The Reserve Bank of India is so concerned with rising incidents of check fraud that they are forcing banks to implement rules to stop it.

As per the new rule, customers who are looking to write checks will have to inform their respective banks about the check details via net/mobile banking or a physical visit to the branch. If the customer fails to inform the bank prior to the check being issued, then the checks will bounce.

The RBI had directed banks to implement these rules starting from January 1, 2021, to safeguard all parties involved from fraud activity.

A New System Called Positive Pay

The rule is part of a new system in India called Positive Pay. But unlike the Positive Pay system for checks issued here in the US, Banks in India have come up with a notification system that comes directly from the customers.

Positive Pay is a tool designed to detect fraudulent activities by matching specific information related to the cheque presented for clearing.

The positive pay rules are required for any checks exceeding 50,000 Rupees, which is the equivalent of $680 in US currency.

To qualify for a check to get paid, the customer will need to provide the following information to a bank before they write the check.

- The account number

- The check number

- The check amount

- The check date

- The payee name

The customer has to notify the bank at least 24 hours before the check is written or they risk the check not updating the system.

Most banks will let customers notify the bank through their mobile device, an SMS message, the ATM machine, or by calling the bank’s customer service department directly. Customers can also share images of the checks through their mobile devices so that the checks can be compared when they are submitted through the system.

Positive Pay Will Impact 1 in 5 Checks

About 20% of all checks will be impacted by this new rule and those checks will cover approximately 80% of all the check value processes in India.

If a check does turn out to be fraudulent, the bank will cover the losses so customers will not be held liable.

Checks Will Bounce If You Do Not Call

As if writing checks were not hard enough already, if you don’t notify the bank, or you provide the incorrect details, your check will likely bounce.

This arcane rule is an incredible example of just how far governments and banks will go if fraud gets bad enough.

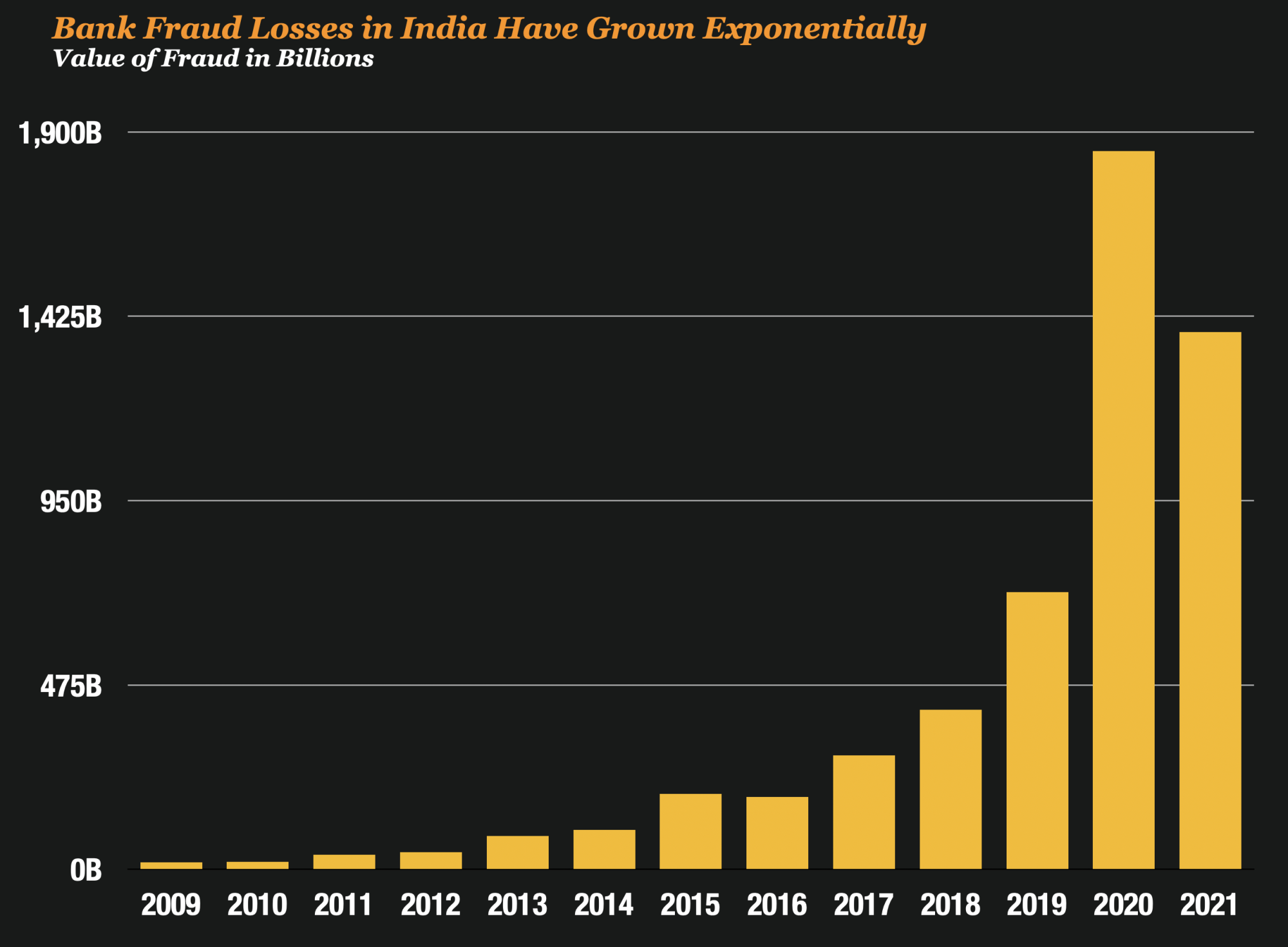

In India, bank fraud has reached stratospheric highs in the last 3 years. These rules implemented by the RBI are designed to crack down on high value fraud that is hurting the banking system

Imagine writing a check in India these days, it takes quite a bit of time.