Liar Loans. Here in the US we know this term all too well. Loans where borrowers lied about their income and employment were a major factor that lead to the demise of our mortgage market in 2009.

We cleaned up our act and knocked out liar loans substantially by requiring multiple forms of verification of income and employment including copies of IRS tax returns straight from the IRS files. It’s far harder to lie on mortgage applications these days and as a result mortgage fraud reports are down here in the US for the first time in many years.

But are liar loans making a comeback? Well if recent shocking analysis by UBS is correct, than they are back in a big way. This time in Australia, where 1 in 4 borrowers there admit that they lied about their income, assets employment or something else on their applications for mortgage loans.

Survey Found That 28% of Loans in Australia Were Not Factually Accurate

The survey which was undertaken by UBS, interviewed approximately 1,200 Australians with mortgages on how accurate the information they supplied on their applications.

The stunning results indicated that over 25% of the borrowers advised that their loans were not factually accurate. What they admitted to fibbing about was a mixed bag including:

- Overstating Assets – 13% admitted to overstating assets

- Income – 14% admitted to inflating their income

- Debts – 17% admitted to understating their debts

- Other – 40% admitted to misstating something else (occupancy, investment etc)

The more worrying aspect about the results is that UBS was able to correlate negative loan performance to Liar Loans.

Borrowers that lied on their application about their debt, income or assets were the same borrowers that had economic stress or had missed payments on their credit bureaus.

In other words, the borrowers that were most likely to lie were the ones that the banks should have kept a more careful eye on.

Loans with Brokers were More Likely to Be Liar Loans

In the US, the problem with Brokers was so bad that some banks found that 3% of their mortgage brokers were sending them 100% of the fraudulent applications and loans that defaulted.

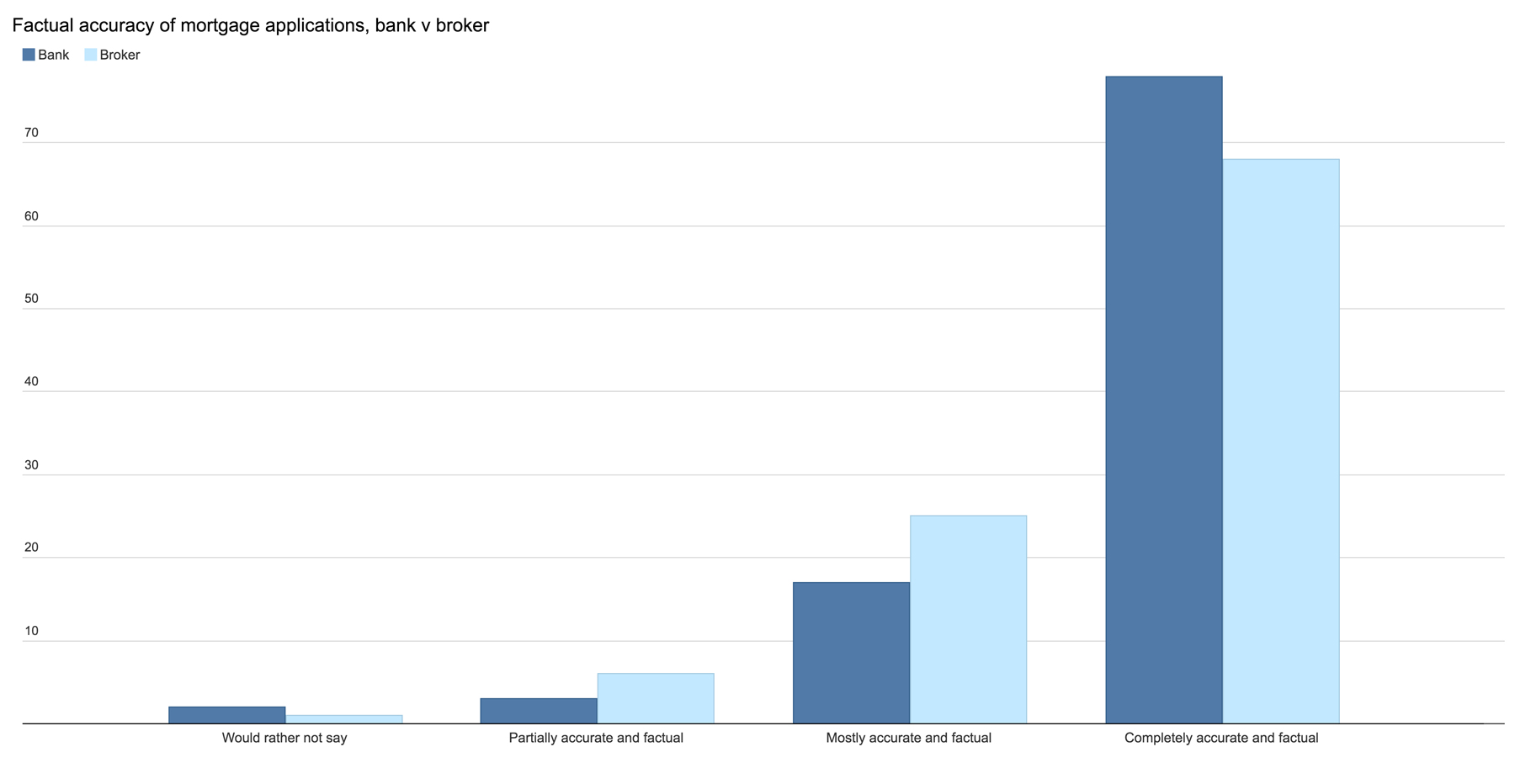

In Australia, UBS studies concluded that applications submitted through brokers were more likely to be liar loans than loans where the borrower worked directly with the bank. 33%of borrowers that worked with brokers admitted to lying on their application vs 22% of the borrowers that went right to the bank.

UBS analysis indicated brokers are higher risk than banks

UBS Believes the Problem is Probably Worse Than Reported

To make matters worse, UBS believes that the results may actually paint too rosy a picture of the problem in Australia. They believe that surveyed results may be skewed because some borrowers were probably afraid to admit they lied on their application.

“It is highly unlikely that the respondents would have stated they misrepresented their mortgage documentation when they were in fact truthful. If anything, we believe it is more likely these figures may understate the level of misrepresentation in mortgage applications as some respondents may not want to state they were less than completely accurate despite anonymity.” UBS

Warning Bells Are Ringing in Australia

Mortgages and housing in Australia are nearing the end of their boom period. Rapid inflation in key markets like Sydney and Melbourne have resulted in high concentrations of mortgage risk that banks are holding.

62% of banks loans to consumers are through mortgages and disposable income is at an all time low as most consumers are highly leveraged

The warning bells that these liar loans will have a drastic impact may be felt sooner rather than later.

What the US Learned About Liar Mortgage Loans

In 2005, BasePoint Analytics (a company I worked for) discovered a high correlation between misrepresentation on applications and loans that defaulted within the first 6 months.

After working with multiple banks, it was determined that up to 70% of loans that defaulted within the first 6 months had evidence of material misrepresentation in the original application that was submitted.

This was an important study because many in the industry believed at the time that liar loans would perform since the borrowers would be motivated to stay in the home so they would pay. This was a fatal mistake and was a key reason the mortgage market melted down in 2009.

What do you think? Do you think Liar Loans perform? Or do you think they will actually hurt the Australian market?