The arrest of a 56-year old named Omar Guardia in Miami marks what could be one of the first arrests of one of the largest organized bust out fraud schemes in the country – The South Beach Bust Out Syndicate.

Charged with organized fraud, grand theft, unlawful subleasing and theft by false statement, Guardia allegedly purchased 17 vehicles, 10 of those in a single month worth over $500,000. He had 20 cars in his name when he was arrested.

According to police investigators, Guardia was involved in a “systematic organized scheme known as a credit bust out,” in which multiple car dealers and financial institutions are defrauded.

Bomnin Chevrolet Contacted Police After Fraud Spike

Guarda was arrested by police after a car dealer called to report suspicious activity.

The arrest report said Guardia had gone to Bomnin Chevrolet in March and submitted a credit application to purchase a 2025 Chevrolet Silverado, which was later reported stolen.

Due to an increased amount of fraud at the dealership, they contacted authorities who looked into Guardia and found he had 17 vehicles in his name, including 10 that had been purchased in March alone, the report said.

When he was arrested, Guarda had 20 cars in his name – an Acura, 2 BMWs, a Honda, 2 Mercedes, 5 Toyotas, a Kia, a Ram truck, a motorcycle, and 2 Yamaha vessels.

He Failed To Inform Dealers And Lenders He Was Stockpiling Cars

Police noted in their reports that Omar Guarda’s crime was in not disclosing his stockpiling of vehicles to the dealers and lenders.

“Due to the defendant purchasing 10 vehicles in the span of one month, the defendant misled the dealership and financial institution, in order to fraudulently obtain the vehicles,” the arrest report said. “If the defendant had provided the correct information and had disclosed the other vehicles he had purchased, the dealership would have never sold him this vehicle.”

The South Beach Bust Out Syndicate Linked To Over $24 Million In Loan Bust Out’s

Organized bust out activity in Miami has increased dramatically in the last year. First reported by Point Predictive’s Scott Ellefson earlier this year, close to 500 applications totaling over $24 million in value have been identified by fraud analysts there.

How The South Beach Bust Out Syndicate Operates

The syndicate’s operations reveal a very specific approach to auto fraud that begins long before a vehicle is stolen:

#1 Straw Borrower Recruiting

The syndicate recruits individuals that have good credit to act as a front for their operation. This use of valid identities helps the scheme run longer than using stolen identities where victims will notify lenders faster.

#2 – Targeted Application Fraud Methods

The straw borrowers will use specific application fraud patterns to make sure the applications are approved. Very specifically it includes

- Target High Value Vehicles – High end cars $65,000 to $100,000 are preferred

- High Reported Income – The average stated income $284,000

- Suspicious Employers – Self-employed borrowers using suspicious LLC business names that include their name and are often trucking companies.

#3 They Monetize The Cars Through Multiple Schemes

After acquiring the vehicles, the fraud syndicate moves to monetizing the cars through an array of different fraud schemes:

- Ship cars overseas – most notably the Dominican Republic

- Altering VINs – to create untraceable “ghost cars”

- Illegal Subleasing – vehicles through platforms like Turo.

- Fraudulent Lien Releases releases to “clear” titles of banks’ legal claims

- Mechanics Liens – with complicit mechanics shops in Florida

Point Predictive detailed the scheme in their annual fraud report.

Florida Is Ground Zero For Sophisticated Auto Fraud Schemes

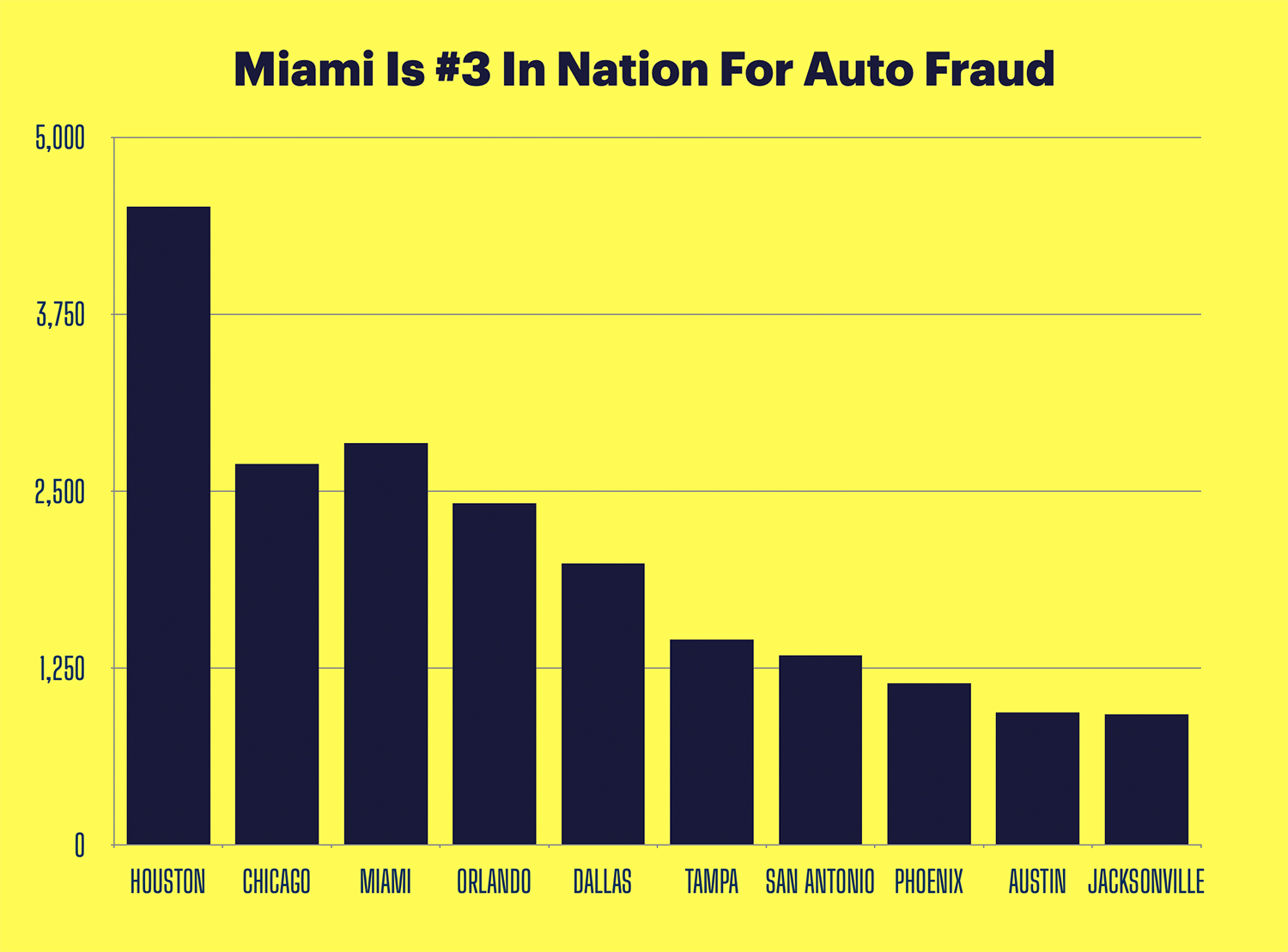

Florida ranks first nationally for fraud, with South Florida leading as the country’s fraud epicenter. According to Point Predictive, Miami ranks #3 in the nation for auto lending fraud schemes, and cities in Florida account for 4 out of the top 10.

The region’s perfect storm of conditions creates an ideal environment for sophisticated auto fraud rings:

- Proximity to major shipping ports facilitates vehicle export

- A strong international connections enable global operations

- A history of financial crime creates expertise networks

The state’s position as a fraud leader extends beyond auto lending, with Florida ranking first in identity theft and general fraud complaints per capita.

The South Beach Bust Out Syndicate represents just a fraction of a growing national crisis in auto lending. According to Point Predictive’s 2025 Auto Lending Fraud Trends Report, auto lenders now face an estimated $9.2 billion in fraud loss exposure – a 16.5% increase over 2023 and the highest level ever recorded.