It’s baaack! Well, it never went away. And it probably never will.

The end of the pandemic and all those stimulus programs are creating new wrinkles in check fraud as fraudsters return to targeting bank accounts.

As is the case with most fraud schemes, new check fraud is just like old check fraud – but with a twist.

According to recent reports and fraud experts, check fraud is booming again. In the last 6 months, a variety of new variants of old methods have emerged.

And now, some banks in the US are reporting that check fraud attempts are way up and losses are on the rise.

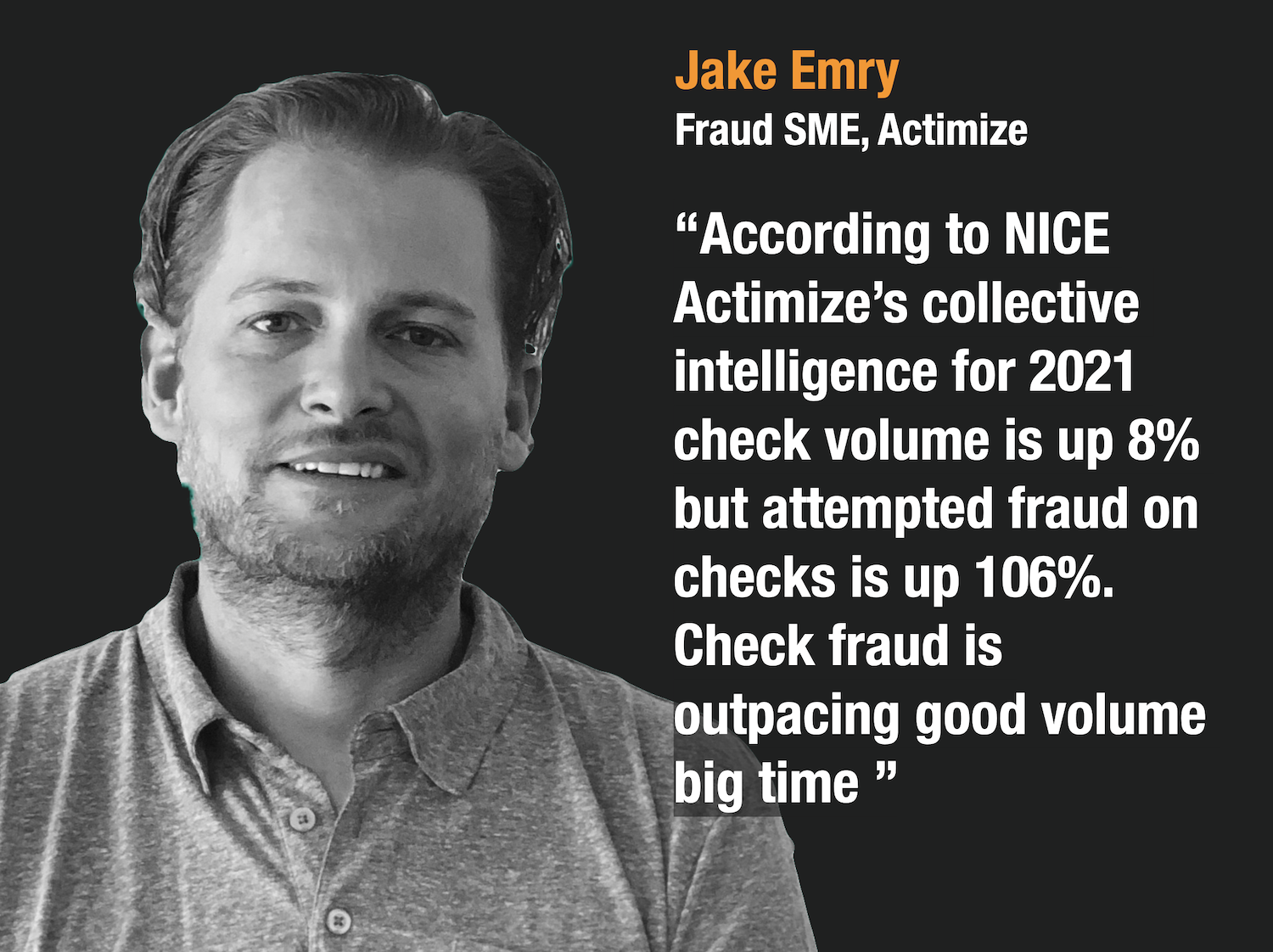

Check Fraud Up 106% in 2021 According to Actimize

While industry stats on check fraud are hard to come by, I did find one report that seemed to confirm that it’s rising.

According to Jake Emry, a fraud expert with Nice Actimize, “attempted check fraud is up over 106% from 2021 while volume increases in checks are only up 8%.”

Nice Actimize solutions are used by all of the top 10 US Banks so their collective insights are a pretty good indicator of industry trends.

From his view, Emry thinks check fraud is putting a lot of operational pressure on banks. As check fraud increases, banks are placing more long-term holds and checks, and that is pushing fraudsters to go in the branch and cash them out.

It’s a real game of “cat and mouse” he says, “And in some respects, the fraudsters are winning in the check fraud war”.

His speculation about check fraud moving into the branch is correct. I heard reports that one bank here in the US has confirmed that their over the counter check fraud is up over 100% in the last year alone as fraudsters are taking the checks to the teller windows.

A Longer Term Trend In Rising Check Fraud Is Evident

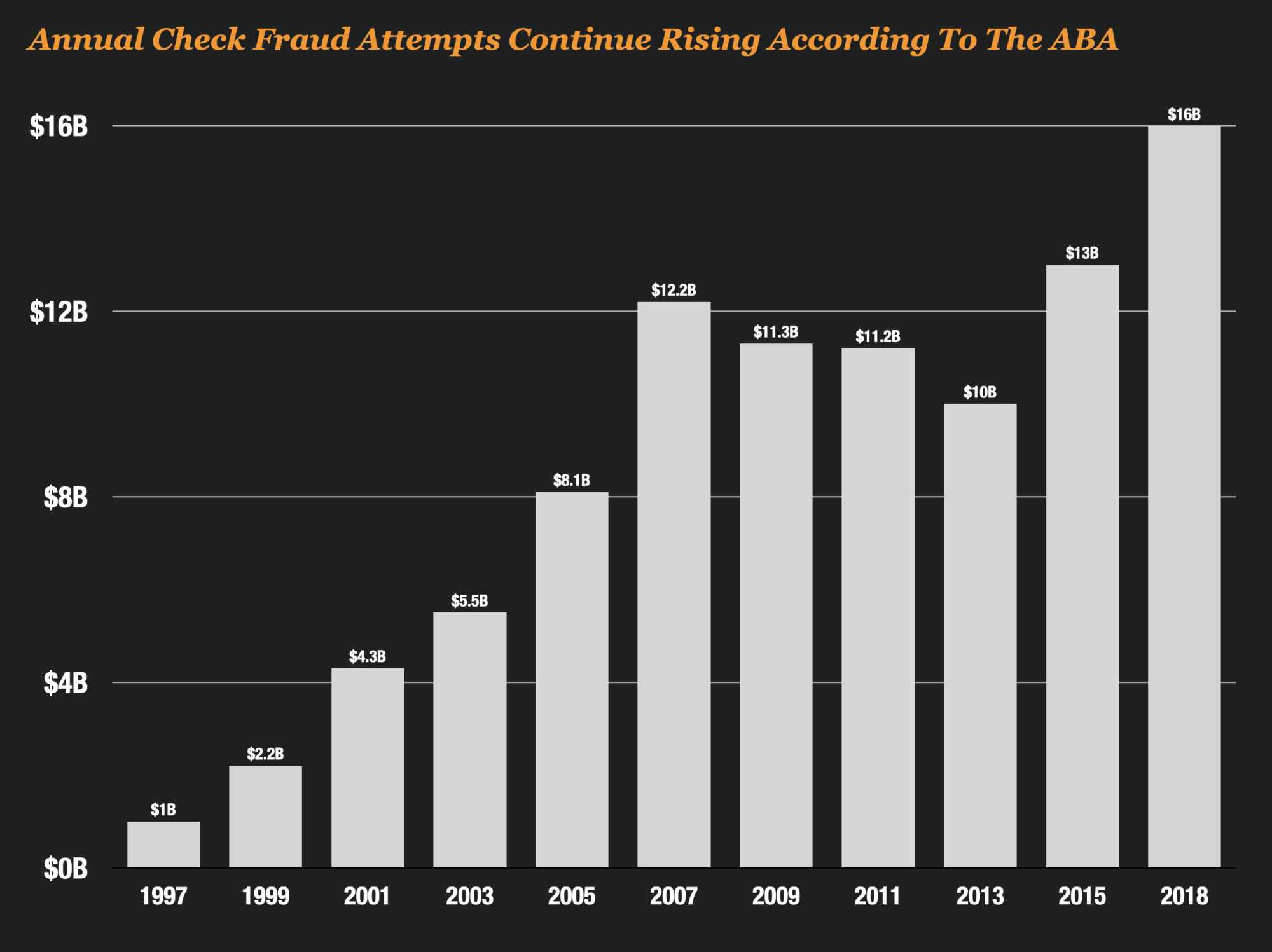

Actimize numbers seem to confirm a very troubling trend that we saw the last time industry reports were released by the American Banker Association (ABA) in 2020.

At that time, they reported that attempted check fraud ballooned to $15.8 Billion in 2018 – close to a 100% increase over the $8.5 billion that was attempted in 2016.

It’s now evident that trend of increasing check fraud attempts is becoming a longer-term trend.

The next ABA Fraud Survey is due in the next couple of months and I expect it may confirm that check fraud has continued rising since 2020.

Experts Cite A Multitude of New Factors That Are Driving The Increase

A few weeks ago I decided to dig into check fraud to see what might be happening. What is behind this recent rise in fraud?

While there is no single reason for the increase in check fraud, there appears to be a multitude of factors driving the increase according to experts.

- Stimulus – Stimulus funds have dried up, fraudsters are turning to checks.

- Social Media – Telegram is creating a booming black market for stolen checks.

- New Accounts -Fraudsters open new accounts and exploit mobile deposit.

- Scams – Scams are rising, driving more check fraud attempts.

- Mail Theft – Checks are being stolen from the mail, then washed and deposited

- Aging Tech – Banks aging check fraud tech can’t keep up with the newer schemes.

Each of these factors seem to be playing some part in the recent increase in check fraud.

#1 – The Pandemic Has Created The Perfect Storm for Check Fraud

Brad Haacke, Financial Crimes Manager of Fifth Third Bank and creator of FraudWit, thinks the rise in check fraud is due in part to the end of the pandemic stimulus.”.

It created a perfect storm for check fraud to return.

“The pandemic and subsequent government relief efforts radicalized people to fraud. Once that was removed, they pivoted back to bank fraud.”, Brad told me.

“At the same time, you have a population of older consumers who may not get out as much due to the pandemic, who use checks. Rather than switch to newer payment methods, they send those checks in the mail. When you combine that with fewer USPS inspectors that can investigate cases – the exposure rate rises”

The bottom line is there are fewer good guys and more bad guys and more checks in circulation to plunder.

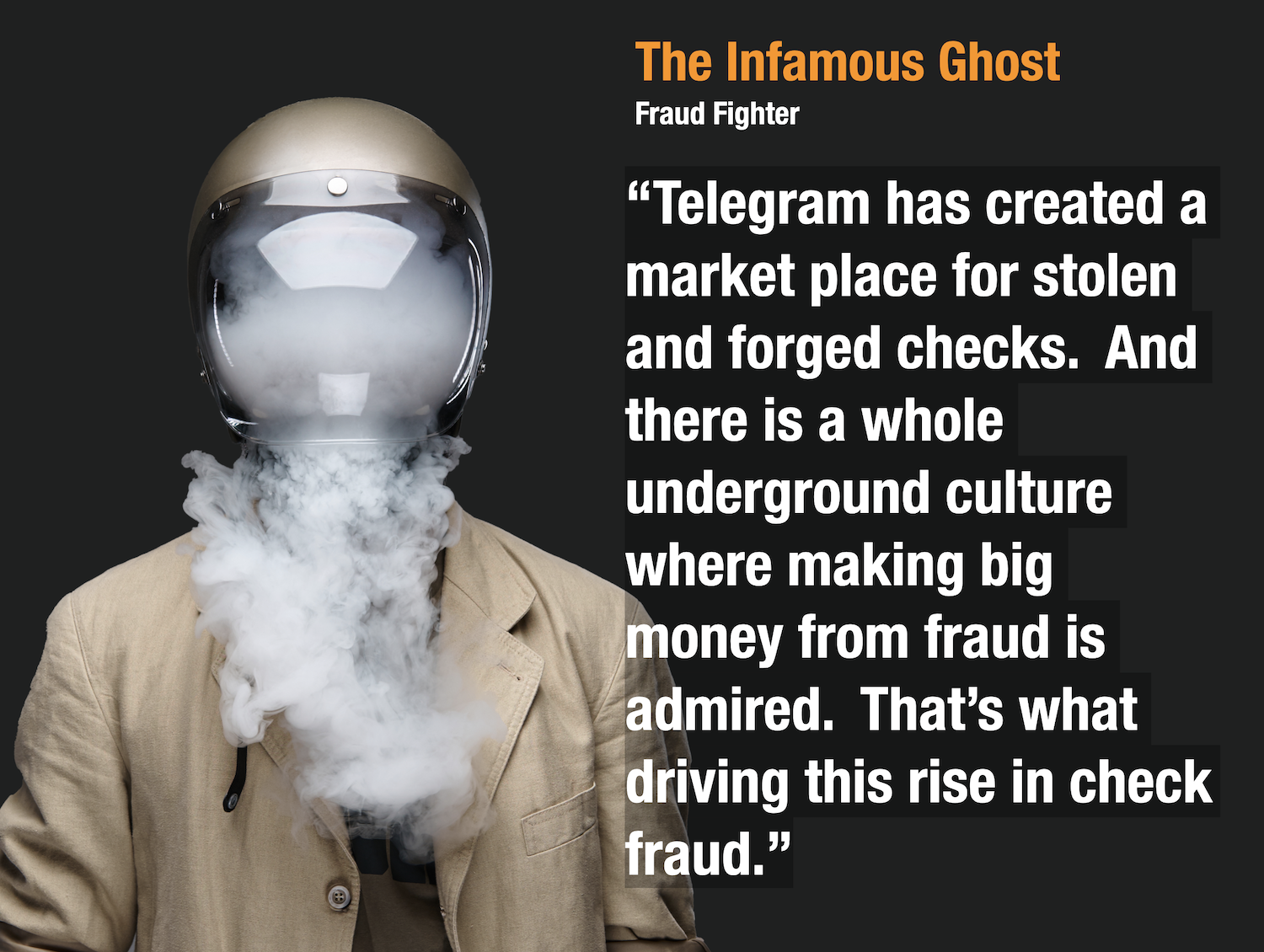

#2 – The Market Place For Stolen Checks Is Booming And Fraudsters Are Being Glorified

Telegram is also a factor in creating a demand for stolen checks.

“One big driver of check fraud is the thriving secondary market on Telegram for stolen checks”, indicated Infamous Ghost, a Youtuber and fraud fighter, “There are thousands of stolen and counterfeit checks for sale and it’s only growing month over month”.

He thinks the growth in check fraud is only a symptom of the larger problem though – the glorification of fraudsters.

“There is a whole underground culture. The kids see these fraudsters on Instagram flaunting their fraud gains and they want to do it too. Check fraud is just an easy low-tech way for them to make some money”.

You can check more of Infamous Ghost on his youtube channel where he highlights recent check fraud cases.

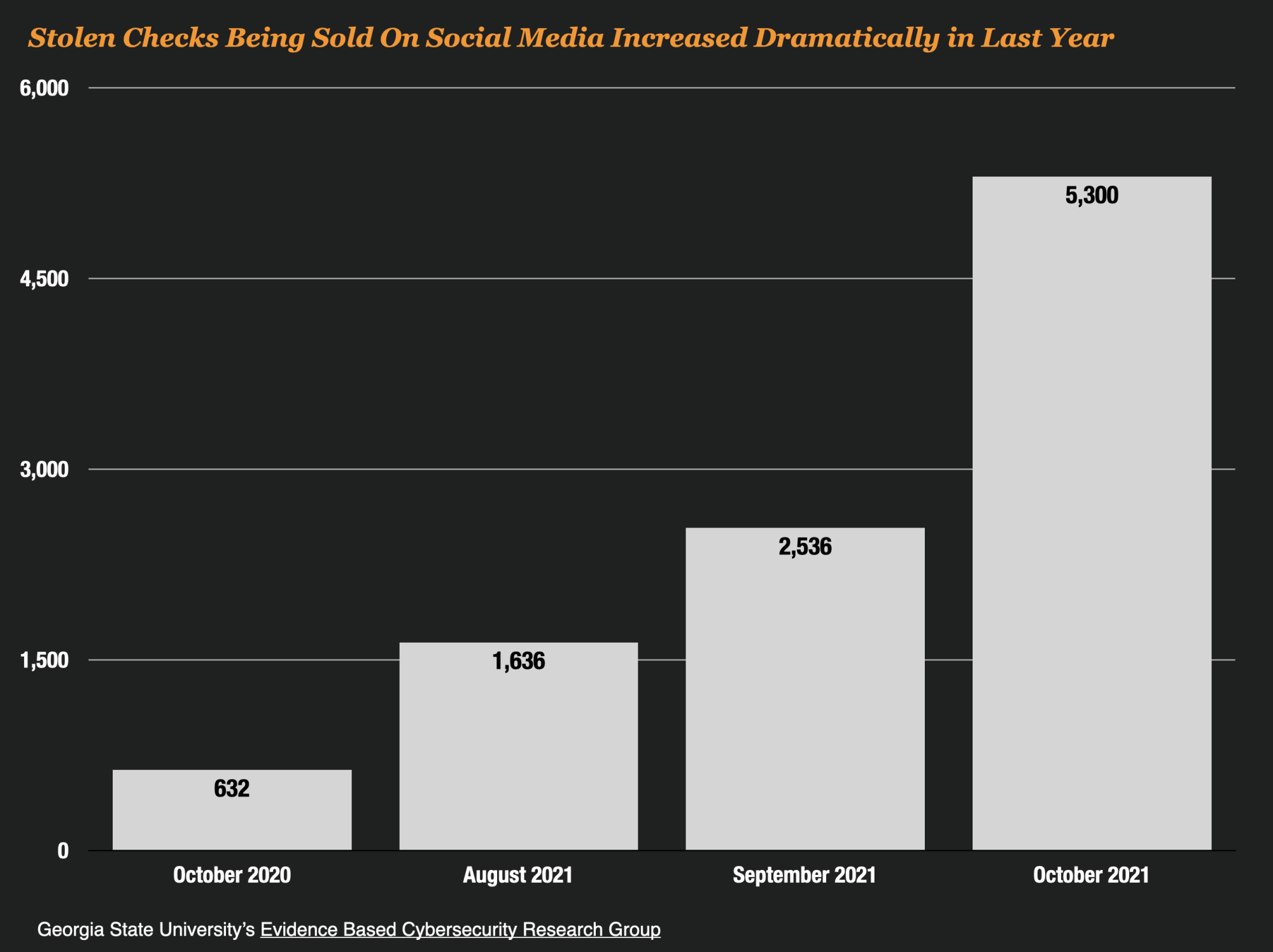

And Infamous Ghost just might be right. Georgia State University’s Evidence-Based Cybersecurity Research Group, recently published a study where they tracked 60 online chat rooms that they knew were trafficking stolen documents.

Their results were shocking. They found a significant rise in stolen checks being stolen each week and sold online. The secondary market for stolen checks is red hot.

A quick review of Telegram confirms their findings. There are hundreds if not thousands of channels marketing stolen checks.

Interestingly enough, reliable stolen checks are referred to as “Glass”. The stolen checks, like glass, are so good that they are guaranteed to clear.

#3 – New Account Fraudsters Are Exploiting Remote Deposit Capture

Mary Ann Miller thinks it’s important not to overlook the role that new account fraud might be playing in the check fraud increase.

“Identity thieves, synthetic identity perps, and real people are opening up bank accounts”, she says, “They seem to prefer exploiting mobile deposits to shotgun bad checks into the account. This is driving check fraud attempts way up.”

“These people can open up account after account – sometimes with bots. Then armed with their smartphone and a debit card, they deposit bad on the phone and then drain the pull the money out of the ATM machine right away. It’s a whole new game with check fraud they like to exploit.”

Now that the stimulus funds have dried up, those fraudsters have just shifted tactics and applying the same methods to stolen checks.

# 4 – Fast Growing NeoBanks May Be Easier Targets

Neobanks are growing fast and they are also ripe targets for online fraudsters. I spoke to one fintech industry fraud fighter and he thinks Neobanks might be taking the brunt of these check attacks.

He believes these fintech banks may be more prone to first-party fraudsters and exploiters since some may not use traditional methods to identify bad checks like Chek Systems .

That and other holes in the process can make them the weakest link in the ecosystem and so fraudsters rush in to take advantage of them.

#5 – Mail Theft Of Checks Is Popular Again

According to a recent report on NPR, check fraud has spiked in the US due to rising mail theft.

In the report, they detail two schemes in particular – 1)theft of outgoing checks in people’s mailboxes, and 2) theft from USPS blue boxes with stolen keys.

“Some of them simply go to your home mailbox and take the mail you left for the post office to pick up,” said David Maimon, an associate professor of criminal justice and criminology at Georgia State University and director of the Evidence-Based Cybersecurity Research Group.

“Others simply go to the blue boxes with the keys that they were able to steal from some of the mailmen out there, empty the boxes and get the checks that some of us send to our utility companies or our loved ones when we want to send a gift. That’s how easy it is.”

The fraudsters use nail polish remover to wash the content from the check. They leave the check to dry, and then offer it for sale on various telegram channels.

Those checks are being fenced on online forums for $175 for personal checks and $250 for business checks. And there are tons of USPS Mailbox keys being sold for between $2,000 to $3,000 in bitcoin.

#6 – The Growth In Scams Fuel Higher Fraud Attempts

To understand why check fraud has risen, you also need to factor in the growth in scams attempts. One of the most lucrative scams today occurs when scammers send victims a fake check and then request funds back before they are notified that the check bounced.

Last year, the FTC indicated that fake check scams were up over 65% since 2015 and earlier this month indicated the fake check scams are an integral part of the rise in romance scams which hit an all time high of $547 million in 2021.

On any given year approximately 500,000 people in the US report being victims of check scams and they lose up to $1.8 billion collectively. These losses won’t show up in any bank reporting because the consumer bears the financial risk.

But according to Ian Michell, founder of the human rights group The Knoble and co-founder of Omega Fin Crime, scams are now part an integral part of industry fraud discussions.

“First-party, abuse, and scams are front and center in industry fraud discussions,” said Mitchell, “Interestingly, this year check and card fraud is making a comeback. Fraudulent check scams against consumer and commercial accounts are a big part of the scams challenge banks are facing”.

#7 – Aging Tech Can’t Keep Up With Newer Fraud

Face it. Check fraud is the “ugly duckling” of fraud types despite accounting for nearly 60% of all deposit fraud according to the ABA. It gets no respect.

While billions of dollars in investment are being poured into identity solutions by silicon valley, the investment in check fraud technologies is at or near zero.

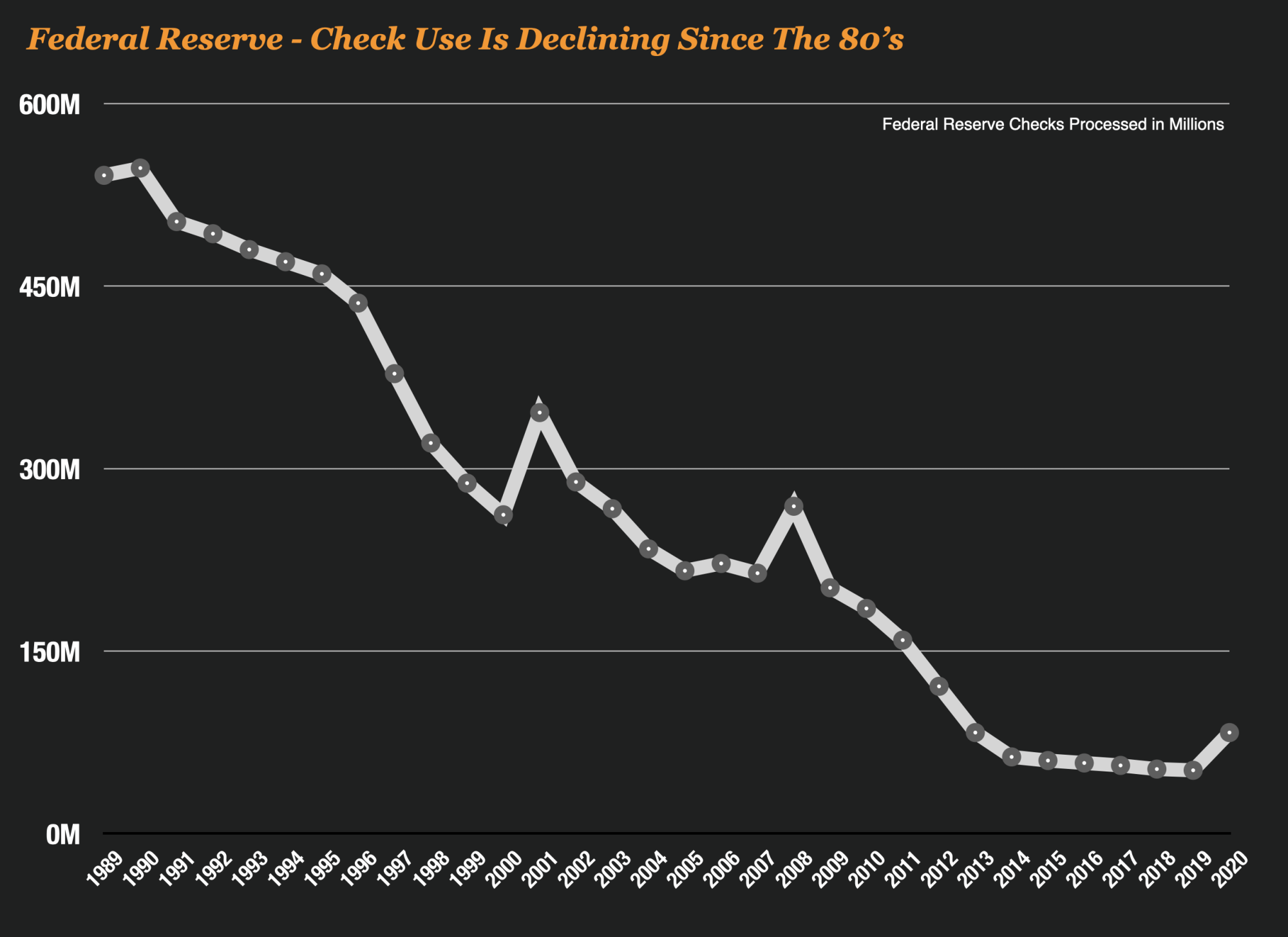

The reason for that? Because check use is declining. And it’s hard to get investors too excited about the future of checks, even while check fraud flourishes.

But the fact is, experts predicted checks would become extinct in 2020. It never happened.

The “Wait for Check Fraud To Go Away Strategy” Doesn’t Work

Unfortunately, the fraud strategy of “Wait for Check Fraud to Go Away” isn’t working. Bank’s aging fraud-fighting tech is limited and old and analysts battle enormous false-positive rates.

As a case in point, many banks are still relying on the rules-based systems that they implemented as far back as 1997. These systems have basic parameters like “check is high dollar amount” and have false-positive rates that can reach as high as 1,000:1 or more. This can make it impossibly hard for fraud analysts to spot a fake check in their queue, even when it is flagged.

Some of the more advanced fraud approaches like consortium sharing, behavioral analytics and user profiling that have been used successfully in other channels are just not widely used to address check fraud.

Bold New Approaches To Address Check Fraud, and Investment Are Needed

With this sudden resurgence in fraud, there is an opportunity for banks to take a hard look at their fraud strategies for checks.

Is it good enough? Can we sustain using the same solutions for the next 8-10 years? What is the cost of doing nothing?

In a banking world where all investment money is going into digital transformation will banks be able to make the business case to invest in the lowly check?

For all the reasons cited by experts in this post, I think it’s a must.

Some Interesting Advancements in Check Fraud Tech

While there hasn’t been a lot of investment in new check fraud tech over the last 10 years, one major announcement did catch my eye in 2021.

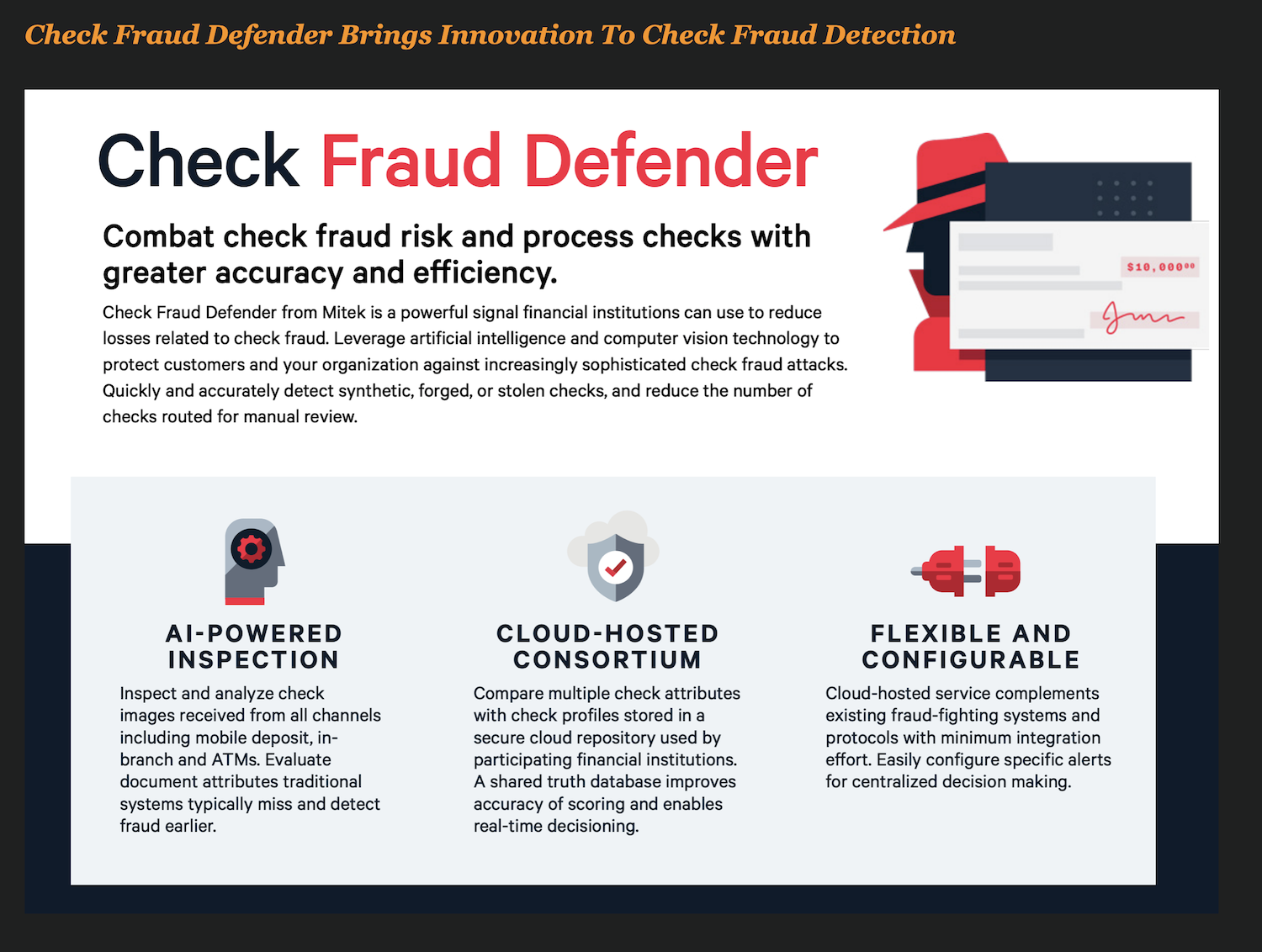

In June of 2021, Mitek announced the launch of a solution called Check Fraud Defender. It introduced two new advancements in check fraud detection that move the needle in my opinion;

- Artificial Intelligence– It leverages artificial intelligence to visually spot fraud patterns – not rules.

- Consortium Sharing – It uses a consortium approach to help banks fight check fraud together.

And Mitek is in the position to pull it off. Their remote deposit capture check software is used by over 6,400 financial institutions and has processed over 4 billion checks.

The use of computer vision to pick up obvious patterns of forged and counterfeit checks, combined with consortium pattern sharing is what makes this so unique.

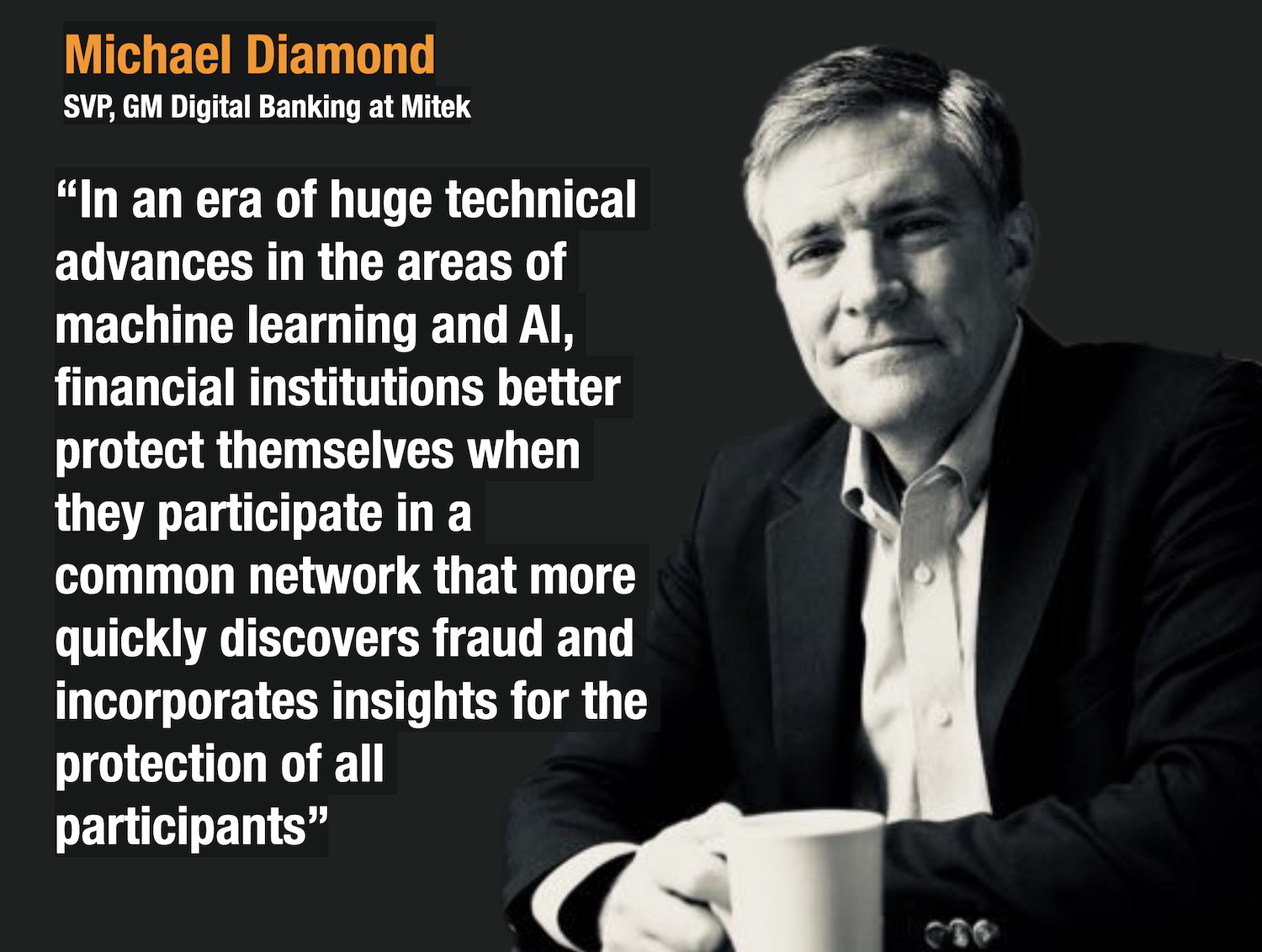

And Michael Diamond SVP at Mitek thinks this is a winning formula in the war against check fraud.

It’s great to see something cool and new in check fraud tech.

What do you think of this resurgence in check fraud? Are you seeing? Would love to hear from you and your experience!

Good luck to all the fraud fighters out there battling check fraud!