According to reporter James Van Bremer with Auto Finance News, Capital One is reporting a significant uptick in applications tied to synthetic identity.

“Fraudsters are targeting the auto industry specifically, Joseph Portera, senior vice president and chief risk officer for financial services at Capital One, said Tuesday during a fireside chat at Auto Finance Summit 2024.

1 in Every 130 Auto Loan Applicants Appears Synthetic

In the fireside chat, Portera revealed how quickly the attack rate escalated.

“We see in our applications that about one out of every 130 or so applications has some indicia of a synthetic identity,” he said. “It’s grown fivefold, in the last four years, maybe 400%.”

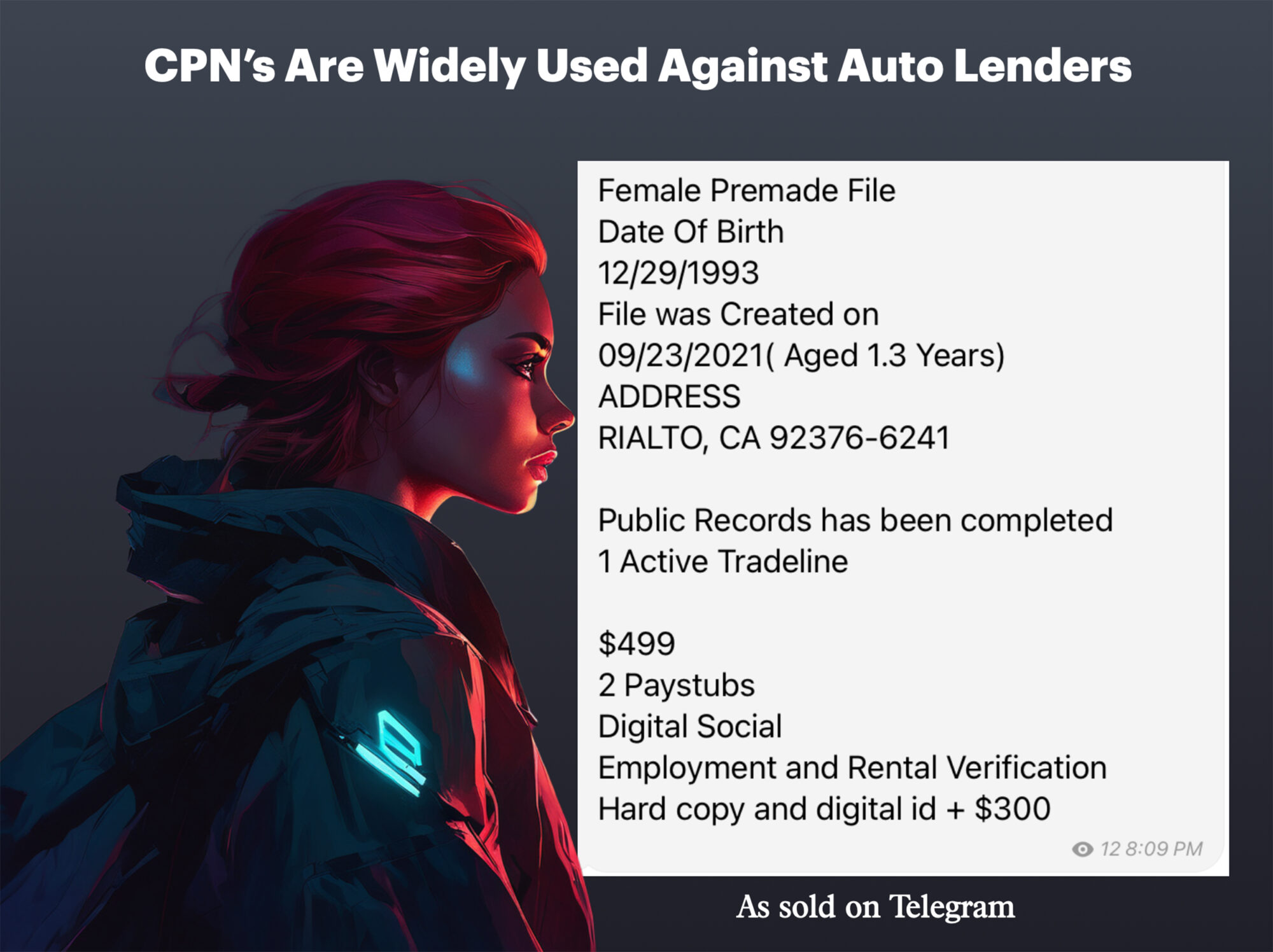

Auto Has Become A Target For Credit Repair Fraud

Capital One’s experience, closely mirrors what Point Predictive has been warning the auto industry about for the last 18 months – lenders are increasingly being targeted.

According to the 2024 Auto Lending Fraud Report, Synthetic Identity and Credit Washing Fraud accounted for $2.3 billion in fraud risk, or 29% of all risk auto lenders experienced, second only behind income and employment fraud.

The primary driver behind increasing losses? Credit repair fraud where borrowers are enticed to use Credit Privacy Numbers (CPN’s) in place of their real social security numbers to hide their true identity.

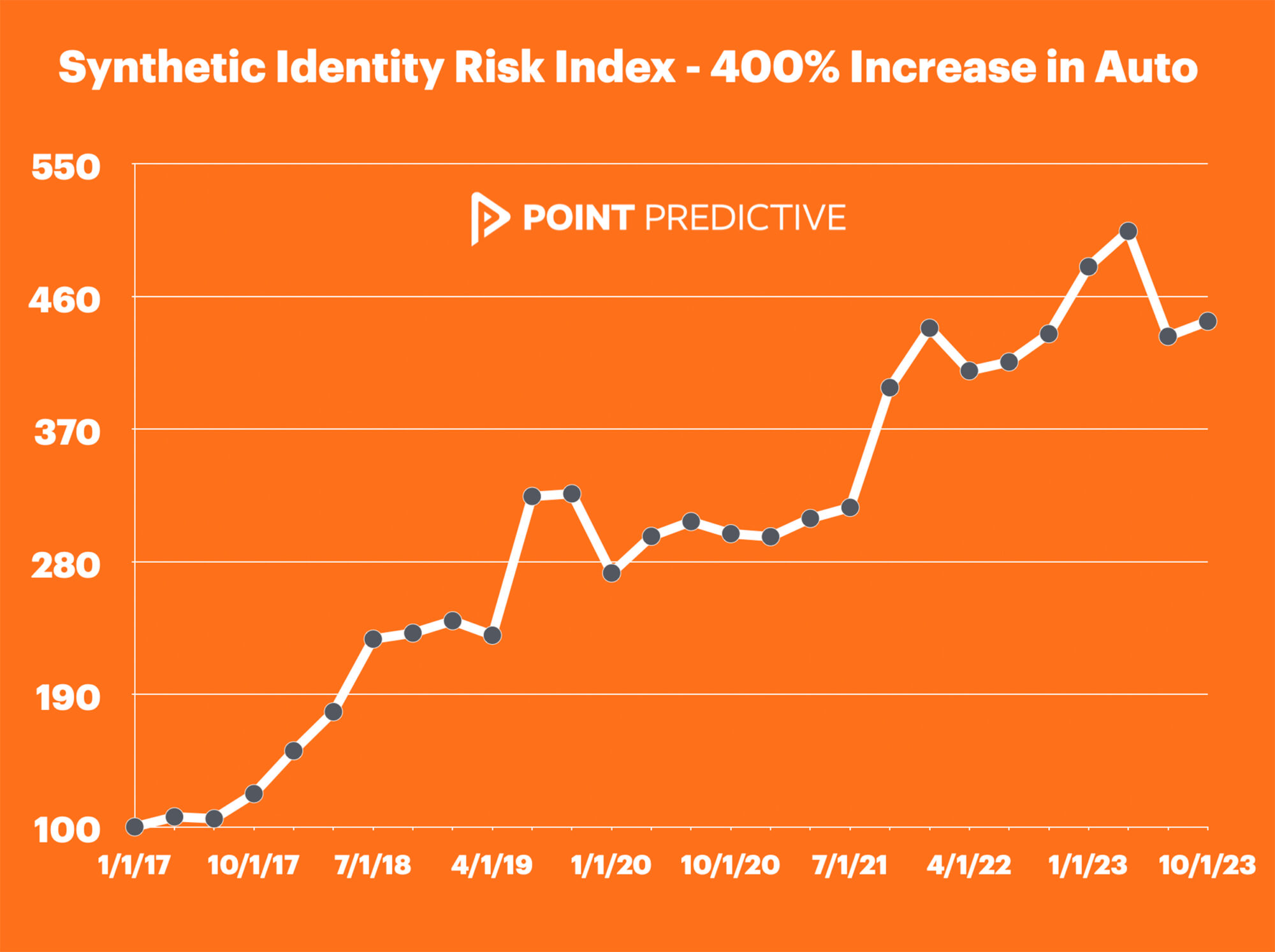

Synthetic Identity Auto Fraud Index Has Climbed 400%

Earlier this year, Point Predictive released their Auto Lending Synthetic Identity Risk Index, revealing a stunning trend – a 400% increase in synthetic attacks against auto lenders.

Updated quarterly, Point Predictive’s Synthetic Identity Risk Index tracks 37 separate synthetic identity risk signals on more than 270 million auto loan applications.

The Synthetic Identity Risk Index tracks the level of SSN misuse, patterns related to potential synthetic identity, piggybacking, matches to prior identity theft cases, and many other factors to arrive at an overall level of synthetic identity risk.

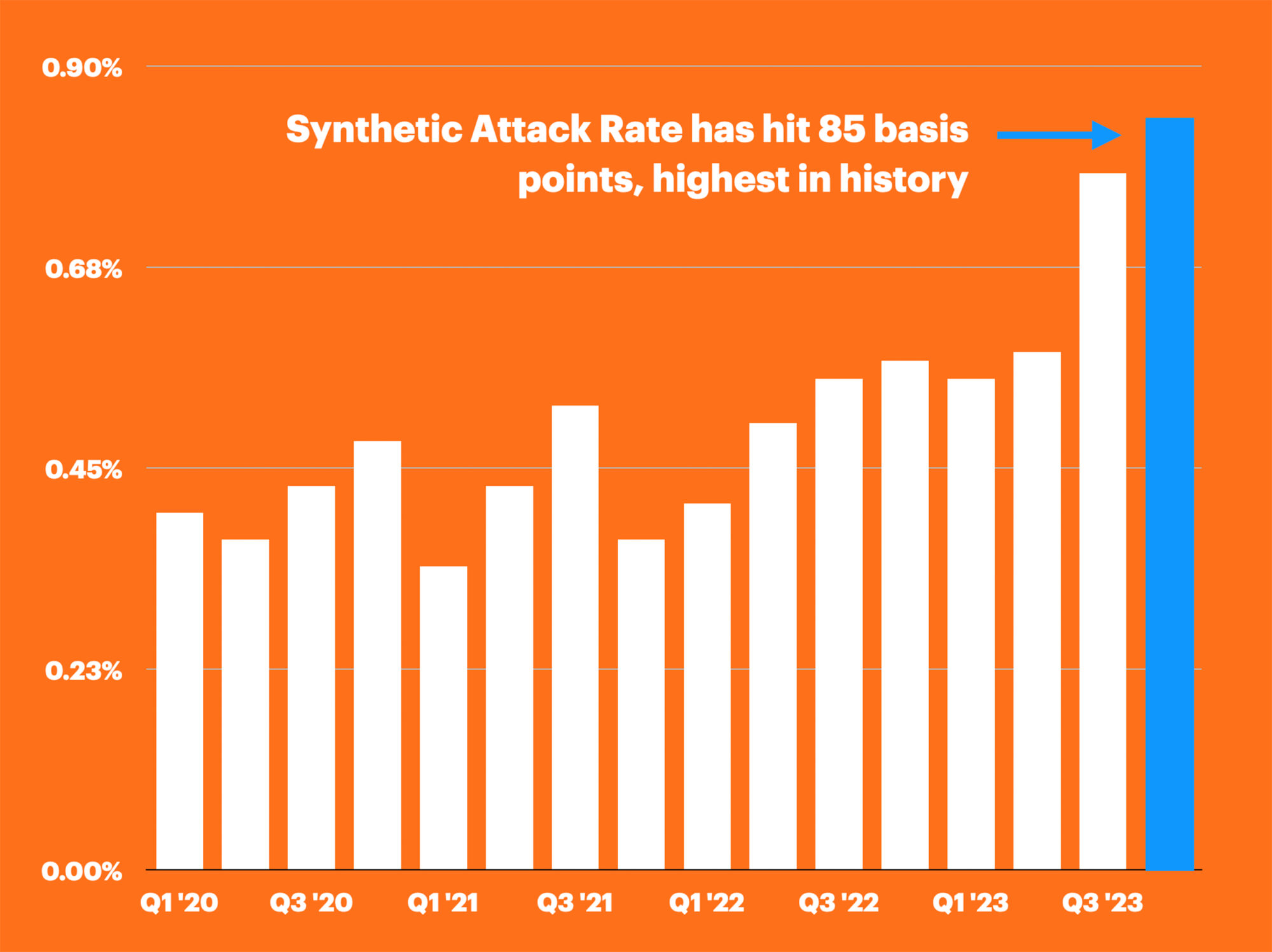

An Attack Rate of 85 Basis Points

While Capital One has experienced a reported attack rate of one in every 130 applications, they actually might be faring better than many other auto lenders.

Across millions of applications, the average attack rate on auto lenders is one in every 117 applications, which is about 13% higher than what they are reporting.

Frequent Synthetic Fraudsters Pummel Lenders With Multiple Applications

Point Predictive tracks over 11,000 frequent fraudsters that hit auto lenders in succession. They use multiple social security numbers, names, and addresses and alternate their information to avoid detection.

A simulation of just one of those frequent fraudsters exhibits how often they shopped across the country. Watch the video below, which shows how one person used over 54 different social security numbers across over 235 applications.

A Problem That Is Only Going To Get Worse, Before It Gets Better

According to Portera, the problem stems from a growing number of free tools that fraudsters can now access, including powerful Generative AI.

“This is a growing threat, and it can’t be ignored,” Portera said. “Because the tools that fraudsters can use now are free, there’s a low barrier to entry. You don’t have to have a lot of expertise; generative models can write code for you.”