The lending industry has a higher cost of fraud than any other industry; that includes auto lenders, mortgage lenders, digital lenders and bank lenders.

In their 2017 True Cost of Fraud study, LexisNexis interviewed 1,196 executives across hundreds of e-commerce merchants, banks and lenders and determined that lenders spent $2.82 in cost, fees, and interest for every dollar of fraud loss incurred.

Digital Lenders are the hardest hit and incur costs of close to $3.07 for every dollar in fraud.

Cost of Fraud Goes Beyond Losses

For every $1 of fraud costs an organization experience between $2.82 to $3.07 dollars– that means that fraud costs them more than roughly 2 1⁄2 times the actual loss itself.

Those cost beyond fraud include; the cost of tools, the cost of fraud personnel, the cost of fraud detection, recovery, reporting, and investigations.

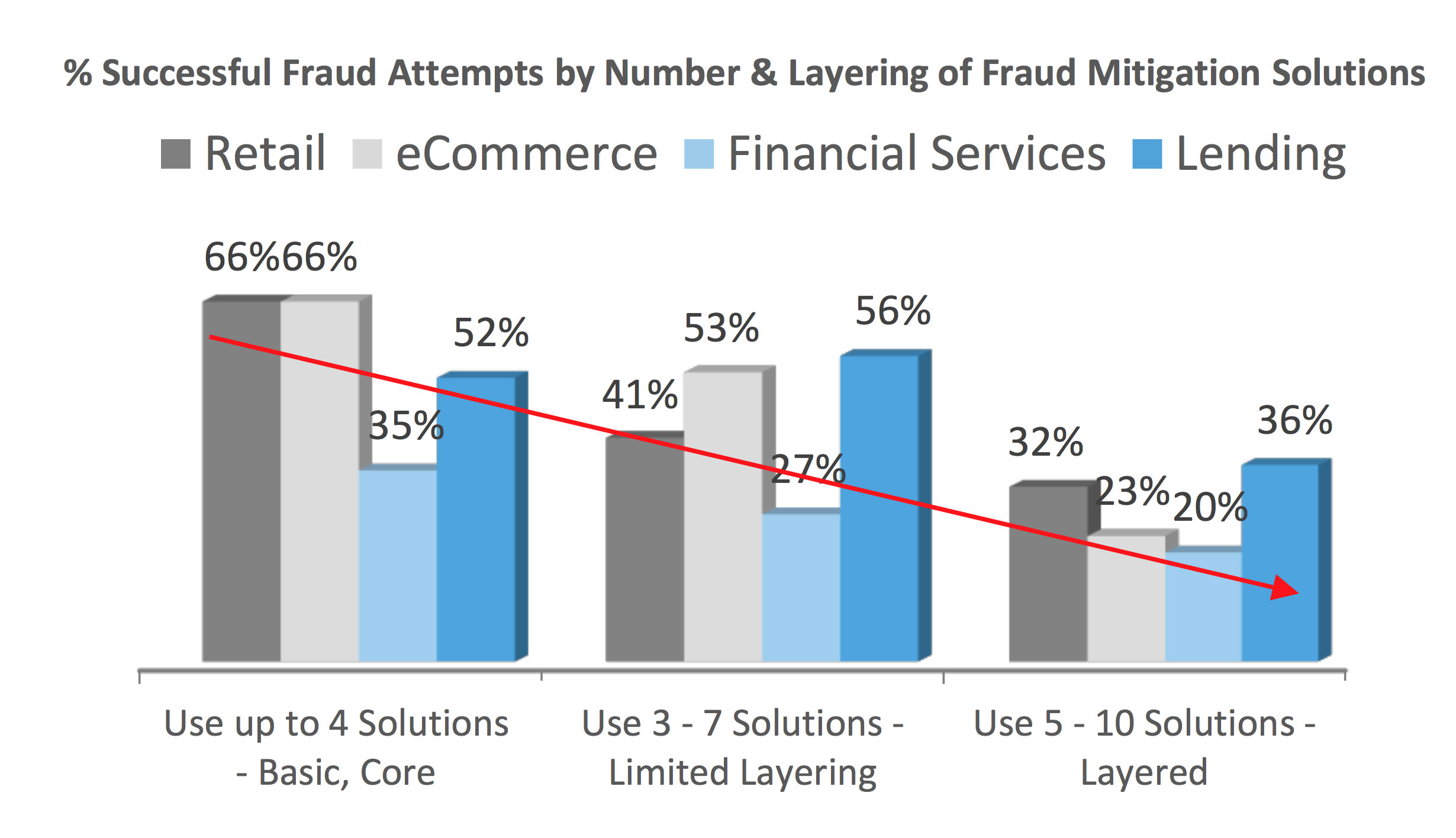

If one made the mistake to think that lowering the cost of fighting fraud would lower their overall fraud budget, they would be sadly mistaken. LexisNexis further determined that those companies that spent more on fraud and layered more tools to fight fraud a variety of ways had overall lower losses and cost that did not spend the money.

An ounce of prevention is worth a pound of cure.

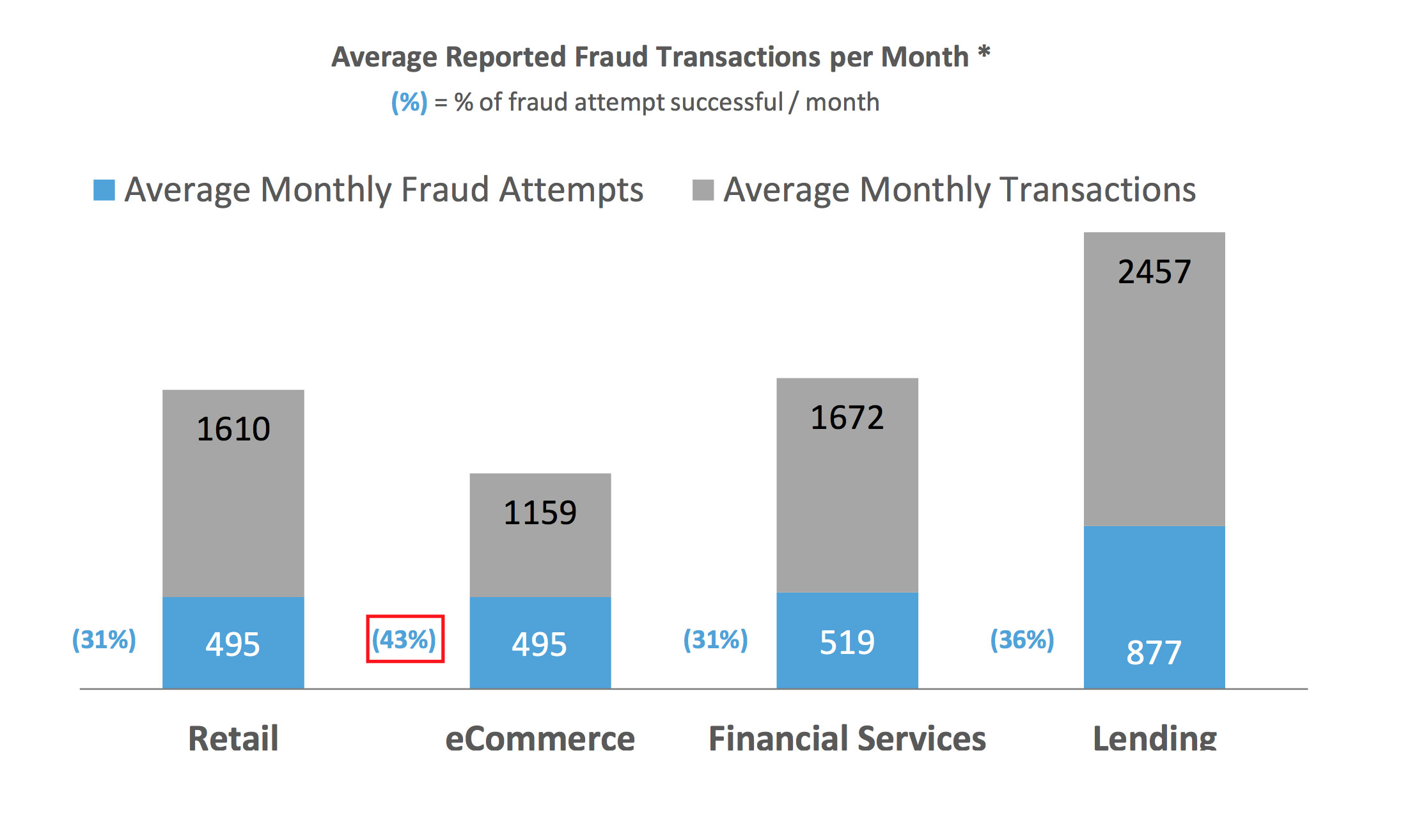

Fraud Attempts are High In Lending

Digital Lending has the highest fraud attempts of almost any of the fraud channels. In fact, LexisNexis determined that approximately 36% of lending applications were fraudulent.

Lending firms which layer solutions, experience fewer issues and cost of fraud.

Retailers, eCommerce merchants, and financial services & lending firms which layer solutions by identity and fraud transaction solutions experience fewer issues and cost of fraud.

- They detect more fraud and have few successful attempts

- They have fewer manual reviews

- Their overall cost of fraud is less as they have far fewer losses.