The much anticipated FedNow Program launched on July 20th. It’s offering the instant, round-the-clock ability to issue a paycheck or pay an invoice. Heck, many think you’ll even get your paycheck faster with the service.

But many fraud experts have been holding their breath, expecting that the tried and true postulate – Fast Money = Fast Fraud will come to fruition.

But so far, it’s been eerily quiet.

Maybe too quiet.

Faster Payments In The UK Came In With A Fraud Roar

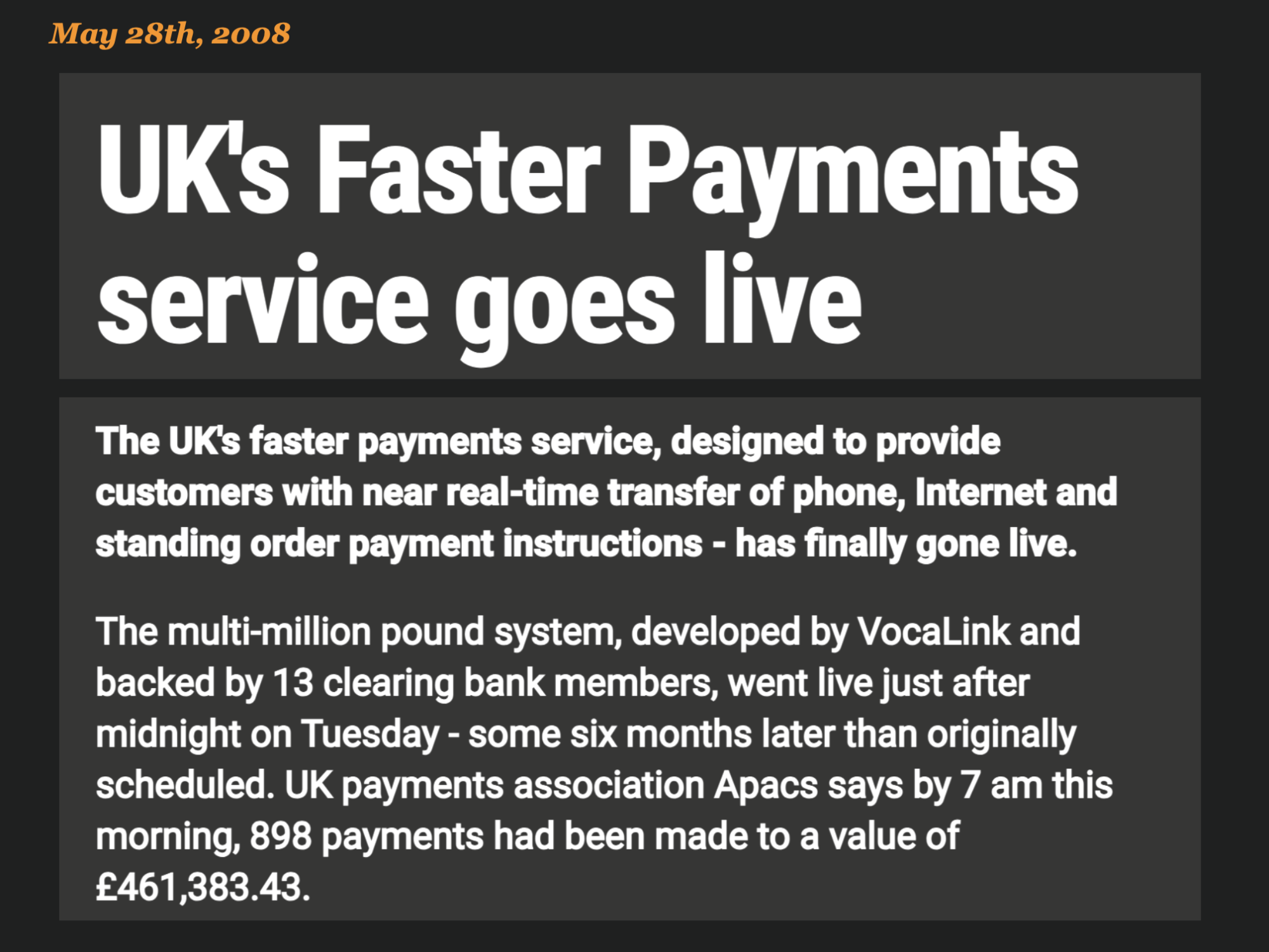

When I saw the FedNow press release, I remember this release that looked remarkably similar way back in 2008.

It was the launch of UK Faster Payments. I remember my teeth chattering in fright. ?

13 banks were set to unleash one of the most anticipated services in the world. It was revolutionary and you would be able to instantly transfer up to 100,000 GBP – instantly!

That was over 15 years ago, and it set in motion a chain of fraud events that changed the banking forever.

Within 3 Days Of Launch Account Takeover Rocketed Up

It didn’t take fraudsters long to figure out Faster Payments in the UK was a golden opportunity.

Within 3 days of the launch, banks were already experiencing a rash in Account Takeover attempts through multiple channels – online and social engineering.

- Credential Stuffing – Online banking channels at banks began to see a spike of fraudulent logins, followed by account takeover and bleeding accounts dry.

- Social Engineering – Call centers were flooded with social engineering attempts by fraudsters luring customer service representatives to change addresses, credentials and then bleed accounts dry.

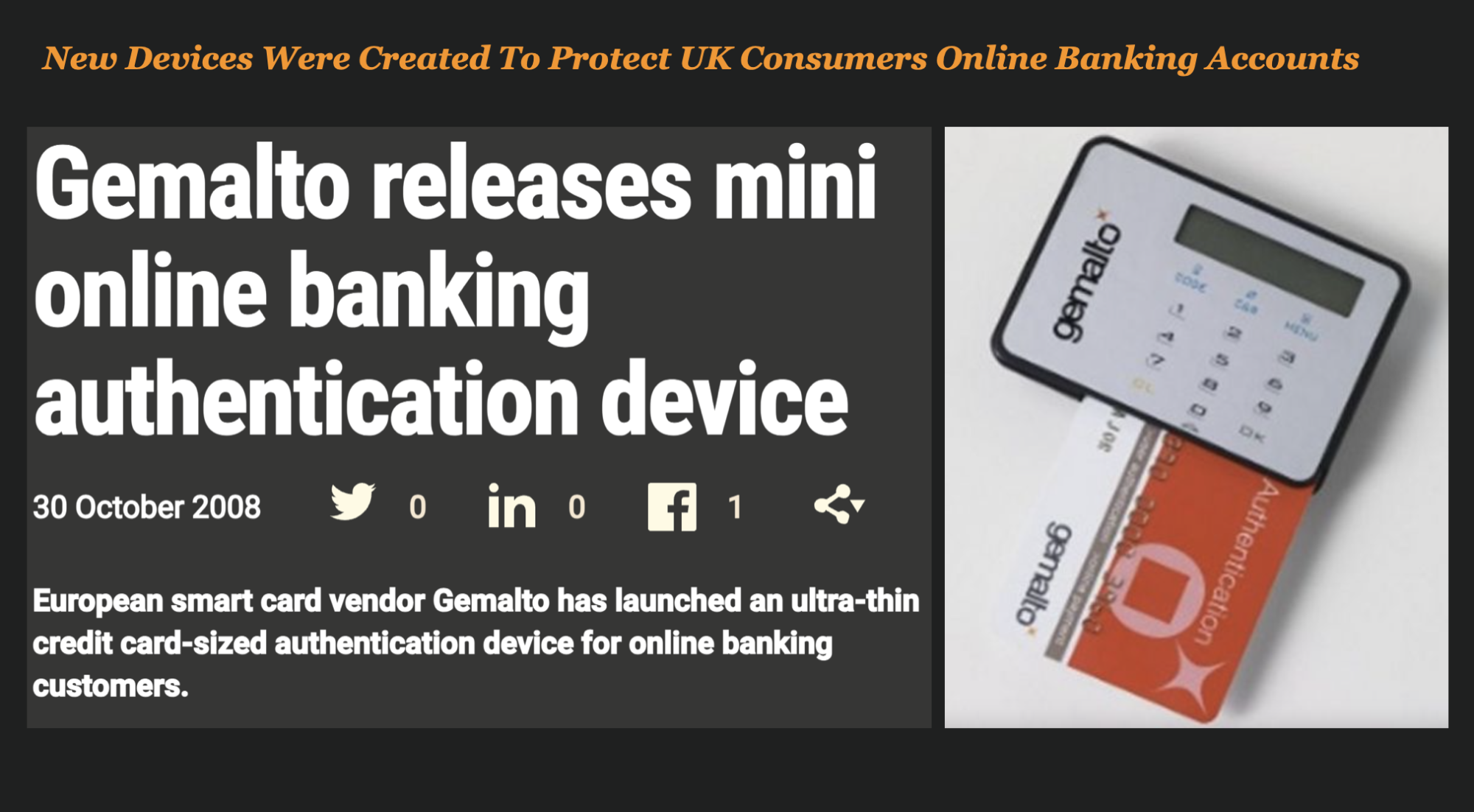

Banks in the UK rushed to make measures to stop the fraud including lowering daily limits, introducing more front end authentication controls and training call center staff on how to stop the rash of account takeover.

Technology vendors even came up with clever authentication devices where consumers could even use their own debit cards to generate one time passcodes.

It provided an ultra secure, if not clunky way, to avoid account takeover.

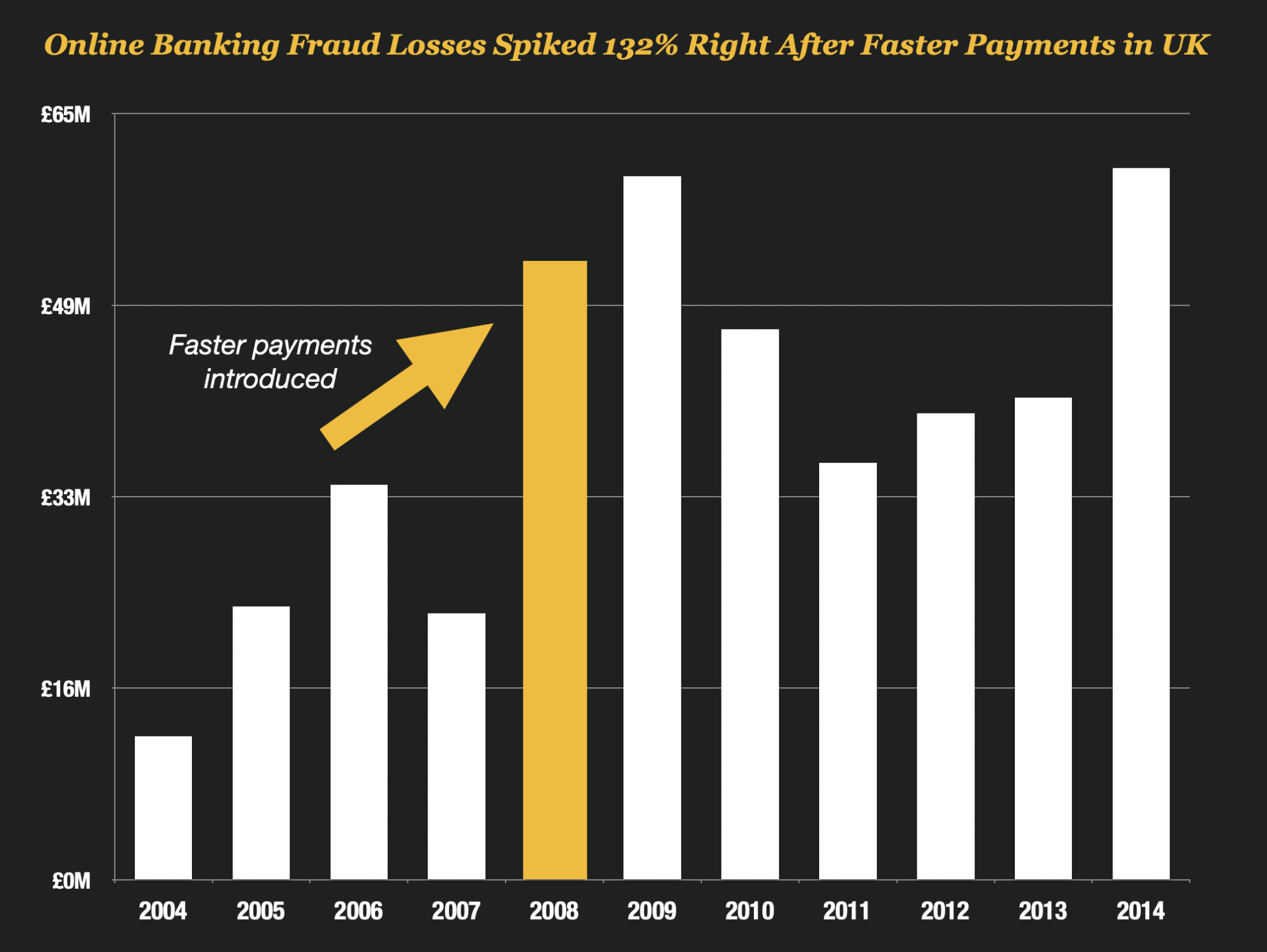

UK Online Banking Losses More Than Doubled

When the dust settled, online banking in the UK was changed forever. In fact, it changed the way everyone looked at account takeover and spawned a whole generation of new technology and investment in fraud.

Do We Owe A Debt Of Gratitude to UK Banks For Showing Us The Way?

Maybe it is just too quiet and that has us fraud fighter nervous?

Or maybe, we owe a debt of gratitude to UK banks for carving the path and making the US journey to instant payments safer.

The UK learned the hard way and to be honest, we may as well.. But for now, it’s all eerily quiet on the FedNow fraud front.