A wave of new viral glitch videos is flooding TikTok and Telegram and its promising viewers free electronics from Best Buy.

In reality, scammers are using stolen identities to open fraudulent accounts on Klarna’s Buy Now, Pay Later (BNPL) service and claiming its a quick and easy hack to get “free” iPhones, iPads, electronics and sneakers that you don’t have to pay for.

The fraud follows the playbook of the infinite money “Chase Glitch” of September 2024 which resulted in Chase filing lawsuits and sending over 1,000 demand letters to participants.

But the “Klarna Method” is far more insidious: instead of scammers exploiting their own accounts, they are using stolen identities and victimizing innocent third parties.

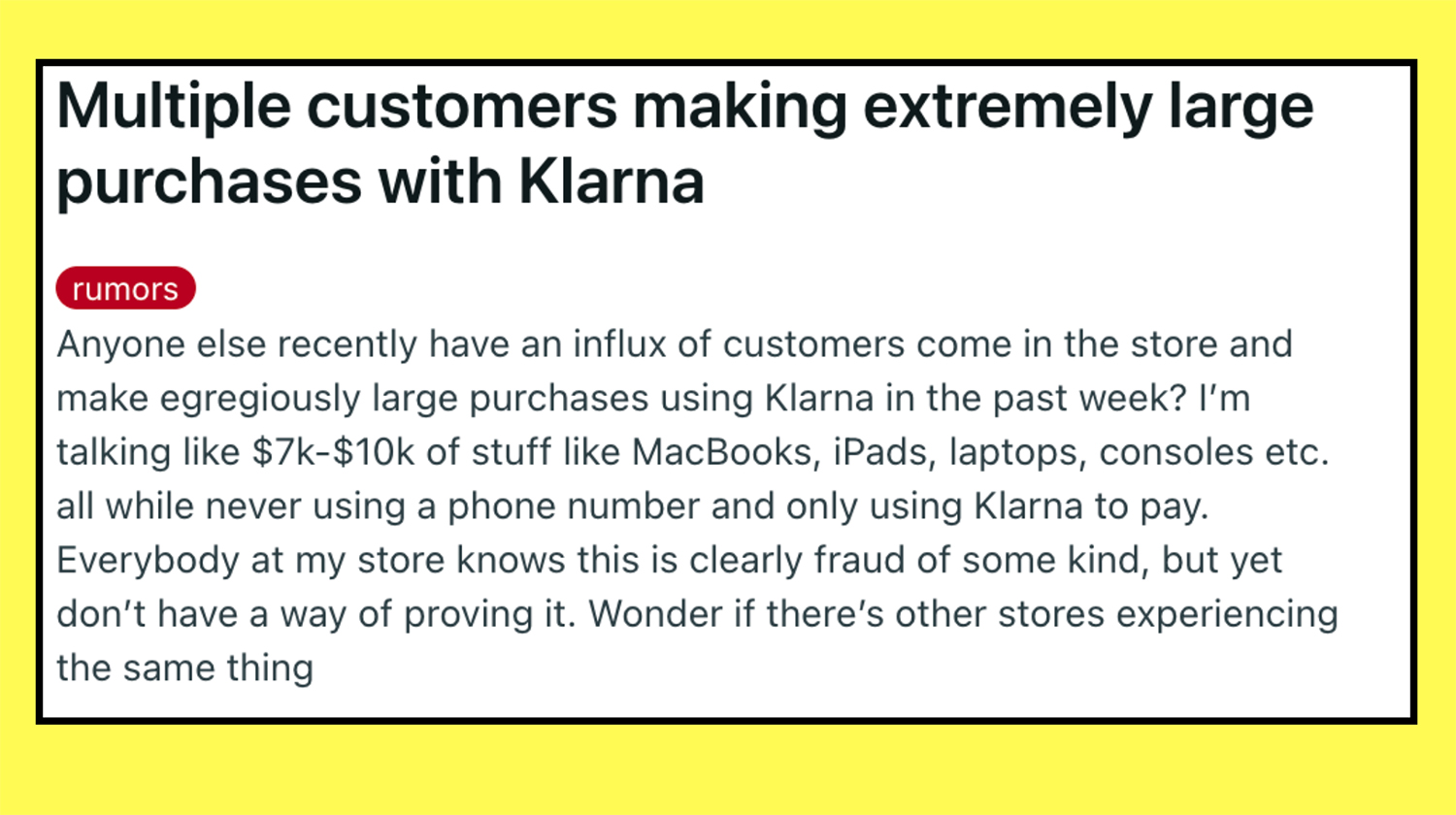

An Influx Of Customers Making Extremely Large Purchases With Klarna

The Klarna Glitch first percolated on social media in Detroit Michigan. Something strange was happening at area Best Buys and it was all over TikTok.

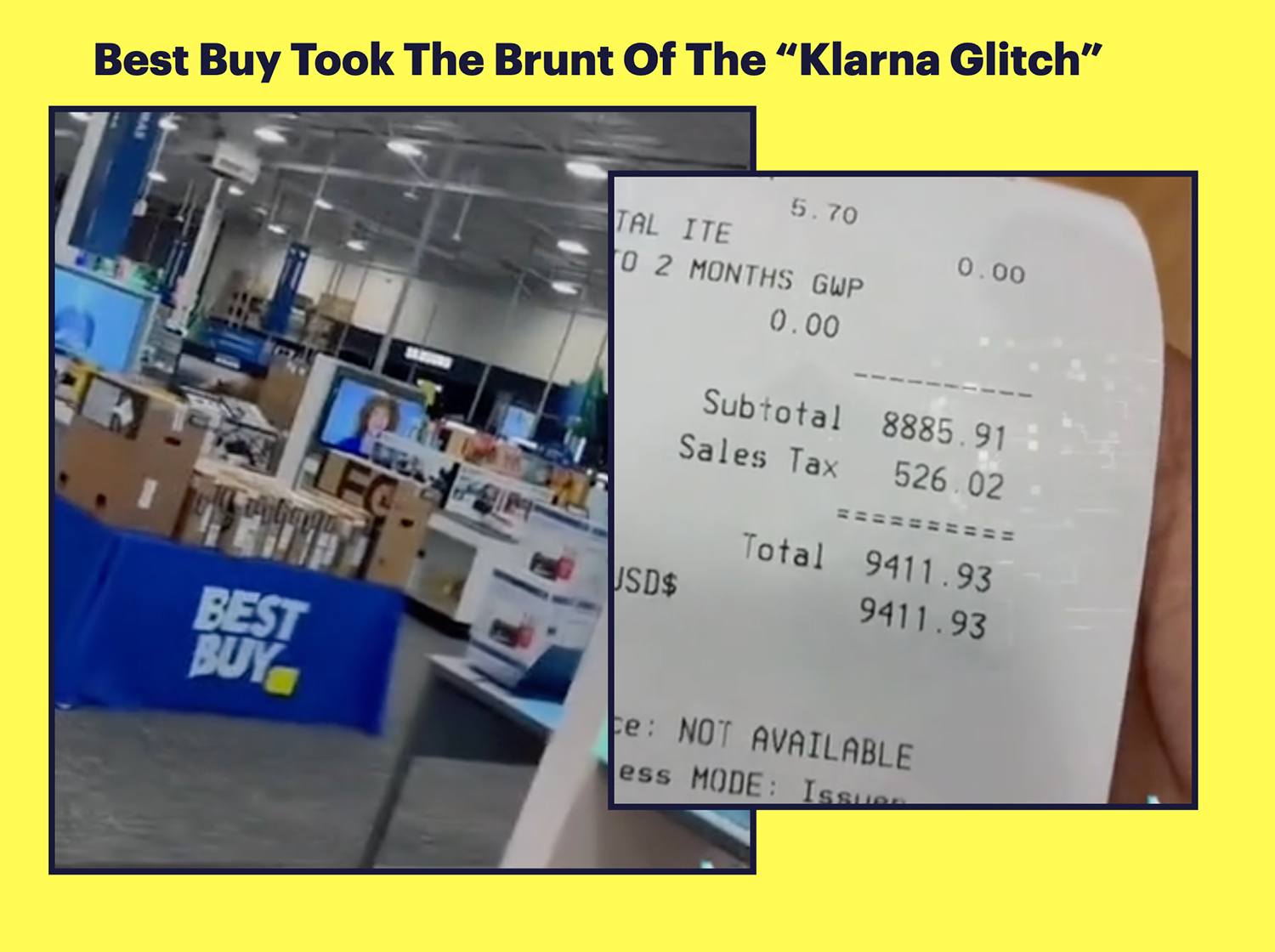

In the week before Christmas, employees from multiple Best Buy electronics stores reported dozens customers making extremely large purchases with Klarna, buying up iPad Pros, gaming consoles, and Apple Watch Ultras to the max allowed.

One Best Buy employee remarked, “It’s a Klarna fraud thing that’s ‘known” and they warned that “a lot of innocent people are getting hit with ‘suspicious activity’ from their banks”.

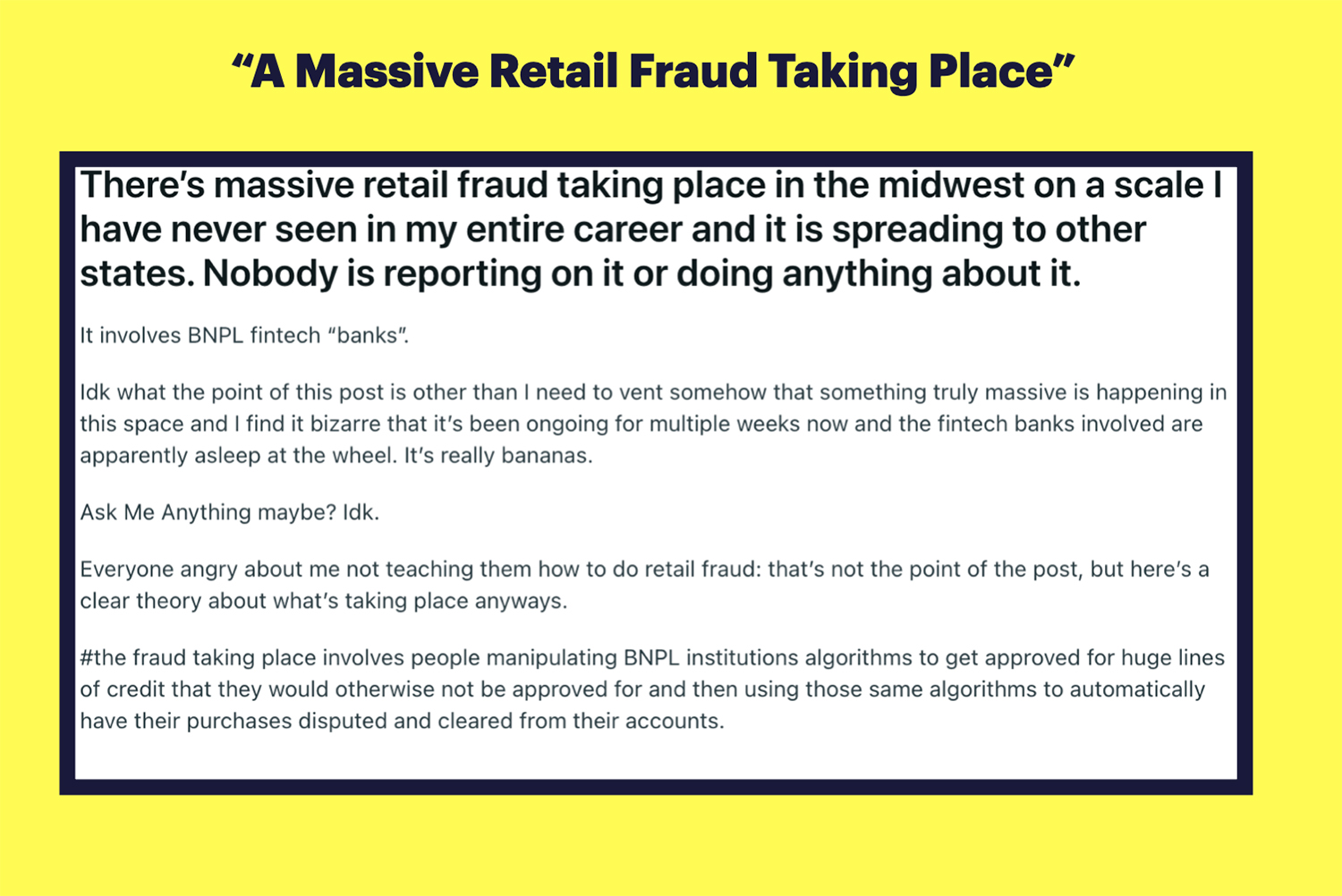

A Massive Retail Fraud Taking Place That No One Is Talking About

Other Reddit users began to notice the trend as well, with one user reporting a “Massive retail fraud” on a scale that they have never seen before.

He was astounded that fintech banks appear to be “asleep at the wheel”.

“I need to vent somehow that something truly massive is happening in this space and I find it bizarre that it’s been ongoing for multiple weeks now,” he says, “and the fintech banks involved are apparently asleep at the wheel. It’s really bananas”.

TikTok Influencers Go Wild On The Trend

As the scheme spread, many TikTok influencers began to jump on the trend.

These users often obscured their identities, often showing stacks of products or receipts as “proof” of the glitch. One viral TikTok clip showed a crew celebrating a $9,000 haul from Best Buy, claiming they’d gotten the items essentially for free.

@whatstrending Viral videos circulating on TikTok and Telegram are promoting a so-called ‘Klarna Method,’ which scammers falsely market as a ‘money glitch’ to acquire free electronics and luxury goods. In reality, this technique is a rebranded form of identity theft where perpetrators use stolen personal data, known as ‘Fullz’ on the dark web, to open fraudulent Buy Now, Pay Later accounts. By exploiting Klarna’s instant ‘soft check’ approval process, these criminals max out credit limits on high-value items like iPhones and Playstations, leaving unsuspecting victims with massive debt and ruined credit scores. See how this is affecting Klarna’s ongoing legal troubles. https://whatstrending.com/video/tiktoks-viral-klarna-glitch-just-made-their-massive-ipo-lawsuit-nightmare-worse/

♬ original sound – WhatsTrending

@eagleslover215 Klarna method glitch explained #klarna #klarnamethod #klarnaglitch #detroit #identitytheft

♬ original sound – eagleslover215

But not everyone was hyping the trend, many influencers were warning that the new trend was outright fraud.

@user5516005335681 WARNING | Klarna “Glitch” Will Result In Jail Very Soon #breakingnews #live #viral #trending #fyp

♬ original sound – Snyder Reports

@theusagendachannel The Viral Klarna “Glitch” Is INSANE, Now People Are Ruining Their Lives #news #breakingnews #klarna #insane #viral

♬ original sound – TheJayReedNews

Was Someone Even Arrested Doing The Klarna Glitch?

Not everyone was getting away with it though.

At Twelve Oaks Mall in Detroit, rumors spread on Instagram that a person named Antwon Miller was caught attempting a $14,000 “cashout” of Apple products using Klarna under a stolen identity.

While the news of the arrest spread on social media, there was no confirmation that it actually occurred.

Whats Really Going On With The Klarna Glitch?

Despite the “glitch” nickname, there was no magical software bug at Klarna granting free money to everyone.

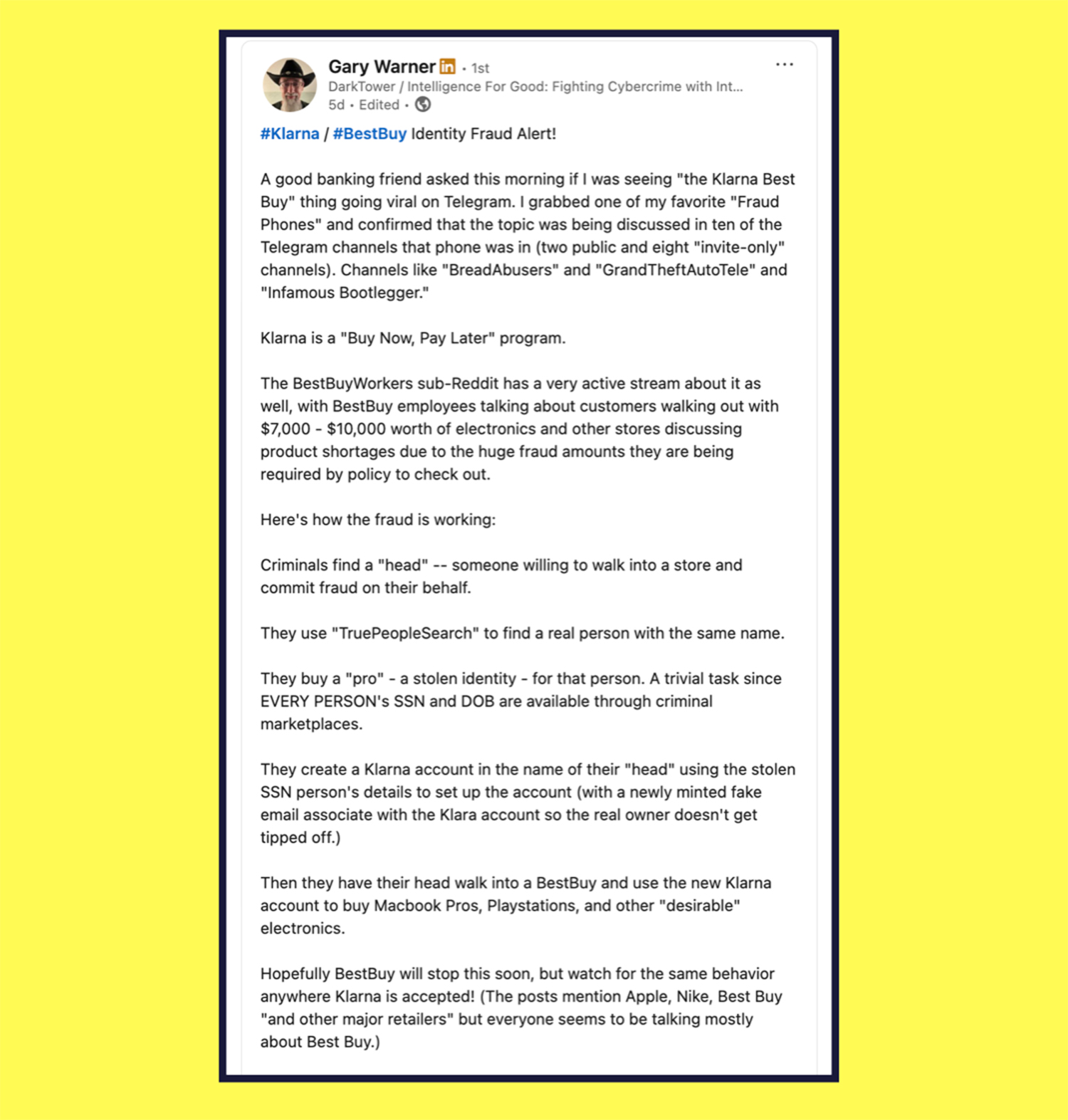

Gary Warner, with Dark Tower broke down exactly how the glitch works after he investigated the trend last week.

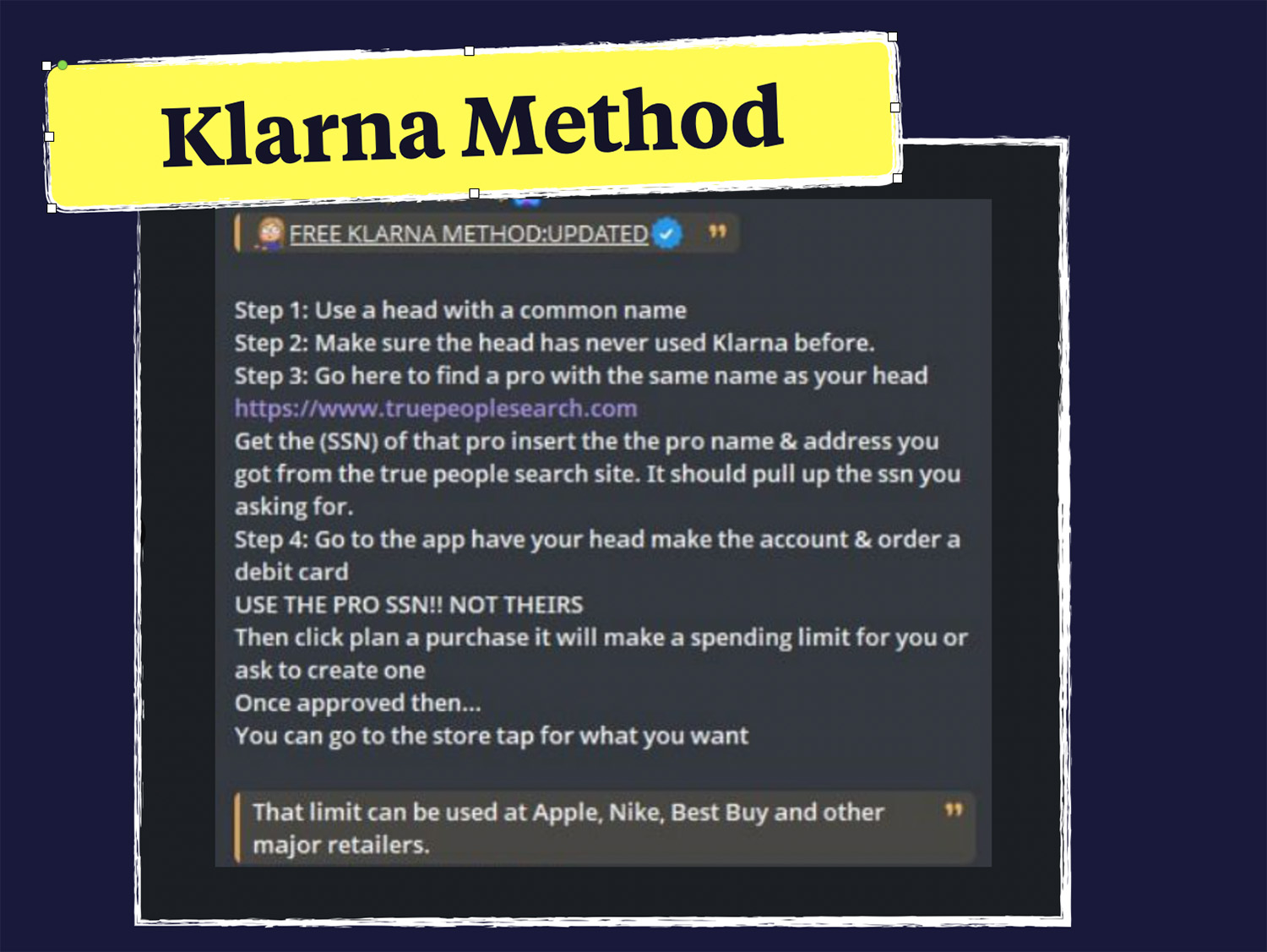

Step 1 – Get Fullz With Common Names Like John Smith With High Credit Scores

For the Klarna Glitch to work, scammers buy full profiles online, typically with common names that match their own name, or the name of the mule. To do that they will use tools like “True People Search” according to Gary Warner who reported the trend last week.

The fullz include Name, SSN, date of birth, address and have good credit scores – typically over 700.

Step 2 – Get A Fake Klarna Account

Using the stolen identity details, the scammer then creates a new Klarna account (often through the app or at an online checkout). Klarna’s sign-up uses a “soft credit check” for instant approval.

This means if the stolen SSN and info check out (i.e. the victim’s credit is decent), Klarna will swiftly grant a spending limit – usually a few thousand dollars or up to $10,000.

Step 3 – Bypass Identity Checks

To pass any ID verification at the point of sale, scammers choose their victims strategically. Some scammers matched the stolen identity to their own name, so they could present a real ID that wouldn’t raise flags (e.g. using John Smith’s SSN if their name was also John Smith).

In other cases, scammers would get matching fake identities to match the common name.

Step 4 – Go On Spending Spree

Once they were auto approved, scammers would go on a spending spree, often purchasing high-value merchandise like electronics and designer goods under the victims newly created Klarna accounts.

Step 5 – Flip The Merchandise For Cash

The final step is cashing out the merchandise.

Scammers will quickly resell the stolen goods for cash, often below retail, through secondary markets (Craigslist, sneaker reselling forums, pawn shops, etc.). This converts the fraud into profit.

In one TikTok video, scammers flashed wads of cash claimed to come from selling Klarna-obtained items, urging others to try the “method.”

Its Deja Vu All Over Again

You can’t help but think of the Chase “Free Money Glitch” when you think of this new viral trend. That scheme which went viral on Labor Day weekend in 2024, encouraged viewers to deposit fake checks into ATM machines, while this trend encourages viewers to steal identities.

And while the Chase Glitch leveraged first-party fraud, the Klarna glitch is firmly leveraging third party fraud schemes which are far more egregious and can result in prison sentences of 30 years or more.

This comes at a particularly bad time for Klarna, which just completed its IPO earlier this year in September.

And it’s not the first time their risk controls have been under fire.

In December 2024, Sweden’s Financial Supervisory Authority fined Klarna $46 million for violating anti-money laundering rules.

In May 2019, CEO Sebastian Siemiatkowski was summoned to the Swedish Ministry of Finance to answer questions about identity theft management.

Klarna Responds – The Social Media Glitch Is Fraud, Plain and Simple

For their part, Klarna issued a terse warning to scammers on December 26, 2025, calling the viral scheme “fraud, plain and simple” and warning that anyone who participates will be “held fully liable” for purchases and stripped of all fraud protection.

The fintech, which monitors every transaction, said it has “the data to identify and pursue any potential case” and reminded users that federal wire fraud carries penalties of up to 20 years in prison.

This is a developing story and one that I will be following closely.