I often refer to check fraud as the Rodney Dangerfield of fraud types because it gets “No Respect” and even less investment.

It’s an arcane fraud that first emerged over 500 years ago but has recently taken center stage again thanks to rampant mail theft of checks, a bustling secondary market for those checks on the dark web, and aging fraud technology implemented over 30 years ago that just can’t keep up with the fraudsters.

That was until now.

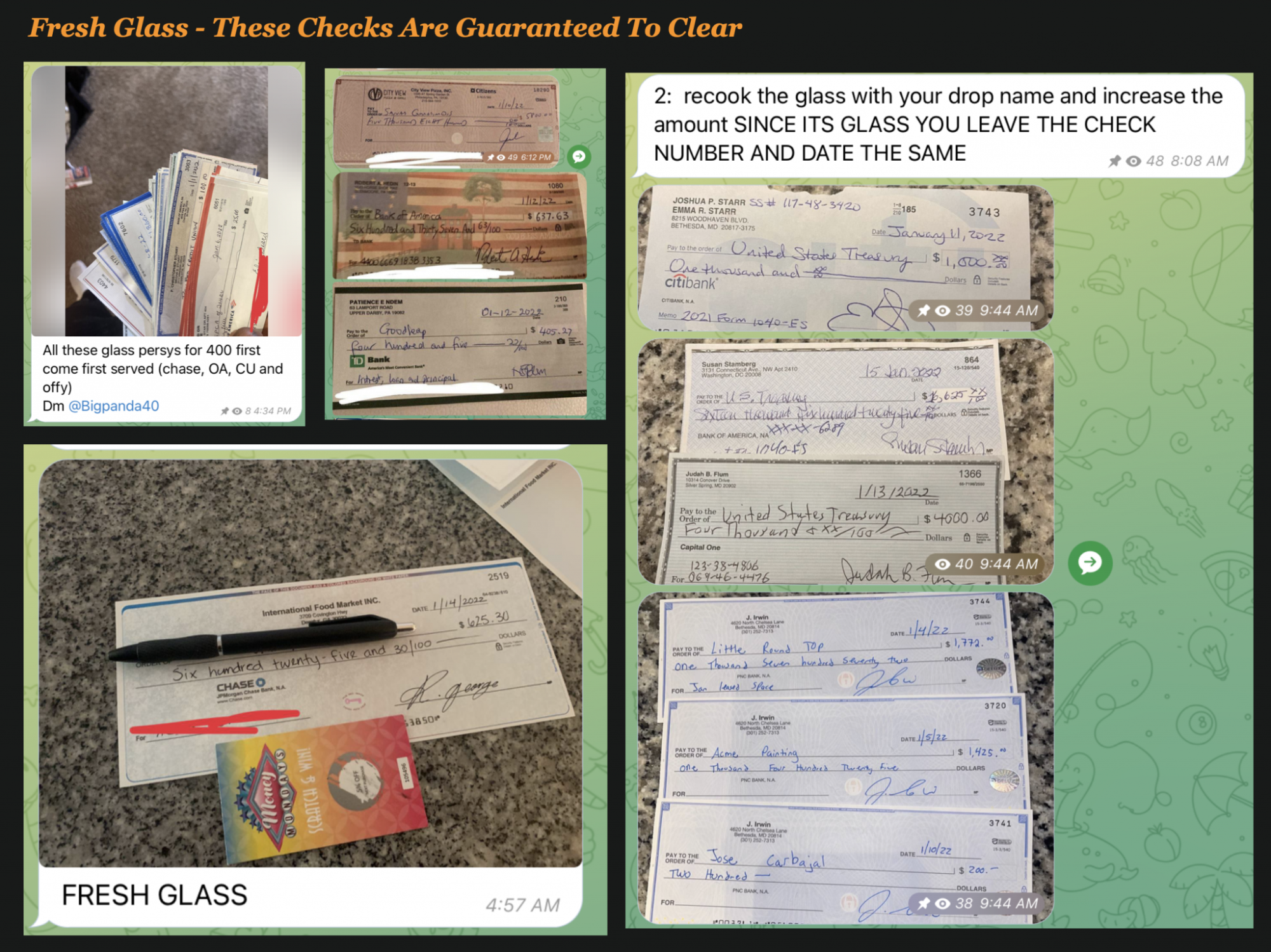

Check Fraud Is Being Fueled By A Massive Underground Market

In 2021 cybersecurity researchers like David Maimon noticed a sharp spike in the number and velocity of stolen checks being sold on Telegram Channel and the Dark Web.

The stolen checks were advertised as “Glass” because they were considered so good that they were guaranteed to clear.

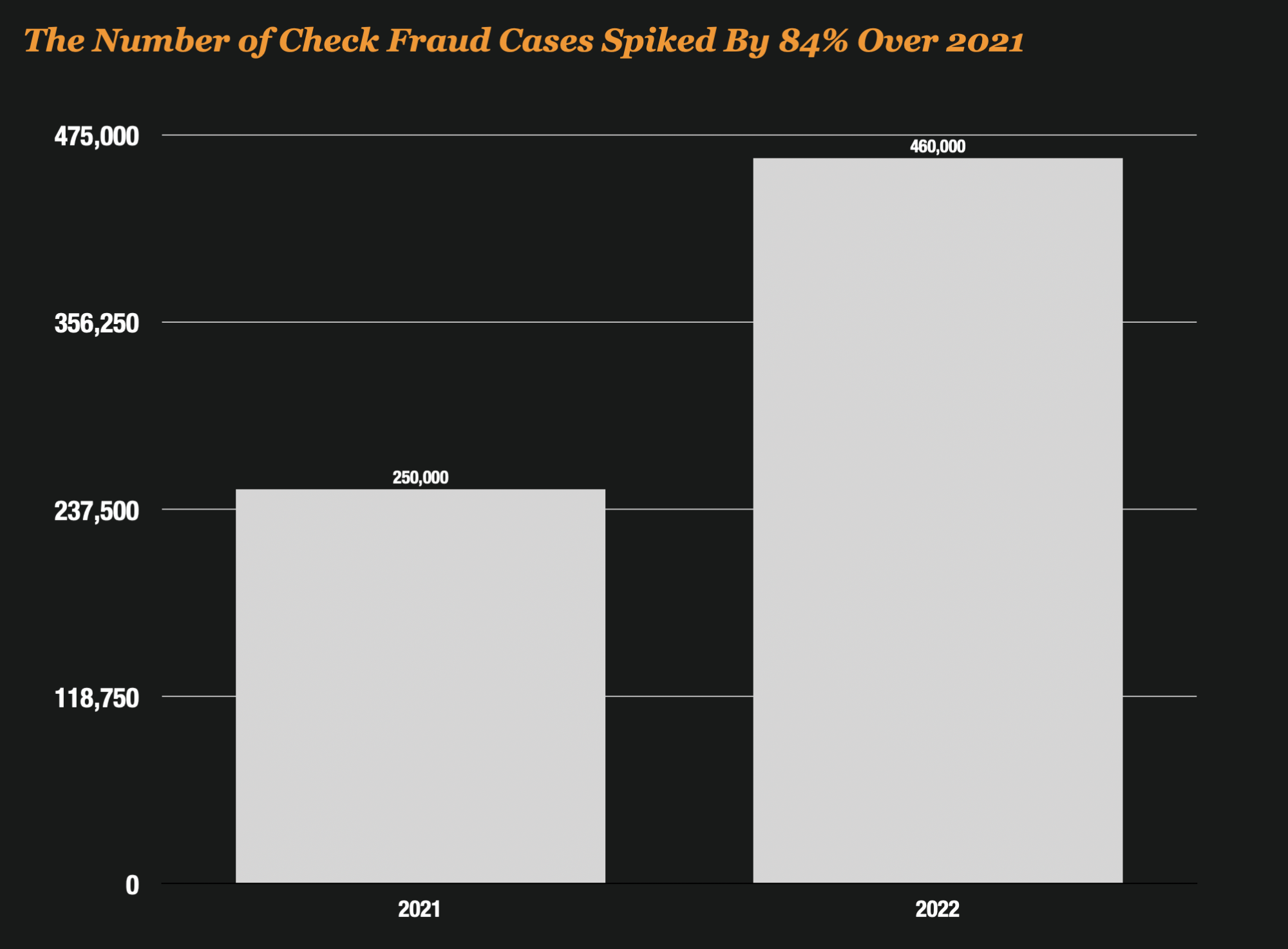

By early 2022 it became clear that the bustling secondary market was hitting banks bottom lines as check fraud cases nearly doubled. By the end of the year, FinCEN reported that check fraud reports (which are a mere fraction of all cases) was up over 84% for the year.

And this year, my projections is that check fraud losses when tallied will exceed over $24 billion for the year.

A CounterAttack By Mitek and DarkTower

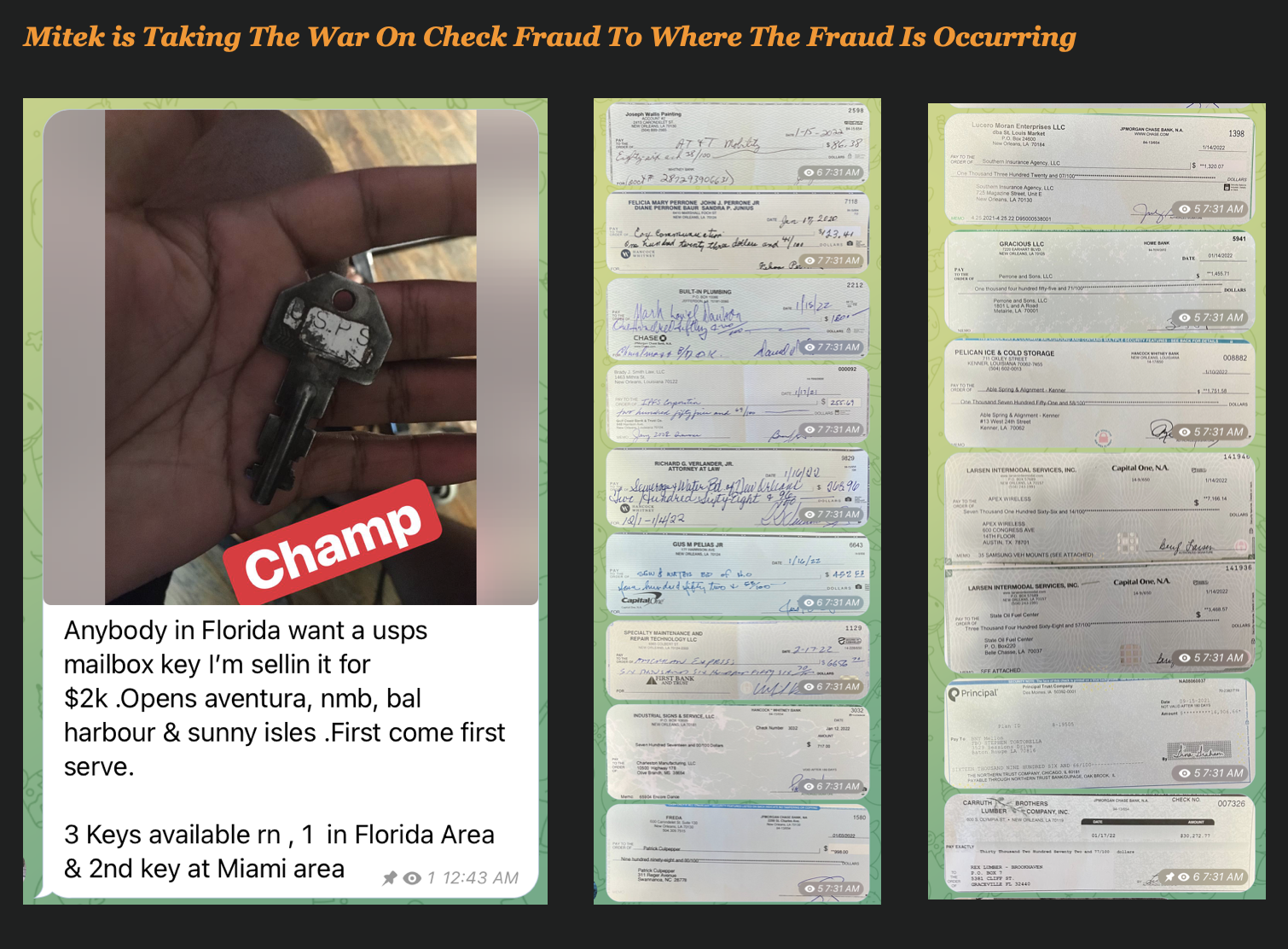

This week, Mitek announced a new partnership with DarkTower to take the war on check fraud to the front lines. They announced that they will offer their customers realtime access to compromised account data.

It’s actually pretty cool how it works. DarkTower will scan Dark Web market places such as Telegram channels and other undisclosed sources for stolen checks. After extracting the images, they will scan the images with their own visual analysis tools and identify which banks accounts are at risk.

The service will not only look for checks but also account screens, and identification documents that are being sold on online channels and in marketplaces.

A Case Study Shows The Power Of The New Approach

In an early test, Mitek and DarkTower provided a large financial institution with extracted data and supporting images.

A small sample of 200 images from a single criminal marketplace processed through Check Fraud Defender revealed more than $10 million in customer funds at risk.

The $10 million at-risk funds represents only a fraction of the potential value of documents available on these exchanges, with experts estimating thousands of similar active markets.

The financial institution confirmed there was undetected fraud and there were claims paid related to the group of stolen checks. More than 90% of the claims showed additional counterfeit documents were distributed. This averaged $50,000 in losses per stolen document.

Mitek’s Bringing New and Progressive Tech To Check Fraud

Banks check fraud systems are aging. Most are still using technology implemented in 1995 as their core detection system and it’s hopelessly dated and ineffective against new check fraud variants.

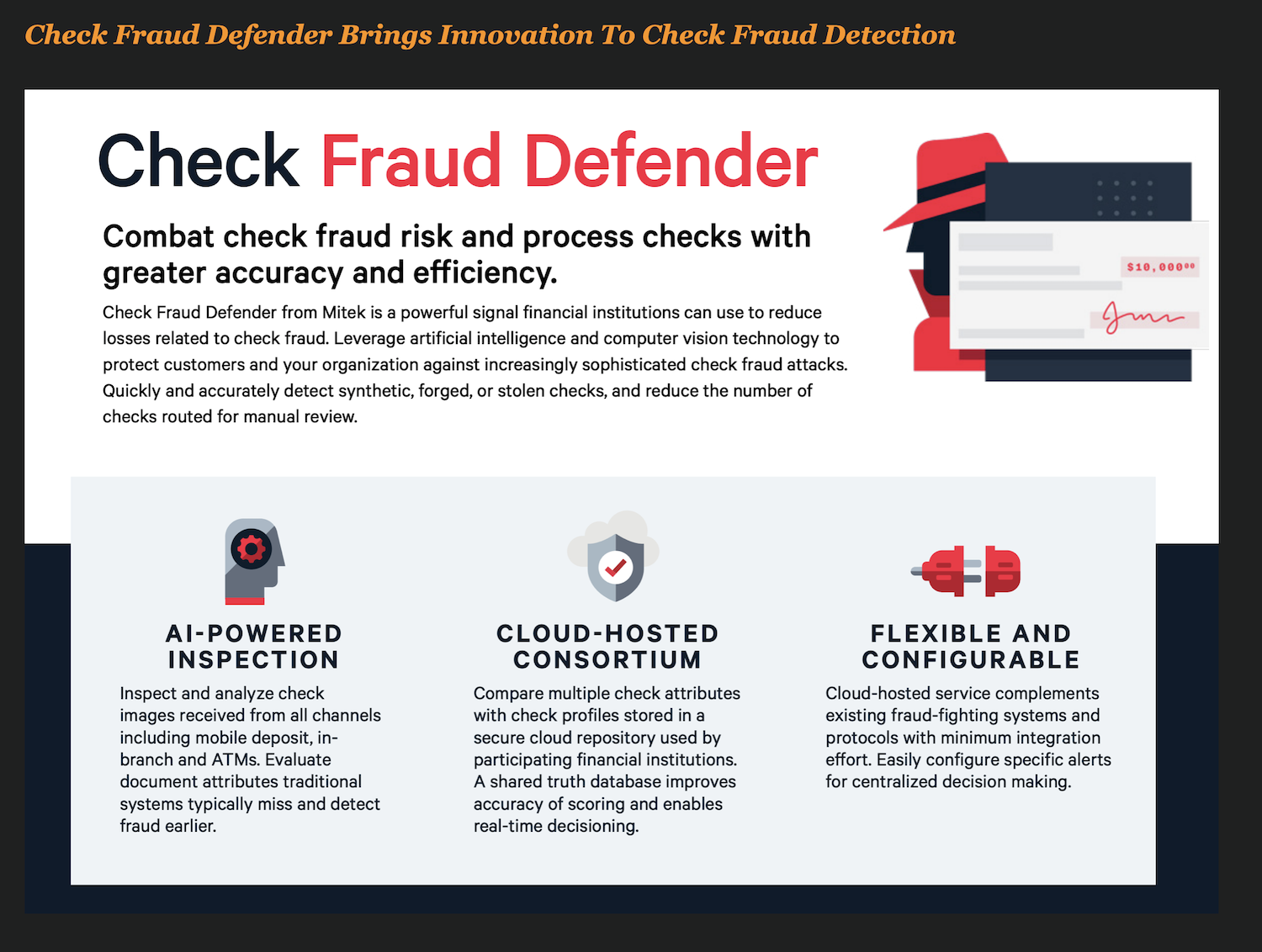

In June of 2021, Mitek broke through the check fraud doldrums by announcing the launch of their Check Fraud Defender solution. It introduced two new advancements in check fraud detection that move the needle in my opinion;

- Artificial Intelligence– It leverages artificial intelligence to visually spot fraud patterns – not rules.

- Consortium Sharing – It uses a consortium approach to help banks fight check fraud together.

With this latest announcement, Mitek is now bringing Ai and investigative tools right to the dark web marketplaces where most of this fraud begins.

If you ask me, they are going to help banks stop a lot of fraud with this new service and make a serious dent in the problem.