What happens when you dangle trillions of dollars in front of people and ask them to line up if they need the money because they have been impacted by the Coronavirus economically?

Everyone would line up right? But how many would be actually telling the truth? That is a very difficult question to answer.

Attestations for Money in 2020

The Coronavirus Aid, Relief and Economic Security Act (CARES) was signed into law last month, promising trillions in relief for people impacted by COVID-19. All told Uncle Sam allocated over $1.8 Trillion dollars in direct aid for individuals and businesses and represented the largest stimulus package in history.

But the key to success was to put that $1.8 Trillion into the hands of people and businesses impacted by COVID-19 quickly – like within a few weeks. But the big question was how would the government determine who actually needed the money so they could get it to them?

To answer that question, the programs would rely on “attestation”. If the individual or business, said that they were impacted, if they needed, or they needed the forbearance on their loan – they would be eligible.

And that has opened a Pandora’s Box of issues for businesses, banks, and lenders who have often been used as the conduit for getting the relief to Americans.

Perhaps Never Before Has Truthful Attestation Been So Important

I doubt there is any point in the history of the US when relying on someone to be truthful to get relief has ever been more important. The scale of impact and the associated relief from the government has never been so high.

But to get the money to the right people, we are relying on the right people to be truthful. If the wrong people get the money, it won’t do any good. If too many people attest untruthfully it could bury our economy and leave deserving people out in the cold.

These days everyone likes to say “We’re in this together” but when it comes right down to it, people can act very much in their own self-interest when the government dangles thousands of dollars in front of their faces.

It is for this reason, that I think “Attestation Fraud” could be the fraud of 2020.

Let’s look at a few examples where the risk of attestation fraud may be particularly high and impactful.

#1 The Impact of Attestations In Mortgage Lending

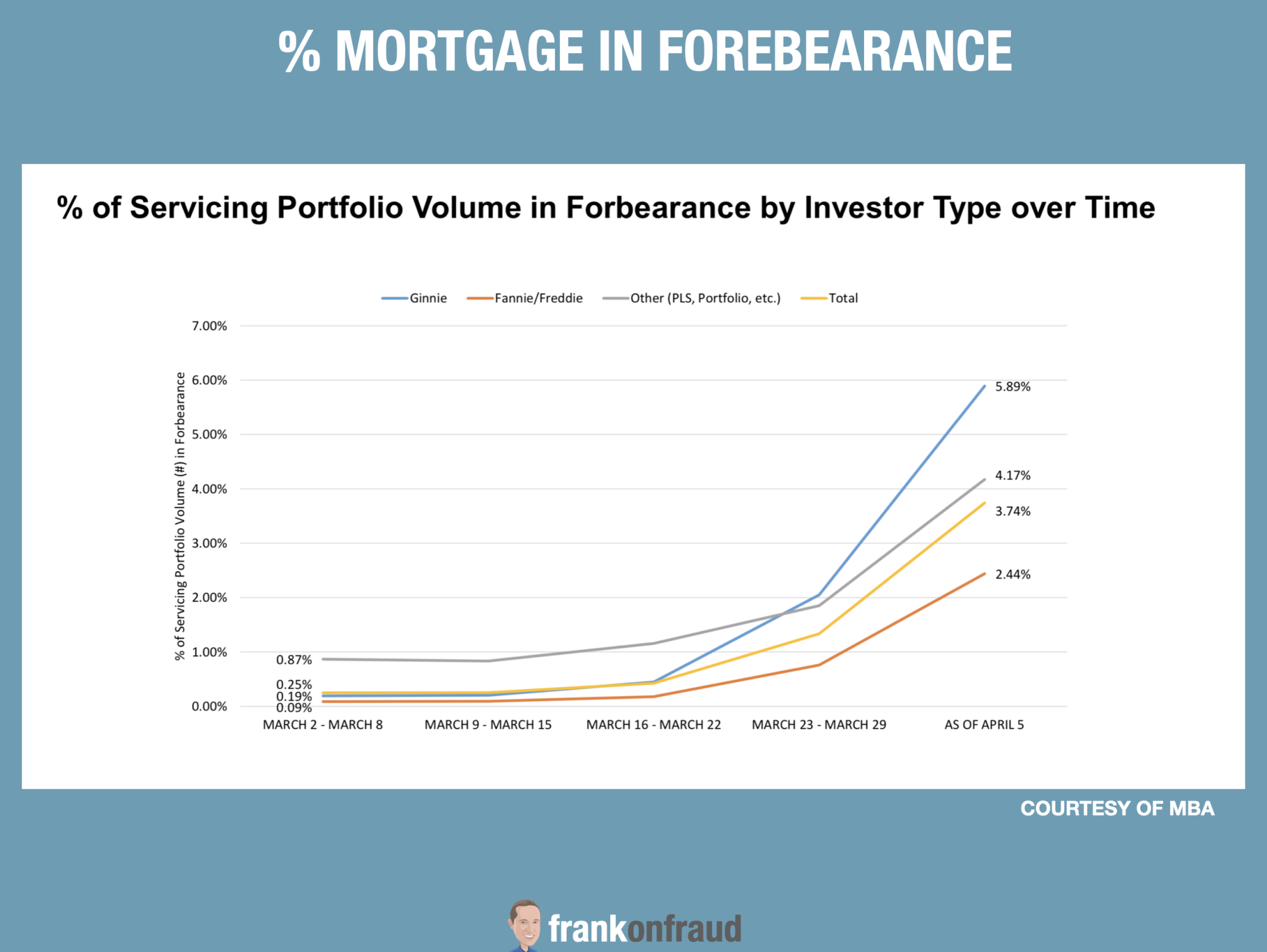

As part of the CARES act, the government required mortgage lenders let borrowers skip mortgage payments for up to 1 year. Borrowers have a right to request a forbearance for up to 180 days, and then for an additional 180 days if they are still impacted

They do not need to submit any additional documentation to qualify other than a claim to have a pandemic-related financial hardship.

And in the last 30 days, millions of borrowers are taking them up on it. Some 6.4 percent of all active mortgages are in forbearance. So far, the total amount of unpaid principal due to forbearance is $754 billion, according to Black Knight. This includes 5.6 percent of loans backed by Fannie Mae and Freddie Mac and 8.9 percent of all FHA and VA loans.

Mortgage forbearances are extremely problematic for both borrowers, lenders, and the general health of the housing market. If for example, a borrower request forbearance on their $2,000 monthly mortgage payment, they are still on the hook for a lump sum $24,000 payment at the end of the year.

Borrowers that claim they need help when they don’t could inadvertently be putting themselves in a situation where they could lose their home in a year because they are too far underwater.

#2 The Impact of Attestations in SBA Lending

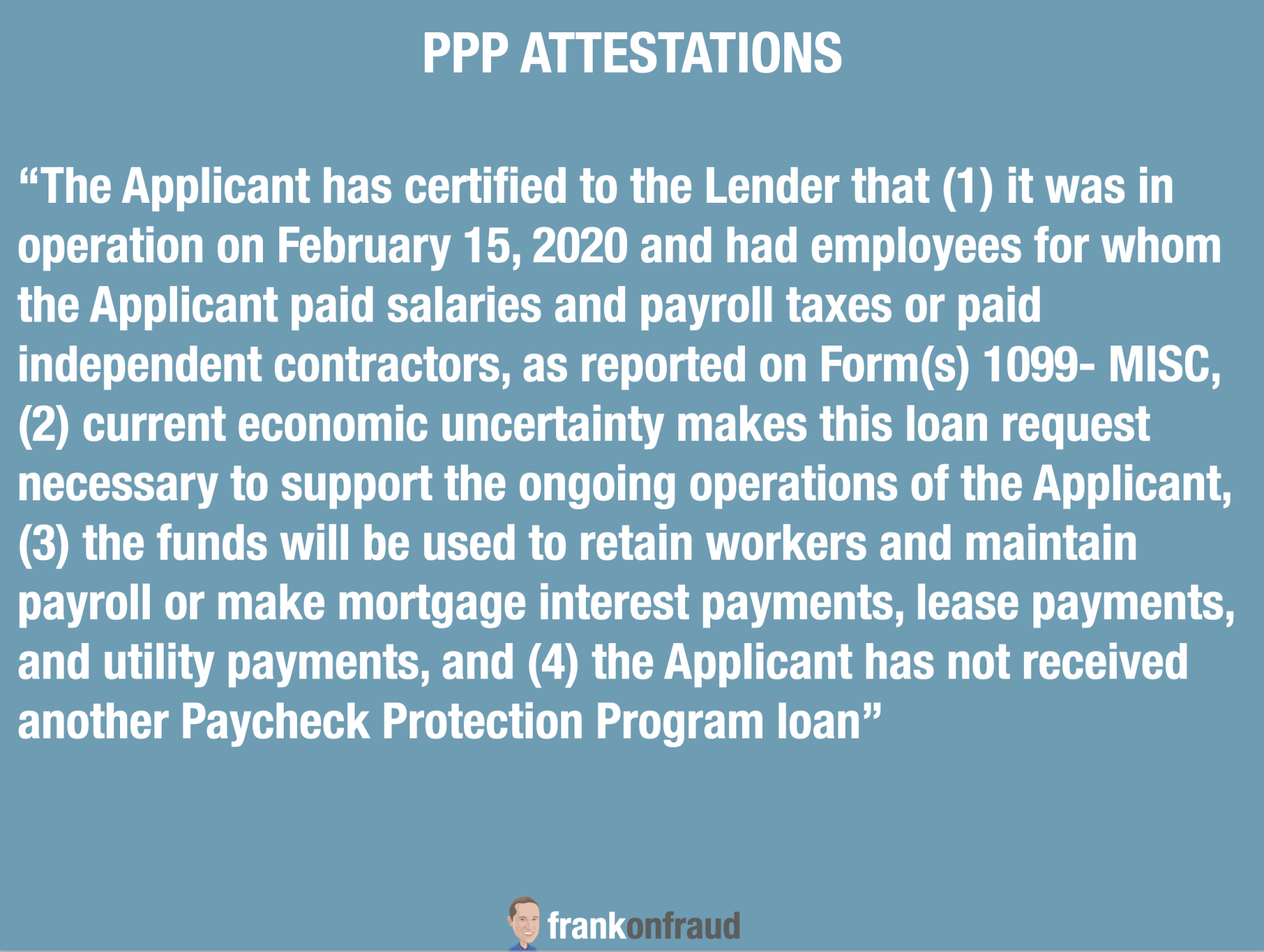

No program has relied on self-certification more than the PayCheck Protection Program from the SBA. And nowhere else have we seen more abuse of the certification than this program.

When the LA Lakers (the most valuable sports franchise in the US) can claim #1 they are a small business and #2 that they needed $4.6 million to survive the impact of the coronavirus it makes you scratch your head.

And perhaps nowhere is the government going to crack down harder on attestation fraud than this loan program. Thousands of “small businesses” were caught with their hand in the cookie jar and are already returning the money during a special grace period the government setup.

#3 Strategic Defaulting in All Lending Programs

A strategic default is the decision by a borrower to stop making payments on a debt, despite having the financial ability to make the payments. It is a strategic decision, not an involuntary decision related to loss of job or life event. Strategic defaulters take advantage of lenders’ new forbearance or loan modification programs or take action when the value of their collateral drops rapidly and loans go dramatically underwater. In the current crisis, strategic defaulting could be exacerbated by debtors strikes where consumers elect to stop paying all debtors and creditors they owe.

In any case, strategic defaults can be fraught with fraud as borrowers misrepresent their financial state or they engage in unscrupulous practices such as “kicking the trade” which is where someone purchases a car with no intent of continuing payment on their current loan.

Making false attestations to strategically default will be a serious concern for lenders in 2020.

#4 The Impact of Attestations In HealthCare

The U.S. Department of Health and Human Services (HHS) has been allocated billions from the CARES Act to give to providers adversely affected by lost revenue and increased costs from the pandemic.

To get the money out quickly the agency relied on providers to qualify based on economic impact and they had to attest that impact when the money was distributed.

In what can only be described as a very similar situation to the PPP Loan Program, the government is now trying to claw back money from some providers that they felt were overpaid and might not have attested correctly.

Fallout for Years

The impact of attestation fraud this year is just in its infancy. It may take 8-10 years for the fraud to surface through audits and investigation and legal wrangling. Many will get away with it. And others that truly needed the money or relief won’t be able to get that money because others lied or “stretched the truth”.

What happens this year will be felt for years to come.