The Guardian reports that robotexts from scammers are bombarding Americans’ phones daily, causing consumers untold losses.

Sophisticated smishing campaigns launched by scammers are so profitable that it has resulted in a GoldRush for scammers – the gold being the money in American’s bank accounts.

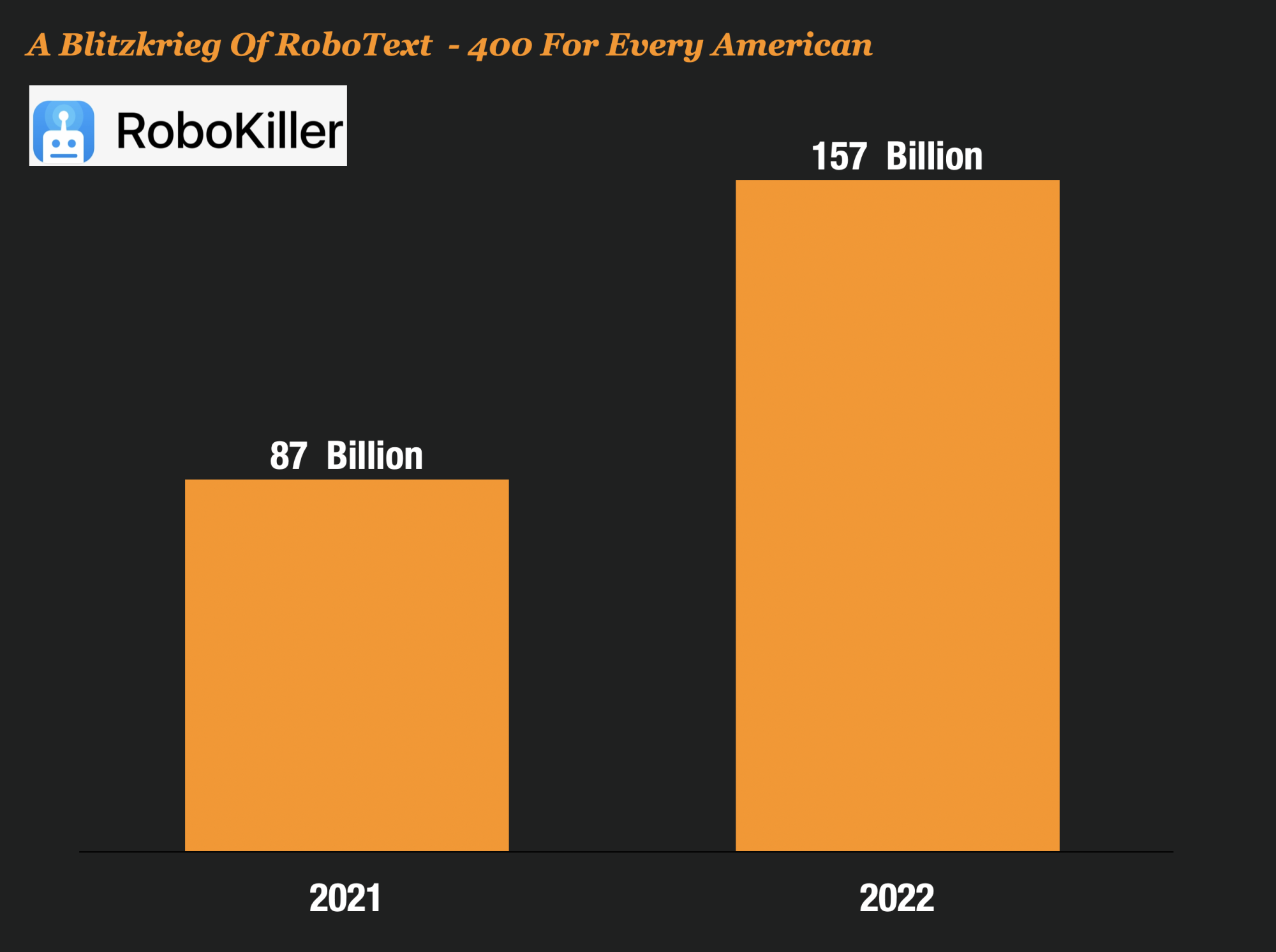

An Absolute Blitzkrieg Of 521 Million RoboText A Day

2022 saw a staggering surge in the number of robotexts received by US phone users, with a whopping 157 billion messages exchanged, translating to over 440 texts per person – an astounding 80% spike from the previous year.

This insight was gleaned from Robokiller, a company that provides cell phone users with a scam-blocking service.

This surge in scam text is causing significant losses for Americans. Last year, over 321,000 Americans fell for phone-based smishing scams. The US Federal Trade Commission indicated the losses to those people were over $326 million – a small fraction of the actual losses.

And scammers use Smishing Campaigns because they are enormously successful. According to Melanie McGovern, director of public relations for the Better Business Bureau – ““People react more to texts than to emails, because they’re so immediate,“Scammers know that text messages are opened 95% of the time.”

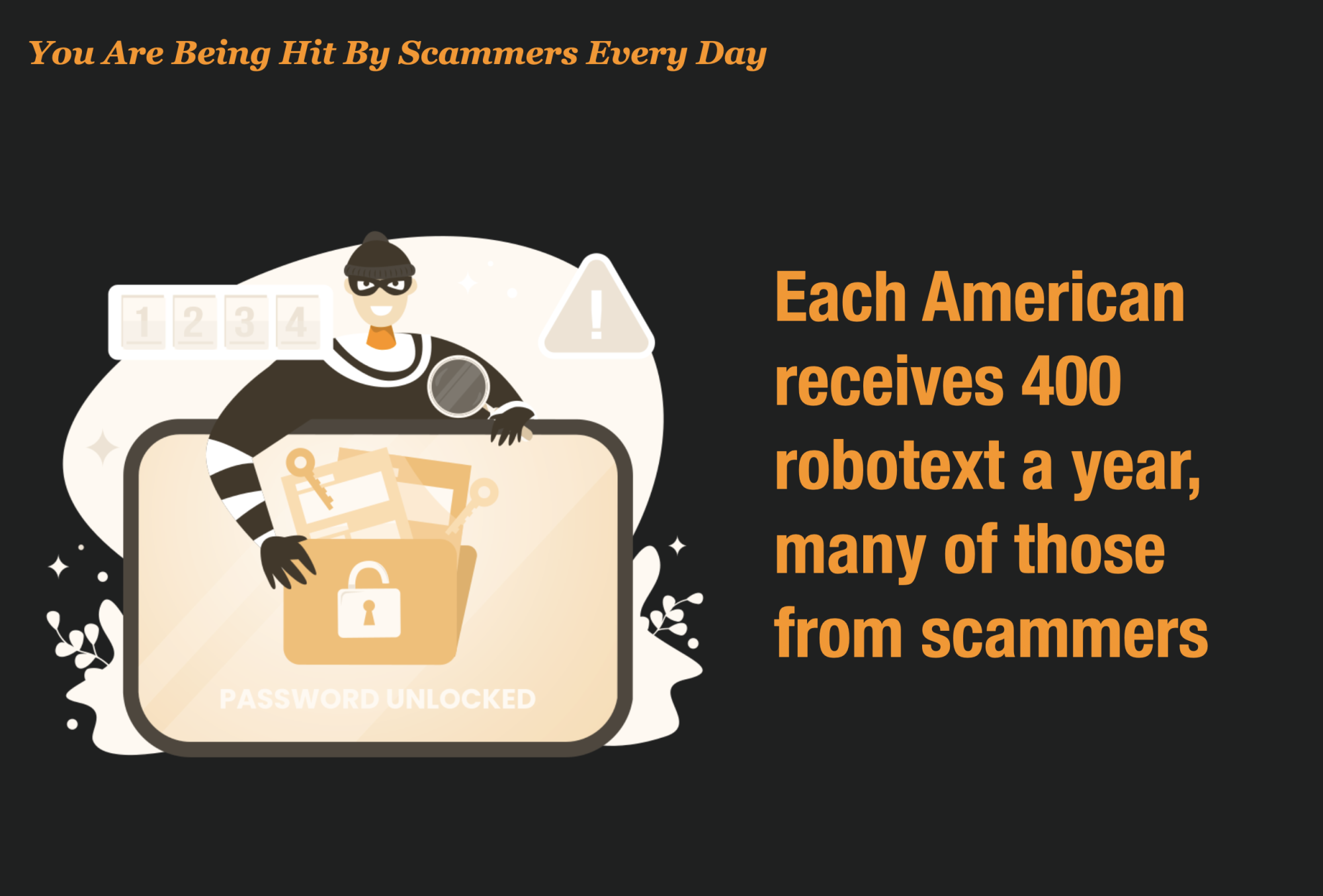

If It Feels Like Someone Is Trying To Scam You Everyday, You Are Right

If you feel like you are getting scam messages daily, it’s because you are. According to RoboKiller, each American receives an average of 400 robotext a year. That’s actually more than one a day.

The impact of those Smishing attacks is drastically under-reported and much of the loss is not reported by banks because they don’t necessarily take the loss – the customer does.

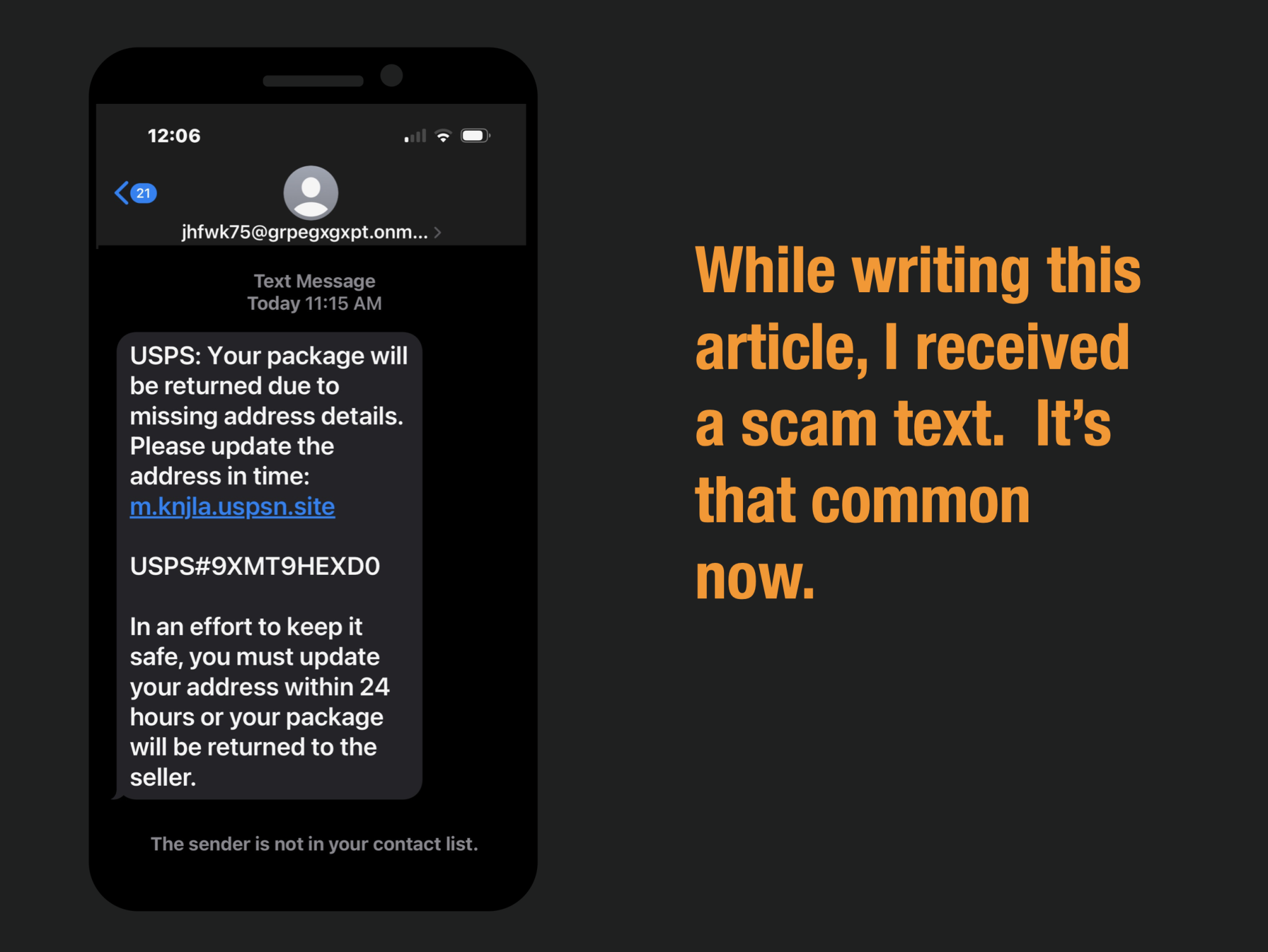

In fact, it is so common that while I was writing this article – which took me about 45 minutes – an obvious scam attempt popped into my messages.

I might be an outlier, but I receive at least 2 scam messages a day on my phone and a flurry of Robocalls. It is literally non-stop at this point.

Everyone Knows A Victim Now – For me, It Was My Sister

You know it’s bad when everyone knows someone that has fallen victim to this scam. For me, it was my sister.

My sister Erin McKenna who runs a popular bakery with locations in New York, Los Angeles, and DisneyWorld, called me to ask my advice about something.

I could tell something was wrong when I picked up the phone. I asked her what was wrong, and she immediately burst into tears.

“I’ve been scammed!”

The Fraud Department Scammers Stole $12,000 From Her Account With A Smishing Campaign

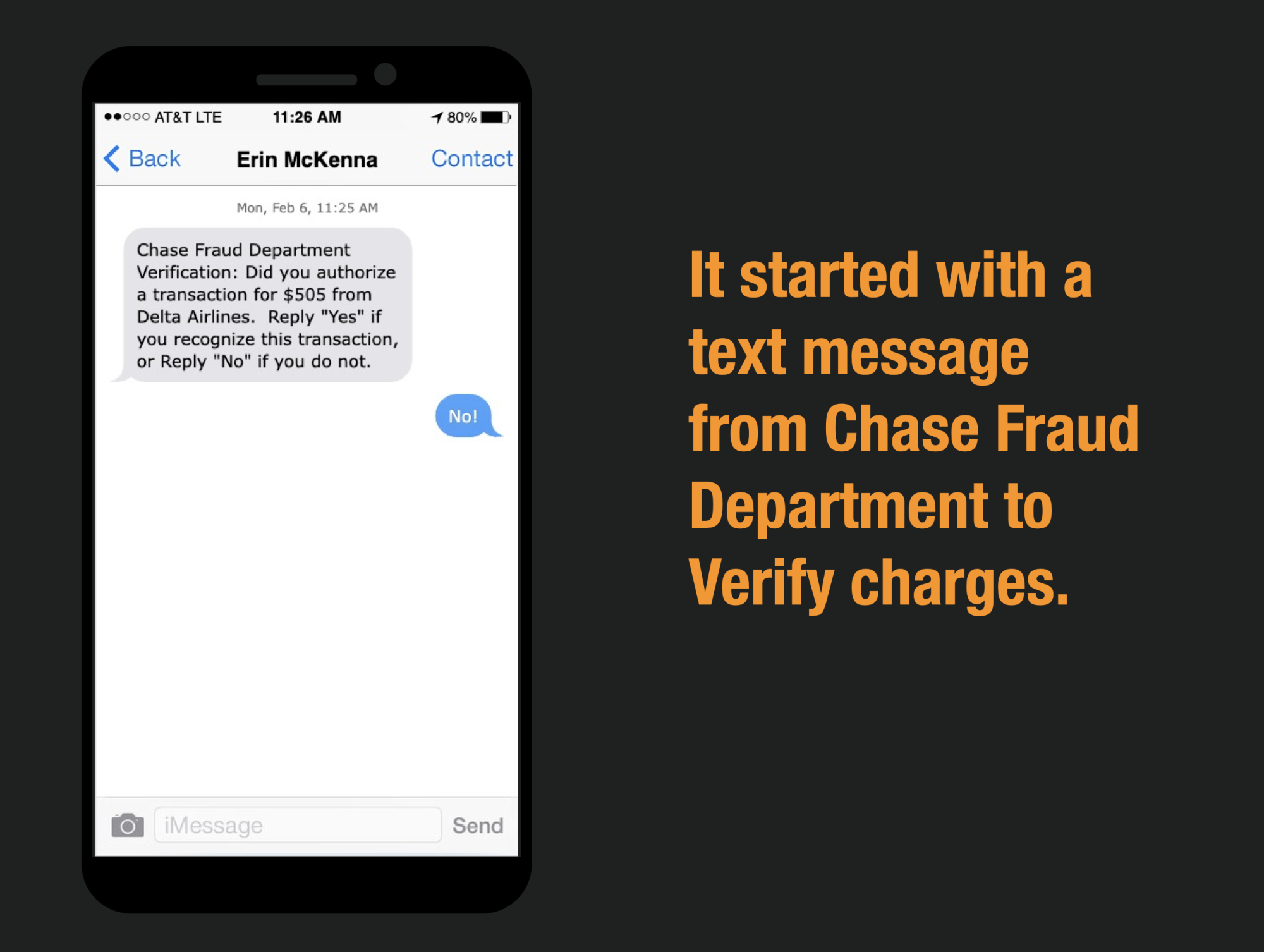

“It started with a text message,” she said, “It was from Chase Fraud Department, and they asked if I had authorized a $505 purchase to Delta Airlines”.

“I replied back -No.”

And so kicked off Erin’s unfortunate brush with a band of prolific scammers using a technique that is targeted tens and thousands of Americans – the dreaded Fraud Department Scam.

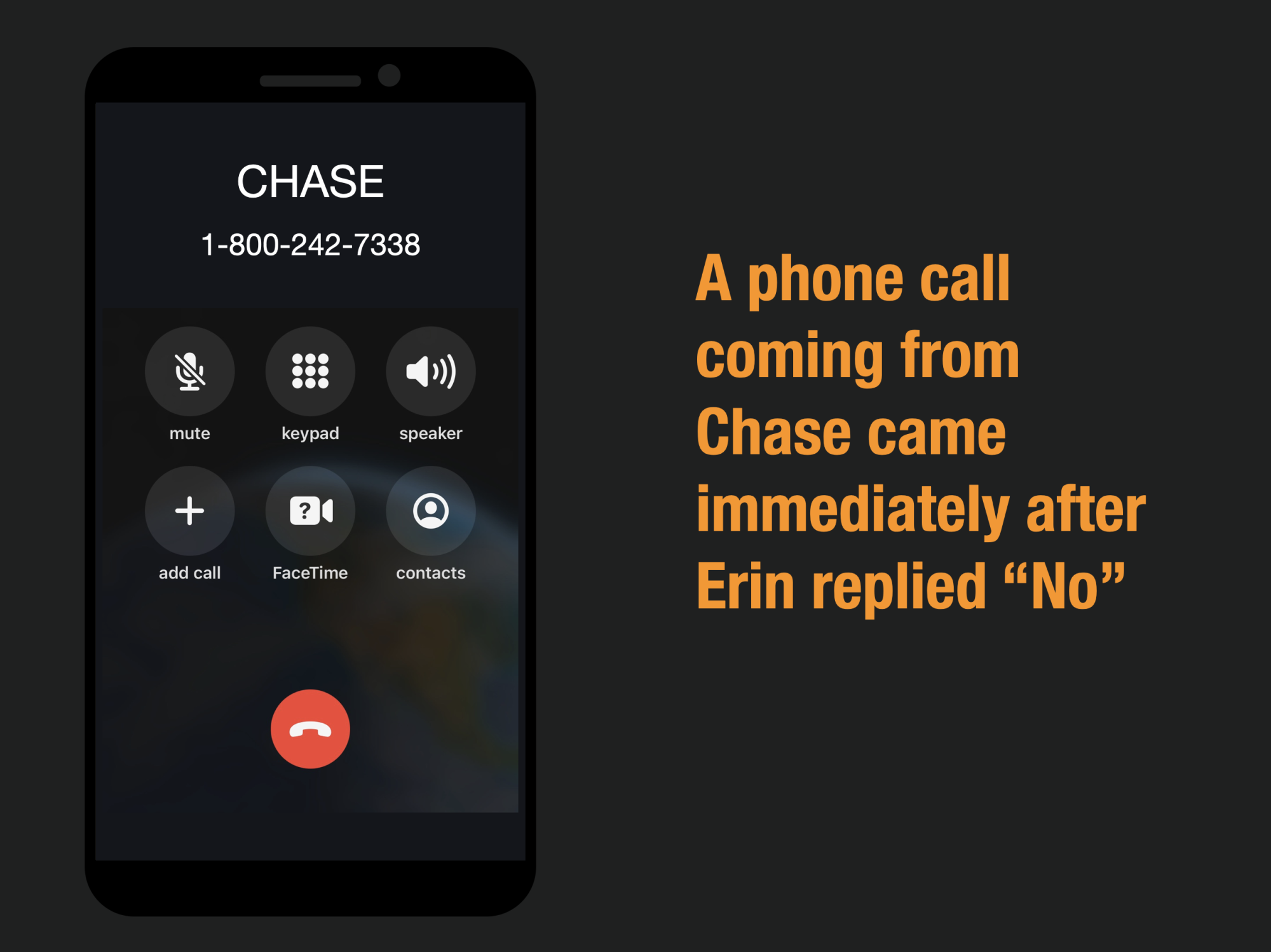

60 seconds after she replied to the text message to “Chase”. She saw an incoming call from Chase Bank on her phone.

Erin answered the person on the other end of the line said “Good afternoon, Am I speaking to Erin McKenna”.

“Mrs McKenna, we are calling from the Chase Fraud Department to protect your account.” They spoke perfect English and had the banking script down.

“Can I ask if you if you recently signed into your Chase Account using a Samsung Galaxy from Ohio?

Erin began to panic and said “Absolutely Not”, I am in New York!”

“Do not worry Mrs. McKenna, we will take care of everything here. It looks like someone has hacked into your account”. You will not be responsible for any charges but it looks like we need to verify a few things with you.”

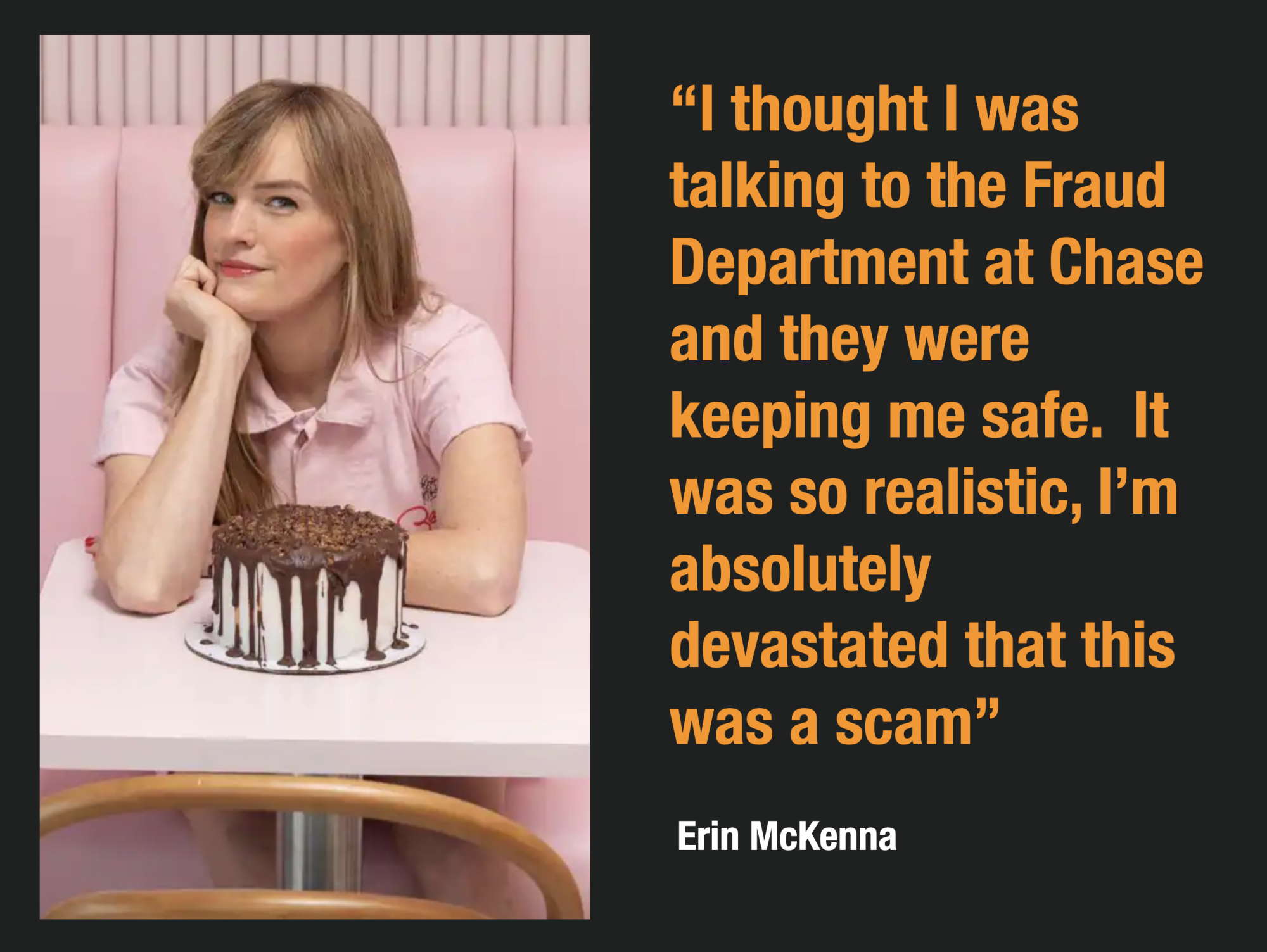

Over the next 5 minutes, they progressively gained her trust and you guessed it – she gave them a One Time Passcode (OTP).

Relieved that the “Chase Fraud Department” had her back, Erin hung up and breathed a sigh of relief.

Little did she know, she was talking to scammers and they proceeded to drain her account for over $12,000 within minutes firing off fraudulent Zelle transactions left and right.

Mounting Calls For More Government Intervention

American’s have reached a breaking point with scams, and there are growing calls for more legislation to help protect consumers.

Raja Krishnamoorthi, Congressman of Illinois, stated that a 2022 report from Robokiller disclosed that America witnesses the sending of over 362,000 robotexts every minute.

In response, Krishnamoorthi proposed federal legislation that makes it unlawful to use automated telephone equipment to inundate consumers with unsolicited texts. If passed, this law would empower the Federal Communications Commission (FCC) with more stringent enforcement measures to clamp down on scammers.