Point Predictive released its 2022 Auto Fraud Trends Report, which details record-high levels of attempted vehicle loan fraud in 2021, a trend that Point Predictive believes will continue to increase throughout 2022.

“The pandemic laid the groundwork for rising fraud risk in 2021 as fraudsters learned to use falsified information and identities to benefit from unemployment and paycheck protection programs,” said Frank McKenna, Chief Fraud Strategist for Point Predictive. “Now that these government programs have ended, automotive lenders are dealing with an influx of fraud. 2021 was another milestone year for fraud risk, with auto loan fraud estimated to reach $7.7 billion – a number we, unfortunately, expect to continue rising.”

The Point Predictive 2022 Auto Fraud Trends Report contains information from surveys conducted across 29 lenders, as well as a comprehensive year-end data analysis of auto lending application, loan, and fraud data from the Point Predictive auto lender data consortium. The report provides the auto lending industry a comprehensive resource on fraud trends and lenders’ perceptions and attitudes towards fraud.

Key findings include:

- More than 1 in 5 (21%) of lenders reported fraud was a significant threat to their organization in 2021

- Income fraud, employment fraud, and synthetic identity were the leading causes of increases in auto lending fraud for 2021

- More than $1 Billion in loan application value was tied to fake employers – more than 5,000 fake employers were used by consumers and dealerships on auto loan applications

- Forged and falsified paycheck stubs and bank statements increased by 22% in 2021 driven by higher levels of unemployment and increasing car prices due to supply chain delays

- Rates of suspicious synthetic identity attempts on auto loan applications increased to 68 basis points from 35 basis points in 2020

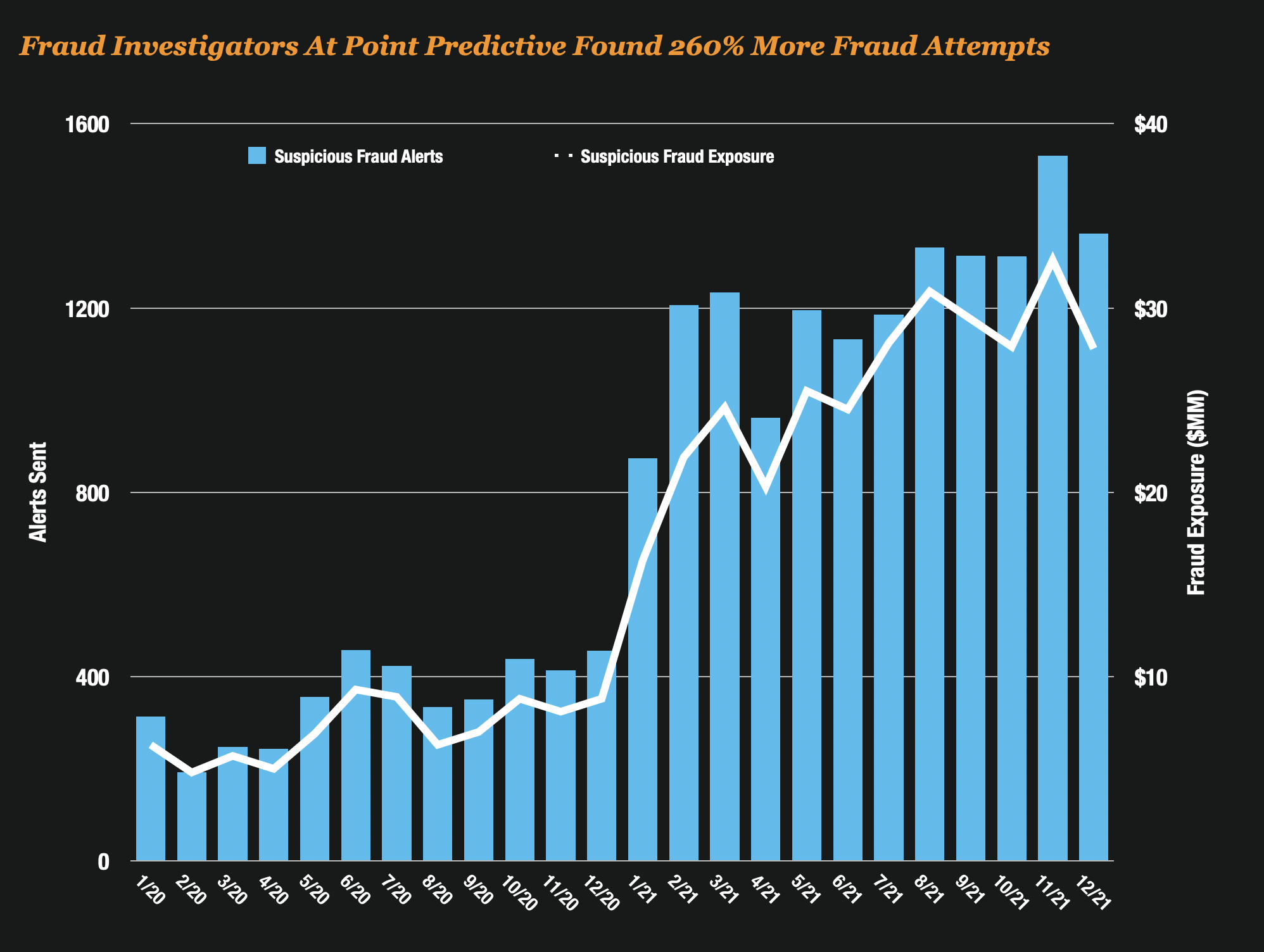

The Point Predictive Fraud Analyst team brings the necessary experience and expertise to identify, interpret, and adapt to rapidly changing fraud trends. During 2021, the fraud analyst team identified more than 16,641 suspicious loan applications with a total loan application value of $309 million. These loan applications all appeared to have characteristics of employment fabrication, income manipulation, synthetic identities, or straw borrower manipulations. These findings represent a 260% increase in loan misrepresentations and suspicious loan application activity identified over 2020.

“Digital automation and the move to digital lending is creating unique challenges for lenders,” said Tim Grace, Chairman and CEO of Point Predictive. “Throughout 2022, we expect to see net losses increase as car prices normalize and pressure on lenders to expand their automation efforts as Gen Z and Millennials become the majority market. Credit washing also continues to grow as credit repair companies leverage it as a way to satisfy their customers, inventory scarcity creating more fraud opportunity, and lenders continuing to see higher levels of identity theft on their new originations.”

Lenders can download a copy of the 2022 Annual Auto Fraud Report at Annual Fraud Report 2022