ShotGunning Fraud is no joke. I wrote about the problem last week in this article – Don’t Get Hit With ShotGun Fraud, Arm Yourself. The problem of shotgunning crosses multiple industries from Home Equity Loans and Mobile Check Deposits and wreaks havoc on banks causing billions of dollars in losses annually.

The fraudsters have recently turned their sights on Online Lending and are engaging in shotgunning behavior with a technique the industry calls “Loan Stacking”. It may be a horse of a different name but it is not a horse of a different color. Fraud is fraud as far as I am concerned.

Loan Stacking Can Be Fraud or Innocent Shopping

Loan Stacking involves borrowers applying for loans simultaneously with multiple lenders and not disclosing that they are doing so. In the end, lenders may make a big loan to to a borrower without understanding how deep the borrower has buried themselves in debt.

It’s important to note though, many lenders don’t actually call this type of behavior “fraud” since many borrowers have full intention of paying the loans back.

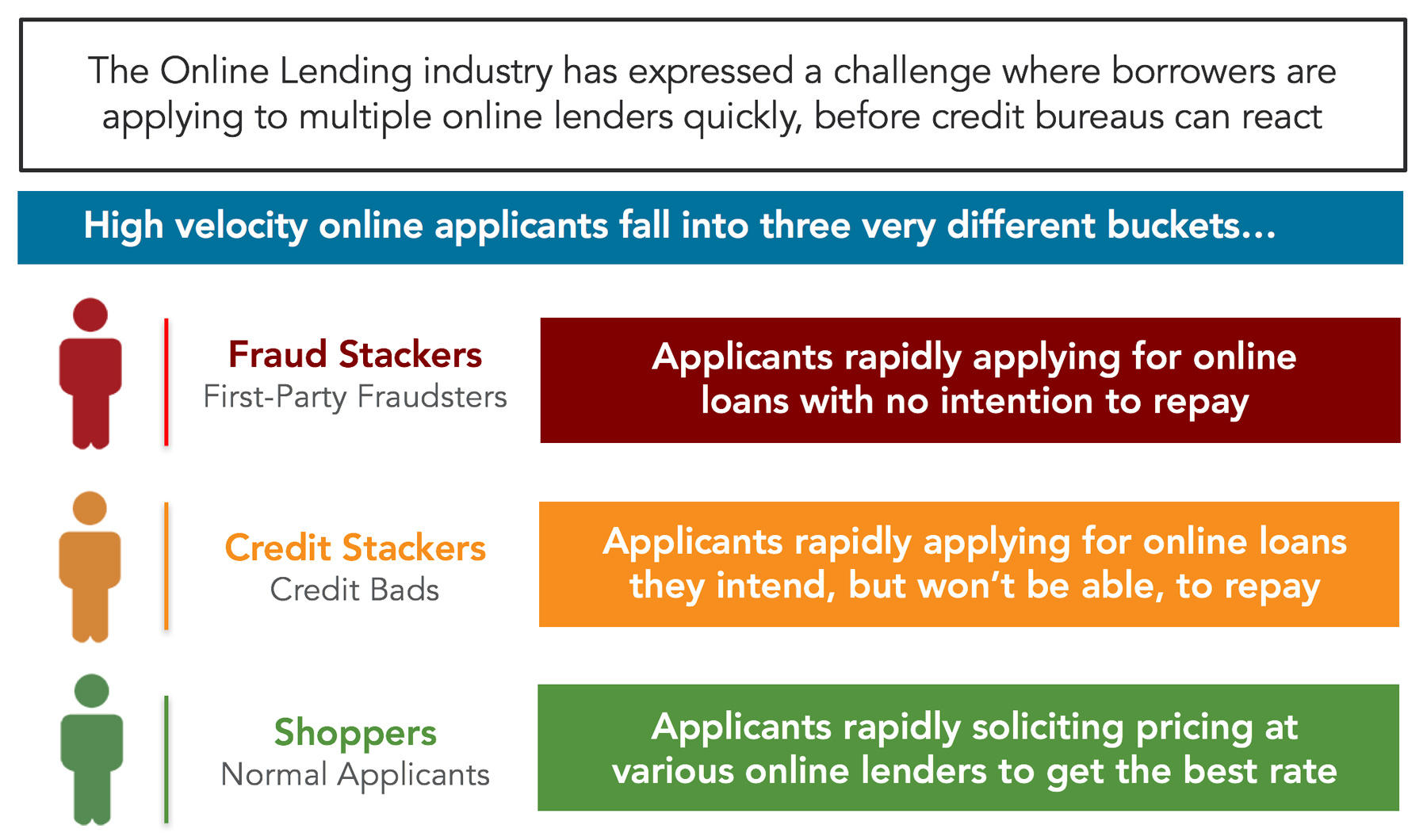

ID Analytics categorizes Loan Stacking into 3 categories; Fraud Stackers, Credit Stackers and Shoppers. Each of these borrowers has different intentions but in many cases the activity could appear the same to the lender

Loan Stacking is Very Common

According to the Wall Street Journal, Loan Stacking fraud is surprisingly common. 4.5% of borrowers that apply for and receive an online loan, will go to another online lender to apply for a loan the same day.

According to the Wall Street Journal, Loan Stacking fraud is surprisingly common. 4.5% of borrowers that apply for and receive an online loan, will go to another online lender to apply for a loan the same day.

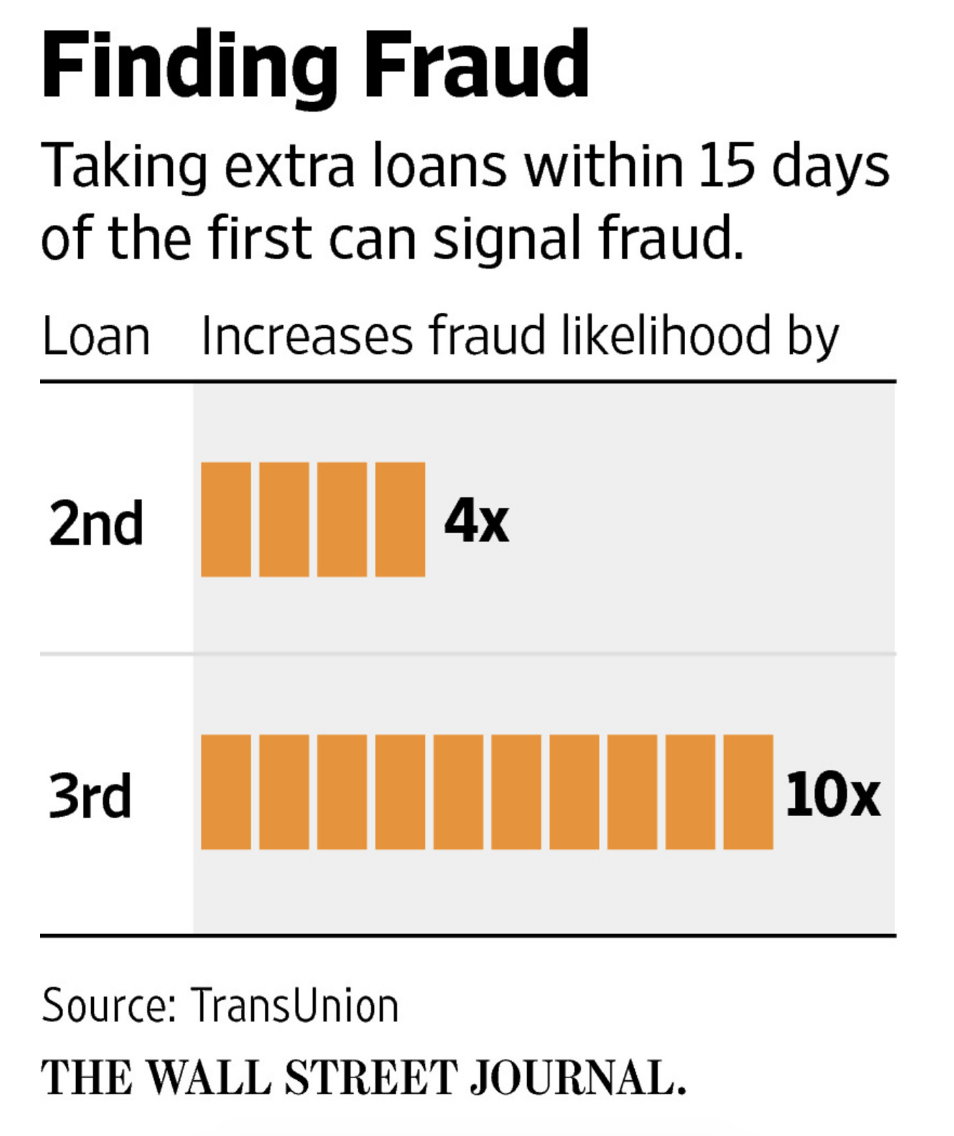

That might not be a big deal but according to TransUnion, borrowers that apply for multiple loans the same day are far more likely to be fraudsters. About 4 times more likely to be fraud than others. And if they apply for a 3rd loan they are 10 times more likely to be fraud. Loan Stacking is a serious issue for online lenders.

ID Analytics Steps Up

ID Analytics today announced the formation of the Online Lending Network. The network has participating from big names in the industry such as Lending Club, Prosper MarketPlace and Marlette Lending and at the time of the official launch has over 2/3rds participation in terms of loan volume.

Through the Online Lending Network, lenders report when a consumer requests an offer for a loan product, submits a loan application, or when a loan is funded. In return, the lender receives information on whether that consumer has either requested other loan offers or applied for loans elsewhere in the days, hours or minutes before. The near real-time nature of the response makes high-velocity fraud, like loan stacking, very difficult. It also has the potential to protect authentic consumers from overextending their credit capacity to facilitate responsible lending.

“Adoption was key for the success of this effort,” said Scott Carter, chief executive officer, ID Analytics. “We’re thrilled about the participation in the Online Lending Network. With industry-wide buy-in, members can leverage the power of the ID Network® consortium model to better assess a consumer’s current level of risk and detect fraudulent activity.

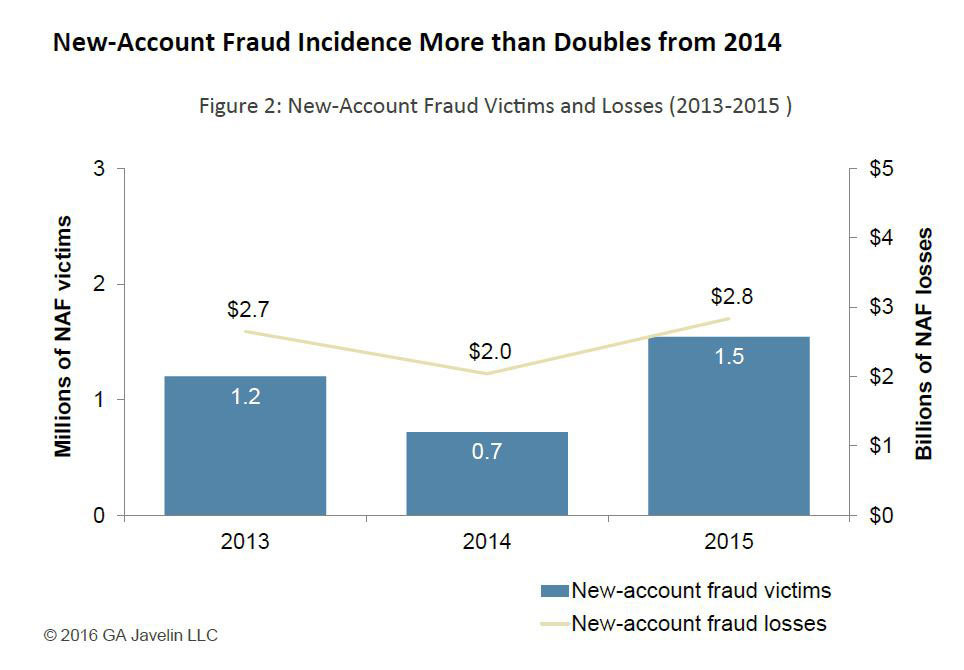

Data Sharing Should Help Curb the Rapid Growth in New Account Fraud

According to Javelin Research, New Account fraud nearly doubled last year and the trajectory is only expected to continue in the next year as EMV takes hold. Since fraudsters cannot use counterfeit cards to get their Iphones, Beat Headphones and expensive computers, they are turning to other channels to get new payment methods.

Fraud Consortiums such as the Online Lender Network are the ideal way to curb these types of fraud trends.