Machine Learning for fraud is big business. Particularly here in San Diego where companies like HNC Software pioneered the use of it over 20 years ago to solve the problem of credit card fraud when there were few fraud detection solutions available. Since HNC, many other companies have sprouted up using machine learning to solve many different fraud problems across many different types of financial fraud.

This blog identifies some companies that specialize in machine learning and the particular type of fraud that they have a niche market in. They are all great companies. I am sure that they are not the only ones so feel free to drop me a note if I missed any big ones.

Machine Learning Uses Multiple Techniques

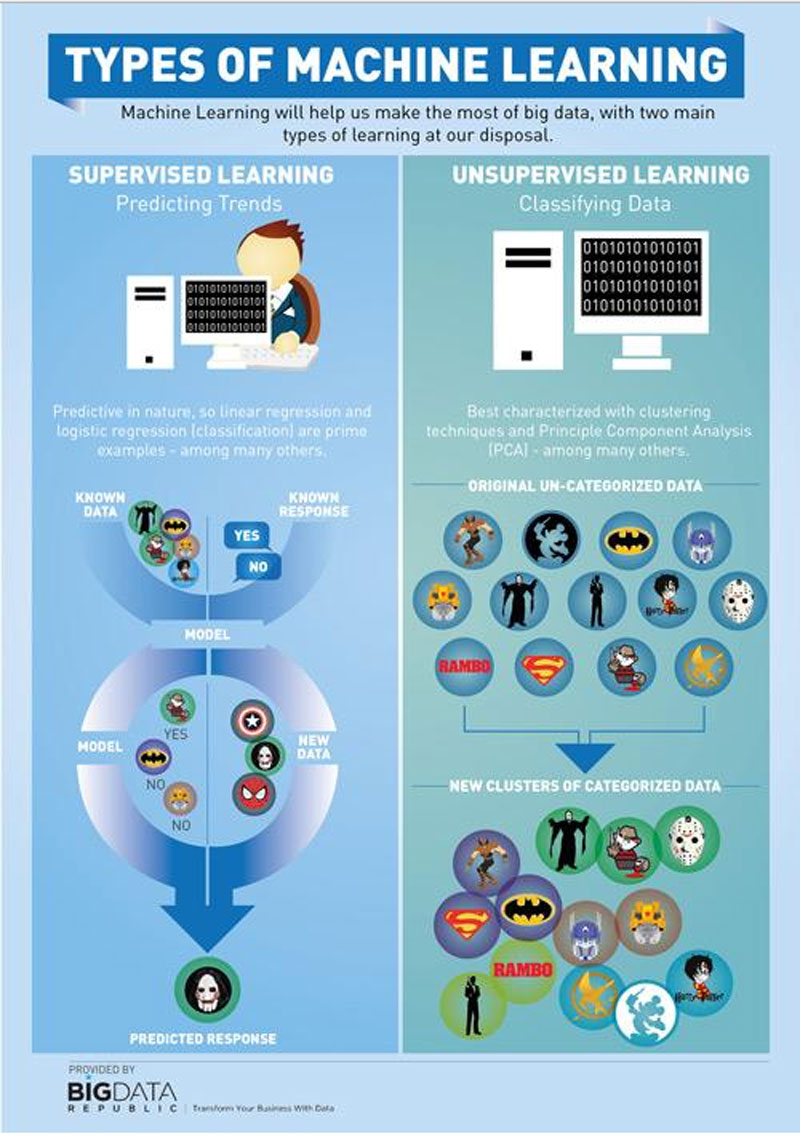

Machine learning is often used as the way to describe multiple techniques that leverage vast amounts of historical data to predict future fraud. If you hear companies say that they use predictive analytics, artificial intelligence, pattern recognition or neural networks to solve fraud; this most often means they use machine learning.

There are generally 2 different ways machines learn – supervised, or unsupervised. Each company specializes in one of these two methods and both are extremely effective techniques at detecting fraud patterns.

3 Things That Separate Machine Learning Companies From Other Companies That Solve Fraud

There are 3 big things that separate machine learning fraud companies from other fraud solutions vendors.

- They use or have a data consortium – Machine learning companies require vast amounts of data to build their predictive models. Because of this, they either collect large amounts of industry data or establish data consortiums to share their patterns of data. The data is unique because it contains both raw data as well as “fraud tags” or target variables that can be used in distinguishing the good from the bad.

- They use data scientist and a modeling approach – These companies all use a modeling approach where scientist mine the historical data for features and signals and then develop algorithms that can score each transaction, application or entity for fraud risk. This is an important distinction from data verification companies that do matching of individual data elements to create red flags to alert for risk.

- They predict fraud risk – Finally, machine learning companies all share the common characteristic of predicting current or future risk for a company. They are not reporting companies. They are prediction companies.

So here is a list of 11 Machine Learning Companies for Fraud.

#1 – FICO

(Card Fraud, First Party Fraud) San Diego www.fico.com

FICO, by way of the acquisition of HNC Software in 2002, is the largest provider of machine learning models to the financial services industry. They boast the largest card fraud consortium but also are entrenched in lending, telecom, retail, insurance, and pharma solving problems for many industries.

FICO was not only the pioneer in card fraud detection but lead the way developing First Party Fraud models for companies over 15 years ago.

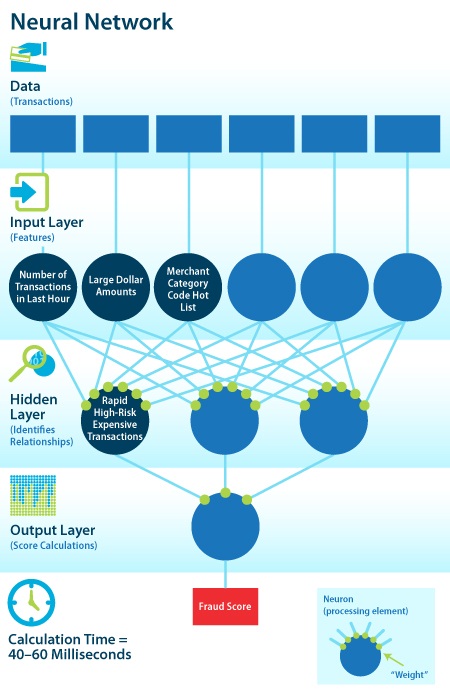

FICO’s primary technique for machine learning is supervised neural networks which they famously created by Robert Hecht-Nielsen after using the technique for the military to find hidden tanks in the desert during desert storm.

Neural network models created by FICO score a majority of both the credit and debit card transactions in the world today. When you get that call from your credit card company to verify activity, it was likely triggered by one of FICO’s Falcon Models that scan millions of transactions each and every day.

#2 – SAS

(Card Fraud and Enterprise Fraud) San Diego www.sas.com

SAS software has been used widely by financial services companies for modeling, reporting, and analytics since the mid-70’s but it was until 2003 that SAS decided that they wanted to create their own analytics products. Their first foray into providing machine learning software to banks was in fraud detection. They setup an office in San Diego to take advantage of the sheer number of fraud data scientist that live in the area.

SAS now boast a rising number of card companies and banks that are using their machine learning software for credit card fraud, debit card fraud, deposit fraud and many other types of fraud detection. Their models are reported to be very high performing according to banks that use the models.

#3 – Sift Science

(Online Fraud) San Francisco www.siftscience.com

With 6,000 customers using their software to detect and stop online fraud and abuse, Sift Science is one of the fastest growing machine learning companies in the US. Founded by ex-Googlers they certainly have become the focus of many. It also helps that they are focusing in on the fastest growing fraud – Online Fraud which had a 400% increase last year.

Sift Science appears to apply a blend of both supervised and unsupervised machine learning techniques to solve the fraud problem. There effective machine learning techniques include:

- Realtime Online Learning – As a fraudster clicks through the website it will update the fraud score and if another site reports a related fraud it will update the fraud score as well.

- A Consortium – Over 6,000 websites are participating in their fraud consortium

- Customized Models – Sift Science customizes their models based on each business select needs.

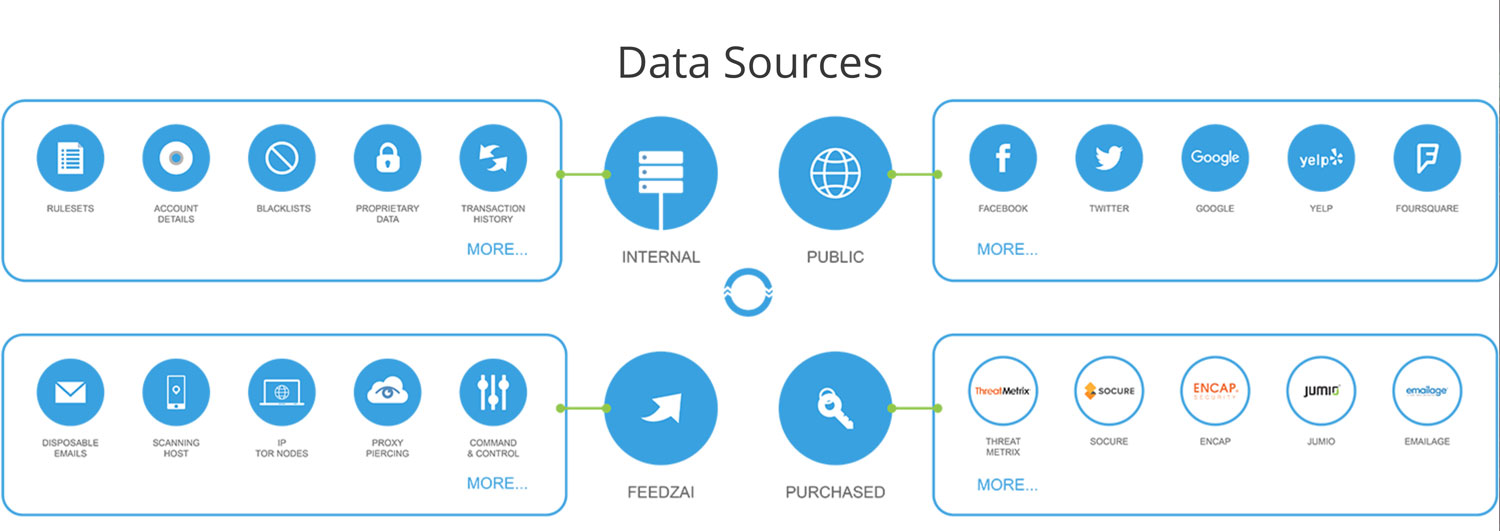

#4 – Feedzai

(Account Opening Fraud, Card Fraud) Lisbon Portugal www.feedzai.com

Feedzai is a unique fraud detection company. They are one of the fastest growing machine learning providers and they are based on Portugal. The have carved out a nice niche for themselves offering things like “WhiteBox Scoring” that offer transparency in models – a concept that is particularly important in today’s world where model’s need to be transparent to regulators.

Feedzai boasts big customers like Capital One for Card Fraud but also is making big in-roads into applying their algorithms for online fraud and alternative lending.

#5 – Brighterion

(Payment Fraud, ACH Fraud) San Francisco www.brighterion.com

Brighterion may be one of the more private companies about touting their success and have minimal information on their customer base, but they are a force in the fraud machine learning community. I have heard that they are the providers of scoring to Visa and other large payment providers making their scoring solutions some of the most used in the world.

Brighterions most successful machine learning product is IPrevent which leverages a technology called “SmartAgents”. These smart agents require no database, can score in less than 2ms and can profile every entity in the transaction to provide precise fraud scoring.

#6 – Guardian Analytics

(Wire Fraud) Silicon Valley www.guardiananalytics.com

Guardian Analytics specializes in the largest and fastest growing type of fraud – Wire Fraud. Using millions of wire transactions across hundreds of banks, they deploy an unsupervised model that can identify anomalies between the online banking session, the activity during the login and wire transactions that are made. By looking at the entire transaction and across institutions, Guardian Analytics can pinpoint wire fraud’s subtle deviations.

Guardian Analytics is one of the few companies that have been very successful in using unsupervised models vs supervised models trained on prior fraud patterns.

#7 – CoreLogic

(Mortgage Fraud) San Diego www.corelogic.com

CoreLogic is a data and analytics company that specializes in mortgage fraud, risk, and valuation. CoreLogic uses proprietary machine learning techniques to scan and score about 60% of the mortgage applications here in the US and leverages a powerful industry fraud consortium. Their models can score fraud from the perspective of the borrower, the property, the appraisal and hundreds of other factors from CoreLogic’s sizeable data assets.

I know of this company very well since their fraud analytics team and technology was acquired from BasePoint Analytics, a company that I co-founded with Tim Grace and Steve Platt.

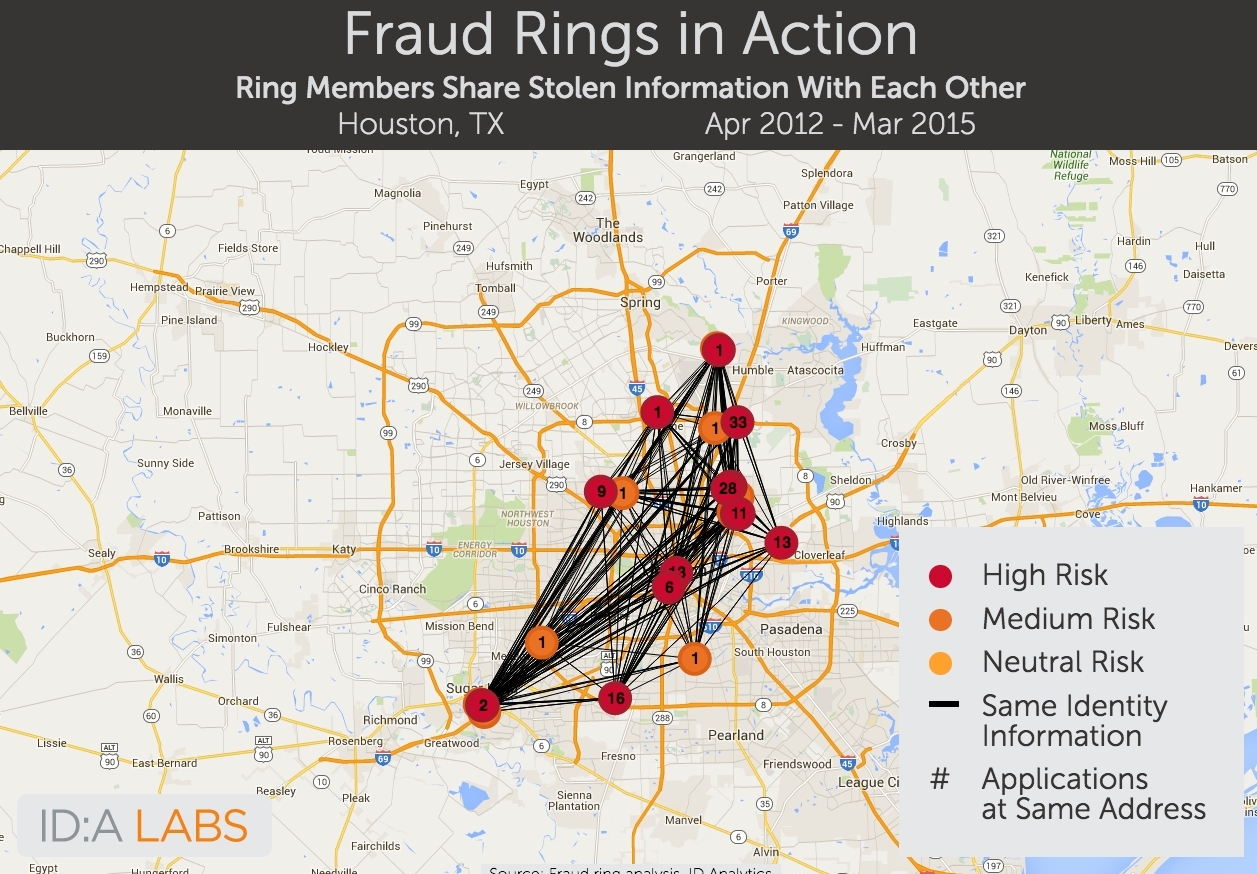

#8 – ID Analytics

(Identity Theft, Synthetic Identity, First Party Fraud) San Diego www.idanalytics.com

IDAnalytics was acquired by LifeLock, who was later acquired by Symantec. IDAnalytics was a startup success here in San Diego and was one of the first companies to spin off FICO that made it big.

IDAnalytics focuses on using supervised machine learning techniques to solve a wide variety of fraud problems using billions of identity attributes from their risk consortium which allows lenders to track fraudulent identity use across the entire network. Their approach to analytics and data gathering has proven to provide a tremendous lift over traditional bureau alerts which have high false positive rates.

#9 – Forter

(Online Fraud) Tel Aviv, New York www.forter.com

Tel Aviv is a hot spot for fraud detection companies with many big names in the industry such as Actimize having their roots there as well. Forter is the latest company but their technique is called “Machine Learning with a Human Touch“

There approach not only leverages supervised learning models, they also leverage human experts that can help inform the models to reduce false positives. Their solution tracks all aspects of the online transaction including device fingerprinting to completely automate the approve, review or decline decision for online merchants.

#10 – PointPredictive

(Auto Lending Fraud) San Diego www.pointpredictive.com

PointPredictive uses supervised machine learning techniques coupled with their auto lending fraud network to scan applications for auto lending fraud. The unique analytic approach uses elements from the application, lender industry data and detailed information about the car dealer to score across every facet of risk.

#11 Fiserv

(Check Fraud) Atlanta www.fiserv.com

Fiserv is a large company which provides fraud software used for online banking to most of the banks in the US.

They are also the largest provider of machine learning models to detect check fraud – a $7 billion a year fraud problem despite the decline in check usage. Fiserv boast the largest consortium of historical checks and frauds and can detect counterfeiting, lost and stolen checks as well as check shotgunning.

Their machine learning models use supervised techniques while leveraging their vast check fraud consortium.

Thanks for Reading!