Could your plumber or home repair guy be behind the next big lending implosion in the US? If you look at the fastest growing loan type here in the US called Property Assessed Clean Energy, or PACE loans, that could be the case.

PACE loans, set up by the government and are designed to help ho meowners buy energy-efficient solar panels, window insulation, and air-conditioning units.

meowners buy energy-efficient solar panels, window insulation, and air-conditioning units.

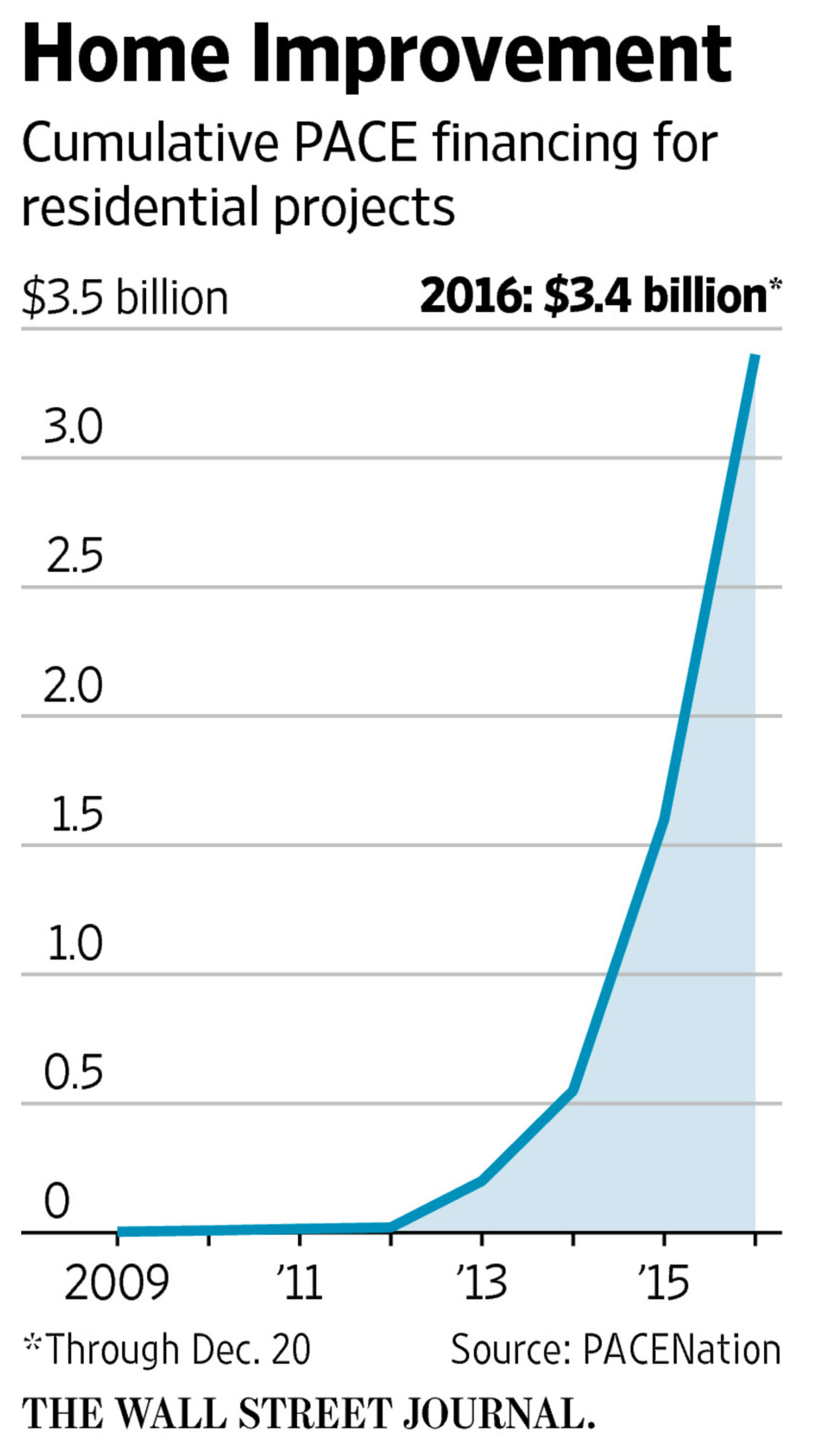

And the loans are booming. According to this article in the Wall Street Journal -About $3.4 billion has been lent so far for residential projects, and industry executives predict the total will double within the next year.

As the loan growth soars to new heights, so do the problems of risk since these loans are originated by guys that are not exactly risk management bankers. PACE loans are primarily offered to customers by repairmen or plumbers and they are loaded with financial incentives from banks to get the loans approved.

Looks Similar to Mortgage Crisis of 2008

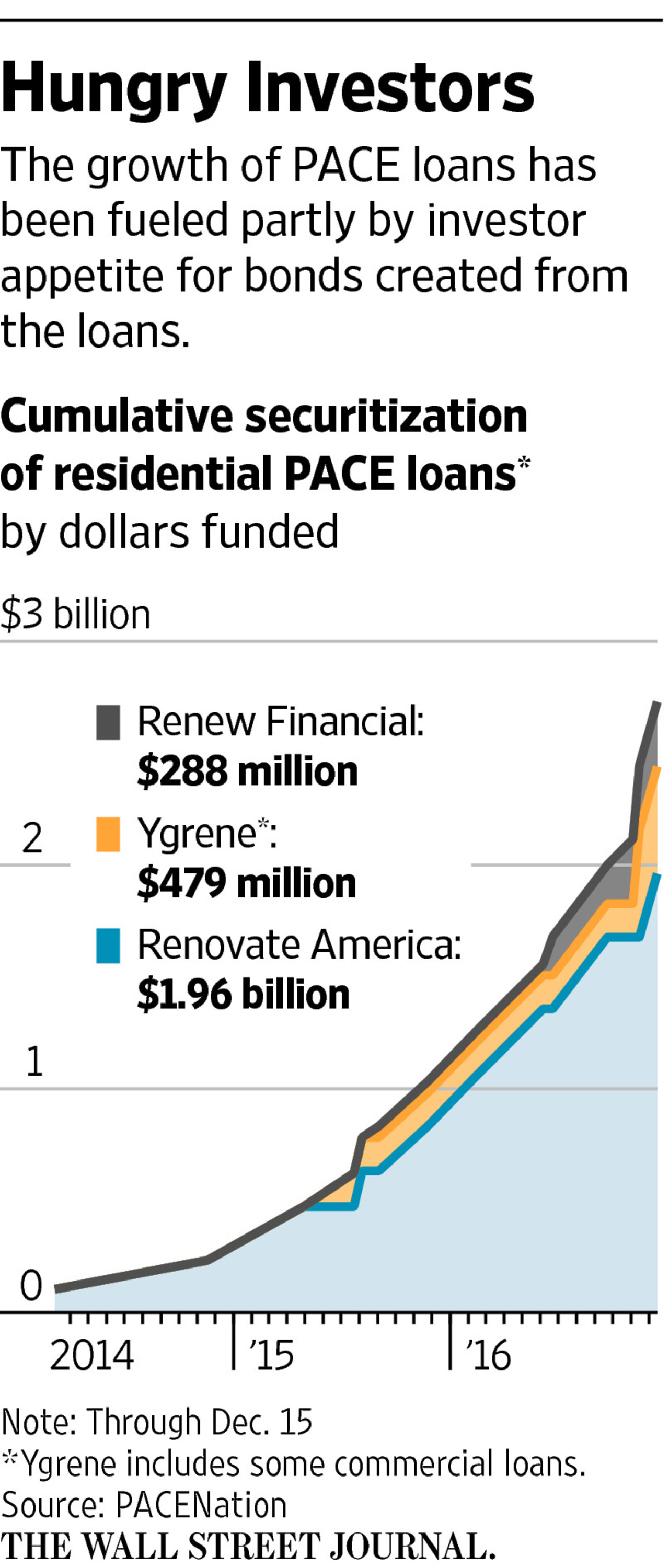

The risk of PACE loans is not felt by lenders. In the mortgage crisis lenders packaged up loans and bonds and pushed the risk off to investors.

The risk of PACE loans is not felt by lenders. In the mortgage crisis lenders packaged up loans and bonds and pushed the risk off to investors.

With PACE loans it is similar. PACE loans require no down payment. With PACE loans there is no underwriting. With PACE loans you do not even need a FICO score or any credit background whatsoever.

But investors love the PACE loans and are securitizing them faster than any other types of loans being booked. PACE loan securitizations are skyrocketing (another similarity to the mortgage crisis of 2008)

PACE loans are simply added to the Property Tax Bill and assessed each year and billed to the customer. This places a huge burden on the borrowers (who are typically low-income or elderly and susceptible to fraud) like Deena White.

Deena White Story by Preston Gannaway

Deanna White told a contractor she couldn’t afford the $42,200 loan he recommended for improvements to her house in Inglewood, Calif. The contractor, she recalled, said she wouldn’t be on the hook because the loan was part of a “government program.” She applied and was approved.

Two years later, Ms. White is struggling to make payments on the loan, which was packaged with more than 10,000 similar loans into bonds and sold to investors. Under its terms, Ms. White’s five-bedroom house could be foreclosed on if she defaults.

In some respects, the PACE Loan programs are worse than mortgage, because the loan officers are not monitored and not even licensed.

And repairmen can make up to $500 as a referral fee for each loan that they close from the lender.

It’s these types of incentives that have many worried about PACE loans and the fraud that is buried in those applications.

County Fairs, Contractors, Repairman and Plumbers

Loan growth is soaring thanks to big marketing and the rush of states that have put in place legislation to offer PACE loans.

Loans are marketed at County Fairs even and Contractors will line up loans while on house calls and can earn a referral fee of at least $500 per borrower, according to current and former employees.

Companies like Renovate America uses about 8,000 contractors to help line up loans, according to bond documents. That’s a lot of loan officers out there that are unlicensed.

Because of the loose marketing of the loans. They are ripe for deception and many borrowers are being mislead. In some cases borrowers are defaulting. About 1% of PACE loans have defaulted even though they are being collected through property taxes.

That spells bad news for the industry.

We’ll keep our eyes on these PACE loans. It appears they may be the next shoe to drop.