Is fraud going down in Canada? According to TransUnion it is. And it’s because Canadian companies are implementing more fraud tech.

According to TU, the rate of digital fraud originating from Canada decreased last quarter, with suspected online fraud attempts declining -40.6% from the same quarter last year.

This is far better than the global decrease of -22.6% which TU saw in other parts of the world.

Fraud is Going Down in Many Areas, But Up In Others

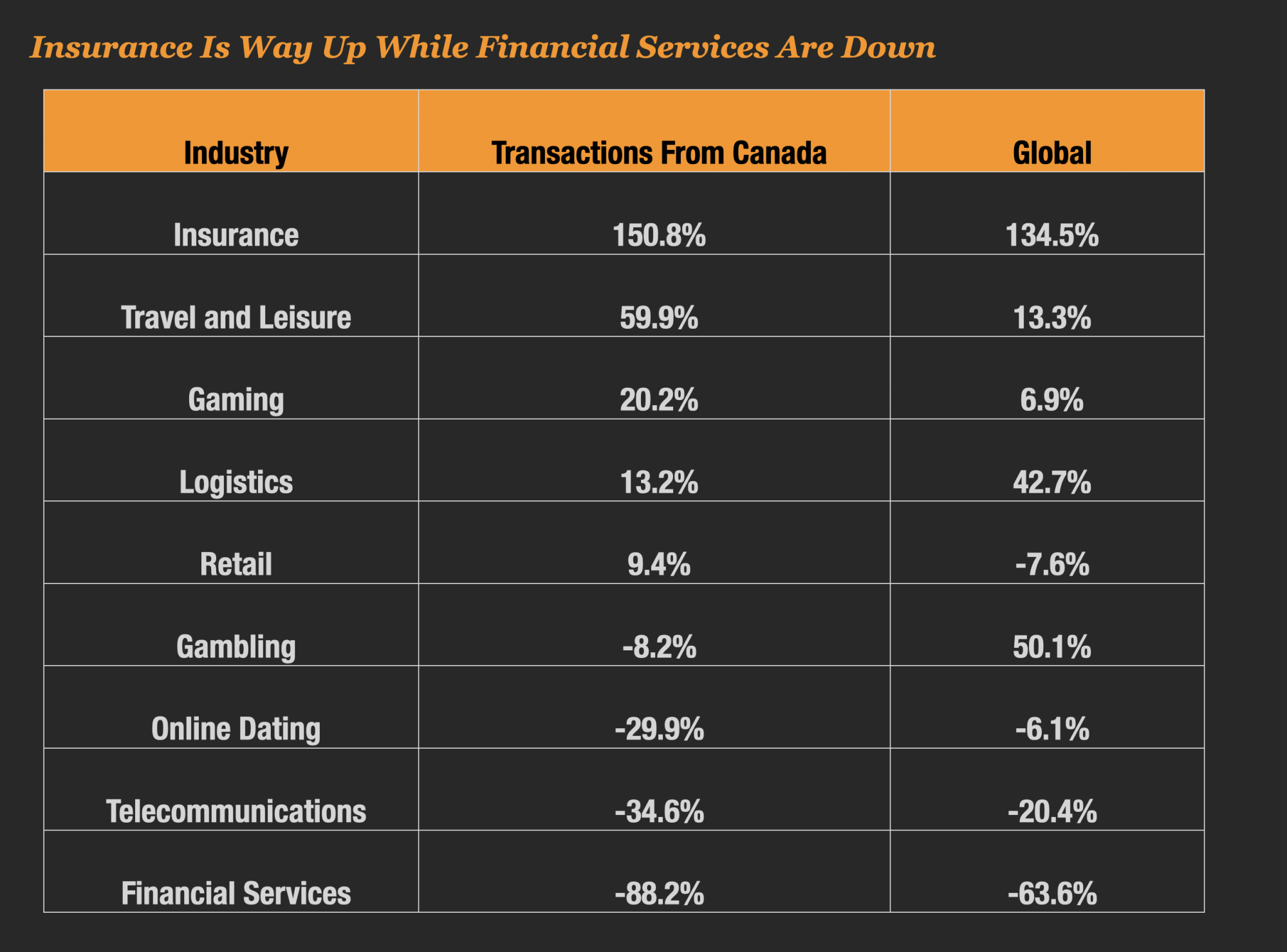

Sectors such as financial services, telecommunications, communities (i.e. online dating), and gambling all saw a YoY decrease in the attempted digital fraud rate from Canada.

But its not all good news, fraudsters in Canada significantly increased their scams in sectors such as insurance, gaming, and travel and leisure.

Patrick Boudreau Says Canadian Companies are Fighting Back With Tech

“What we are observing in Canada, and on a global stage, is that these sophisticated fraudsters are shifting their focus to target new industries as prior industry targets have ramped up fraud prevention measures. In other words, fraudsters are constantly seeking out new opportunities based on vulnerabilities,” said Patrick Boudreau, head of identity management and fraud solutions at TransUnion Canada.

“What’s critical is that companies don’t become complacent with fraud prevention measures as fraudsters become ever more sophisticated. At the same time, companies should leverage this temporary shift in fraudulent activity to focus on optimizing customer experience without compromising security.”

Financial Services Are Benefiting Most With an 88% Drop

The financial services industry saw the largest YoY decrease in the suspected fraud attempt rate for digital transactions coming from Canada at -88.2%.

When digital fraud in financial services did occur, TransUnion found the most dominant type in that industry was first party application fraud.

That’s when an individual completes a fraudulent application(s) that contains intentionally inaccurate or manipulated information with the intention of receiving a lower rate or better terms for a policy or contract.

TransUnion came to its conclusions about fraud against businesses based on intelligence from billions of transactions and more than 40,000 websites and apps contained in its flagship identity proofing, risk-based authentication and fraud analytics solution suite – TransUnion TruValidate™. The percent or rate of suspected digital fraud attempts are those that TruValidate customers either denied or reviewed due to fraudulent indicators compared to all transactions that were assessed for fraud.