Last year, banks announced a new initiative to cut push payment fraud by re-validating the name on the account customers are transferring to before the transaction is completed.

This year, Lloyds, the largest bank in the UK, was the first bank to implement name verification prior to sending payments. And the results worked beautifully.

They Reduced Fraud by 31% With Name Verification

Over 5 weeks in February and March of this year, Lloyds processed over 4 million payments and reverified the name on the account with the customer before transferring the funds.

Lloyds found that customers that had received the name verification had push payment fraud rates 31% lower than customers that had not received the name verification.

Only 72% of Names Matched Perfectly

Name checking is great but it can be fraught with errors and false positives. But in this case, the system seems to work pretty well. Of the Lloyds customers that received a response the statistics showed some interesting results

- 72% of the payments were a full match to the payee account

- 13% of the payments were a partial match to the payee account

- 15% of the payments were a complete non-match

Surprisingly, customers could still send the payment even when the name did not match at all.

The great thing about this service is that it does not represent any inconvenience to the banking customers and actually saves them money at the same time.

It’s a real win, win for everyone.

Stupidly Simple But Effective In Preventing Fraud

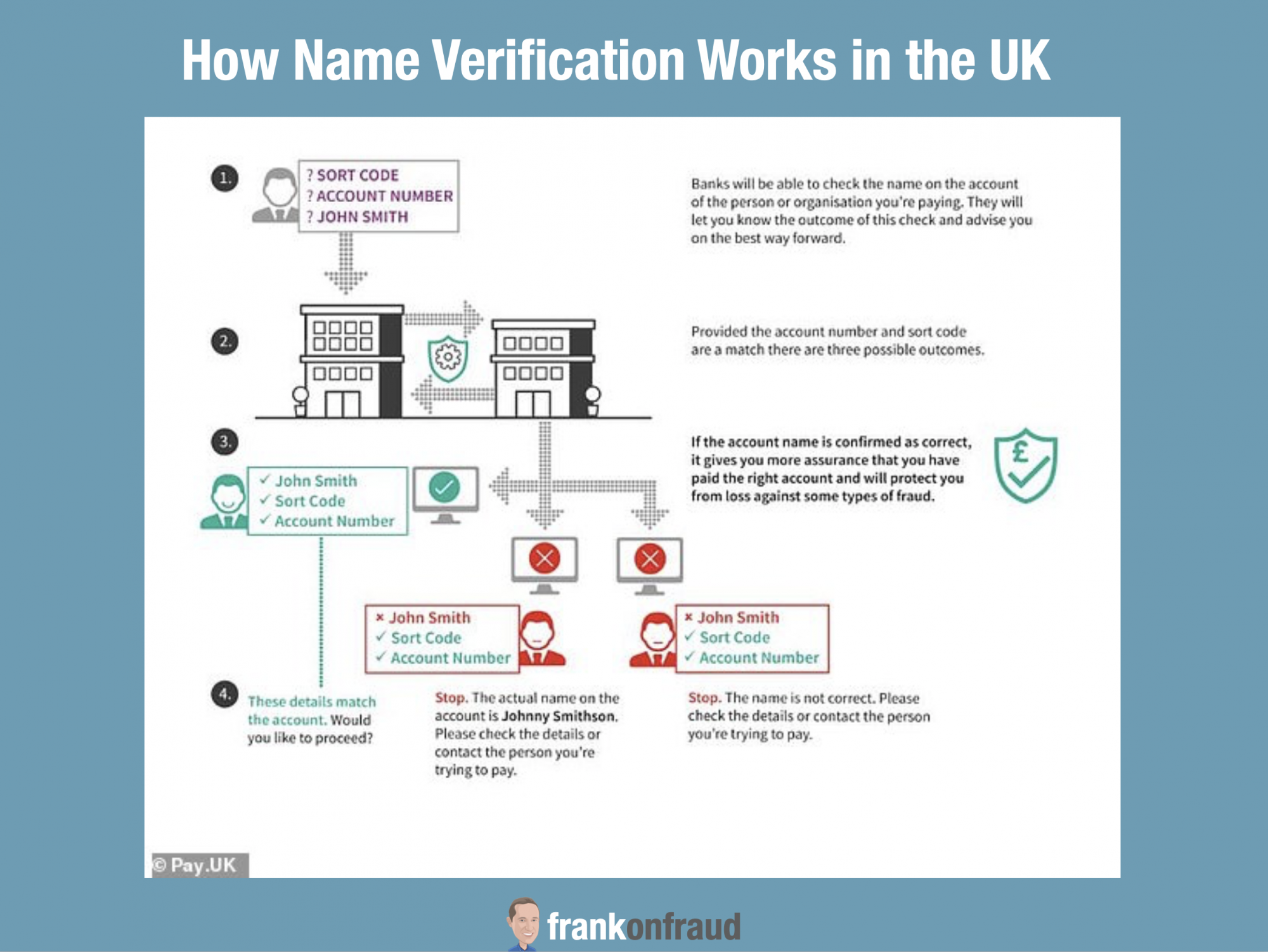

Currently, if a consumer wants to transfer money, they are asked for the recipient’s account name, account number, and sort code. However, banks do not currently check if the account name is correct. And this leads to lots of fraud.

This year they begin checking the name of the payee account to make sure it is accurate before funds are transferred. Customers are given 3 possible outcomes before the funds are transferred

- If they used the correct name, they receive confirmation that it matches and the payment will be processed.

- If they used a close match to the payee account, they are provided with the actual name to validate. They can then update the details and try it again.

- If the name is no match they receive a message that the name does not match the name on the payee account.

UK is Leading the Way in Protecting Consumers from Scams

The UK is leading the way that many other countries will essentially follow. Initiatives such as name-checking and verification are proving to reduce victims of scams by over 30%.

‘Helping keep our customers’ money safe is our priority and falling victim to fraud can have devastating effects – not just on people’s finances but also their lives. We’ve seen in recent weeks how quickly fraudsters have adapted their methods with new scams related to coronavirus. This extra layer of protection gives customers added peace of mind when making payments and gives an extra reminder to stop and think before transferring cash out of their account.’

Lloyds Banking Group’s fraud director Paul Davis

It’s great to see some real progress here and some great results!