He’s the hottest thing in fraud management. A rising superstar with dashing good looks, a nice suit, and an impressive educational resume. And he’s headed to your company to save it.

His name? Rick Spolofiloto.

His game? Fraud Consulting.

And he’s ready to kick some serious butt and get your company back in line.

I had a chance to catch up with Rick last week and hear from this rising star himself. I interviewed him to get an idea of what makes him so special. Because in the world of fraud consulting, Rick is special. At least he likes to think so.

Ladies and gents, I introduce to you – Rick Spolofiloto – The Most Useless Fraud Consultant.

So Rick, tell me a little about yourself. How did you get your start in fraud and what makes you a great fraud consultant?

Actually, I have no experience in fraud. But I have something far better – an MBA from a good school and a pretty good knack for PowerPoint.

The fact I had a 4.0 GPA speaks volumes and besides actual experience in fraud is overrated. I don’t need experience to know that fraud is bad. It’s a bad, bad thing. And that is precisely why you need someone like me who understands that and is here to help.

Can You Tell Us What Recommendations You Have For Banks? What Should They Consider When They Want to Control Fraud?

Banks need to understand that they need to really look at controlling fraud. If you want to control fraud, you have to reduce your fraud losses.

The only way to reduce fraud is to lower it. And to lower it, you have to start by taking the fraud losses from a high number to a lower number.

I will leave the details on how to exactly do that to other lower-paid people than I, but that is my recommendation.

So Rick, when you are consulting with a bank, how do you come up with your brilliant recommendations? I imagine banks pay you a lot of money to help them right?

That’s exactly right. The consulting fees generated by our big consulting company run in the 6 to 7 figures for our fraud consulting reports. And that’s because we hire only the best non-experts in fraud in the industry. And then we send them out to the banks with an IBM laptop to figure it out with their big brains.

But, my personal strategy is quite simple really.

My consulting approach is to first bleed your staff dry of every single idea they have. From that, I will create a 200 slide fraud deck with everything I heard from them but I take all the credit for myself.

You see, everything I say just sounds better coming from me rather than an employee. I am more credible. And that’s why I get paid the big bucks!

Everything so far sounds impressive Rick, but do you have any actual case studies where you saved a bank big money? Can you tell us about that?

I sure do. Last year I did a simulation and convinced a bank that they could reduce their fraud staff 100% by cutting headcount in the fraud group to zero. I was able to show a savings to the bank in staffing costs of about $1,000,000 a year.

That’s pretty huge, right? That’s why I get paid the big bucks.

Did that end up working out for them? Did they achieve the savings?

Yes, they absolutely did. In fact, they saved $1,150,000 a year. That far exceeded even my most aggressive simulations! What a win for the bank. And for me too for being such a genius.

Unfortunately, there was a very large fraud outbreak during the year which resulted in over $200,000,000 million in losses.

A lot of haters in the bank ended up blaming me for getting rid of the fraud staff! That was quite unfair if you ask me. Anyway, they ended up re-hiring all the staff and in fact tripled it from what it was before since fraud was so high.

Is there a Silver Bullet for Fraud? What Should Banks Consider When Building Their Long Term Fraud Plan?

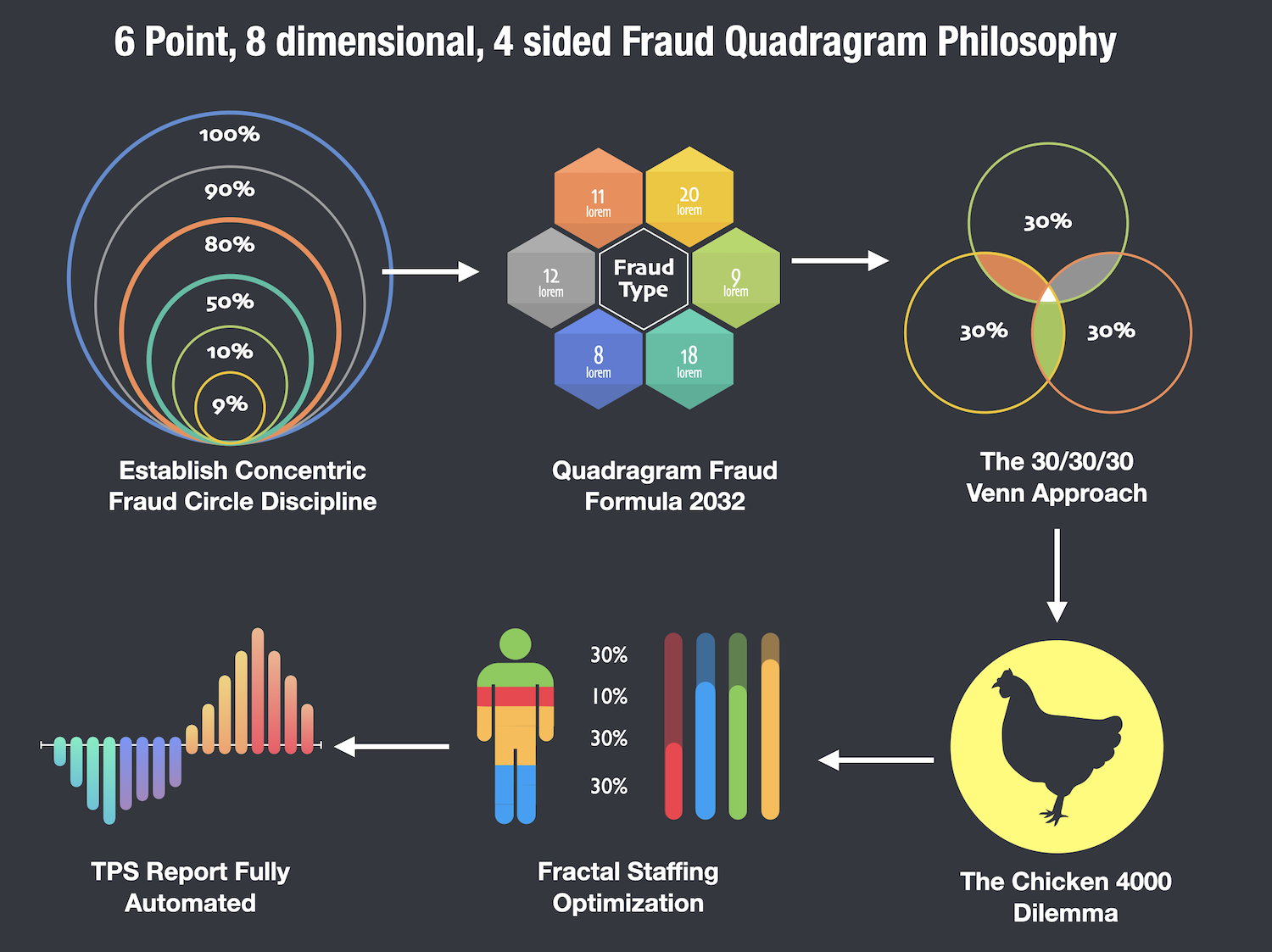

Yes, of course, there is a silver bullet for fraud. It’s based on the KISS principle– Keep it Simple Stupid.

And that silver bullet is my 6 Point, 8 dimensional, 4 sided Fraud Quadragram Philosophy. It takes approximately 10 years to implement and will involve about $25 million in consulting fees paid to me but it’s kind of a “no-brainer” and will virtually eradicate your fraud problems.

While I can’t give away too many trade secrets, this diagram below illustrates the patented process I and I alone can deliver. As you can see it’s fairly obvious why it should work perfectly.

Now Rick, you must work with some banks that really struggle with fraud right? What are your recommendations for a bank that really has no idea what to do?

I certainly do. And really there is nothing like a massive re-org to correct the problem. That’s my go-to recommendation when I don’t know what else to do.

First. you move your fraud people from over here, to over there.

Then you have them report to someone who just started at the bank a week ago. Preferably choose someone with zero interest in running fraud.

Then change the fraud team’s job titles slightly and force them to move to another city to keep their job. It keeps them guessing and you’ll see productivity and morale improve immediately.

Re-orgs rarely fail. Trust me.

Face it, Finding a Good Fraud Consultant Is Not Easy

Satire Alert!

Thanks for reading my spoof on Rick Spolofiloto. As you can probably guess, he’s not a real guy. But that doesn’t mean his ham-handed fraud consulting techniques aren’t based on reality.

In fact, I hear from a lot of banks that struggle with consultants. They hire big consulting companies to come in and help and what they get back just isn’t helpful or actionable.

Here are my tips on what to look for in a good fraud consulting company, or even an independent fraud consultant.

#1 – Look for A Fraud Practitioner or Fraud Expert

Look for people that have either been fraud practitioners before or that have a good deal of first-hand knowledge on how fraud is perpetrated and the mechanics of it.

If you are working with a big consulting firm, work with one that is bringing in fraud practitioners to help you, and not just loading you up with a team of people that have never worked in fraud before.

#2 – Look for A Company With A Collaborative Approach

Good fraud consultants are collaborative and work with your company to find out what works best for you and your organization. Remember consulting is more about change management than anything else so the person needs to be a collaborator. You don’t want a Rick Spolifiloto just regurgitating your ideas back to you in a fancy PowerPoint.

#3 – Don’t be Afraid to Use Independent Consultants or Small Boutique Companies

The lure of working with a very large consulting company can be strong. But many of the best consultants in the world work as solo practitioners or boutique consulting companies. You can get incredible and useful work with smaller consulting groups.

#4 – Check Their Work

The best indicator of what sort of result you will get is what the consultant has done in the past. Ask to see case studies or generic samples of their work. That is the type of work you can expect to see when you hire them.

#5 – Have Them Meet Your Fraud Team First

Don’t just impose a huge consulting project on the fraud team. That can create a lot of uncertainty and also make the project a lot less successful. Before the project, have the consultant(s) meet the fraud team and executives to make sure it is a good collaborative project.

#6 – Set Clear and Actionable Objectives

So many consulting projects fail because the company does not set out clear objectives of what they want to see at the end of the project. Set those very clear expectations right upfront and make sure everyone knows what they will be doing on the project.

#7 – Don’t Hold Back

Once you bring a consultant in, make sure your team gives them the time and support they need to make you successful. You get what you give in a fraud consulting engagement so treat the person as part of the team and you will be happy with the results.

Thanks for reading and have a great week!