1 in 22 Americans could be victims of synthetic identity, and they haven’t a clue they are. But regardless, even if they do know, there is nothing they can do about it. There is no help for victims of synthetic identity.

Synthetic identity has been called a victimless crime, but that isn’t true. When a fraudster exploits a person’s social security number, it can haunt a victim for years.

Silent Victims That Never Know

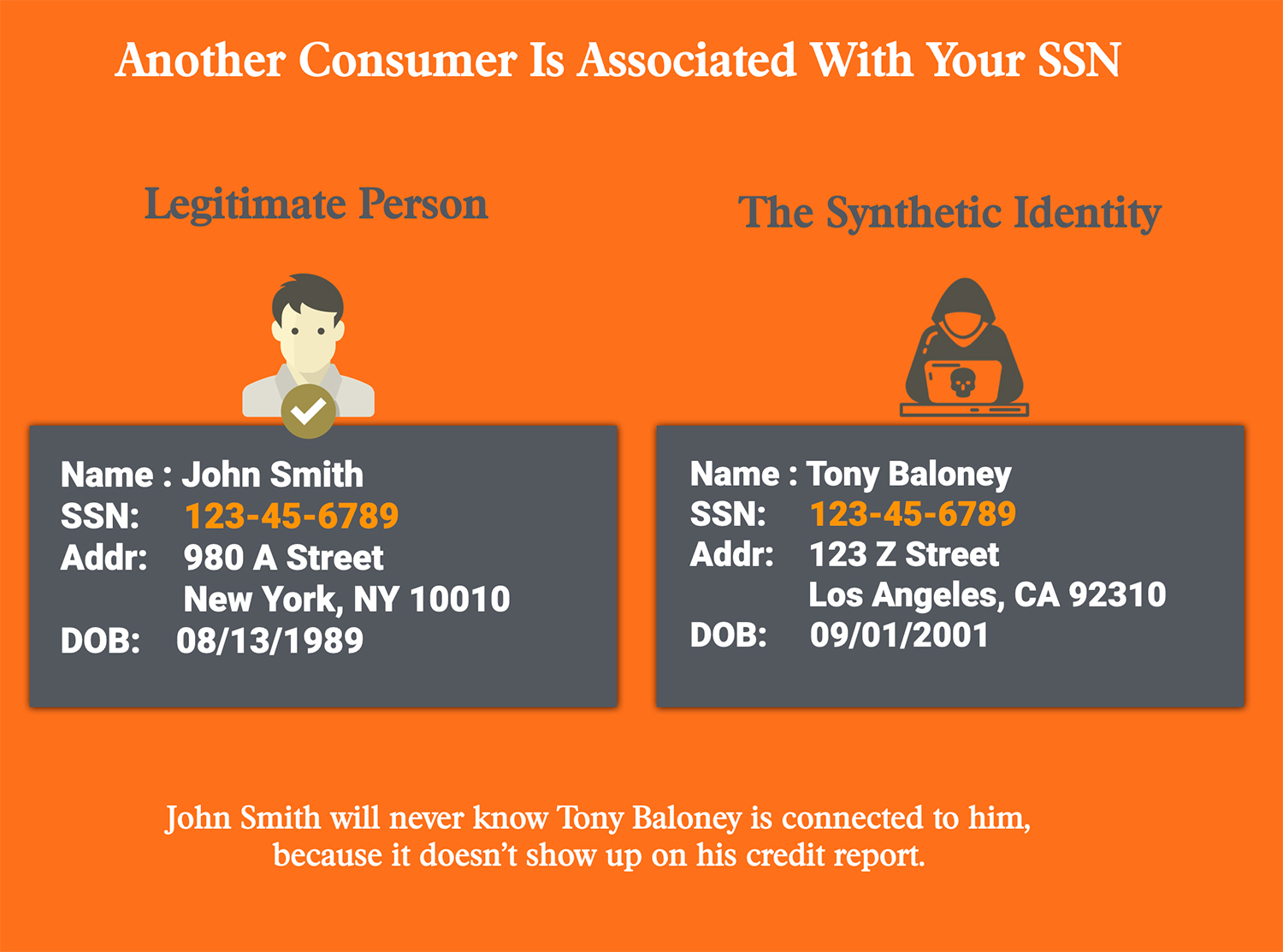

Victims of identity theft often know when someone stole their identity. They can see it on their credit report, and sometimes, they may even get an alert from a bank.

However, victims of synthetic identity typically never know. It doesn’t appear on their credit report, and banks never notify them.

There is no mechanism to inform a person that someone else has used their social security number. It simply doesn’t exist. They are silent victims who don’t understand they have been defrauded.

Synthetic Identity Victims Are Forever Linked To The Fraudster

When someone steals a social security number to create a new credit profile, they link themselves to the actual owner in the credit system. Many databases use the SSN as a unique key.

Every time the actual owner of the SSN applies for credit, the lender or bank receives an alert that says, “This SSN is associated with more than one consumer.” This arouses suspicion in the bank, so they will likely make the actual owner prove they own the SSN by providing further documentation.

More Than 15,000,000 Victims, Probably More

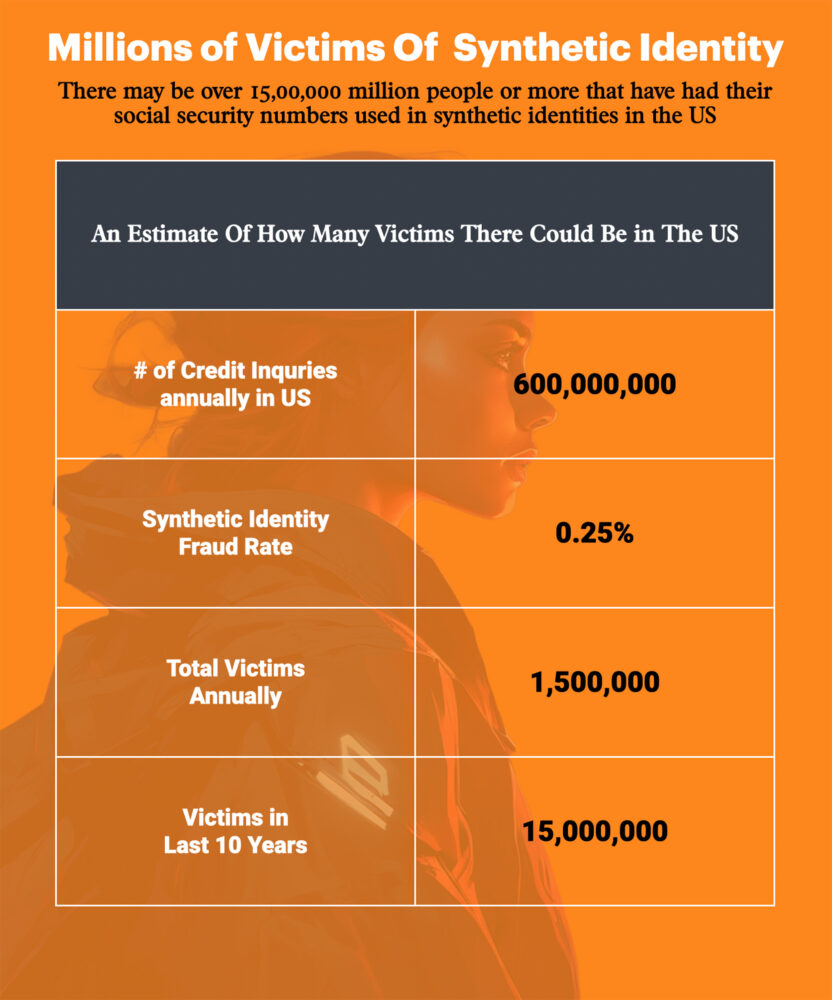

There are no statistics on just how many people are victims of synthetic identity in the US. So, I calculated my estimate based on things I know.

I used the following assumptions:

- Inquiries – I assumed there are 600 million credit inquiries a year.

- Synthetic Rate – I assumed a conservative 25 basis point rate of synthetic identity

With this conservative approach, I just did the simple math. It suggests there is a minimum of 15 million people in the US who have had their SSNs exploited in the last ten years.

Who Cares? It’s No Big Deal.

The perception that synthetic identity is victimless is a myth. Let me tell you about some actual impacts of synthetic identity that you might not have considered.

Here are five examples of where victims are hurt.

#1 – An Overwhelming Number Of Victims Are Kids

Fraudsters love to use SSNs issued after 2011 because they are not tied to adult credit profiles. Millions and millions of synthetic identities have been created that will now be forever tied to those kids.

Here is the problem: when those kids apply for credit cards, banks will be suspicious because someone else has a profile. Those kids will have difficulty passing fraud checks and getting loans and cards.

#2 – You Get Added To Industry Negative Files

Social security numbers are often flagged as fraud when banks discover a synthetic identity. Those flags are fed into “negative files,” so any new applications require manual review.

When someone else uses your SSN, you will likely end up in negative files and get flagged.

I know several people who have difficulty getting loans now because a synthetic fraudster used their SSN before.

#3 – Trouble Renting, Getting Bank Accounts, Getting Into College

It’s not just credit products. People who are victims of synthetic identity have trouble renting apartments and getting bank accounts. Those negative files are used across industries.

#4 – Duplicate Accounts Tied To Your SSN At Banks and Lenders

Most companies use your SSN as a unique identifier. When you are a victim of a synthetic identity, you may be surprised to find that you have multiple accounts registered at your bank or even your lender.

Those accounts can get crossed, and your bank or lender may not be able to decipher whether you are the real owner or the fraudster is the real owner.

#5 – Your Social Security Benefits

Have you ever heard of Hilda Witcher? Over the years, over 40,000 different people have used her SSN after her boss used her social security card as a sample in wallets he was selling.

Many people used her SSN for employment, which meant that they were depositing money into her social security benefits. Hilda had millions of dollars in social security benefits by the time she died.

Imagine if someone who is using your SSN, starts taking your benefits before you can get to them.

There Is No Remedy Or Cure For Victims

I present pretty frequently on synthetic identity and get the same questions every single time.

What can I do to protect myself?

Unfortunately, the answer to that question isn’t satisfying or helpful. There is nothing you can do. Here is a list of things that I know don’t work.

- Credit freezes do not work – those are tied to your identity, not your SSN.

- Lifelock does not work – that is also tied to your identity.

- Lock your SSN – Those only work for employment verification.

- Victim Alert on Credit Bureau – those don’t work for this.

- Police Reports – You can’t do that because you don’t know the perpetrator

- Pull Your Credit – You won’t see the inquiries.

A Little-Known Search Might Provide The Answer

The only thing that might work is a little-known search only available to investigators, skip tracers, and law enforcement.

The search is called a “Social Security Number Trace” and scans public databases looking for any name tied to a given SSN in history. If you ran an SSN trace on your number, it would probably show you, but it might show other names, too. If that is the case, you might be a victim yourself.

Is the SSN Trace service, the next LifeLock for synthetic identity prevention and detection?

It could be…