In July last year, Heartland Tri-State Bank abruptly closed. While it was not clear then, it was soon revealed that the CEO, Shan Hanes, had fallen victim to a Pig Butchering scam and wired over $45 million in bank funds to fraudsters.

This week, he pled guilty to the fraud and faces 30 years in prison. According to court documents, Shan Hanes, pleaded guilty to one count of embezzlement by a bank officer.

It All Began Two Years Ago

For Hanes, it all began in December 2022. He reportedly fell victim to a Pig Butchering scam and started trading Cryptocurrency with his own money. But when that ran out, he allegedly turned to embezzling funds from a local church group and investment funds.

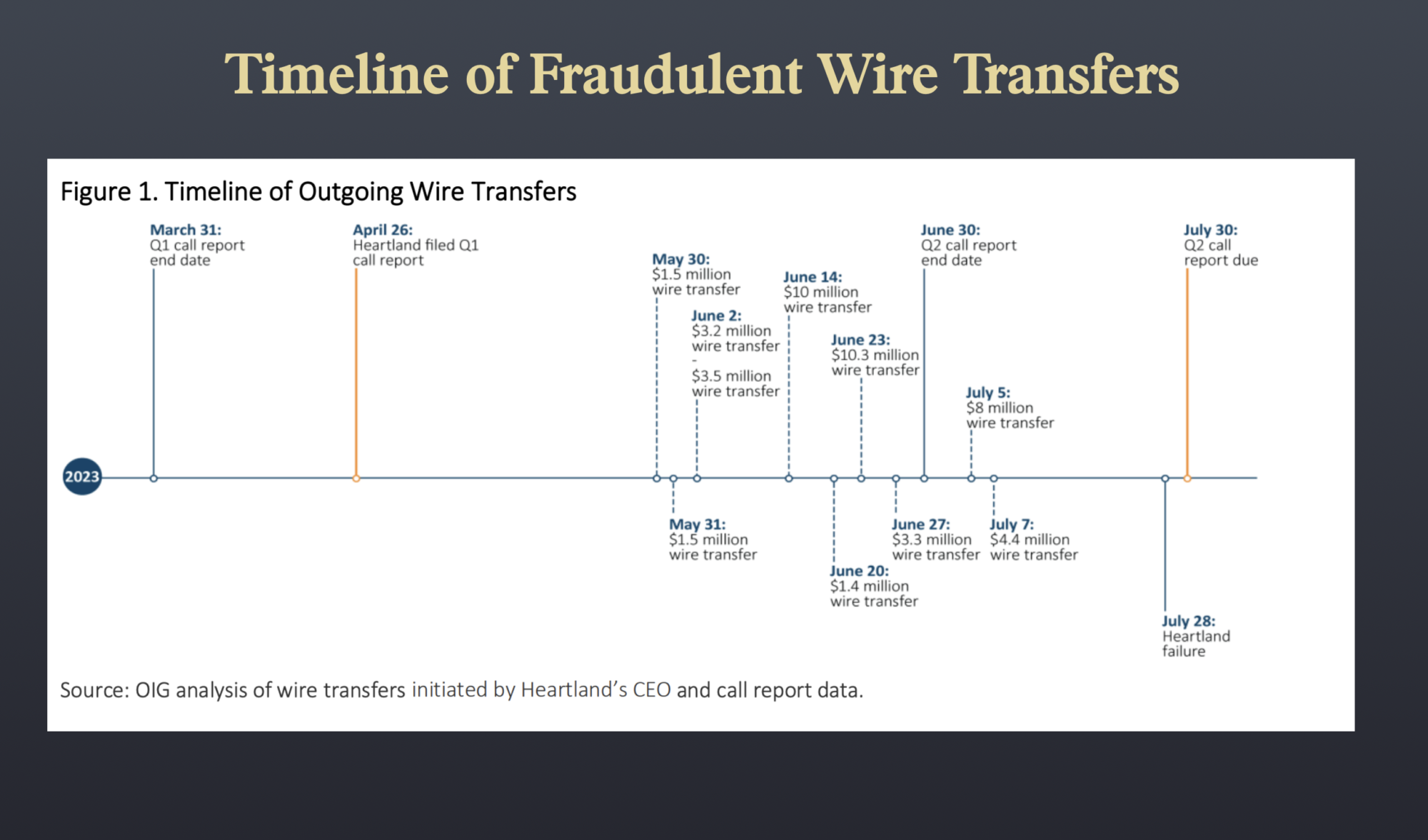

By May of 2023, having depleted those resources, he shifted his focus to embezzling from his company – Heartland Tri-State Bank. According to the indictment, he did the wire transfers himself or sometimes directed other employees to do it for him.

By July 7th, he had made 11 separate wire transfers for $47 million. Given the bank’s relatively small size, those transfers were a death blow, and the bank was forced into closure. The scheme unraveled when Hanes reached out to a bank client for a loan of $12 million.

He is Called A Master Manipulator

In an Internal Loss Review conducted by the Office of The Inspector General, they determined that Shan Hanes’s dominant role in the bank and prominent role in the community contributed to a reluctance on the part of Heartland employees to question or report the alleged fraudulent activities earlier.

In fact, they reported that Shan Hanes had requested employees to issue wire transfers that far exceeded the bank’s limits and policies. Specifically, senior bank employees circumvented the bank’s wire policy and daily limits to approve and process his fraudulent request.

For example, the bank’s daily limit for employees was $5 million, yet he instructed employees in June to wire transfer over $10 million in transfers, which exceeded their limit.

“Shan Hanes is a liar and a master manipulator who caused Heartland Tri-State Bank to collapse. Even as he was squandering away tens of millions of dollars in cryptocurrency, Hanes orchestrated schemes to cover his tracks concerning the losses at the bank,” said U.S. Attorney Kate E. Brubacher.

“Many victims will never fully recoup losses to their life savings and retirement funds, but at least we at the Department of Justice can see that Hanes is held criminally responsible for his actions.”

Hanes is scheduled to be sentenced on August 8, and faces a maximum of 30 years in prison.