It happens to everyone. You go to a website and find something you want to buy. You type in your credit card number, personal details, and shipping address and click submit. Then you get the message, “We were unable to complete your transaction, please call your issuing bank”

You probably got declined because something about the transaction made the merchant or your issuing bank suspicious and they thought it was fraud.

The industry refers to these incorrect rejects of online transactions as “False Declines”. And according to recent studies, they are costing retailers billions of dollars in profit each year.

dollars in profit each year.

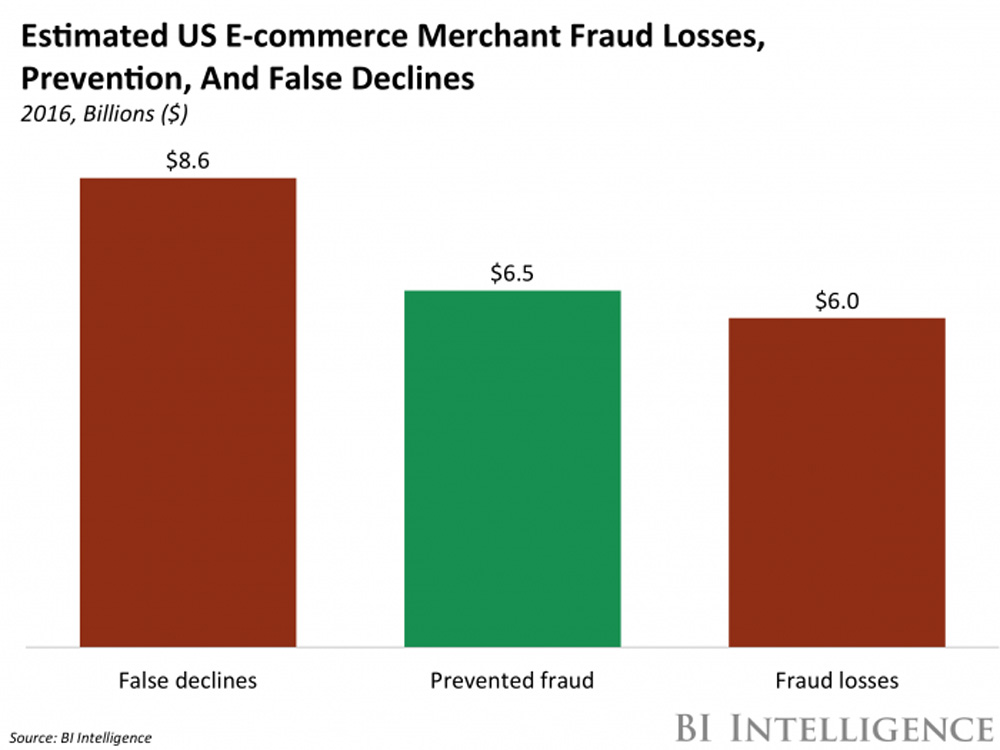

Business Insider estimates that retailers are false declining $8.6 Billion in orders a year.

If you consider an average profit margin of 30% on those orders, that means that retailers are losing about $3 Billion in annual profits for false rejects.

Retailers Struggle to Reject The Right Transactions

Retailers are struggling to reject the right transactions. The report estimates that retailers correctly reject about $6.5 Billion of real fraud but still let another $6 billion in fraud go out the door.

And this struggle is nothing new but it is being compounded by an increasingly complex environment driven by higher fraud attacks and BotNet attacks.

The Domino Effect

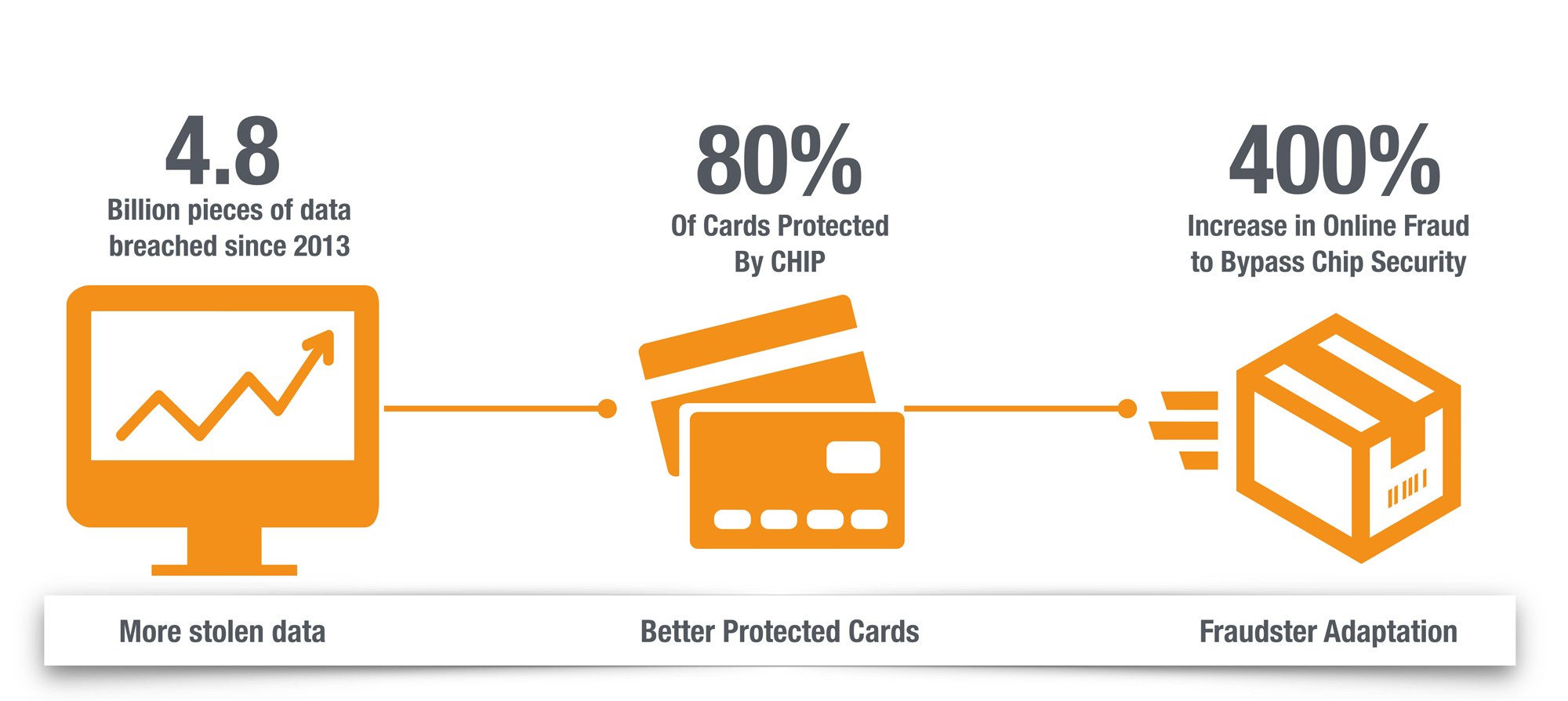

There was no doubt that adoption of CHIP Cards was the right move for the US. And while it helped Card Issuers address their fraud problems, it created a whole new host of problems for online retailers.

Fraudsters still have millions of card numbers from massive data breaches that they want to use, and their only outlet is to place orders online with the Chip Cards are irrelevant.

Higher Fraud Rates Lead to Higher Reject Rates

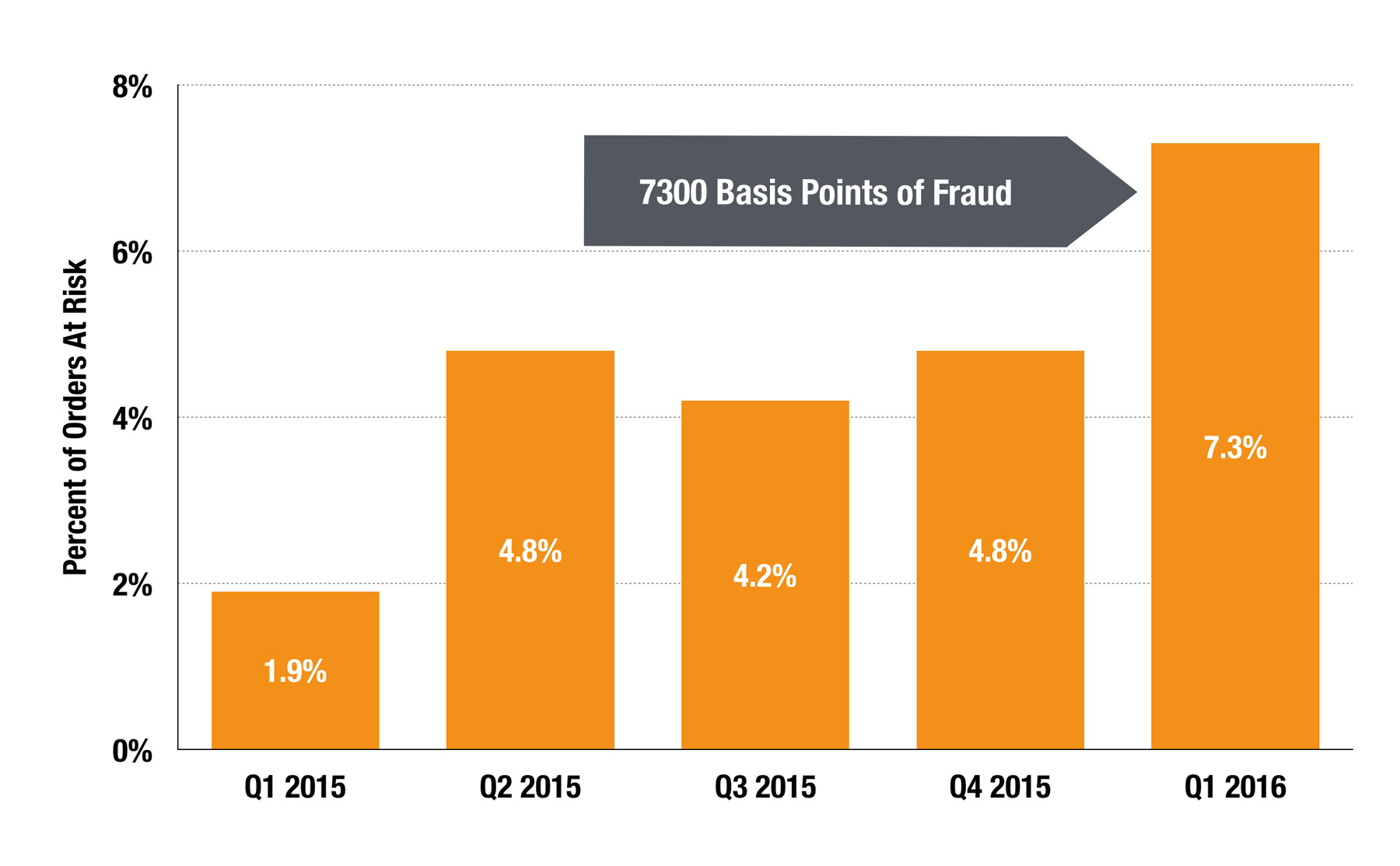

If you noticed a spike in crime in your neighborhood, you would probably take more precautions to avoid becoming a victim. Well, Retailers are experiencing the same problems. Fraud Rates have spiked to over 7% of all online transactions.

As fraud rates increase, they respond by trying to curtail the fraud by rejecting more transactions that look suspicious. Your good transaction often gets caught in the cross-fire between retailers and fraudsters.

Are Retail Merchants Bogged Down with Too Many Fraud Tools?

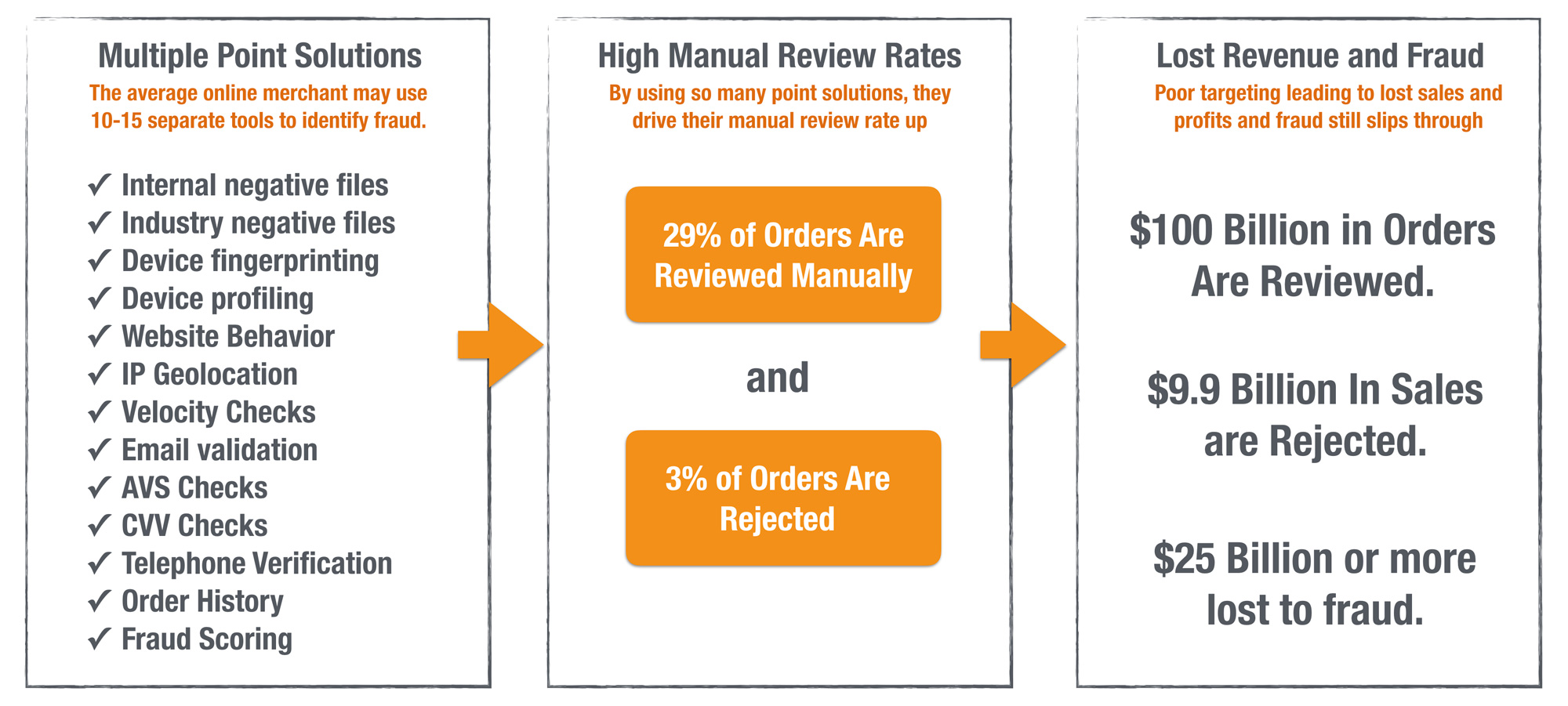

Over the years Online Retail Fraud tools have flooded the market. Each of the tools and stop gaps can solve individual problems for the retailers.

But each new fraud tool and stop gap reject some good transactions and some fraud transactions. So while retailers get better at stopping fraud, they also stop more good transactions.

Retailers simply have too many solutions, doing too many things and as a result they decline too many good transactions and not enough fraud transactions.

Hybrid Analytics is the Key to Reducing False Rejects

I am a big believer in industry solutions like 3D Secure and I believe those need much higher adoption by card issuers and merchants to stop the problem.

But in addition to adoption of 3D Secure like technologies, I believe better analytic approaches are needed that incorporate multiple data sets into a single Hybrid Fraud Score that maximizes fraud detection while reducing false positives.

Hybrid Fraud scores replace the welter of rules at a retailer with a modeling algorithm that determines if a transaction should be rejected or reviewed based on thousands of factors, not just a single factor like an IP address.

The benefits of Ensemble Fraud Scores are many;

- Better use of external data and tools by optimizing the use of that data

- Better targeting by leveraging the relationships between the internal and external data

- Better use of shopping cart information and profit margins to optimize the true and false rejection rates

The key to solving the dilemma of false rejects is analytics in my mind.

2017 Should be an Interesting Year

2017 should be an interesting year as Chip Card rollout reaches 100% adoption and fraudsters go into full swing.

I imagine that there will continue to be more devistating breaches and more attacks on retailers pushing the fraud rate up even further.

Thanks for reading!