Synthetic Identity is a beast of a fraud. ?♂️

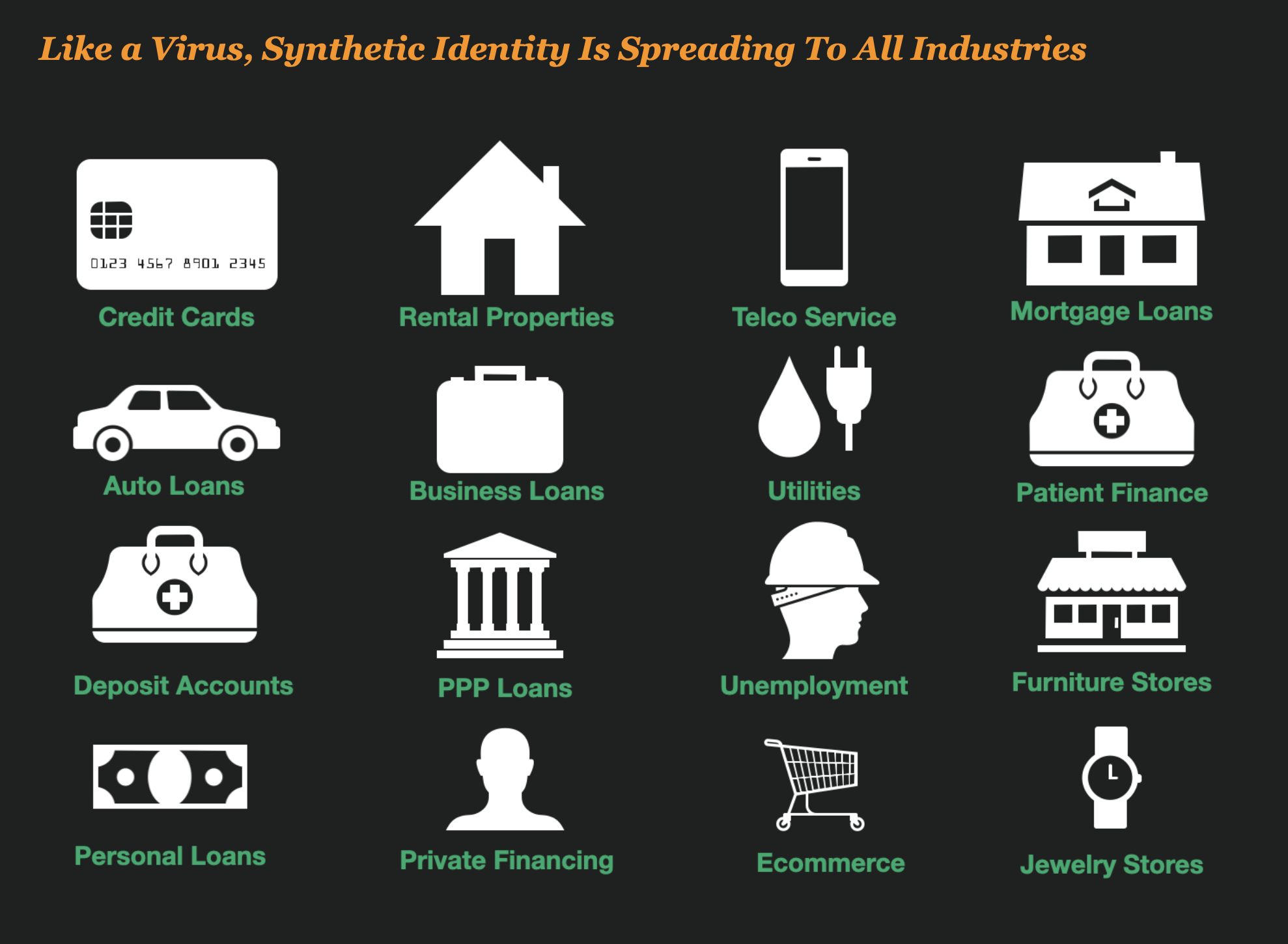

It’s America’s fastest growing financial crime, according to the FBI, and is now causing billions in damages every year to just about every type of business.

That includes banks, credit card companies, lenders, jewelers, retail stores, landlords renting their properties, and every retailer that grants credit.

Like a virus, it has spread to every industry, and now, no one is immune or beyond its reach these days.

But Synthetic Identity It Is Often Remarkably Easy To Spot

Even though Synthetic Identity is seemingly running rampant, it’s also one of the easiest frauds to spot.

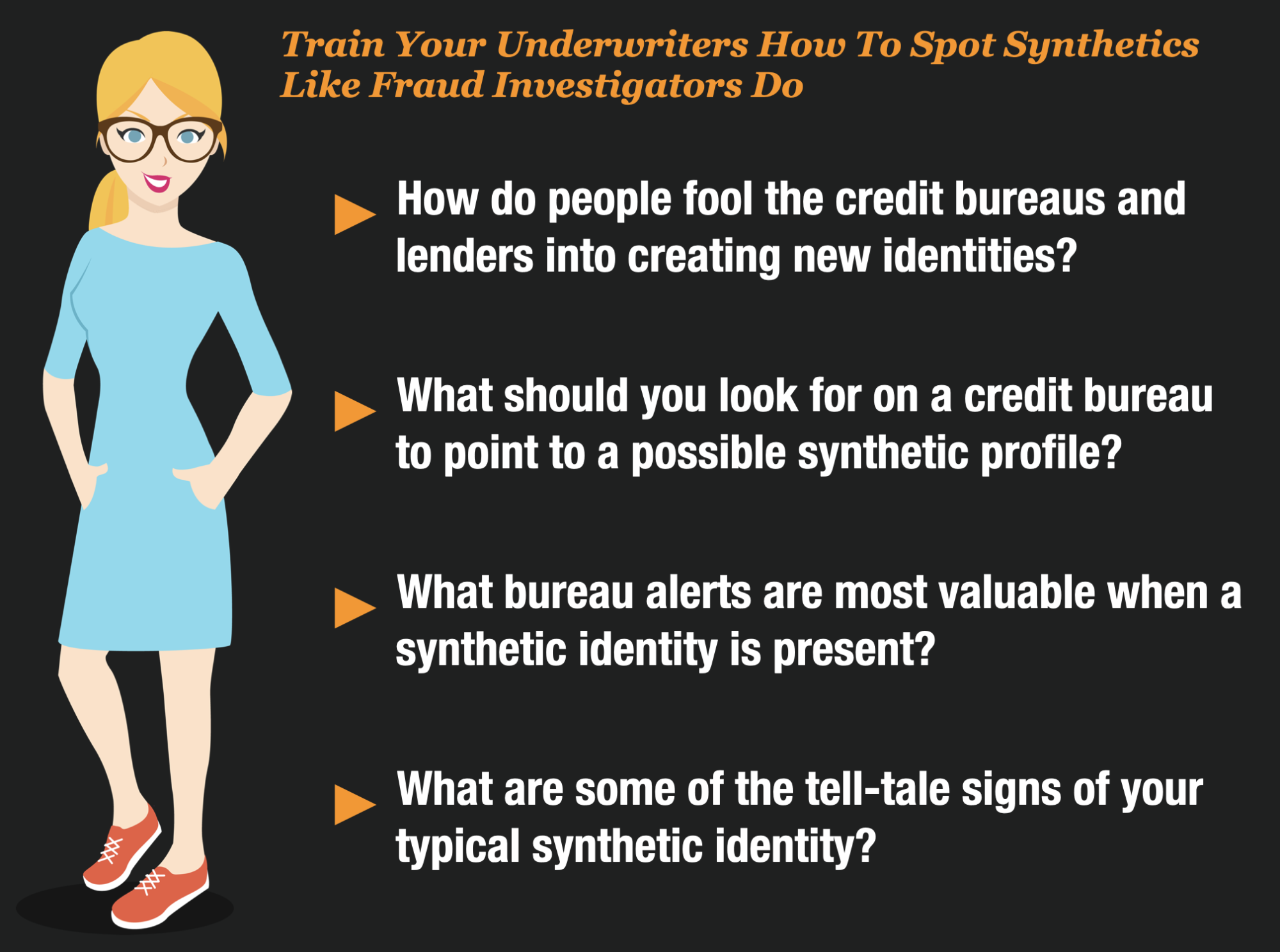

A well-trained fraud investigator ? or underwriter can spot a synthetic identity almost instantly because they look for a few key indicators that occur in almost every synthetic identity.

You just need to know where to look for it.

Use Techniques That Investigators Use To Find Synthetic Identities

There are many synthetic identity variants, but the most common and damaging is creating a fake credit profile.

In this article, I will cover the 8 Tell-Tale Red Flags that experienced fraud investigators look for when they are reviewing credit profiles so you can learn how to spot a synthetic identity instantly yourself. These are things that investigators look for while they are evaluating an applicant’s credit report.

Now, you can train your underwriters or front-line staff to spot the patterns of fraud just like investigators do when they look at a credit bureau.

It All Starts By Understanding How Synthetic Fraudsters Manipulate Credit Bureaus

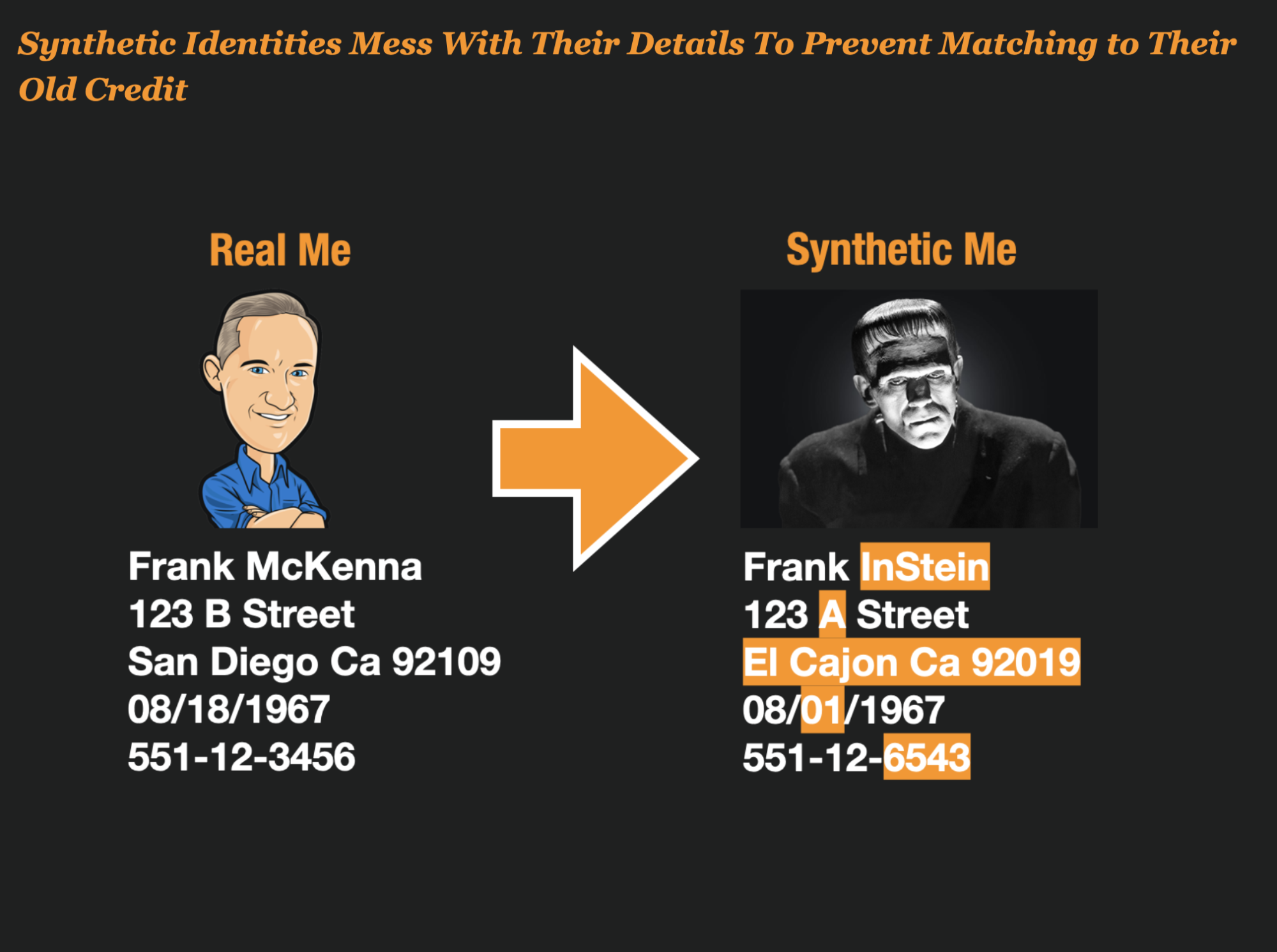

Synthetic fraudsters are successful because they manipulate credit bureau matching logic so that they can create brand new credit files.

Credit bureaus match consumers based on matches to that person’s credit header data, including name, date of birth, SSN, address, and sometimes phone numbers.

Synthetic fraudsters understand that when they change these key identifiers, the credit bureau won’t be able to match them to prior history. So, a brand new credit file is created with that new PII combination, creating a brand new identity.

It’s a bit like creating a Frankenstein identity as I did in this illustration here. None of this data is actually real, but you get the point, right?

So the key to identifying synthetic identity is to spot the signals of when someone is trying to create a fake new credit profile by mixing different pieces of data together with a social security number that doesn’t belong to them.

And that is what I am going to try to show you how to do here.

Spot These 8 Red Flags Often Associated With Synthetic Identity

Here are the 8 Red Flags you should look for when reviewing a credit bureau. Keep in mind that none of these red flags can stand independently.

The most important thing in each case is to ask: Does this really make sense for this applicant?

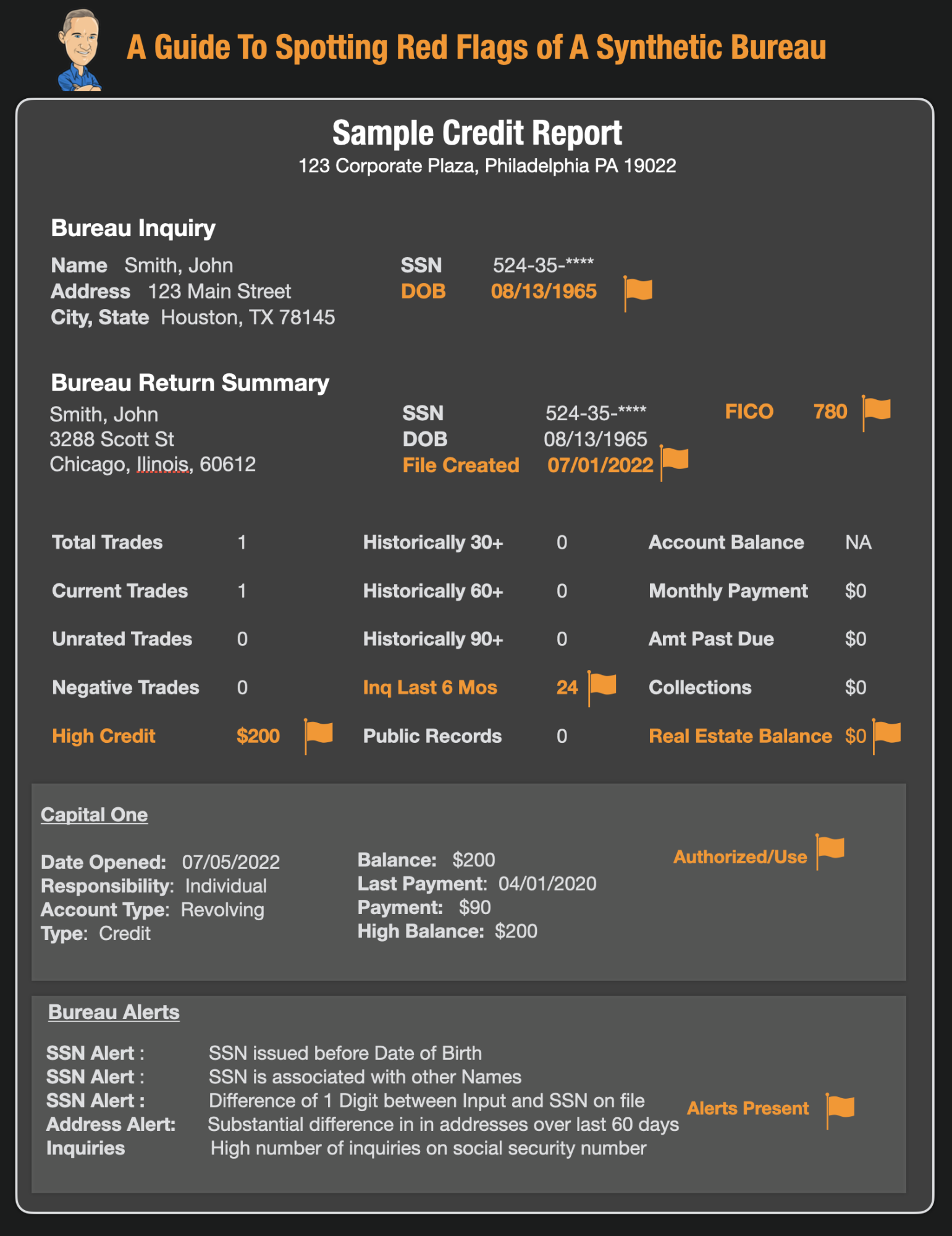

#1 – The Borrower’s Date of Birth Is Older, But Their Credit Is Relatively New

This is the #1 red flag to look for. If the borrower is born in 1965, but their credit bureau only started to appear in the last 6 months, that is often a big red flag. Usually, people begin their credit profile between the ages of 19-22 here in the US.

There are two exceptions to this however; 1) they could be recently immigrated to the US and are just now getting credit and at an older age, or 2) they might have been incarcerated for a long time and are just now getting into the credit system.

Red Flag Tip- Check the borrower’s date of birth against the age of the oldest tradeline to see if it makes sense.

#2 – The File Created Date (Time In File) is Very Recent, Which Means That Its a Very New Credit File

Check the date the credit started reporting for the borrower, often referred to as the “time in file”. If the time in file is less than 18 months, that can be a big indicator of synthetic identity.

The only exception to this might be younger borrowers that are just starting out, or recently immigrants that are new to credit.

Red Flag Tip- Check the ”Time in File” date and make sure it makes sense for the applicant. If the applicant has a low time in file, it could be a red flag.

#3 – The Credit File Is A “Thin File”

A “thin file” means that the borrower has little or no established credit history. This is a particularly important flag when the applicant is over 30 and should have at least some established credit history.

If the applicant has less than 5 total tradelines, this is what is known as a thin file.

Red Flag Tip- If the applicant has only 1 or 2 low limit credit cards on their credit bureau and they are over 30, that could be a reason to be more suspicious.

#4 – For Most of the Applicant’s Tradelines, They Are Only Listed As An Authorized User And Their Credit Score is Unrealistically High

This is a big one. If the applicant has 3 or 4 tradelines, and on 2 of these, they are listed as an authorized users that is a red flag.

That’s because credit repair companies sell authorized tradelines to consumers to help them boost their credit scores. While this is perfectly legal, fraudsters use it extensively when setting up a synthetic identity profile.

A synthetic identity thin file with a couple of authorized tradelines will often have a credit score of 725 or better. This is a major red flag and if you end up funding the account or loan, they will often default almost immediately.

Red Flag Tip- If over 50% of the borrowers tradelines are authorized user accounts, be very careful

#5 – The Highest Credit Amount The Applicant Has On History is Very Low

If the highest credit amount is $1,200 or less, this means that the applicant has not been granted large amounts of credit in the past.

If the borrower has a very low high credit amount and they are claiming to have a high income or are financing something extravagant, this is another red flag of a possible synthetic identity

Red Flag Tip- Look for high credit amount of less than $1,000 and evaluate if it makes sense for this applicant given what they are financing and what they claim their income to be.

#6 – The Applicant Does Not Have A Mortgage

The lack of a mortgage on a credit bureau makes it at higher risk for synthetic identity. Not many synthetic identity fraudsters apply for mortgages because they have stringent identity requirements, including signing papers in front of a notary public.

Red Flag Tip- If an applicant has a mortgage on their credit bureau, it is low odds that they are a synthetic identity.

#7 – The Applicant Has A Very High Number of Recent Inquiries

A dead giveaway of synthetic identity is a high number of recent inquiries. If the applicant has more than 10 inquiries in the last 6 months and its a recently created credit profile, this is very suspicious, particularly if the applicant is over 30 years of age.

Why is this applicant applying for so many accounts when they didn’t have credit before?

Red Flag Tip- Car shopping is quite common and can result in lots of inquiries for an applicant. However, if those inquiries are spread out over several weeks, it could be a bust-out situation.

#8 – The Applicant Has Some Very High-Risk Bureau Alerts Related To The Social Security Number

Credit bureau alerts can have high false positives but keep your eye out for some of the better alerts that identify synthetic identities.

These include

- The Social Security Number Was Issued before the Borrower’s Date of Birth

- The Social Security Number Appears on The Death Master File

- The Social Security Number Has Many Other Names Associated With It

- The Social Security Number Was Issued After 2011 (Randomized)

Red Flag Tip- The presence of bureau alerts is the icing on the synthetic credit profile cake. They can often be the dead giveaway you were looking for.

Here is A Handy Sample Credit Report To Show You What A Synthetic Bureau Might Look Like

I created this handy sample credit report to show you the types of red flags you might want to look for when you review a credit report.

Thank you for reading, and Happy Hunting for those Synthetic Identities!