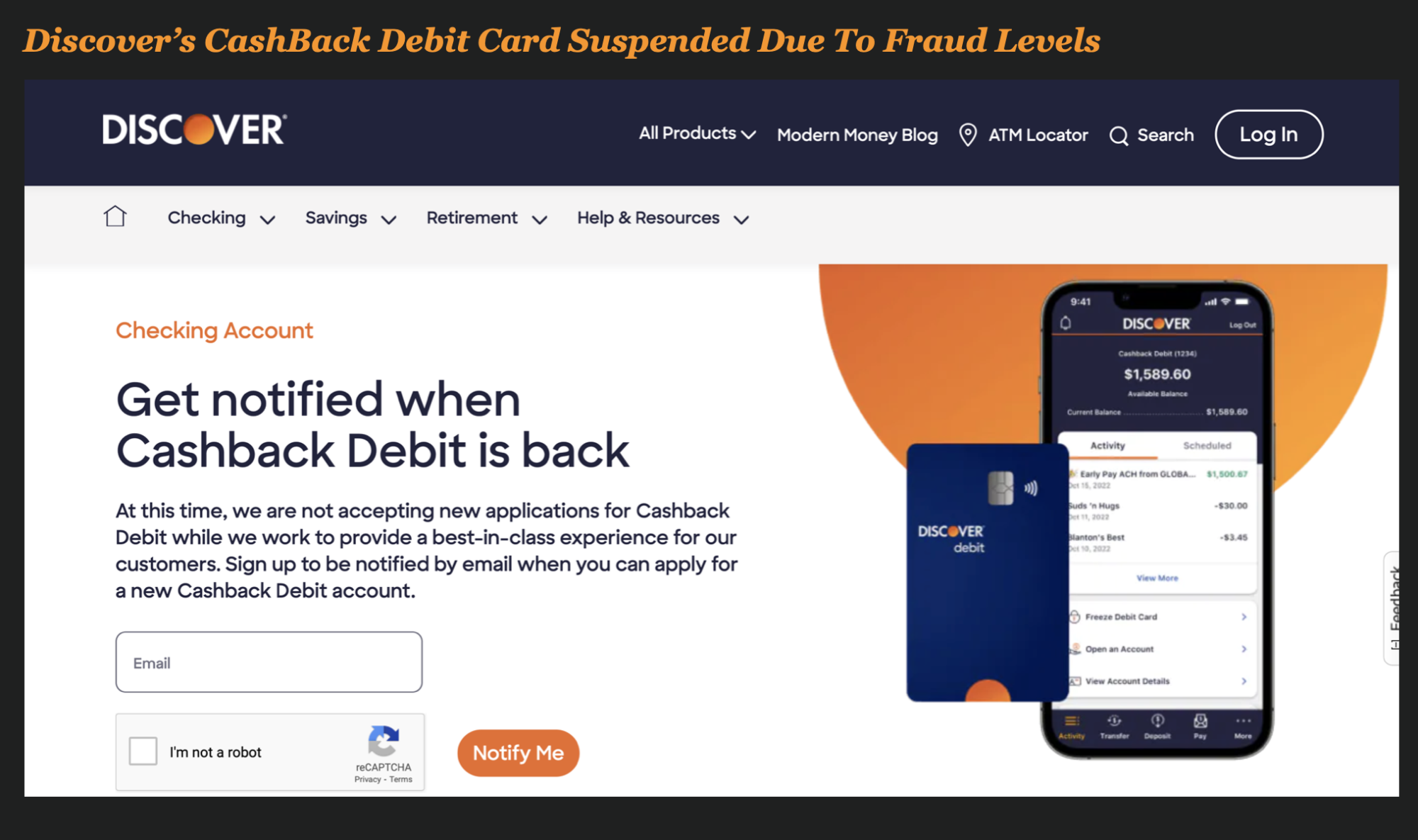

Discover has stopped accepting applications for their new product – A Cashback Debit Account, because of high levels of fraud.

CEO Roger Hochschild said Tuesday during an appearance at the Goldman Sachs financial services conference that Discover had “pulled back on the marketing because of the amount of fraud we were seeing”.

The product, which was launched in April of this year, promised cashback rewards and early access to paychecks.

The financial impacts of fraud were “manageable,” according to Discover, but the fraud caused service levels to deteriorate which lead the company to suspend the product.

Professional Fraudsters May Have targeted the Product

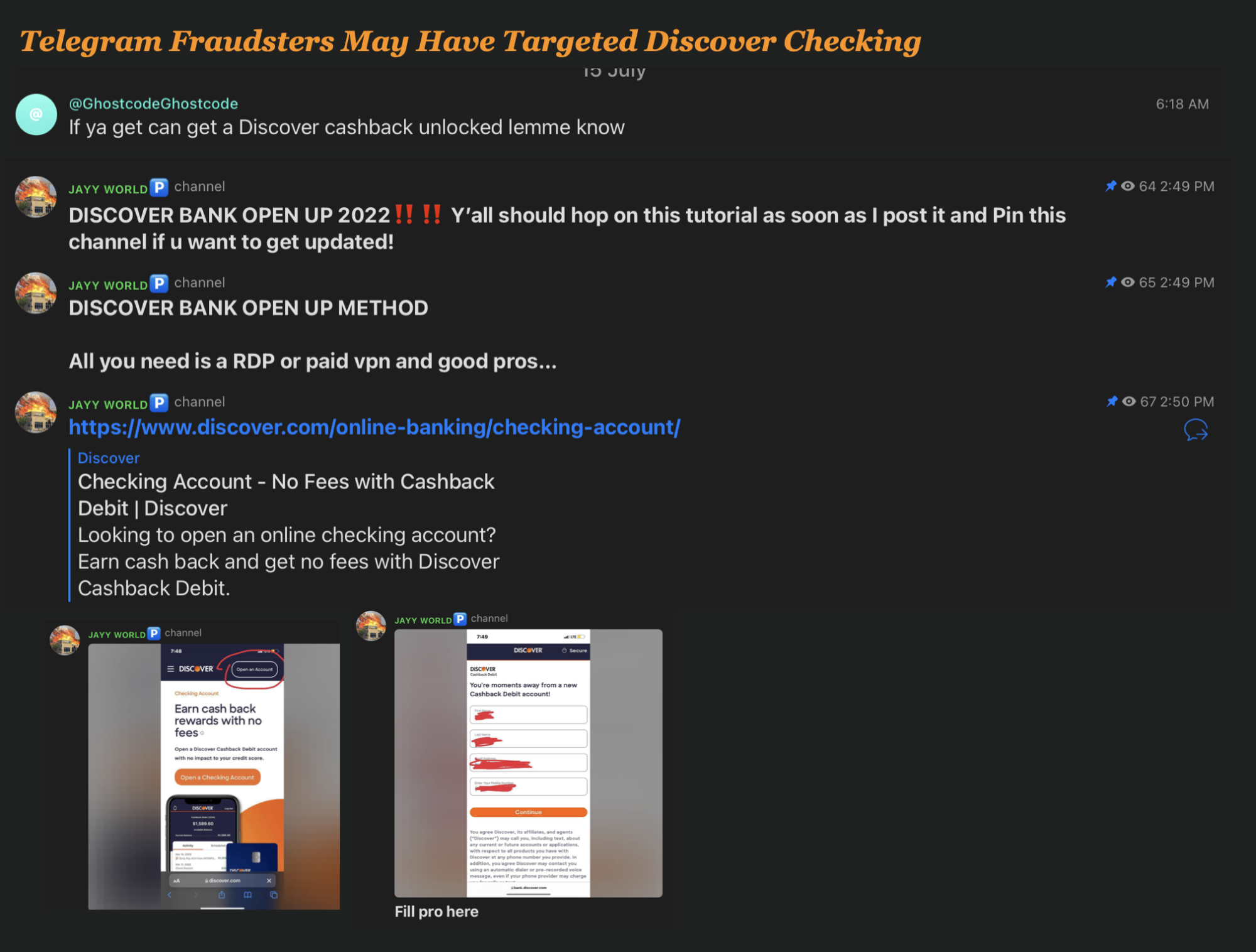

While Discover did not provide details on the type of fraud that would have caused them to suspend applications on the product, clues on Telegram indicate that it may have been related to “Bank Open Ups” – which is the term scammers on Telegram use for application fraud.

One Telegram Channel, Big Steppas Bandit, which boasts over 17,000 members, posted and sold tutorials as recently as last month on methods to open up Discover Cashback Checking accounts.

As part of the tutorial, they would sell a full identity for the fraudulent account and a VPN allowing the buyer to submit applications while remaining anonymous.

New Products Are Typically Targets Of Fraud

Discovers experience with high levels of fraud on a new product is nothing new. As new products are launched, fraudsters know that the product will often have fraud controls that are not thoroughly tested so they are able to find loopholes that they can exploit.

Another pitfall of new product launches is when Product Managers do not consult with the fraud departments before they release the product. In a rush to get the product out the door, they do not want to slow it down with costly fraud checks or cumbersome customer processes.

Oppenheimer & Co Senior Analyst Dominick Gabriele thinks other things could be happening too.

In an interview with Banking Dive they indicated that Discover’s move is likely indicative of “growing pains of a new product” as the company ensures it has the right fraud solutions and analytical technologies in place Oppenheimer & Co. senior analyst Dominick Gabriele. The company also might focus on ensuring the product is drawing in the type of account holders it targets, they indicated.

Discover plans to relaunch the product some time next year with more advanced levels of protection.