Got fake accounts and fake identity theft claims? You are not alone.

A newly released report from TransUnion, H2 2024 Update to the State of Omnichannel Fraud Report, sheds light on the dramatic rise of synthetic identity and credit washing at fintechs, banks, and lenders in the United States.

Both frauds are experiencing unprecedented increases as credit repair schemes proliferate.

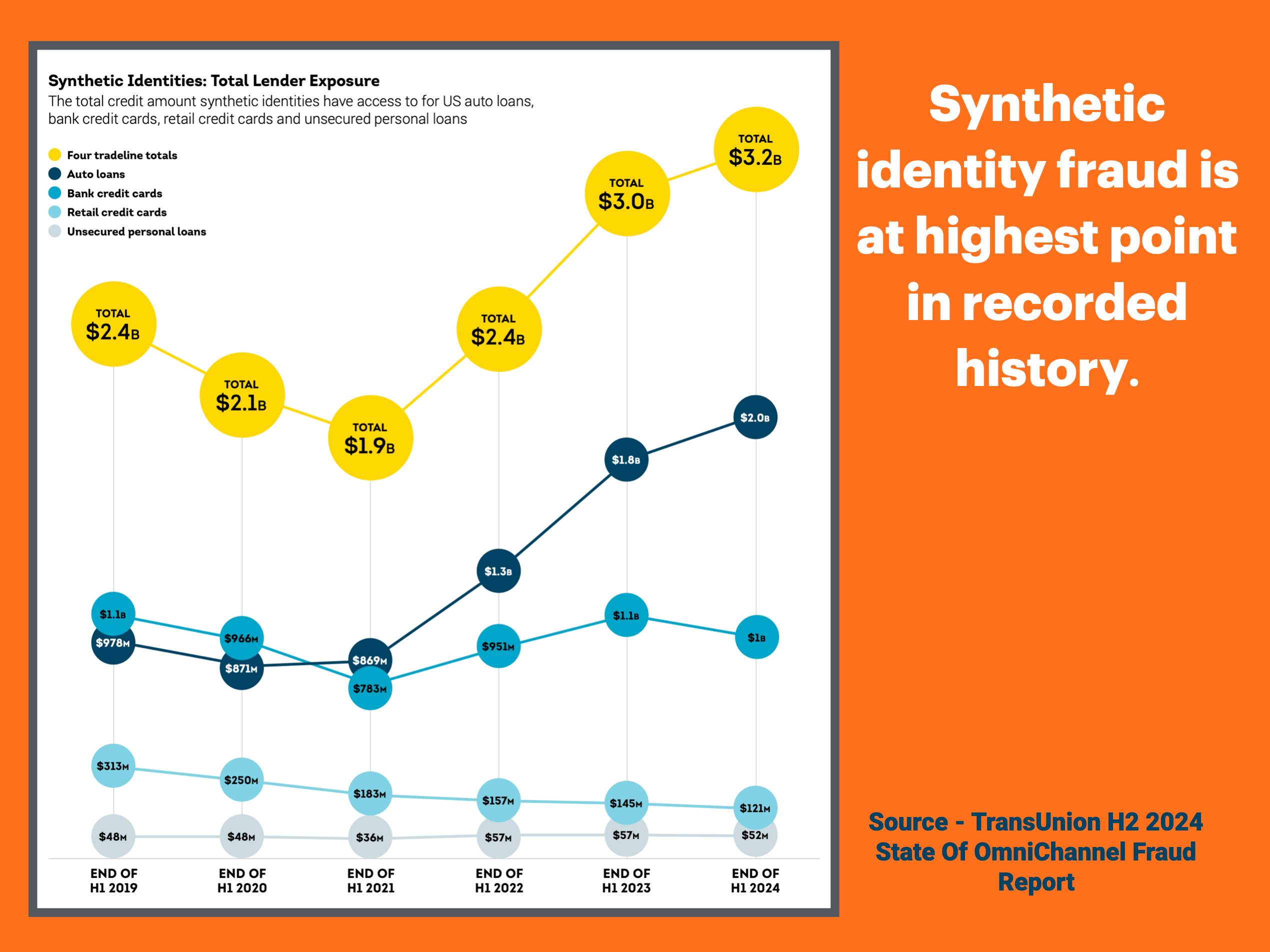

Synthetic Identity – The 3.2 Billion Dollar Fake Account Problem

TransUnion’s analysis reveals that synthetic identity fraud has hit an all-time high. By the end of June 2024, US lenders were exposed to a staggering $3.2 billion in potential losses due to synthetic identities across auto loans, bank credit cards, retail credit cards, and unsecured personal loans.

The percentage of synthetic identities among newly opened accounts reached 0.20% in the first half of 2024, an 18% increase from the same period in 2023.

While synthetic identities impact all fraud types, auto lenders are bearing the brunt of the problem.

The report indicates that the total lender exposure to synthetic identities for auto loans had balances approximately double those of the next highest category, bank credit cards.

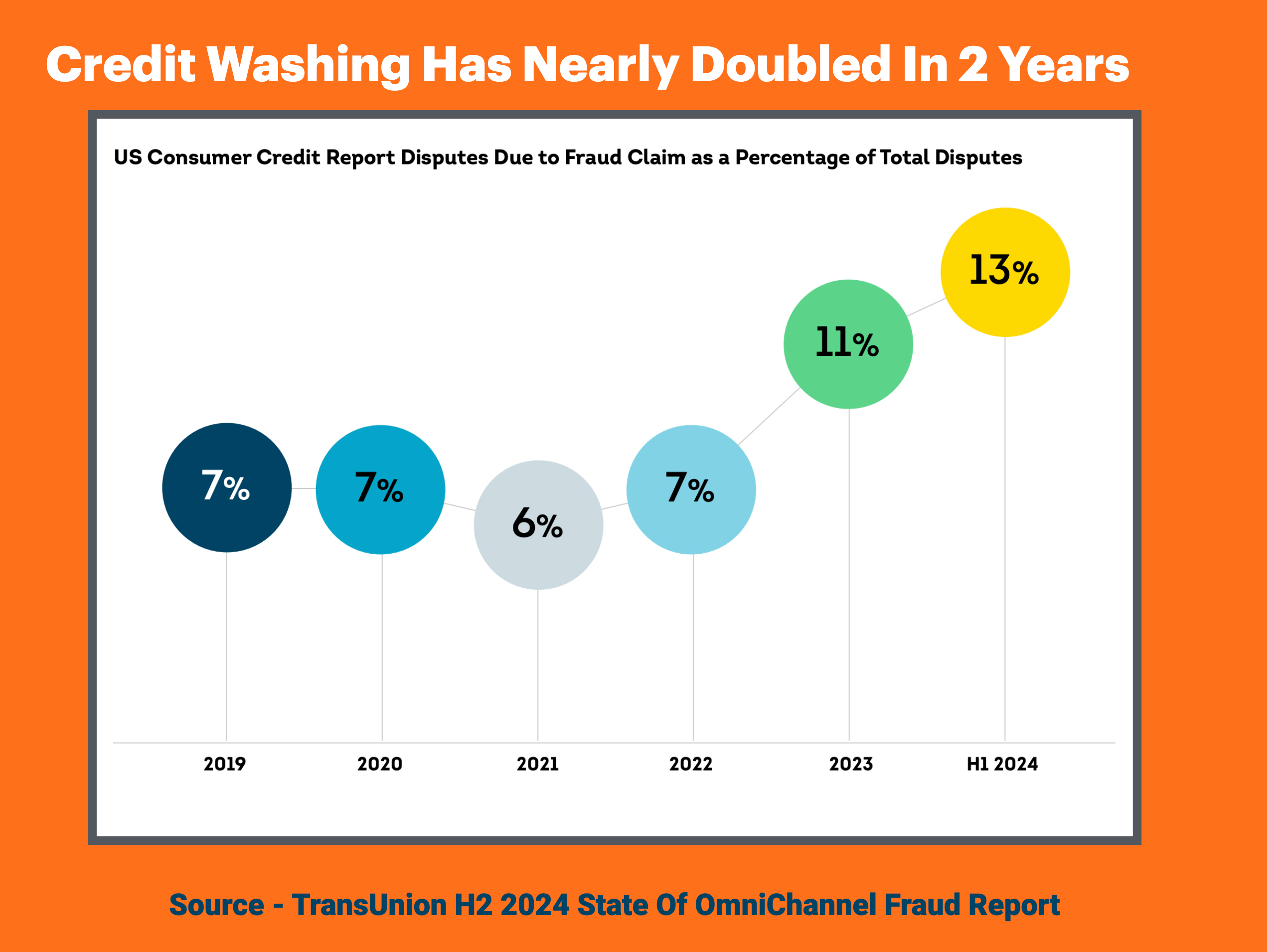

Credit Washing – The Dirty Problem That Keeps Getting Dirtier

Compounding the synthetic identity problem is the increasing prevalence of credit washing, a technique fraudsters use to manipulate credit reports by systematically claiming identity theft on legitimate tradelines.

TransUnion’s data shows that in the first half of 2024, disputes due to fraud claims represented 13% of all credit report disputes in the US – the highest level analyzed since 2019.

The Credit Repair Link

It’s no secret that a symbiotic relationship exists between synthetic identity credit washing and shady credit repair.

Credit repair companies regularly push their clients to use CPN, which are used to exploit the credit bureaus’ matching logic, as well as make credit sweeps, which eliminate all negative tradelines by systematically claiming identity theft.

These schemes will only grow as these credit repair companies continue to generate hundreds of millions of dollars enabling consumers to hide their identities and their credit.