Always listen to your Fraud Manager.

One company, BlueSnap, learned that lesson the hard way. When their Director of Fraud warned the CEO in 2021 that a big customer was engaging in fraud, the CEO ignored him and said it was an important client they needed to take care of.

The CEO prioritized company profits over running a responsible business, and years later, this decision came back to bite the company hard.

The FTC Fined BlueSnap $10 Million and Banned Them From Working With High-Risk Merchants

Today, the FTC announced a settlement with the company after suing them for assisting companies that scammed people. As part of the settlement, the FTC will collect $10 million in fines from BlueSnap and use that money to refund all the people scammed by companies for which they “laundered” card transactions.

In addition to the settlement, the FTC will ensure that the company can never again work with high-risk scamming companies. BlueSnap will be permanently banned from providing services to merchants selling debt relief and debt collection and other industries prone to fraud and deception.

The FTC’s settlement is just the latest allegation that the company facilitated scammers. Brian Krebs once highlighted the company back in 2014 for involvement in several debit card scam operations, and he reported that at least one industry fraud expert believed the company processed payments for “criminals.”

Assisted Debt Relief Scammers Who Had a 40% Chargeback Rate

According to the FTC’s complaint, from 2016 through 2021, BlueSnap opened and maintained merchant accounts for a deceptive debt relief operation called ACRO Services, which bilked consumers out of tens of millions of dollars through false promises to eliminate their credit card debt. BlueSnap allegedly continued processing payments for ACRO Services despite glaring warning signs and direct evidence of fraud.

The company operated under many different names, including Tri Star Consumer Group, Thacker & Associates International, Reliance Solutions, and Consumer Protection Resources, and ripped consumers off.

The FTC says Bluesnap was well aware ACRO was a fraud and ignored consumer complaints about the company despite numerous lawsuits and even as the chargeback rates soared. At one point, ACRO’s chargeback rate exceeded 40%, far above Visa and Mastercard’s 1% high-risk limit. BlueSnap kept ACRO on Visa’s High Risk Monitoring Program for over a year and failed to terminate their account or take significant action.

In 2019, another payment processor told BlueSnap to close ACRO’s accounts due to high consumer chargeback rates, but BlueSnap left the account open and failed to do anything about it.

It Didn’t Stop There – The FTC Claims They Were Involved in Credit Card Laundering For ACRO

The FTC says BlueSnap went a step further than simply ignoring the fraud. The agency accused them of actively” laundering ACRO Services’ payments to conceal the true nature of ACRO Services’ business so that they could continue processing for the scheme.”

Laundering typically involves processing transactions through another company’s account or concealing one’s identity from consumers, banks, and card networks, using shell companies, or hiding the true nature of one’s business.

Rather than terminating ACRO Services, the FTC alleges that BlueSnap executives took steps to help the ACRO evade fraud controls. In April and May 2021, Dangelmaier reportedly coached ACRO’s owners on how to continue processing under the radar through a shell company under a different owner’s name. Dangelmaier and Monteith allegedly helped disguise the “new” company as an educational service to avoid scrutiny.

BlueSnap opened a new merchant account for this shell company, First Call Processing, in May 2021. It processed over $3 million in just a few weeks before BlueSnap’s processing partner demanded the account be terminated due to excessive chargebacks and evidence the company sold prohibited debt relief services. Undeterred, Dangelmaier and Monteith allegedly directed ACRO Services to resume processing through another existing account.

BlueSnap Engaged In Load Balancing To Hide High Fraud And Chargeback Rates – It Backfired

In their attempt to continue processing risky transactions for ACRO, BlueSnap also engaged in load balancing.

“BlueSnap moved payment traffic from ACRO and other merchants generating excessive chargebacks to its “merchant of record” account to dilute those companies’ high chargebacks by mixing them with other accounts.

Eventually, though, that deceptive strategy backfired on Blue Snap because chargeback rates for those merchants were so high that BlueSnap’s “merchant of record” account exceeded monitoring thresholds.

They Failed To Listen To Their Director Of Fraud Strategy

According to the FTC, company executives didn’t even listen to their own fraud experts. BlueSnap’s Director of Fraud Strategy warned CEO Ralph Dangelmaier and SVP of Global Acquiring and Payments Terry Monteith about ACRO Services’ fraudulent practices.

In an email from April 2021, the Director reported to the executives that ACRO Services was making illegal, deceptive calls to consumers, charging consumers’ cards without authorization, and that a bank investigator had visited ACRO’s headquarters due to so many of the bank’s customers being defrauded.

Despite this clear and urgent warning from their own fraud expert, Dangelmaier and Monteith failed to take action to terminate ACRO Services. Instead, they allegedly told the Director that ACRO was an important client and they needed to work closely with them to continue processing payments -putting profits over their responsibility to prevent fraud.

BlueSnap Also Assisted Another Shady Company That Sold Spyware Too

ACRO was not the only risky business that BlueSnap worked with. The FTC says they also worked with PowerLine Group – a consortium of 16 companies that promoted several apps as tools to spy on spouses or intimate partners without their awareness or consent.

Powerline created websites that purported to provide independent technology advice but, in reality, solely promoted stalker ware products that would embed themselves in people’s devices to track them.

A Long History Of Questionable Activity, Brian Krebs Highlighted The Company Back in 2014

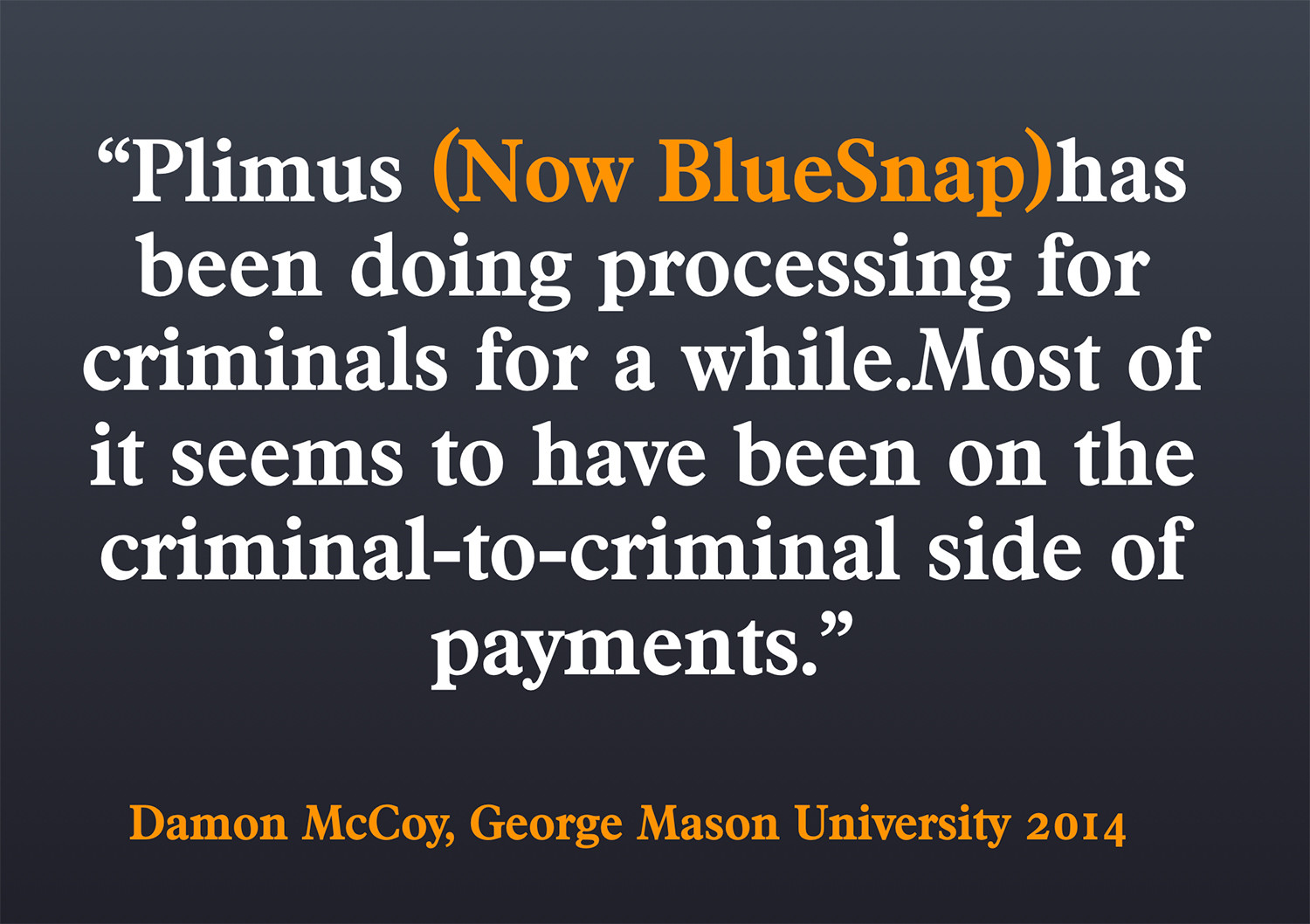

BlueSnap appears to have a long and troubled past with risky merchants that scam people. According to an article by Brian Krebs back in 2014, he also sniffed out trouble.

According to Krebs, BlueSnap, formerly known as Plimus, had been associated with processing payments for criminal schemes. The very first time cybersecurity reporter Brian Krebs encountered Plimus was back in 2011, when it was processing credit card payments for a hacked botnet operation.

Plimus changed its name to BlueSnap to break from the past, which included a class action lawsuit alleging its marketing campaigns were full of fake reviews and blogs designed to trick consumers into paying for sham products.

In the 2014 article, Krebs noticed that BlueSnap was processing tiny transactions for scammy merchants for odd amounts like $10.27 or $12.96. These were essentially junk charges tied to high chargeback rates and fraud—very similar to the current type of activity that the FTC alleges occurred.

At that time, Krebs contacted CEO Ralph Dangelmaier, who said BlueSnap terminated the merchant 10 days before his story ran. Dangelmaier’s excuse was that the merchant in question was a legitimate affiliate program that got “hacked.”

Oh, But There is More

If you think that’s it, it’s not. There is more.

In 2011, Plimus (the company that eventually became BlueSnap) was involved in a massive allegation of founder fraud after Great Hill Partners purchased the company. Hagai Tal (then CEO of Plimus) committed fraud by failing to disclose that PayPal was threatening to terminate its payment processing relationship with Plimus before the acquisition for excessive chargebacks—something that another payment processor, Paymentech, had also done shortly before.

In 2012, another explosive class action lawsuit was filed against the company alleging that they used “fabricated consumer reviews, testimonials, and fake blogs that are all intended to deceive consumers seeking a legitimate product and induce them to pay.” The lawsuit claimed that “Plimus works with dozens of affiliate sites that offer the “free” digital goodies using false advertisements.”

Turning Over a New Leaf?

It certainly appears that BlueSnap has a history with some sketchy stories. Old habits die hard, but the new management team has said they are committed to getting it right.

In a statement to Pymnts this week, new CEO Henry Halegeson explains steps they have taken since finding out about the investigation.

“Since becoming aware of the investigation two years ago for actions in 2021, we have proactively taken several corrective measures on our own to improve internal review, compliance and risk mitigation processes,” Helgeson said in the statement to Pymnts.

“Most notably, we created a compliance officer position in April 2022 and retained a former FTC attorney to fill that role,” he added. “We’ve also made several changes at the senior management level, which include my arrival as CEO and the departure of the executives named in the report.”

Helgeson added in the statement that he was fully aware of the investigation when he took on the role of CEO at BlueSnap and is confident that the company has “taken all the necessary steps to ensure this will never happen again.”