American Banker had an interesting report on Zelle this week – Zelle Anti Fraud Effort Trips Up Customers.

They report that the person-to-person payments service Zelle differentiates itself from rivals by promising users that transactions sent over its network will clear in near-real time. Yet in recent months, the service has faced a number of complaints from consumers who say they are having problems sending or receiving money or setting up accounts in the first place.

Zelle has acknowledged the problems but says the occasional delay is the price some users will have to pay as the big banks’ rival to PayPal and Venmo aims to create one of the industry’s strictest fraud-prevention programs.

Fraudsters Are Stepping Up Their Efforts

Consumers want instant and easy enrollment in Zelle. They want the ability to send cash at the drop of a dime. But so do fraudsters. And banks are reporting that fraudsters are loving the new service even more than many consumers.

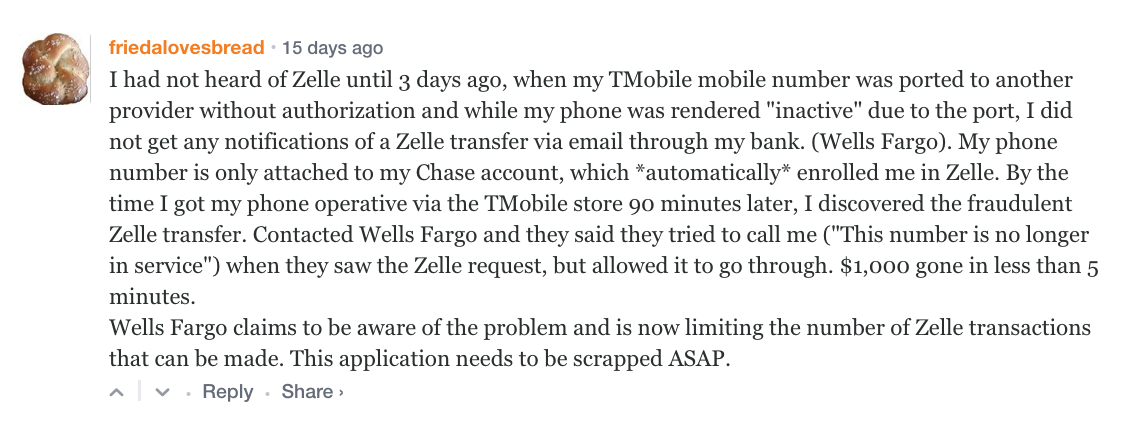

Check out this recent comment a consumer that was recently posted to FrankonFraud. Sadly, this type of scam is becoming more commonplace as fraudsters attempt to steal consumers money right from under their noses.

From recent post and comments, it appears that fraudsters are targeting P2P providers with the following general scams.

There are others that emerge but these the big ones.

- Account Takeover Scams – Fraudsters are taking over consumers online bank accounts through phishing emails, phone calls. They then log into those accounts and use Zelle and other payment types to wipe out that consumers accounts. They are calling the customer pretending to be the bank and having the customer divulge their usernames and passcode.

- One Time Pass Code Phishing – Fraudsters are loading consumers debit cards onto a new device and then bypassing One Time Password controls by contacting the consumer directly.

- Phone Porting – Fraudsters are porting over consumers cell phones to another number and then using that to get access to Zelle and other P2P apps to transfer money fraudulently.

Zelle Is Stepping Up Their Efforts Too

Zelle is not sitting idly by however and is stepping up security to crack back at fraudsters that are attempting to abuse the payment service.

“We have taken extra steps during the enrollment process to verify that Zelle is not enrolling a debit card that has been compromised by fraud and to verify each applicant’s identity,” said Lou Anne Alexander, group president of payments at Early Warning, the company that operates Zelle. “Sometimes when those don’t match, that’s https://staging.https://staging.https://staging.https://staging.https://staging.https://staging.https://frankonfraud.com/wp-content/uploads/2016/09/online-fraud-losses-7.jpgonfraud.com/wp-content/uploads/2016/09/online-fraud-losses-6.jpgonfraud.com/wp-content/uploads/2016/09/online-fraud-losses-5.jpgonfraud.com/wp-content/uploads/2016/09/online-fraud-losses-4.jpgonfraud.com/wp-content/uploads/2016/09/online-fraud-losses-3.jpgonfraud.com/wp-content/uploads/2016/09/online-fraud-losses-2.jpgonfraud.com/wp-content/uploads/2016/09/online-fraud-losses-1.jpgly been a friction point with our customers.”

While Zelle refuses to divulge their security practices which is a wise move, they do indicate that they do multi-channel security checks to stop fraudsters from stealing consumers identities, accounts or debit cards.

It appears that those security checks might be impacting some customers from enrolling their accounts on the platform.

StandAlone Zelle App Consumers Are More Likely To Be Impacted

American Banker reports that “hundreds” of consumers have been complaining and that a majority of those complaining appear to be doing business with banks outside of the Zelle Network. Those consumers are using the stand-alone app that can be downloaded off the internet.

But while “hundreds” of consumers might complain, the fact is that millions of others appear to be using the app with no problem. I downloaded the app, installed it, registered my debit card and sent money to a friend in less than 5 minutes. It worked for me perfectly and was a superior experience than my current Venmo account.

Venmo transactions can take 2-3 days for money to clear, while Zelle transactions pop up with an alert notifying my friends of the transfers almost immediately.

It is that instant gratification that has Zelle growing like crazy, but which has also drawn the attention of fraudsters that love instant money.

Fraud Controls are Always Unpopular But Necessary

I applaud Zelle for not wavering and turning off fraud controls just because a few customers have been impacted.

Too many times, I see banks, lenders and finance companies turn off their fraud controls, tools, and processes when complaints become too visible to higher management – or in this case the media.

When fraud controls are turned off, fraud increases and the stakes for consumers, for banks and for Zelle are just too high.

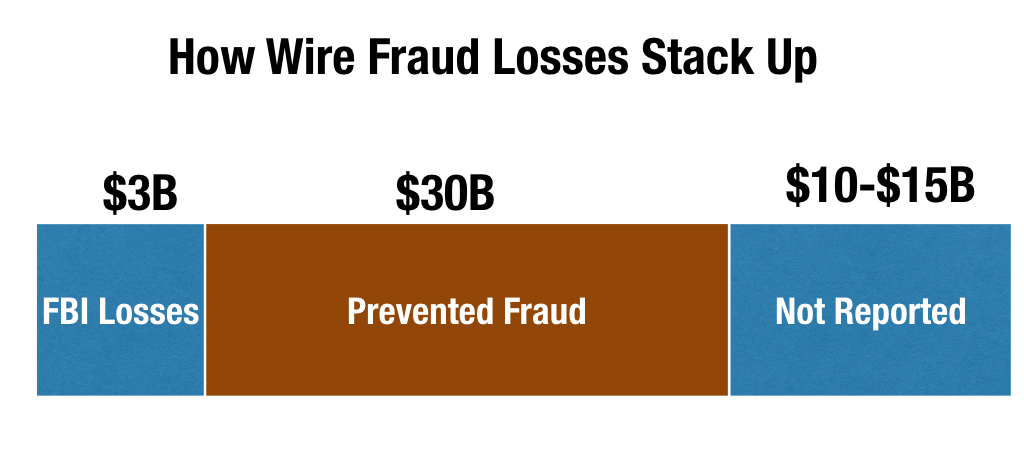

Fraudsters have their sights on instant payments and they are eager to replace manually requesting wire transfers to use Zelle instead. Wire Transfer fraud is a 30 to 50 billion dollar a year issue and if successful, that type of fraud could easily shift to P2P instant payments without solid controls.

Data Breaches and EMV Are Driving Up Opportunity

While the fraud potential is high, there is another reason why Zelle is stepping up their efforts. The unprecedented level of breaches has given fraudsters more access to stolen credentials that are used for a wide variety of purposes.

Fraudsters have access to your bank login details, to the details that you use to setup your phone service to your email access credentials. All of this information makes it far easier for them to fraudulently setup a Zelle account in your name.

And EMV Chip cards are pushing fraudsters to other channels that don’t require the merchant to read the Chip – and that is where Zelle comes in. Fraudsters have millions and millions of card numbers but they do not have access to the Chip so naturally, they are trying to use those cards by loading them on phones or using the cards online.

2018 promises to be a very interesting year for fraud practitioners as they grapple with these new payment methods and all of this stolen information.

Thanks for reading!