There are 3 recent fraud reports that have left fraud experts scratching their heads and wondering if everything they know about fraud is wrong.

Fraud is a cat and mouse game and experts that have been in the industry long enough know that fraudsters move quickly to the weakest link in the chain. They like to expose holes and if you close one, they will just move to another.

Which is what makes the 3 recent reports most puzzling. If the reports are correct, then fraud hasn’t shifted as we would have expected.

Well here the reports, judge for yourselves.

#1 Visa and MasterCard Report That Gas Station Activity is Low Risk

In December, both Visa and Mastercard reported that they would be delaying the EMV (Chip Card) requirement for 3 years. The reason? Because Gas Stations were low risk and the cost to implement Chip cards would be high.

Wait a second. Gas stations are low risk? When did that happen?

Last time I checked, not only were Gas Stations the largest point of compromise for skimming but they were the highest risk merchant location for pre-testing cards. Gas station activity has been closely monitored for years because it is so highly correlated to big fraud purchases which are made minutes after the initial test.

But the biggest issue with this report itself was that it was used to delay Chip implementation at gas stations by 3 years. If gas station activity was in fact low risk, what do you think will happen after all the other merchants implement and they are the weakest link?

#2 Visa Report That There Has Been No Increase in CNP Due To Chip Card

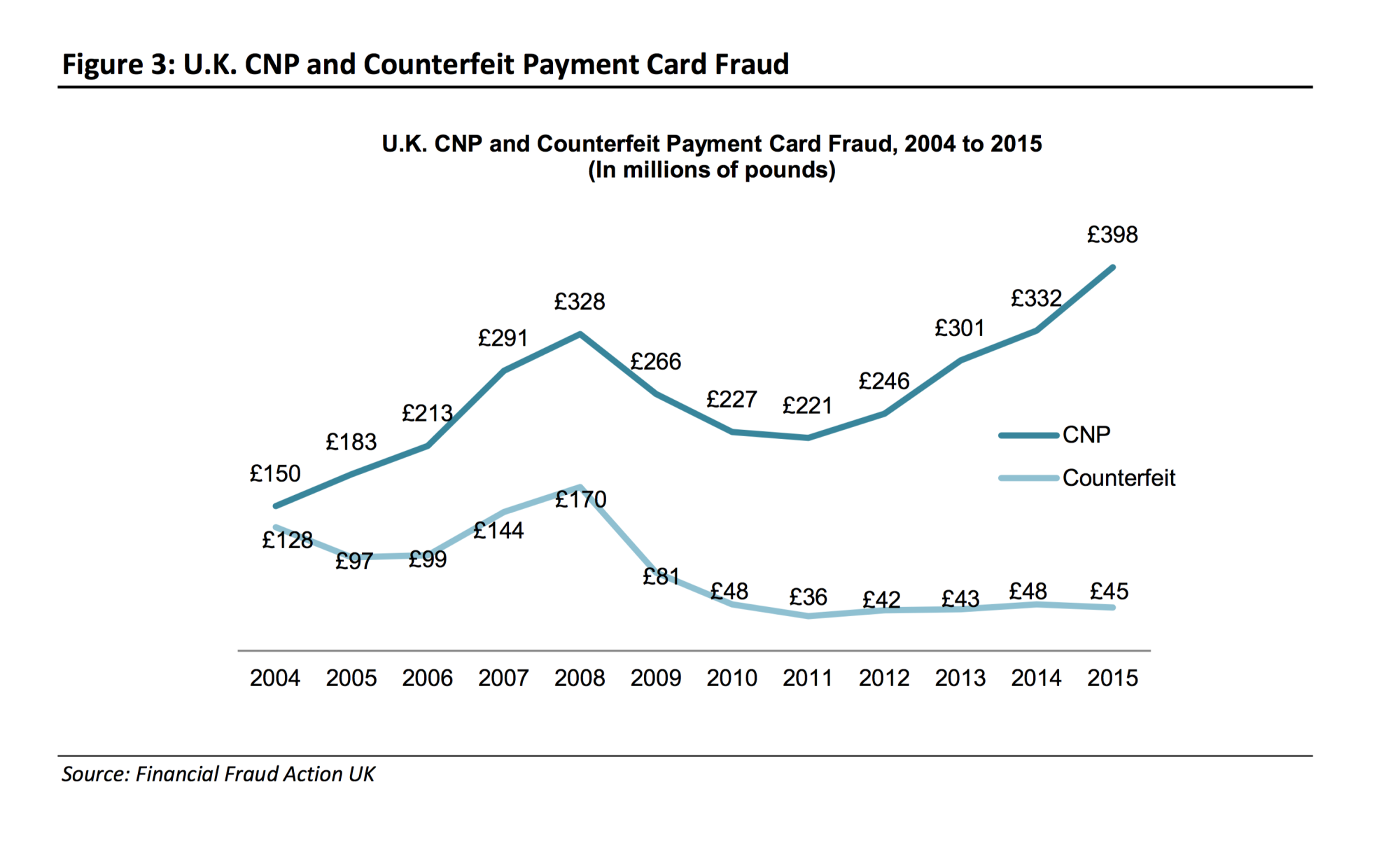

In every region of the world, CNP losses increase after the implementation of Chip Cards. That’s because fraudsters need somewhere to use those stolen card numbers and with Chip cards, counterfeiting a card is nearly impossible.

Here check out an example in the UK. You can see how CNP fraud doubled after Chip cards were implemented.

Which is why experts were so surprised last week when they read that Visa is reporting zero increase in CNP fraud in the US after Chip cards were implemented over 1 year ago.

However, according to Visa, there has been no increase in the rate of card-not-present fraud.

“We’re not seeing an increase in the rate of online only fraud,” said Stephanie Ericksen, vice president of risk and authentication products at Visa International.

But they might be the only ones.

Javelin, ThreatMetrix, NuData and almost every online merchant that I talk to is reporting big increases in CNP fraud all through last year. If the Visa report is true, most of the merchants would very much disagree with their findings.

#3 NACHA Report That There Has Been No Increase in Fraud with Same Day ACH

Faster payments, Faster fraud. That has been the age-old fact of how fraud works. But apparently, this has not happened with Same Day ACH.

Nacha is reporting zero increase in fraud due to same-day ACH. This came as quite a surprise to most as there had been an expectation of increased fraud with the rollout.

As it turns out however, the rollout just occurred 3 months ago, and doesn’t include debit transactions which are expected to be rolled out later this year.

I would say, let’s wait and see on this one.