Credit Repair is a noble business. Helping consumers understand how credit works and then helping them find ways to improve the way they manage their credit just makes the whole system better.

But there is a dark side of the business too; run by con-artist who convince consumers to engage in shady, illicit and sometimes even criminal acts and those elements of the shady credit repair business are working overtime to exploit loopholes in the credit process.

Just this week the FTC and a Federal Judge cracked down on shady credit repair companies by ordering them to cease operations and launching a lawsuit for over $6 million.

The company, Startup Masters NJ is accused of illegally charging upfront fees and falsely claiming to fix consumers’ credit. The company also advised consumers to mislead credit bureaus by filing false identity theft affidavits and to mislead lenders by claiming to be authorized users on other individuals’ credit accounts, according to the FTC.

The company also went by the names Deletion Experts and Inquiry Busters.

Credit repair companies (often run by individuals working out of their home) are recruiting more unsuspecting consumers on social media and it is creating a wave of illicit and questionable activity that is hitting banks across the nation.

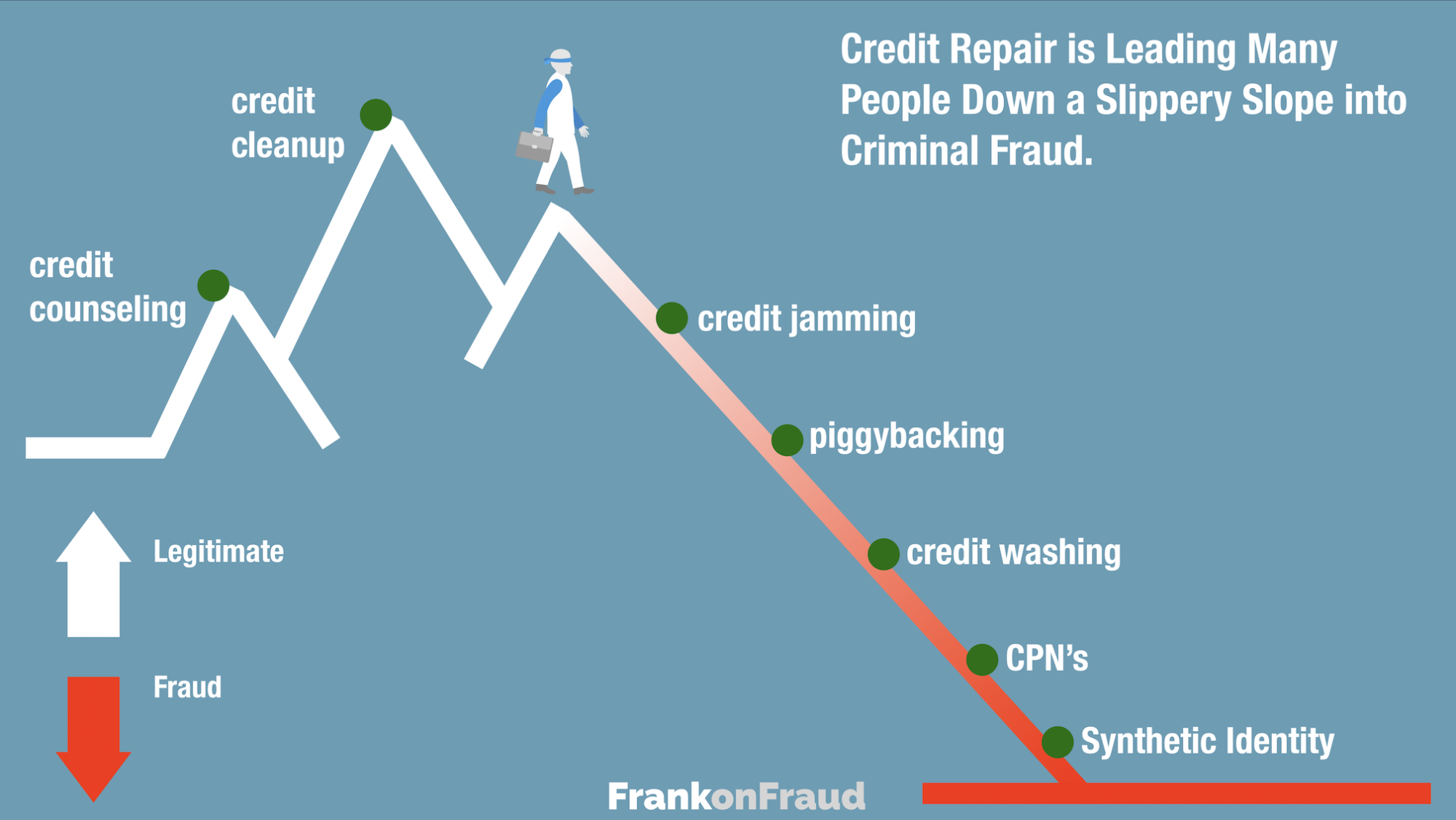

The Slippery Slope of Credit Repair Can Lead Consumers to Jail

Credit repair can start off innocent enough and a vast majority of credit repair companies stay in the zone of legitimacy.

Legitimate credit repair involves two primary activities – credit counseling where the borrower is educated on how credit works and how to resolve debt with their creditors, and credit cleanup where a borrower removes bad data and unauthorized tradelines from their credit bureaus.

But credit repair practices can quickly slide into illegitimate activity through several different unscrupulous methods of cleaning or even hiding a person’s true credit profile.

Credit Jamming – Disputing everything on the credit bureau en-masse to hope that the creditors cannot respond in time – or better yet remove the items completely because they do not want to address it.

PiggyBacking – Buying access to other people’s credit scores by having them add you as authorized users on their accounts for purposes of defrauding lenders

Credit Washing – Disputing tradelines on your credit bureau and claiming they were identity theft and that you never applied for the account.

CPN’s – Stealing other people’s social security numbers and calling them a CPN and using them to hide your true identity.

Synthetic Identity – Creating a brand new identity leveraging a CPN, fake name and fake address to get credit.

A New Wave of Credit Washing is Upon Us

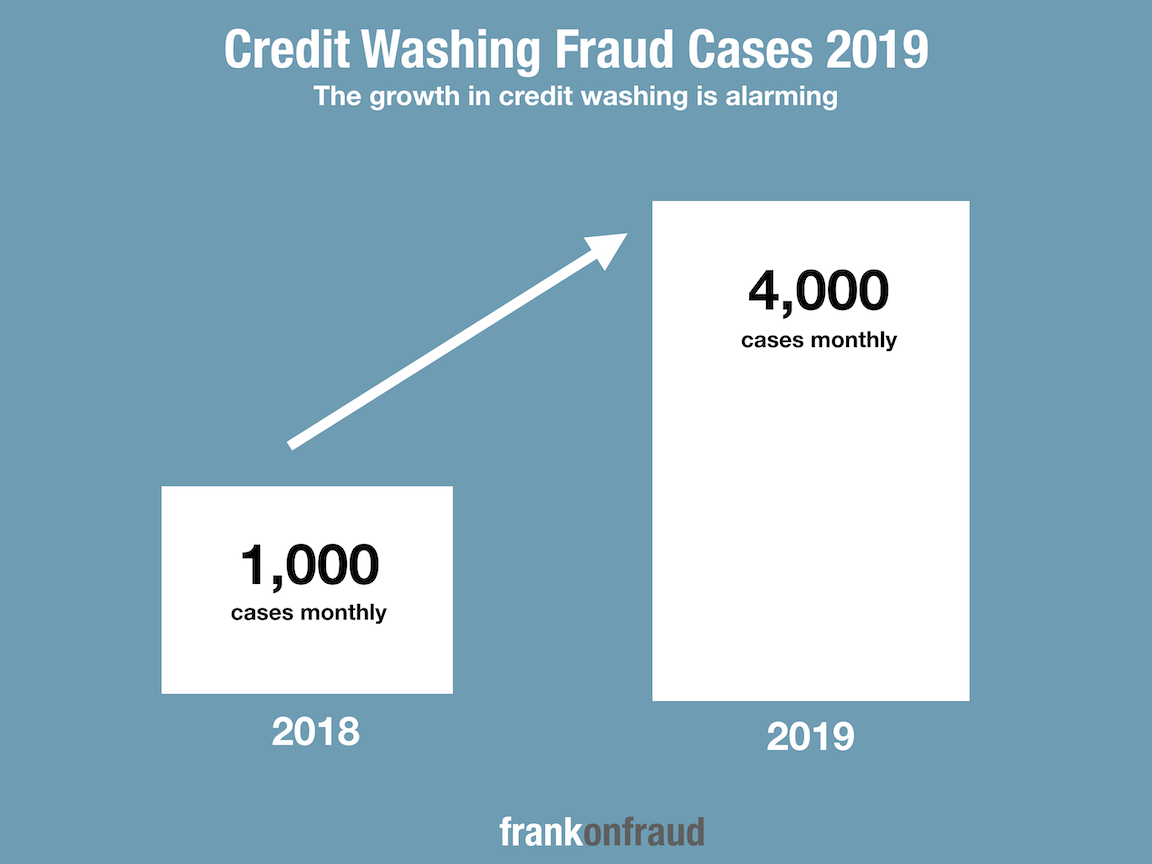

While Synthetic Identity fraud has been on the increase for many years, there is another credit repair fraud that has experienced an alarming increase of late – Credit Washing Fraud.

Credit washing fraud involves systematically disputing all negative tradelines on a credit report, not as reporting errors but as outright identity theft. Credit repair companies instruct the consumer to file a false affidavit claim with the FTC and to use that document to dispute all their negative tradelines due to the fact they were a victim of identity theft.

Earlier this year, many banks started to report a sharp increase in the number and velocity of identity theft disputes coming into their fraud departments for prior loans that they had granted.

Banks and lenders have reported a 500% increase in identity theft claims since Fall of 2018.

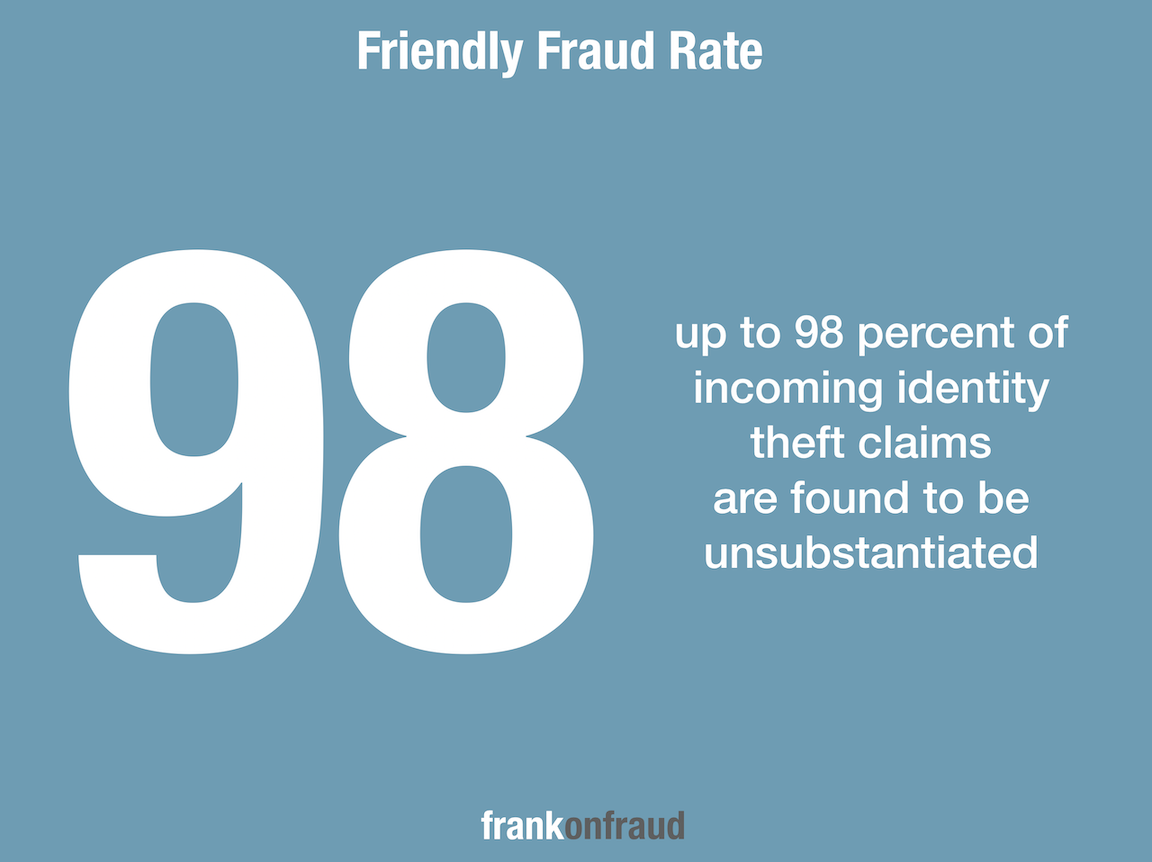

A Case of Friendly Fraud – 98% of Claims are Not Fraud

But how do we know that these are not legitimate cases of identity theft? Perhaps customers are legitimately disputing accounts and loans that they did not apply for?

Well, some banks are reporting that 98% of these newly received identity theft claims are found to be legitimate accounts after they are reviewed by investigators. Only 1 in 50 claims are legitimate identity theft.

What’s Behind This Increase in Credit Washing Fraud?

This may be a systematic and well orchestrated attack on banks and lenders but there has not been a fraud ring identified yet. But there has been a number of factors that appear to be driving the increase in credit washing fraud and they have been forming over the last 2 years.

#1 – The Growth in Information Sharing on Social Media

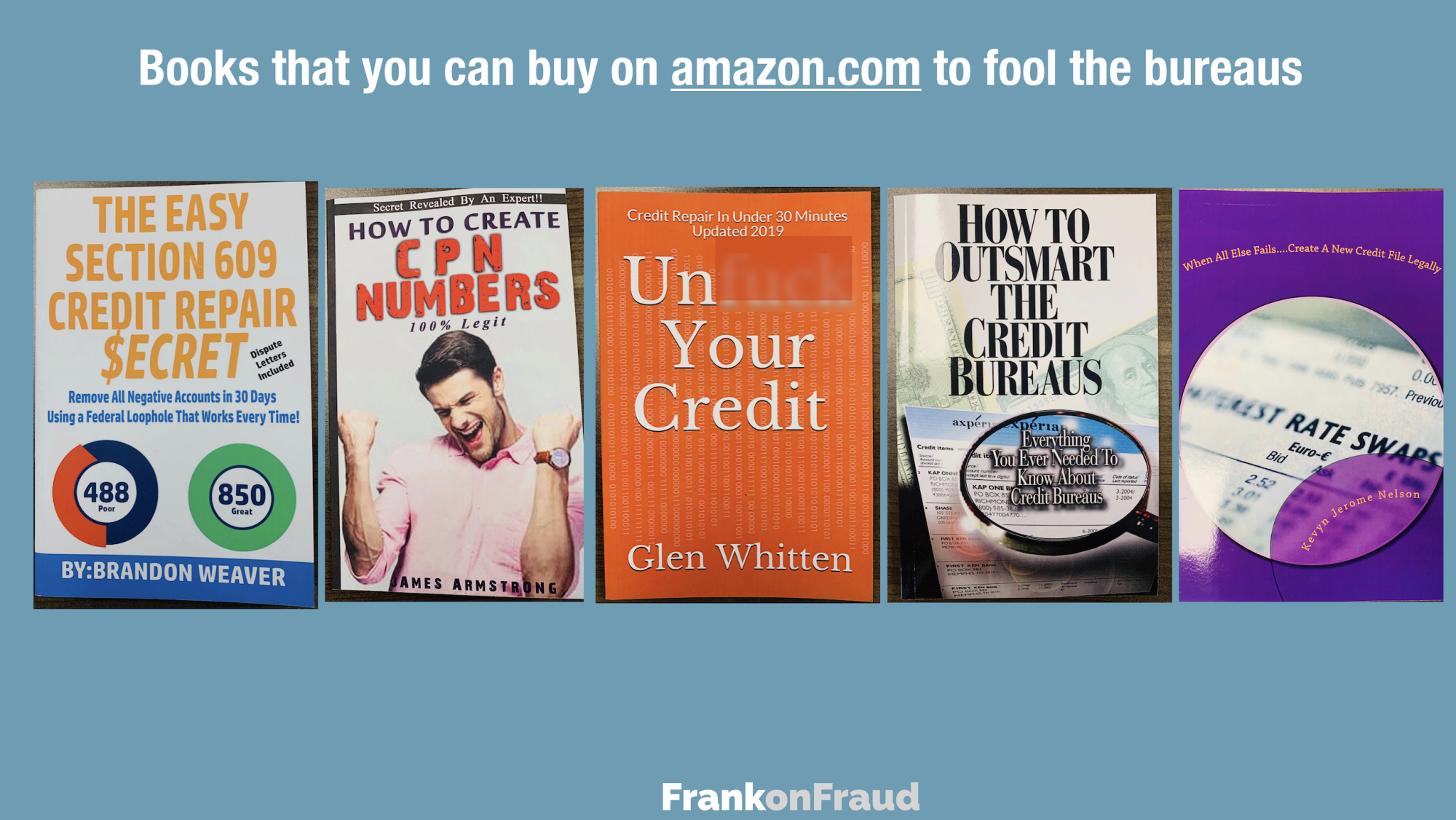

Social media is fueling an unprecedented level of bad information sharing among fraudsters and con artist. You can go to Youtube and find hundreds of videos that teach you how to commit credit repair fraud

And On Amazon.com, I was able to purchase ebooks and paperback books that taught me precisely how to fool the credit bureaus. Almost every single book taught me the same basic principals – credit washing, CPN’s, Piggybacking tradelines and creating synthetic identities.

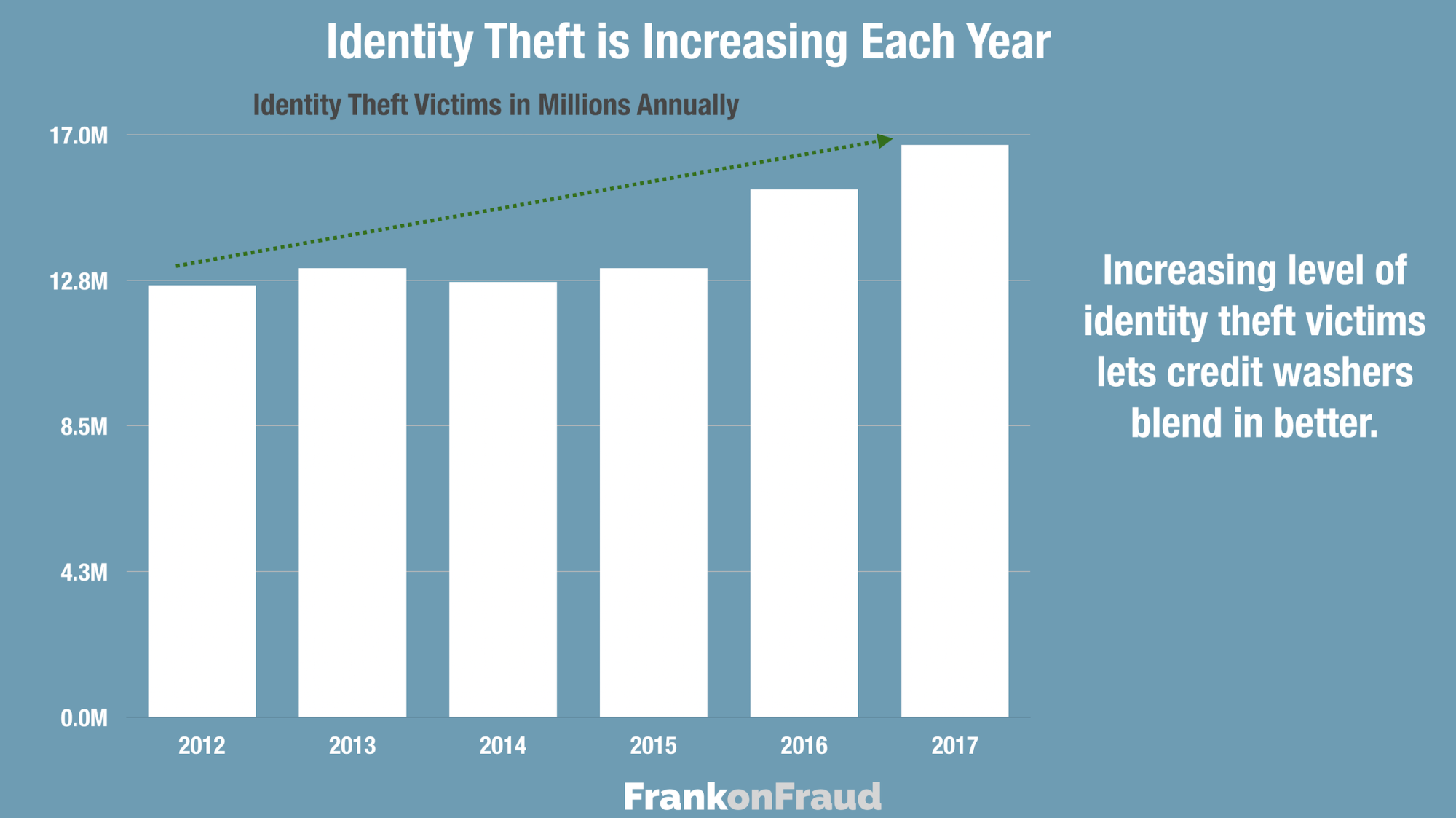

#2 – The Growth in Identity Theft Levels Each Year

Identity theft is growing each year. That is enabling fraudulent claims to more seamlessly blend into the background as already overworked investigators try to keep up with the barrage of claims they receive.

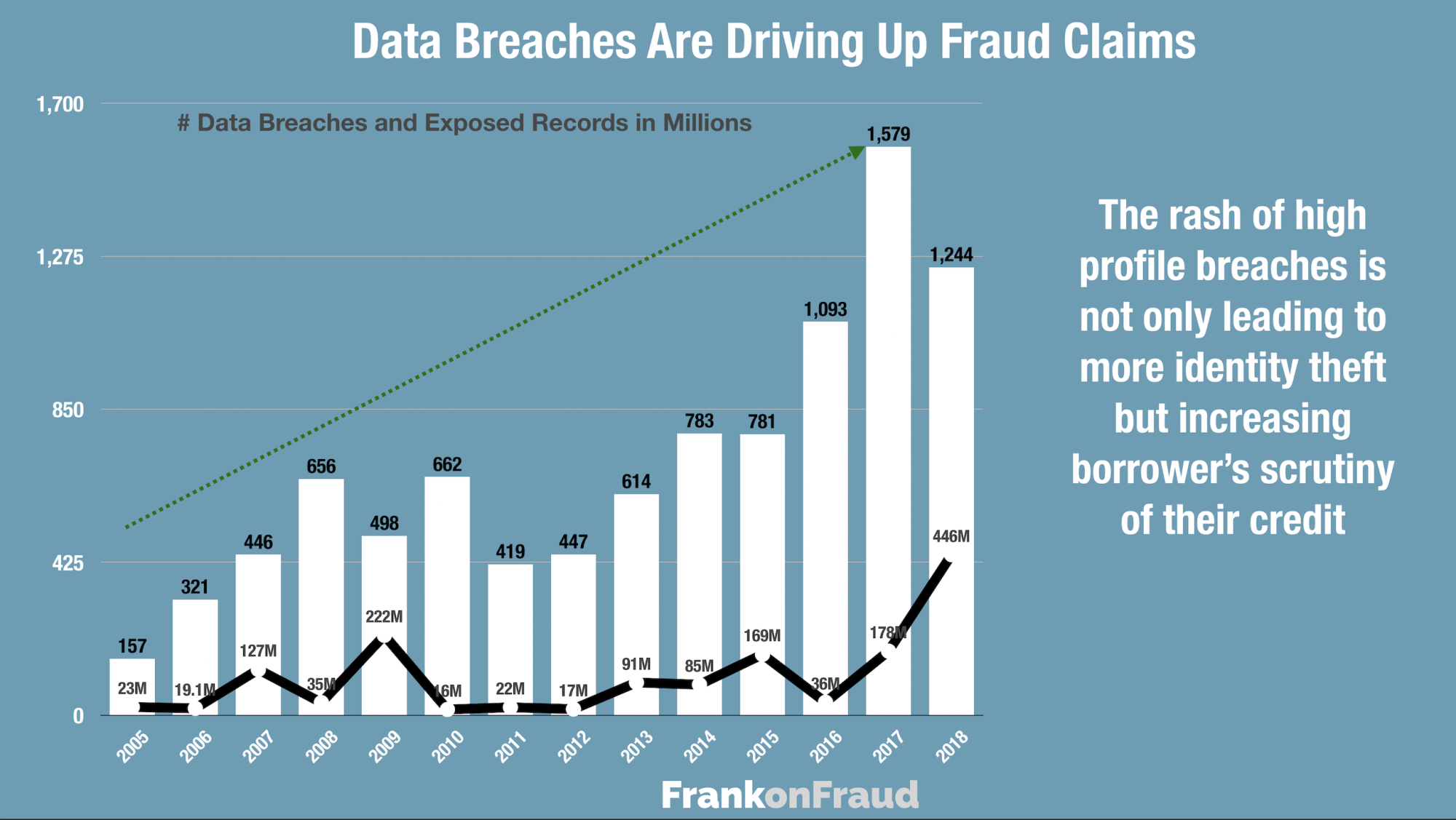

#3 – The Growth in Data Breaches

The rash of high profile breaches is not only leading to more identity theft but increasing borrower’s scrutiny of their credit. This, in turn, may cause more consumers to dispute legitimate items and drive up false fraud claims.

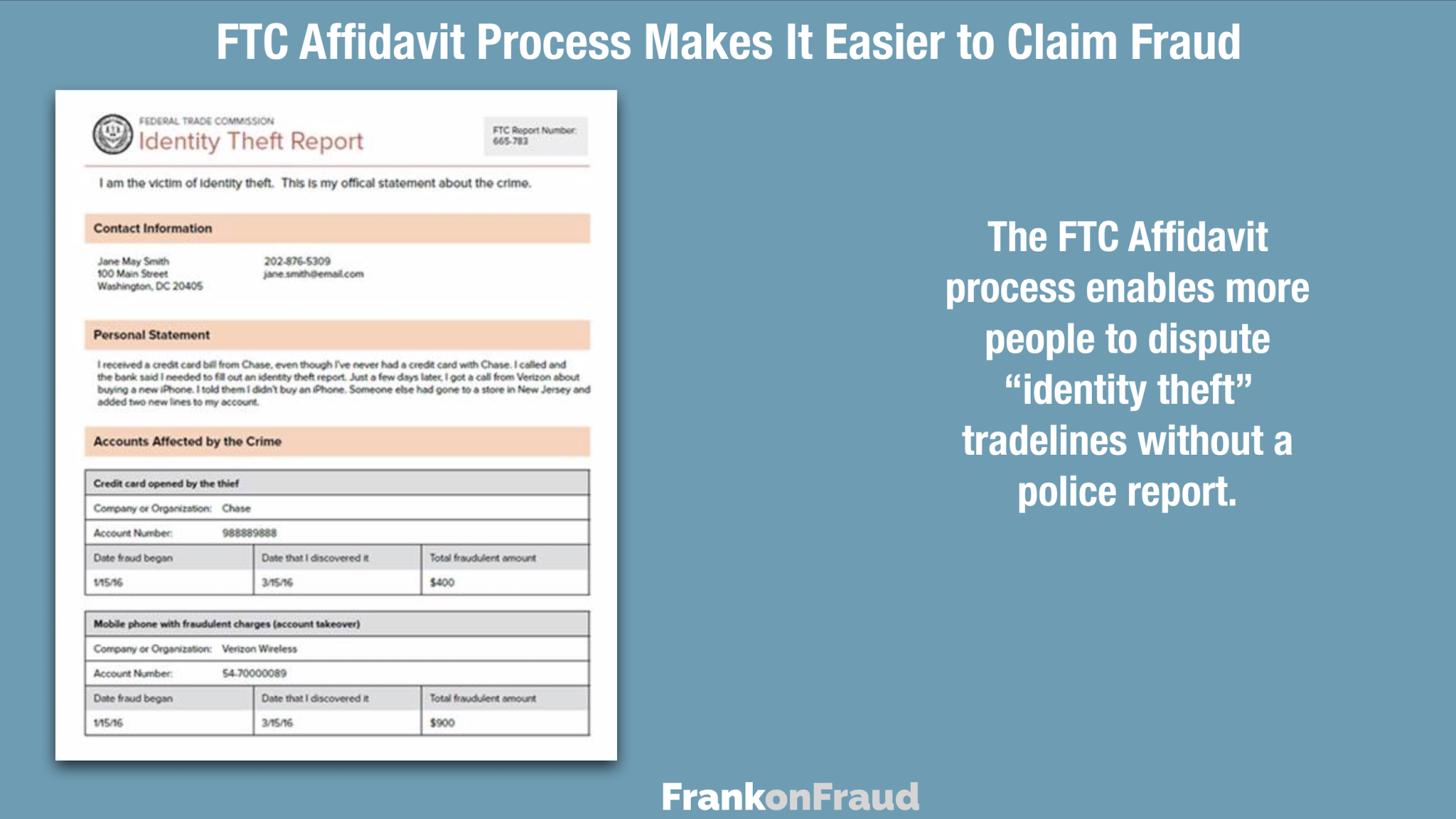

#4 – The FTC Affidavit Process Makes It Easier to Claim Fraud Without Police Reports

The FTC ruled that their affidavit is enough to warrant an identity theft claim. This FTC Affidavit process enables more people to dispute “identity theft” tradelines without a police report. Many consumers that might have been previously afraid of filing a false police report have no problem filing a false affidavit and submitting it to the credit bureaus.

Each of these things appears to be part of the now epidemic level of credit washing fraud that appears to be taking place.

What’s Can the Industry Do About It?

The financial industry is mobilizing to fight back against the wave of credit washing schemes.

#1 – Eoscar Universal Forms to Speed Up Claims Handling

The first initiative is being undertaken by Eoscar, the universal system developed by the credit bureaus to provide Data Furnishers with an online solution for processing Automated Credit Dispute Verifications and Automated Universal Data forms.

Sources indicate that Eoscar is creating a more standardized and efficient way for data furnishers to respond to the rising wave of identity theft claims. This should shorten the time it takes to respond and reinsert tradelines that have been removed.

#2 – Proactive Prevention By Validating Identity Theft Claims Thoroughly

Unfortunately, many identity theft claims are falsified. The second initiative banks are undertaking is increasing the front end controls when the identity theft claims come into them. They are boosting staff, increasing the education on friendly fraud claims and requiring more substantiation of consumers claims of identity theft beyond just making a simple declaration.

#3 – Requiring Police Reports and Validating Police Reports

Some banks and lenders are initiating requirements for police reports to validate the consumers claim of identity theft. In some cases banks are discovering that fake police reports are being purchased online or forged by consumers. In those cases they are validating the police reports directly with the police department.

But police reports are not infallible. A network of dirty Miami-Dade County police officers and other local cops were arrested in 2015 for falsifying police reports for fraudsters. At least four officers wrote 215 falsified police reports for $200 to $250 a pop that were used to claim customers were victims of identity theft — when they were not.

#4 – New Application Credit Washing Indicator Flags

Since many credit washed credit bureaus are making their way back into the credit cycle, lenders, banks and finance companies are implementing proactive reviews of credit bureaus that appear to have “washed” indicators. I won’t detail what those red flags are here since shady credit repair companies will only use that information to hide their sinister deeds further but if you want to know what they are, feel free to reach out to me.

What’s Next in Credit Washing?

The wave of credit washing is just beginning. The next phase will be a more damaging phase to the financial industry when all those credit washed consumer bureaus begin to make their way back into the credit cycle.

Armed with improved credit scores and little debt to worry about, those same borrowers will begin to apply for, and receive new lines of credit which will inevitably begin to default.

At PointPredictive we monitor loan applications carefully looking for red flags to identify risky applications associated with credit washing. The fraud consortium perspective provides a unique insight into this type of activity. We’ll keep our eye on this one carefully to see what develops.