The CFPB has been used and abused by credit washers for so long, and they are not going to take it anymore.

This week they announced several sweeping changes designed to prevent credit washing scammers from filing frivolous complaints.

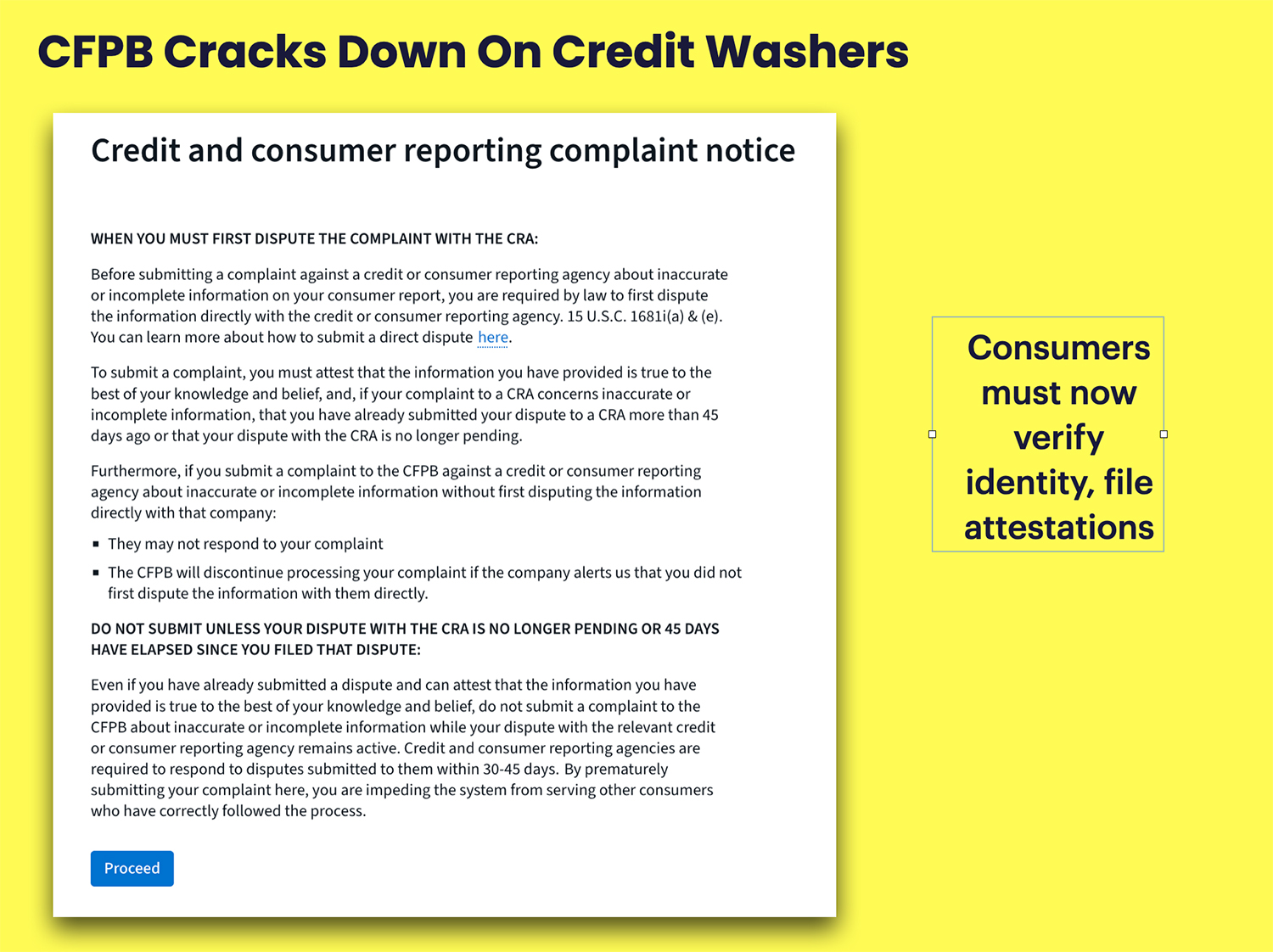

The changes will include: 1) forcing consumers to verify their identity before filing a complaint, 2) requiring them to file an attestation of truth, and waiting at least 45 days after filing a dispute with the credit bureaus to file their complaint.

Consumers that want to file complaints must now navigate through 3 separate pages of disclaimers and instructions before reaching the complaint form.

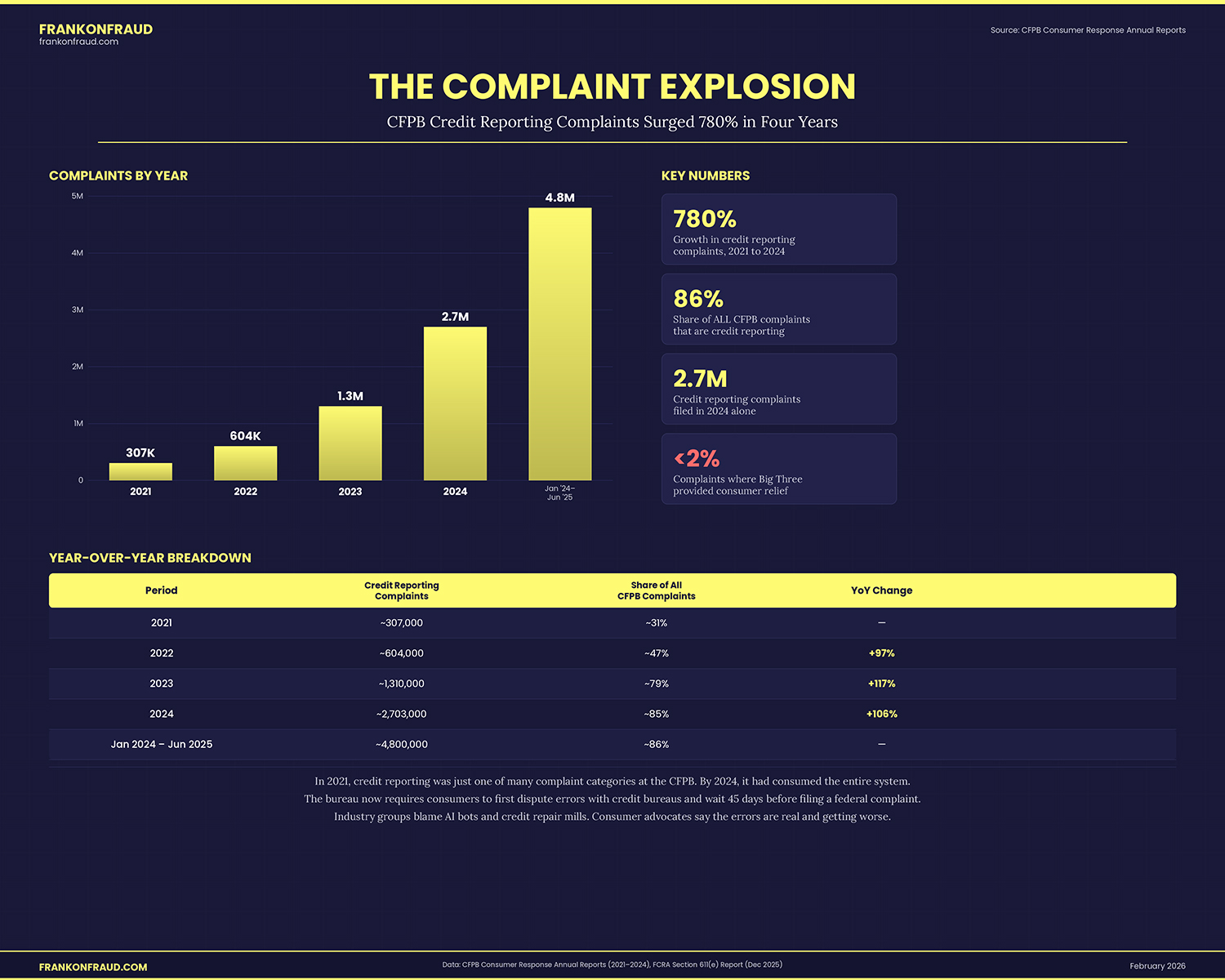

The new requirements respond directly to a years-long campaign by credit bureau trade groups who argue the complaint portal has been overrun by AI bots and credit repair companies filing meritless, duplicative complaints.

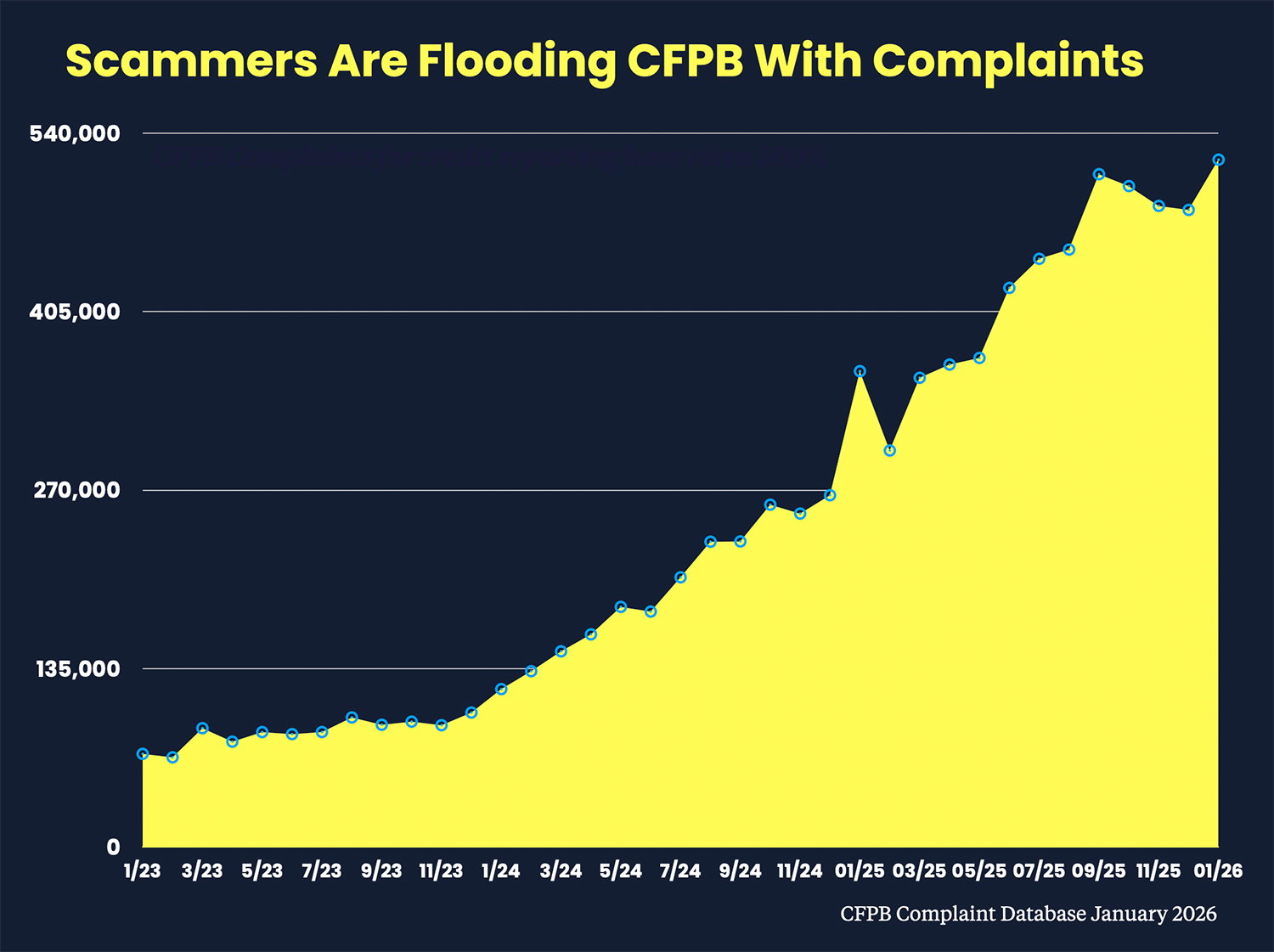

CFPB Complaints For Credit Disputes Hit Record Last Month

The CFPB provides a lot of transparency around complaints they receive. So if you visit there complaint site, you will note that complaints for credit disputes have soared from approximately 80,000 a month in 2023 to a record 520,000 complaints a month by January 2026.

Experts believe a vast majority these reports are bogus and are being generated by bots and through AI websites that are touting automation of “credit sweeps”

The Changes Come After Industry Groups Took Action

The timing of the changes is not just a coincidence. The CFPB’s drastic action took place after industry groups sent letters advising the agency of how bad their portal was being abused.

On January 27, 2026, the Consumer Data Industry Association — the trade group representing Equifax, Experian, and TransUnion — sent the CFPB a letter requesting sweeping changes to the complaint portal.

The following day, the American Financial Services Association filed similar comments. Within a week of those letters, the CFPB has implemented several of their core demands.

But there are more to come, and scammers may be out of luck because the industry groups are demanding even more.

They want the CFPB to require date-of-birth and demographic data, implement two-factor authentication, restrict the number of complaints per phone number, and limit complaints from a single IP address.