Covid Fraud 2.0 is still hitting.

Months after the IRS stopped processing applications for the ERC (Employee Retention Tax Credit) program, it is still inundated with fraudulent applications.

So much so that they asked Congress to extend a moratorium on the program initiated in September last year.

Widespread Fraud And A Shocking Fraud Rate

Since September, the IRS has received about 17,000 new applications weekly, about 680,000.

An alarming review of those applications has uncovered potential widespread fraud in tax credit claims, with as many as 90 percent of applications raising red flags.

The analysis revealed that 10 to 20 percent of claims exhibited clear errors, while an additional 60 to 70 percent demonstrated what officials termed an “unacceptable level of risk.”

Only a small fraction, between 10 and 20 percent of the claims, collectively valued at approximately $86 billion, have been found to be valid.

Shady Tax Companies That Lure Victims

The ERC program, much like the PPP and EIDL programs did, has spawned a cottage industry of accounting and tax firms that are trying to help Americans get some of that government money.

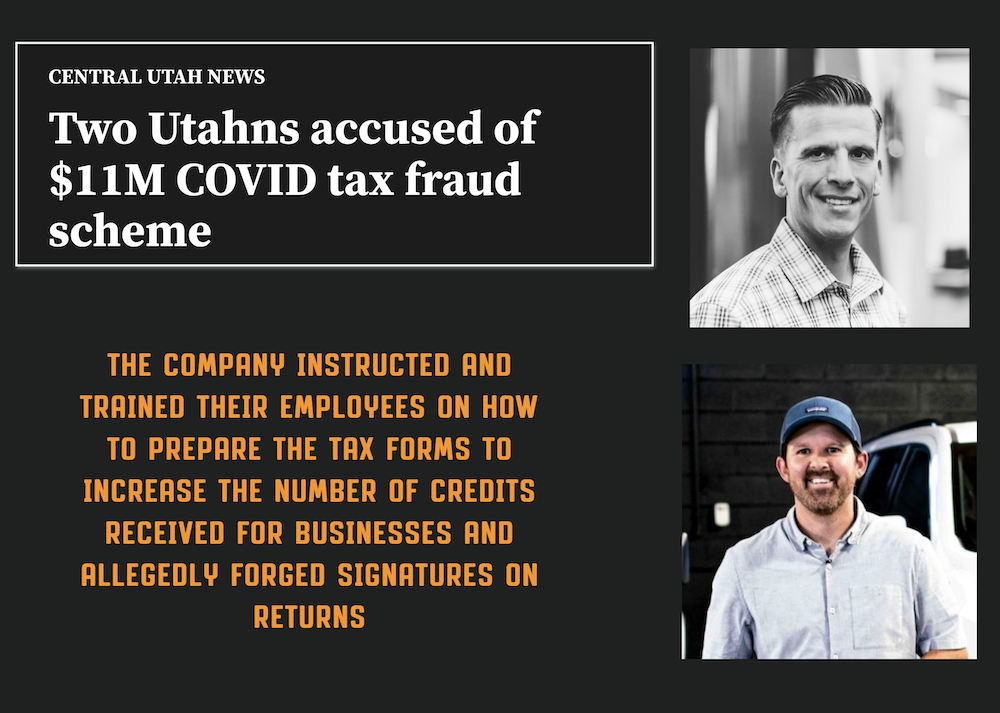

And some of those firms have been accused of fraud. In February of 2023, COS Accounting and Tax was accused of submitting more than 1,000 fraudulent tax returns for businesses trying to claim pandemic-era stimulus funds.

The company allegedly solicited single-member LLCs, including independent contractors, rideshare drivers, sole proprietors, and other Form 1099 workers, to convert their businesses into LLCs taxed as S corporations in order to claim the ERC.

The owners then instructed and trained their employees on preparing the tax forms to increase the number of business credits received. They would increase the number of employees, the paid wages, the sick leave wages, and other factors to fraudulently boost the companies’ checks.

In some cases, they would forge the signatures. They received $11 million in ERC credits as part of the scheme.

A Queue of Over 1.4 Million Applications

Because of those findings, the IRS has been forced to re-investigate a mountain of claims. As of today, the IRS reports that it has over 1.4 million applications in a backlog, most of which are fraudulent.

Since the I.R.S. started cracking down on fraud associated with the program, it has initiated 450 criminal cases, 36 of which led to federal charges.