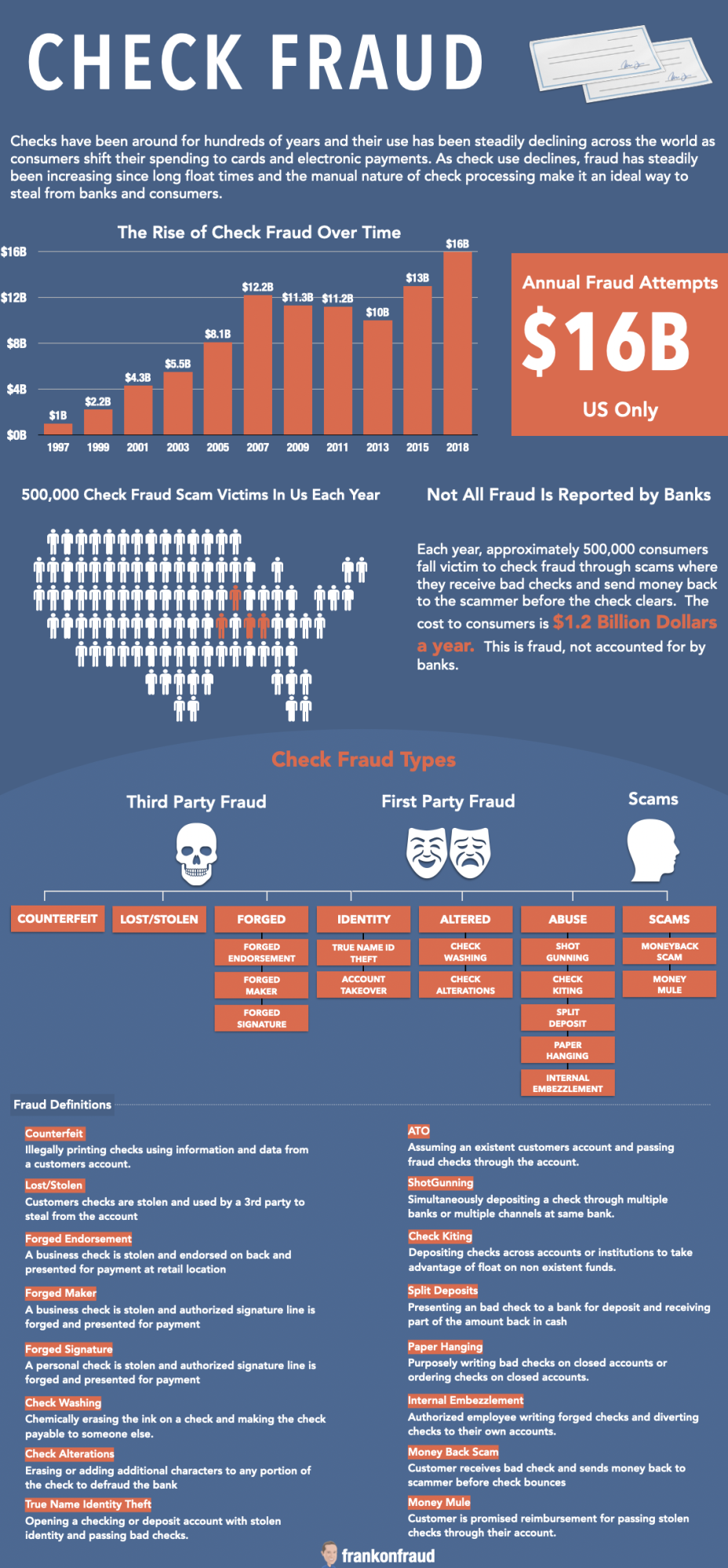

Check fraud can take many different shapes and forms and that is why there are 16 different types of fraud that commonly occur at banks.

Check fraud has been around, since the dawn of checks. And that’s a long time.

If you are interested to know it’s over 250 years ago in 1762 that checks started being used here in the US. And some say that the first checks were written over 1000 years ago by ancient Muslim traders.

But, despite our best efforts to kill the check, the darn things keep hanging around and keep causing bank big losses each year.

Face it. Checks are ancient creatures but check fraud has continued to evolve all this time and seemingly there is always a new twist.

In this article, I will describe the basic check fraud types, but also give you some interesting statistics that show that check fraud is only growing and it looks like it’s going to be around for a long time!

Check Fraud Includes Both First and Third Party Fraud

Check fraud primarily occurs due to third party fraud – lost/stolen forged checks, identity theft, account takeover, counterfeit checks, and forged endorsements.

But check fraud can also occur due to first-party fraud due to customer abuse, check kiting, shotgunning, split deposits, and other undesirable customer behavior.

Check Fraud Is Complicated Because The Loss Can Be Incurred by The Bank or Customer

Banks that hold the signature cards (drawee banks) are responsible for check fraud and that is where most of the liability for check fraud occurs. That is why most banks review checks that are debiting their customer’s accounts before they are posted.

In many cases, however, banks that are receiving checks on deposit from other banks or cashing those checks can be out money as well. Those banks are responsible for holding funds until the checks clear.

In all cases, banks receiving checks and debiting the checks are incentivized to stop check fraud before funds are released to the fraudster or customer.

But increasingly, the losses from check fraud are being pushed off to the customer. And that is because scammers are increasingly sending their bad checks to banking customers and having them do their dirty work for them. They send the bad check to the customer, and then before the check can clear they have the bank customer send them a wire transfer back. It’s a real dirty crime.

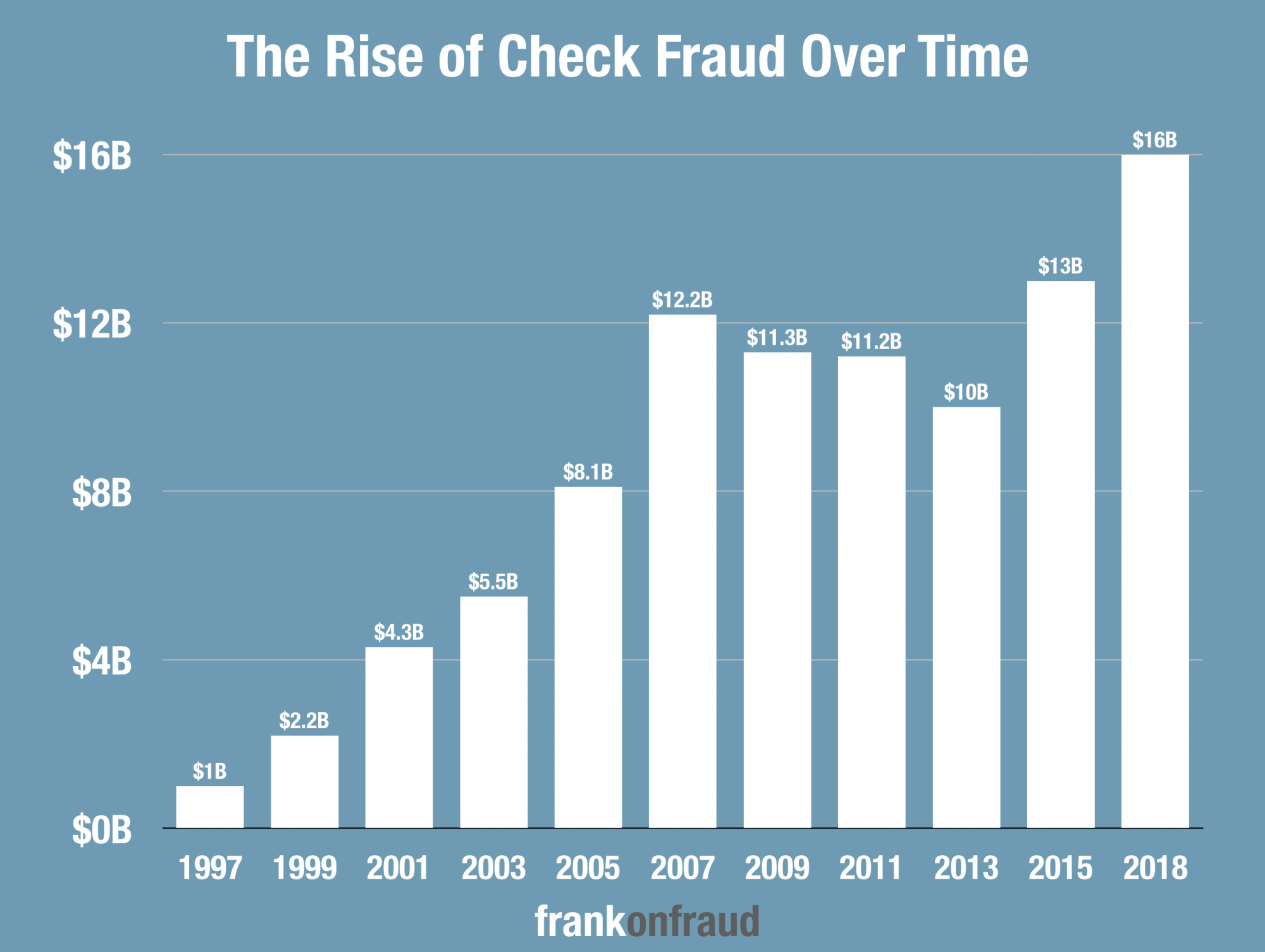

Check Fraud is Steadily Growing Despite The Fall in Legitimate Check Usage

A survey by the American Bankers Association (ABA) recently reported that attempted check fraud ballooned to $15.8 Billion in 2018 – close to a 100% increase over the $8.5 billion that was attempted in 2016.

Check fraud continues to grow over time which confounds logic. As it turns out though, the very thing that makes checks suck – they’re paper and take forever to clear – is exactly what makes them a choice for fraudsters and scammers.

They rely on those long float times to steal from everyday consumers that deposit bogus checks into their own accounts.

Check Fraud Typology Infographic

Here is an infographic that lays out all real nicely for you. Download this infographic here.