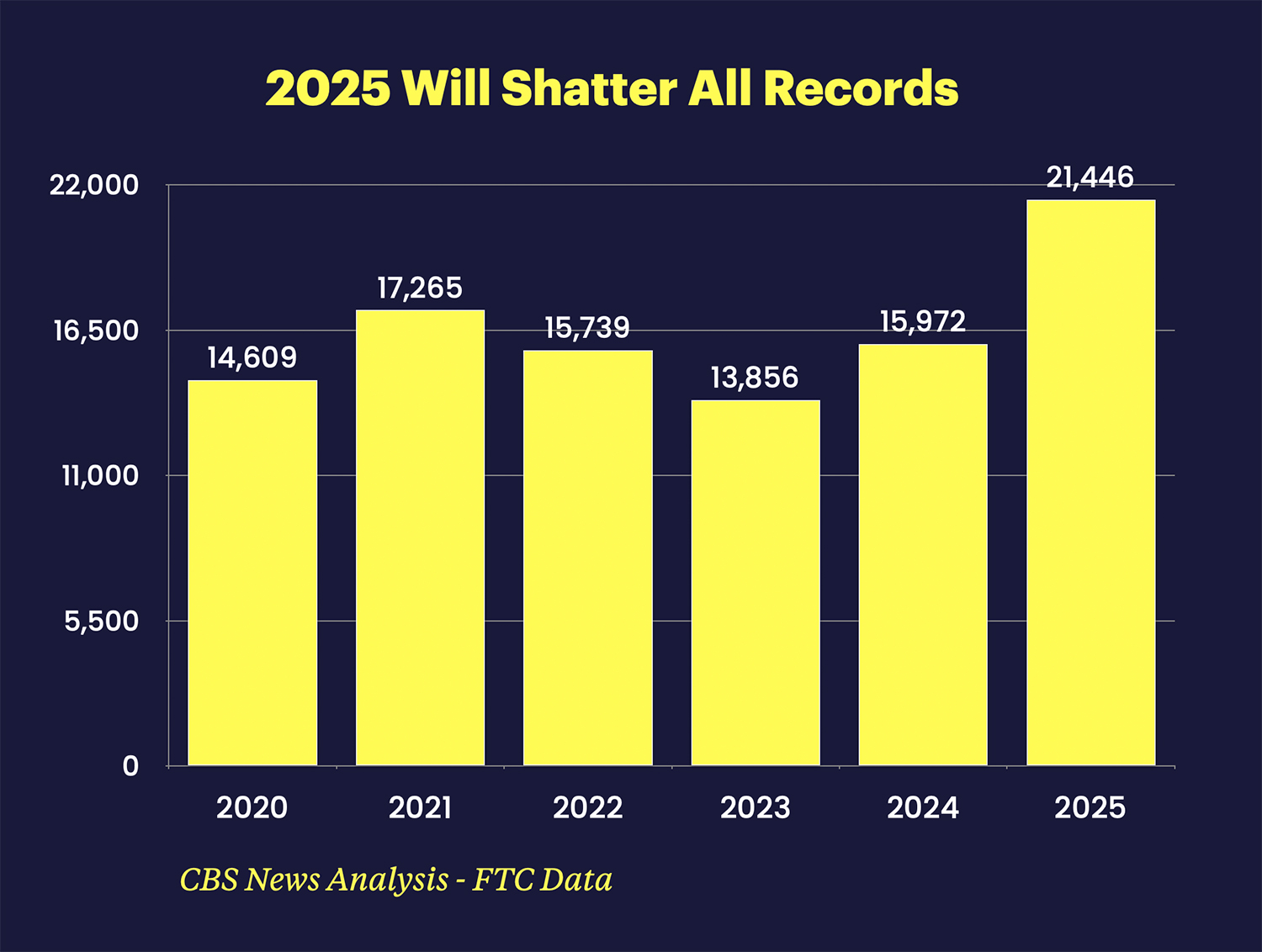

Americans are on pace to file close to 90,000 complaints for fraudulent auto loans to the FTC this year. That will shatter previous records.

According to CBS News, the FTC received 21,400 auto fraud complaints in just the first quarter of 2025, representing a 43% increase from 2024 levels when consumers filed more than 60,000 reports for the entire year.

Surge In FTC Complaints Spells Trouble For Auto

Complaints of fraudulent auto loans have been increasing since 2024 according to FTC data. Consumers are filing more reports for auto loan identity theft than ever.

At the current rate, auto loan fraud reports could hit 86,000 complaints for the year.

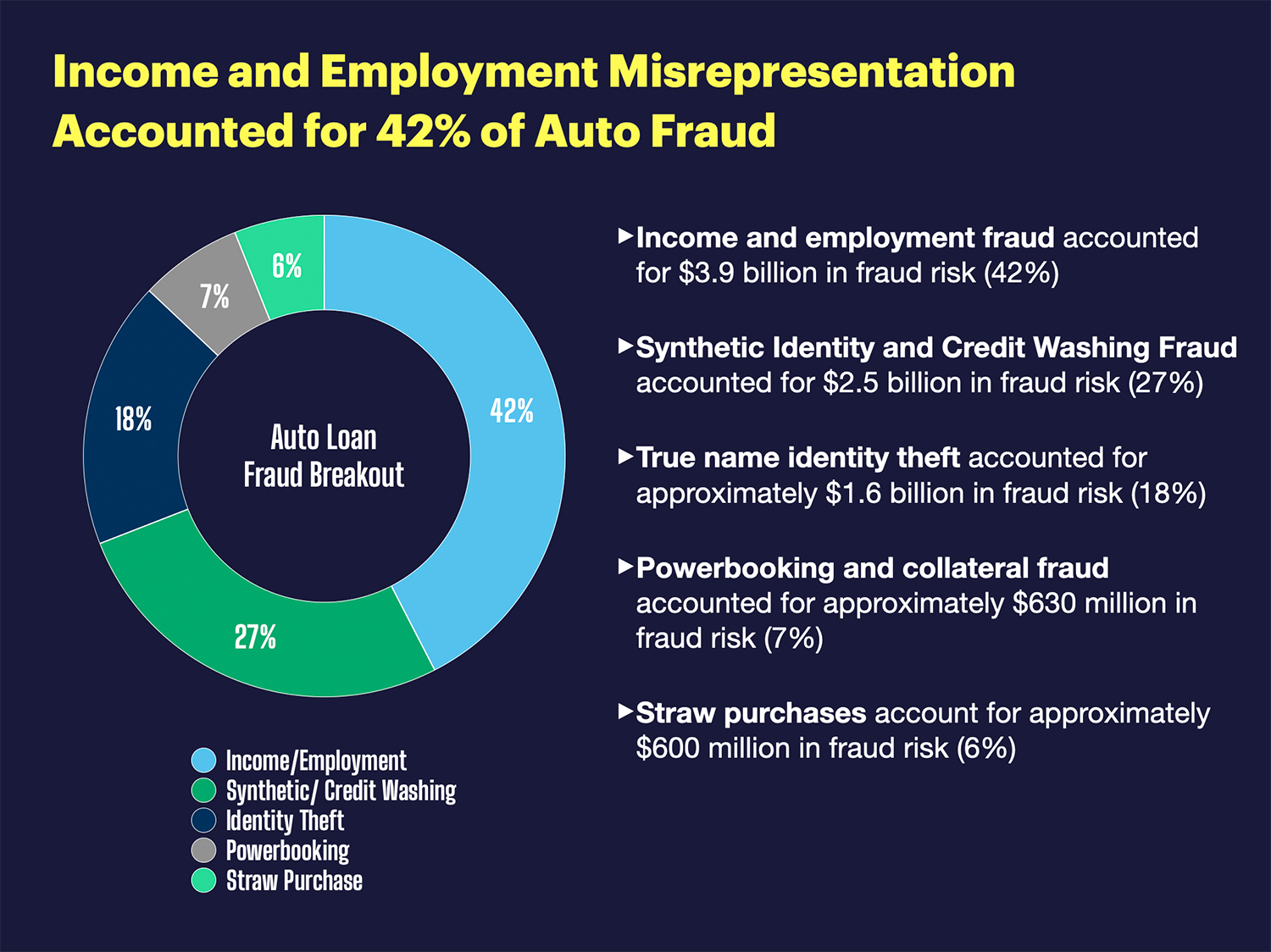

Auto Lenders Faced $9.2 Billion in Fraud Last Year

At Point Predictive, we alerted to this disturbing trend earlier this year, reporting a record $9.2 Billion in risk to the industry in 2024. This represented a 16% increase over 2023 and similar to the FTC, it shattered all previous records.

What’s Driving Auto Loan Fraud To Record Levels?

While the FTC reports focused soley on identity theft reports, Point Predictive data points to increasing risk across a multitude of both first and third party fraud.

So what is driving auto fraud to record levels? The data points to an array of credit repair fraud schemes, income and employment fraud and higher levels of identity theft.

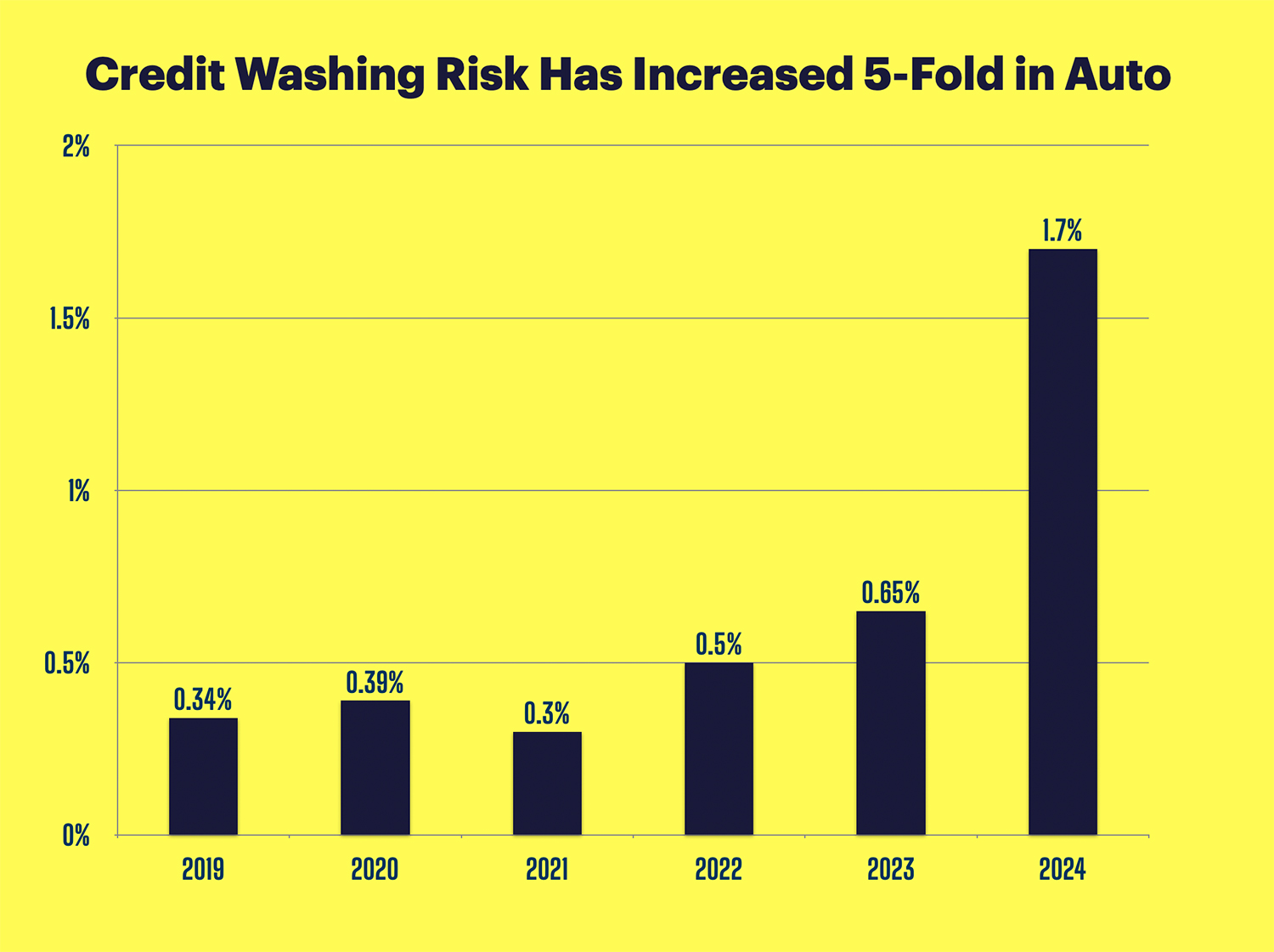

Credit washing fraud where borrowers work with shady credit repair companies to erase their bad debt on credit bureaus experienced the biggest increase, soaring to a record 1.7% of auto applications appearing to have some credit washing risks.

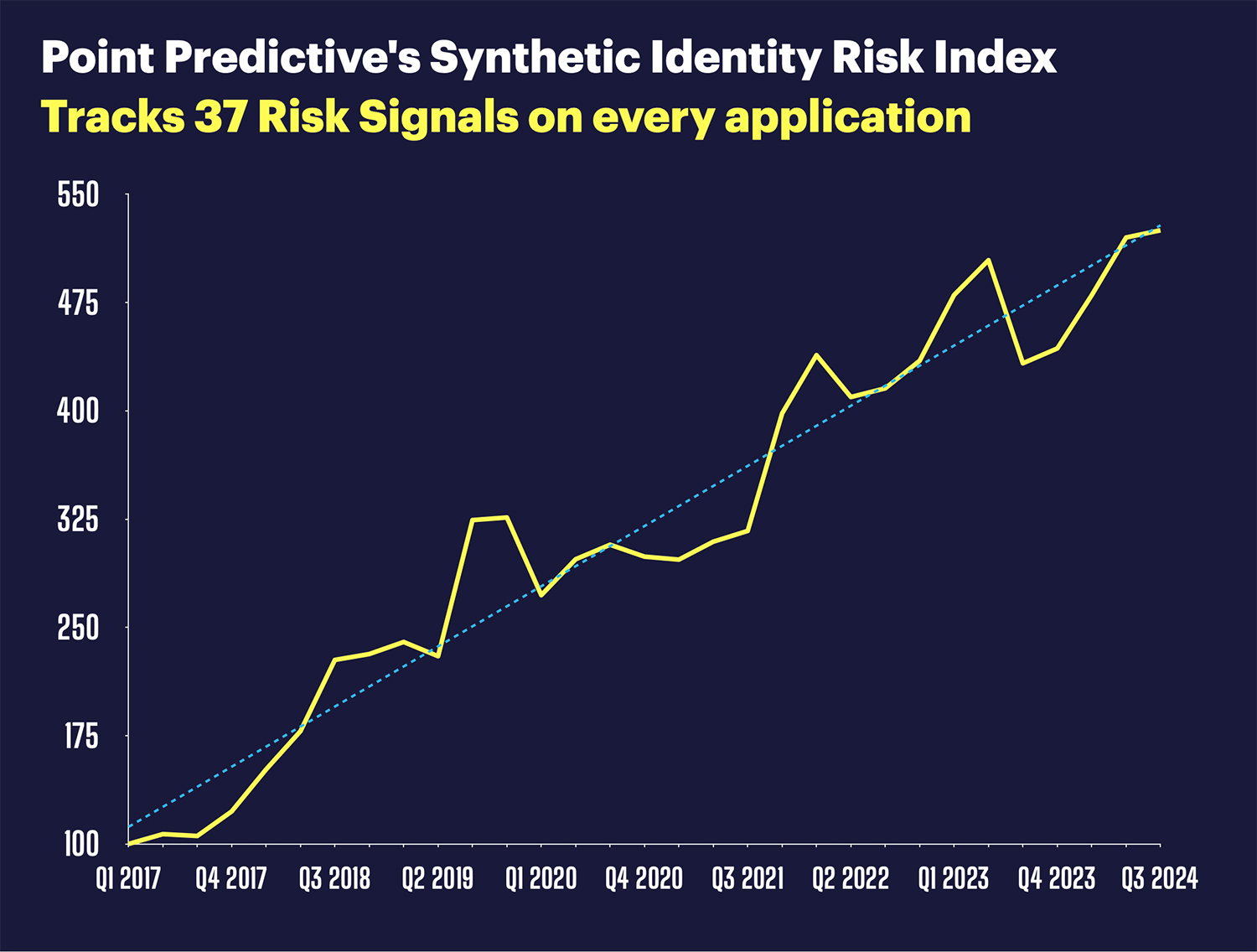

And synthetic identity is soaring in auto as well, driven by higher use of CPN’s by consumers.

The synthetic identity attack rate on auto lenders reached historic highs, hitting 88 basis points in 2024 – meaning nearly 1 in every 114 auto loan applications now involves a fabricated identity. This represents a dramatic increase from just 0.4% in 2020, more than doubling in just four years.

Digital Car Buying Is Creating New Exploits Pushing Up Scams Too

As online car sales explode – forecast to reach 6 million vehicles worldwide in 2025 – scammers have created sophisticated fake dealership websites. These sites feature complete online presences including falsified inventory and customer service channels.

I reported on this last week in this article – This Dealership Never Existed But AI Made It Look Real.

And its not just fake dealer websites, social media platforms like Facebook Marketplace are a devils den of scams against consumers buying cars. The Better Business Bureau reports that social media marketplace fraud has expanded, with an estimated 34% of vehicle listings on these platforms being fraudulent.

Download The 2025 Auto Loan Fraud Trends Report

If you’re not focused on bolstering your defenses on Auto Loan Fraud, it might be time to take a look if you have the best approach.

If you would like to receive a copy of the report so you can peruse more statistics and insights into Auto Lending Fraud click this link here.