Joel Kennedy knows a thing or two about auto finance. You could call him an expert. He co-founded a company that specialized in lending to borrowers with low credit scores called Pelican Auto Finance.

In a recent article that appeared in Non Prime Times, he shines the spotlight on one issue that he believes the industry needs to admit is a big problem – fraud. In his words, the problem could possibly stem from one of 3 things; 1) Ignorance – lenders don’t understand what fraud is, or don’t understand the impact of it on their portfolio , 2) Complicity – lenders either intentionally or unintentionally look the other way when it does happen, or 3) Greed – lenders have tunnel vision on increasing revenue and don’t want to impact their operations.

As an industry insider, its an opinion you have to respect, or at least listen to what he has to say.

“Ignorant, complicit, or greedy? Let’s just take the first step and admit that we have a problem Joel Kennedy

Don’t Just Take is His Word For It

To back up his claim, Joel cites industry stats that back up his claim of the problem. Don’t just take his word for it, here is what others in the industry believe as well.

- Point Predictive estimates that auto lending fraud in total is a $6BN problem, about 60 percent of which is misrepresented income and employment

- According to TransUnion, Synthetic Identities alone are estimated to be $500MM/year in 2017 ending, which is up from $143MM/ year in 2012 year ending

- DecisionLogic estimates that between 10-20 percent of borrower provided bank statements have been altered

- FICO estimates that 20 percent of bad debt is fraud, and they have observed 60 percent year over year increases in application fraud

- Auto ID estimates that dealer power booking exists in 30 percent of indirect auto transactions, with an average of $1,100 impact per hit

Kick Fraud Out of Auto Lending

Does fraud have it’s rightful place in auto lending? Is it merely a negotiating tool between lenders and dealers trying to work a deal? Should it be tolerated?

Not if Joel had his druthers.

I spoke to him briefly and he advised me his primary focus is to shine the spotlight on fraud and risk with the intent to “Kick fraud out of auto lending”.

If it sounds like he has a personal vendetta, he does. He believes the lack of focus in fraud and relying on old technologies to combat a sophisticated problem is putting the fraudsters ahead of the game.

“It’s absolute nonsense, when I hear others say fraud can be priced into the business model. I don’t want fraud in the business model – period.”

What do you think, do you agree?

Education is Key

Joel’s focus has turned to educating the lending industry and then helping to organize what he believes are aggregated tools and approaches to solve the problem.

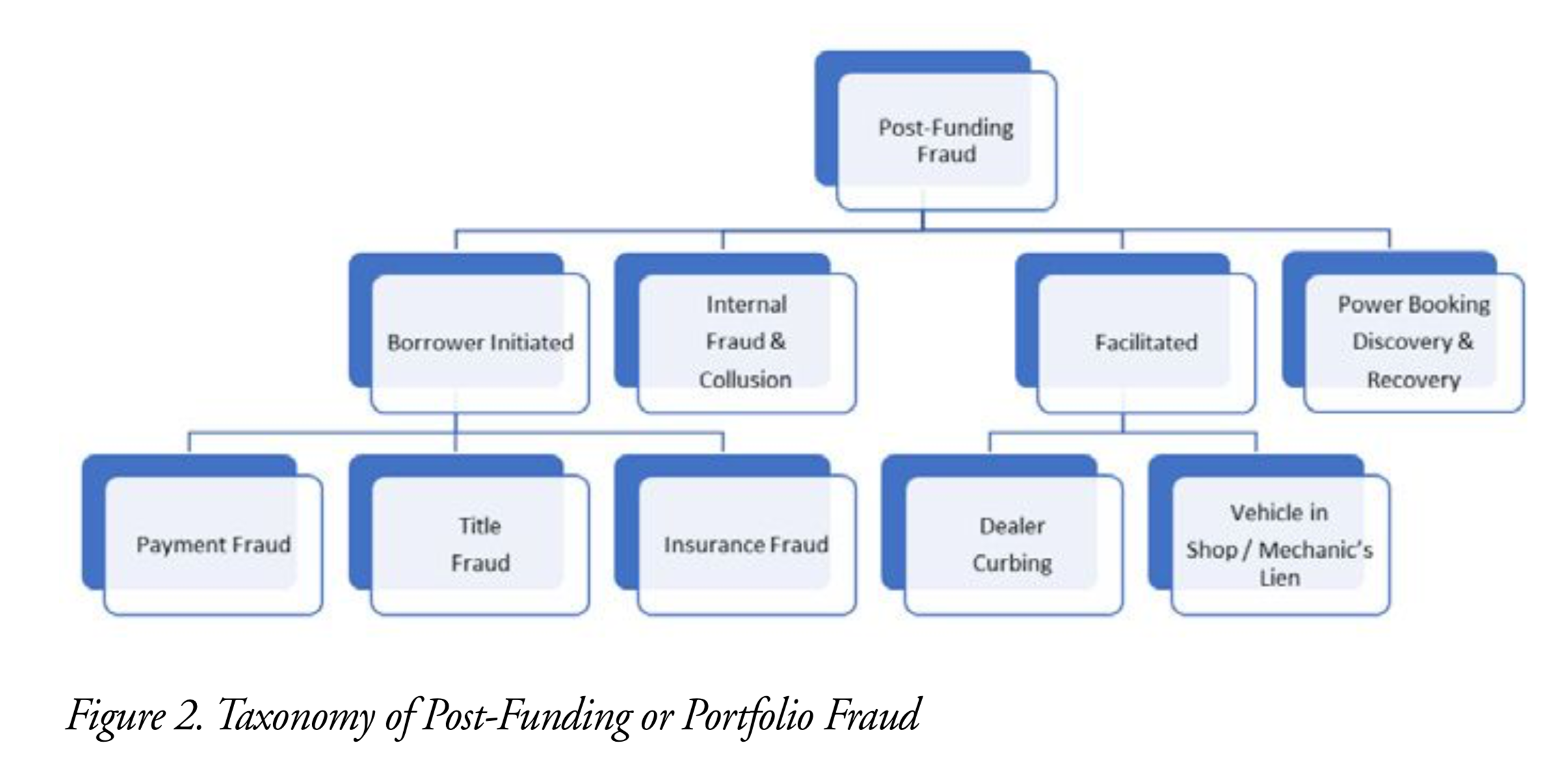

He’s created a taxonomy which includes fraud types for pre and post funding. He believes each branch of the Taxonomy can be addressed with technology as well as better business processes.

In his mind, fraud needs to be broken into 2 categories – Acquisition risk and Post Funding (servicing risk)

Acquisition fraud that is seen at the time of application, and 2) Portfolio fraud that is seen post- funding (on the balance sheet).

You can catch Joel at the NAF conference where he is leading a whole day of activities called “Fraud Friday”. I’ll be right there having fraud sandwiches on Joel’s panel discussing new fraud technologies to stop fraud.

Also, I would highly recommend having a look at his article here to see what he thinks can be done. There are a lot of gems here – Joel Kennedy Article

About Joel

Joel Kennedy is a board member of the NAF Association, consumer finance executive, advisor, and consultant. He has a passion for growing and improving the auto finance ecosystem. Joel has over 23 years’ experience helping big banks to start- up finance companies build, grow, improve, and repeat. He can be reached at 240-308-2169 or [email protected].