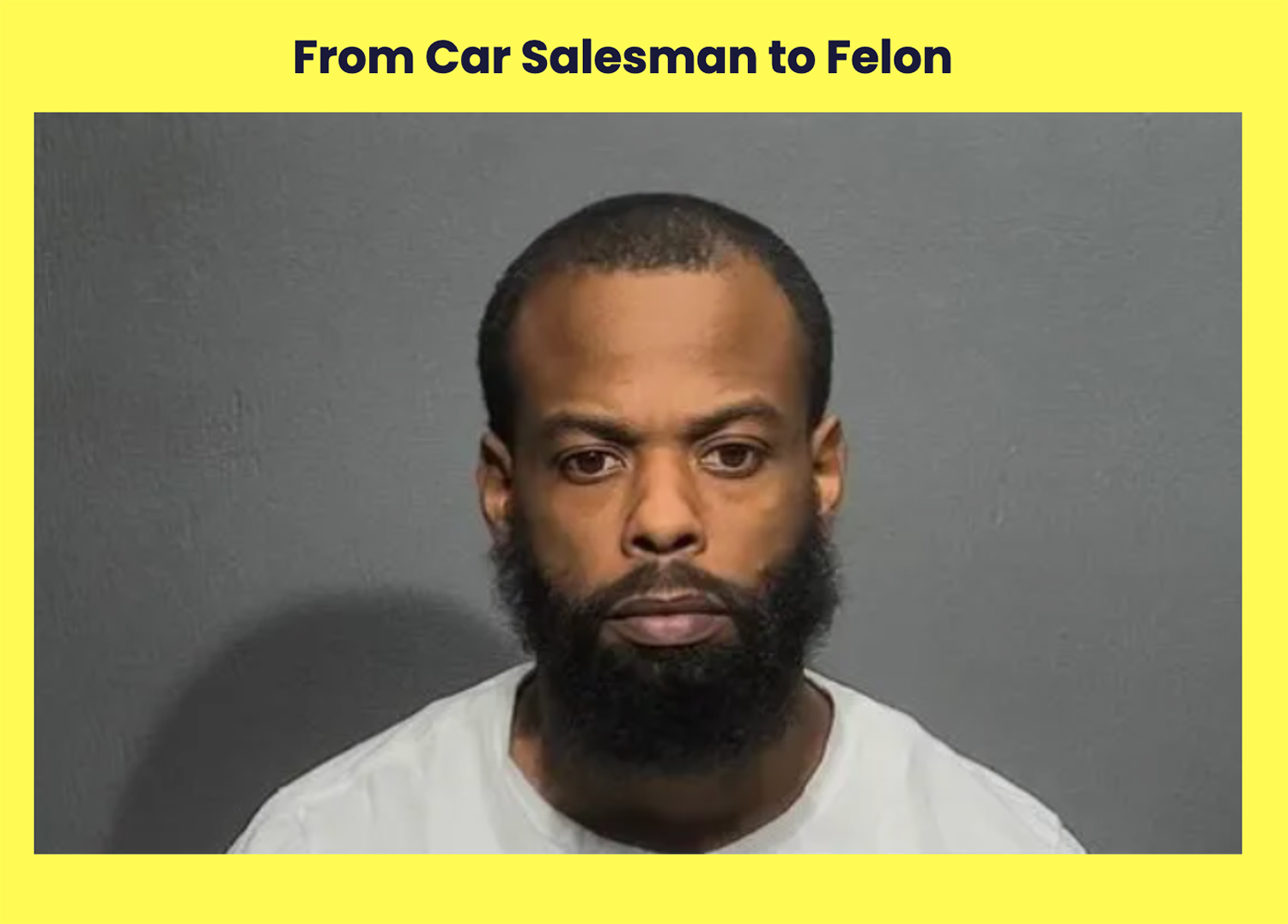

Adrian Knight seemed to have a talent for selling cars. The only problem was most of them never existed.

For years, he ran a phantom car operation out of a Ace Auto Sales, a dealership that he owned in Chesapeake Virginia. He submitted loan applications for luxury vehicles to credit unions, pocketed the cash and then told the banks that he was a victim of identity theft.

This week, he was sentenced to six years in prison for causing more than $2 million in losses to dozens of banks and financial institutions.

Ace Auto Sales Looked Like Any Small Car Dealership

Knight owned Ace Auto Sales, a small used car dealership that was located at 1201 S Military Hwy in Chesapeake.

Knight apparently used a seemingly legitimate car dealership as a front for a massive ghost car fraud operation.

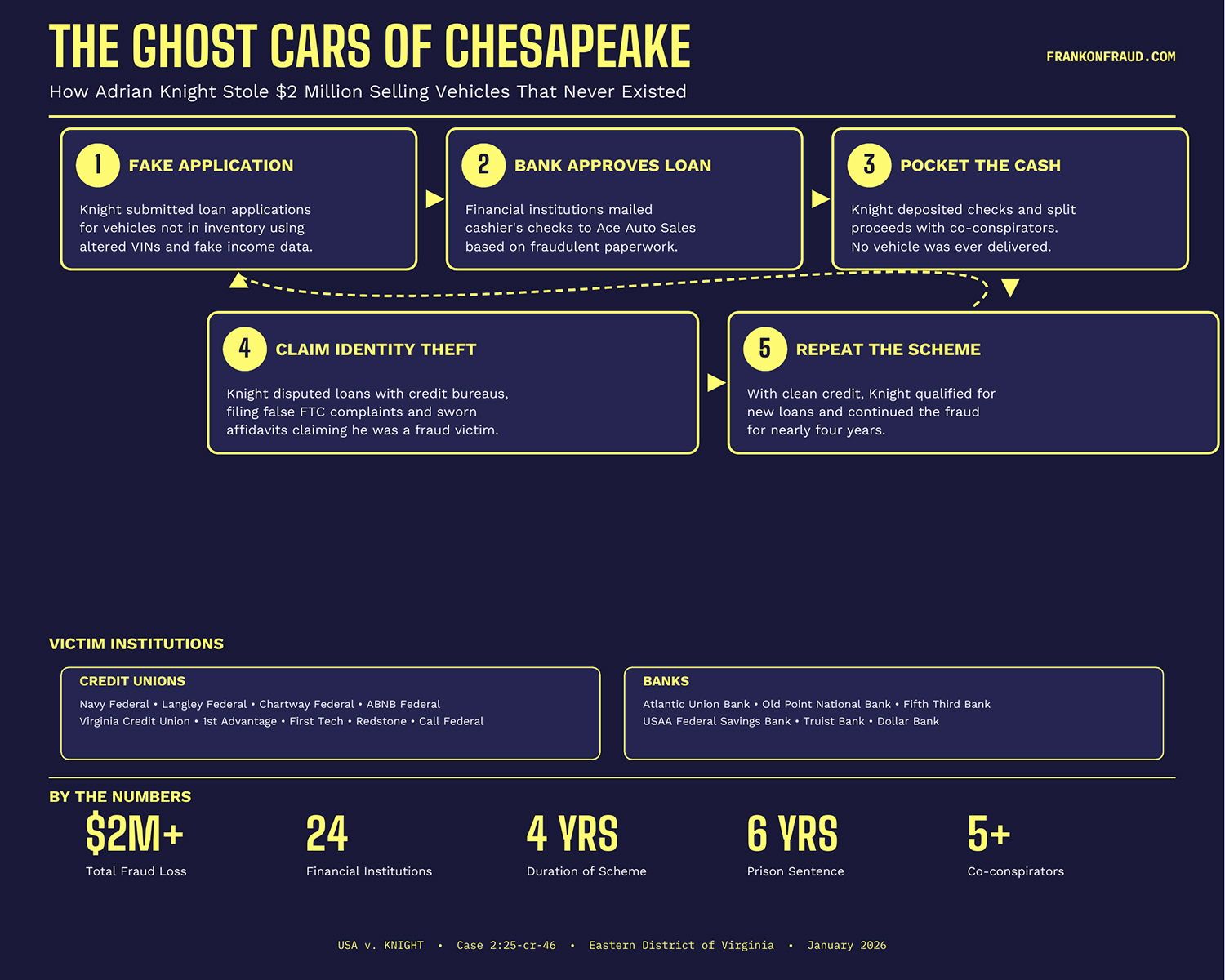

He would recruit straw borrowers, and submit applications in their names using falsified Vin numbers, fake employment, fabricated income documentation. Sometimes he would even submit the loans in his own name.

When lenders approved the loans, they would mail cashiers checks or wire the funds directly to Ace Auto Sales. Knight would then split the proceeds with the straw borrowers and no cars were ever exchanged.

The Cover Up Got Worse With Credit Washing

What made Knights operation even worse is that he would resort to filing false claims of identity theft to dispute the debts with the credit bureaus and the lenders.

In December 2022, Knight mailed documents to Experian disputing a $164,904 loan from Toyota Financial Services for a Mercedes-Benz G550. He included a Federal Trade Commission identity theft complaint and a sworn affidavit signed before a notary.

By disputing the loans, Knight could wipe his credit clean and qualify for new financing to continue the scheme. The banks and their insurers absorbed the losses.

He Kept Opening More And More Dealerships

Adrian Knight played a shell game with various dealerships in the area.

Records show that Knight had a network of dealerships in the area. He registered ATK Enterprises in 2014, followed by 4 Us Auto Sales in 2016 and Ace Auto Sales in 2018. A second dealership called Saint Auto Sales opened in April 2021 at the same address as Ace. That company listed a different registered agent, Treyvond D. Lockhart, though Knight operated it according to the indictment.

Even after his fraud scheme completely collapsed he continued to try to open dealerships and he registered another company called World Wide Autos at the same location as Ace.

He Targeted Credit Unions With His Fraud

Apparently, Knight found a soft spot with credit unions because he specifically targeted them with this phantom loan scheme.

Victims included Navy Federal Credit Union, USAA Federal Savings Bank, Langley Federal Credit Union, Chartway Federal Credit Union, and Atlantic Union Bank. Many of these institutions serve military families in the Hampton Roads region.

Individual loans ranged from $15,000 to nearly $70,000. Knight applied for vehicles including BMWs, Range Rovers, a Porsche Macan, a Mercedes-Benz, Ford trucks, and a Lexus.

None of the cars were actually purchased with the loan proceeds, he just kept the money for himself and his fraud friends.