It used to be so simple. Back in the 80’s, fraud managers jobs were pretty straightforward – make sure that you stop bad checks from being written and occasionally if someone lost their charge card make sure you shut it down quickly before a bad guy found it and tried to buy a Sony Walkman with it.

You just had to manage two fraud types. Check Fraud and Credit Card Fraud. And losses were low. People were more honest back then maybe.

There wasn’t a lot of fraud back in the 80’s. You had plenty of time in the day to do your Jazzercise workout and catch some MTV without worrying too much.

It’s Not So Simple Anymore. Just Look at All Your Options as a Consumer

Over the years times changed. Technology got better. Consumers got more demanding for convenience and everyone started buying more stuff in many different and unique ways.

It used to be simple, we paid for things 2 ways – with cash and checks. Now we pay for things with many ways – checks, credit cards, debit cards, prepaid cards, Paypal, Venmo, Zelle, wire transfers, ACH checks, ACH transfers, bank transfers, Western Union, Moneygram, Facebook, Google pay, Paymo, Zong, Applepay.

It’s mind boggling how many ways we can pay for something. It’s almost hard to keep up with all these new fangled payment methods and how they work.

It’s Not So Simple Anymore. Just Look at Banking

And as we bought and paid for things in new and different ways, banking got more complex. When I was a kid, when you opened a bank account, they gave you a passbook where you could make deposits and withdrawals. That was about it. Oh yeah, and you could get a safety deposit box to store your most valuable things. But that was all that banks really did back then.

But things changed pretty dramatically.

In the 60’s, they started sending everyone checkbooks.

In the 70’s they introduced ATM machines.

In the 80’s they started sending everyone a credit card.

In the mid-80’s they introduced ACH payments instead of checks.

In the 90’s they started sending everyone debit cards.

In the late 90’s they gave everyone an online banking account.

In the early 2000’s they started offering mortgage loans to just about everyone.

Then they offered apps to let you bank on your phone.

Since the 60’s, banks have offered a dizzying array of convenient products that made accessing your money, or their money easier than ever before.

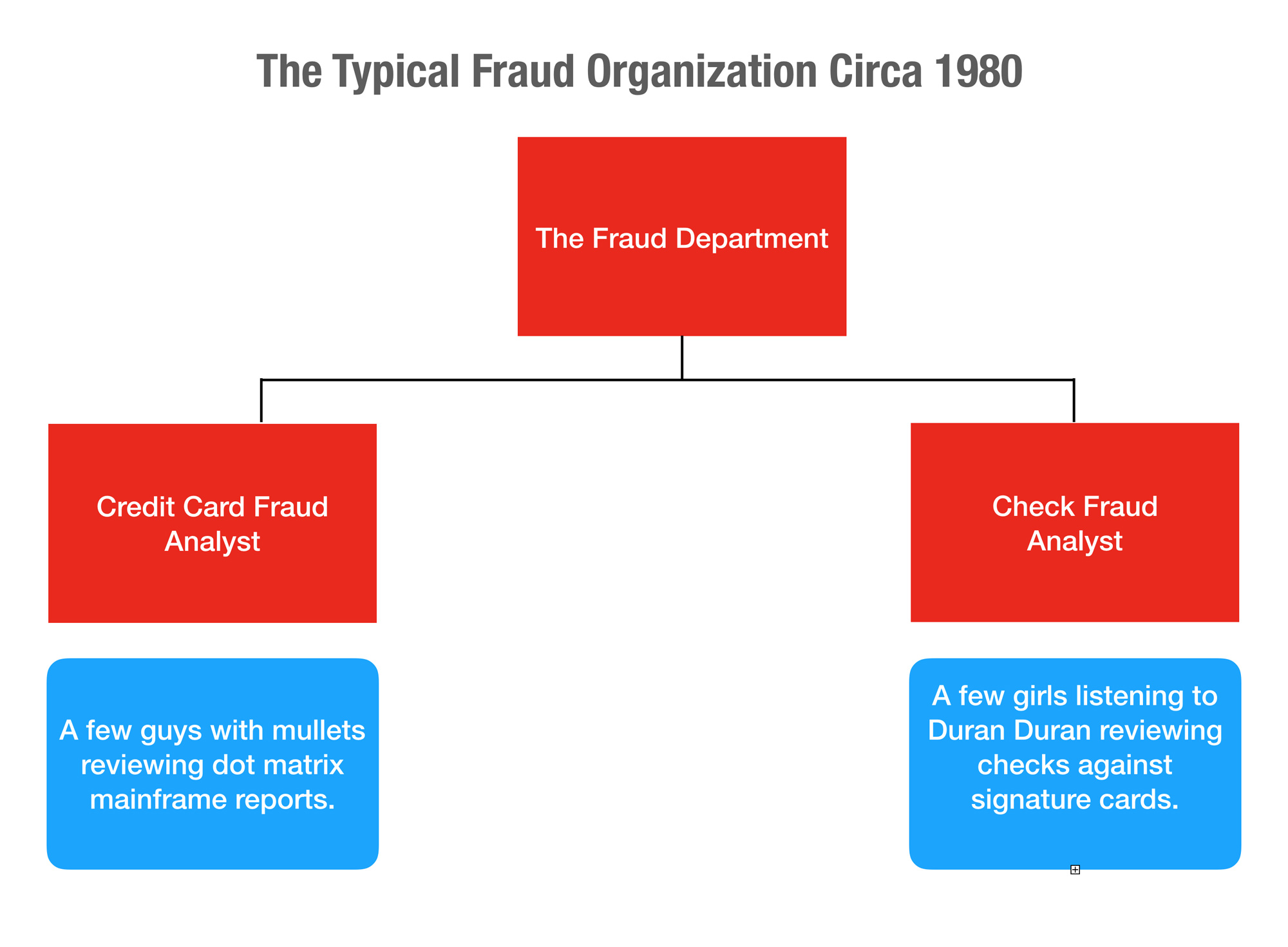

The Good Ol Days of Ye Olde Fraud Shoppe

I lived through some of the transformation of banking. Probably the most transformative years.

When I started as fraud manager, the fraud department was pretty small. You had your Check Fraud Team and you had your Credit Card Fraud Team. The teams were small, and the problems were small. We used to have Pizza parties and take lots of breaks.

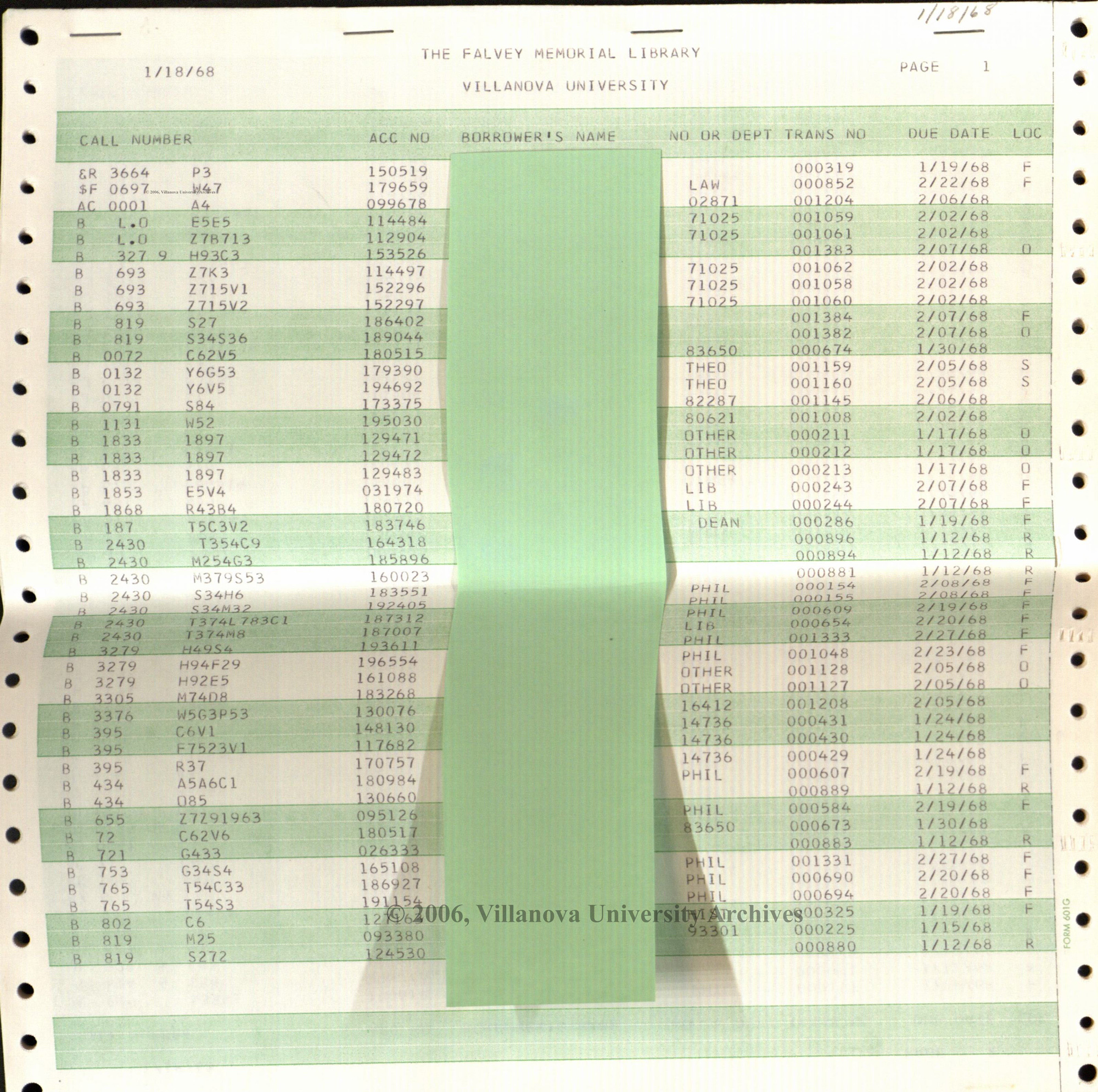

I was on the credit card fraud team. Every day we reviewed a report that looked straight out of the 80’s. Well, it technically was out of the 80’s. The report showed the credit card number and a count of the number of transactions for the prior day. It was sorted in count descending order. It looked a little bit like this.

On Mondays and around Christmas that report would be stacked a few feet high, and the other analyst and I would have to rip the pages apart and work our own sections. As volumes of card transactions increased, you had to work more. It was old school.

But it was simple. Not too much to think about. Just look for stolen cards where there was a bunch of activity from the day before.

The Check Fraud team was across the floor. Every day they would get a box of checks that were being processed. They would have to pull the signature cards for the accounts and validate that the signatures matched. It was so archaic that they had to actually get the physical check out of a box, and then get the signature card, and then eyeball it.

Everything was paper. It was so manual.

Every Year Things Got Crazier and More Insane

As the years rolled by, things just got crazier and more insane. The banks I worked for started rolling out more products that made me cringe with fear. “Why Are They Doing This!?!” I would say every month as they rolled out more and riskier things. “Are they insane?”

IVR’s, Online Banking, Mobile Banking, Easy Mortgages, Easy Auto Loans, Person to Person Payments. Those products scared me to death as they rolled them out. Things were getting more and more complex with every new fangled product we rolled out.

We tried to yell and scream about them, but you see, the fraud manager does not run the bank. No, that is usually someone in sales and marketing. Those guys just want growth and convenience for customers which is exactly the opposite of the way a fraud manager thinks.

They introduced IVR and the first thing they did was let customers change their PIN over the phone without ever talking to an operator! They soon found out that 1 out of 10 requests turned out to be fraud and stopped it. Such is the way of progress in banking. Fraudsters are usually the first to adopt the new features and customers follow later.

Fast forward 25 years later and it’s no wonder we’re experiencing more fraud than ever before. Not only have we opened the door to customers and convenience, but we opened the doors to fraudsters too.

Senior Executives May Not Grasp Fraud Management Completely

I think there is a big gap between what senior executives think fraud management is, and what it actually is.

I have run into Senior executives that think the solution to fraud is simple – just buy a platform to manage fraud and hire a few people. “Set it and Forget it” – the Ron Popiel Way.

So they spend several million dollars on a technology and wait for fraud to go down. And they wait. And they wait. And they wait. And they are surprised when it doesn’t.

Fraud management isn’t as simple as “Set it and Forget it” Chicken Roasting

Fraud is not simple. Fraud Management is a mindset of the organization. It is a collaboration of many, not a responsibility of a few. It is a daily battle against fraudsters, not a passive technology implementation. It is a balance of power between the forces of Good (The Fraud Team) and the forces of Evil (The Marketing Team). Just kidding. A little humor.

But you get my point. Fraud is complex. It is ever changing. It shifts like desert sand. It ebbs and flows based on both internal and external factors.

Those internal and external factors have increased in complexity exponentially. We are no longer in the 80’s when a fraud team manages a few things. Fraud teams are managing infinitely more, at a larger scale with far more consequences. We’re living in a different era.

The Fraud Manager today must manage many many more fraud risks than ever before.

The Many Many Fraud Risk That Fraud Managers Must Manage

If you think of the typical fraud department at the typical bank they have many different risks that they are managing each day.

Each of those fraud risks they manage is different. Each of the data sources that are available to run models on that fraud risk is different. And each fraud type requires an expert to know how to manage it.

Increased Products – Bigger Fraud Teams

As you increase fraud risk, you increase complexity and you increase the number of specialist and resources you need. And that’s why fraud teams are growing and fraud spend is growing.

Increased Products – More Fraud Spend

The platforms that worked 20 years ago to manage a couple of fraud types, may not be a good match to the new fraud types and the new schemes. That is why so many platforms have transformed to “OMNI CHANNEL”.

Omni Channel Fraud Solutions have basic components Models, Alerts, Strategies, Case Management and Reporting which can be applied to different risk generically rather than building a fraud solution for every new product that gets created.

These solutions are expensive but they still provide banks and lenders with a platform for growth.

Increased Risk – Point Solutions Still Matter

Platforms are great. But you still need to manage the fraud risk with point solutions that are specific to the fraud problem. You can’t use a mortgage fraud score to find credit card fraud. And you can’t use a check fraud model to find ACH fraud. You need point solutions.

Handy Infographic – Look at all the Risk That Matter

I created this handy dandy infographic to help banks understand just what fraud manager have to go through every day they show up to work.

It certainly is not like it once was. Look at all those fraud risks that have emerged from the good old days! How do fraud managers keep it all in check?

Make sure you pay them well, a good fraud manager is worth of penny!

Thank you for reading!